A Complete Guide to Investing in Your 20s

It’s never too early to start investing for your future. It may seem complex, or even unimportant, but investing is easier and more accessible than ever. This guide explores different investment opportunities, expert tips and the importance of investing young.

- Written by Rachel Christian

Rachel Christian

Financial Writer and Certified Educator in Personal Finance

Rachel Christian is a writer and researcher for RetireGuide. She covers annuities, Medicare, life insurance and other important retirement topics. Rachel is a member of the Association for Financial Counseling & Planning Education.

Read More- Edited By

Matt Mauney

Matt Mauney

Financial Editor

Matt Mauney is an award-winning journalist, editor, writer and content strategist with more than 15 years of professional experience working for nationally recognized newspapers and digital brands. He has contributed content for ChicagoTribune.com, LATimes.com, The Hill and the American Cancer Society, and he was part of the Orlando Sentinel digital staff that was named a Pulitzer Prize finalist in 2017.

Read More- Financially Reviewed By

Toby Walters, CFA®

Toby Walters, CFA®

Chartered Financial Analyst and Paraplanner

Toby Walters, CFA®, has over 25 years of financial research experience. With a knowledge and understanding of researching and analyzing financial data, he has developed a unique and experienced viewpoint on money matters. He has been a chartered financial analyst since 2003, and most recently a portfolio analyst and paraplanner.

Read More- Published: May 1, 2020

- Updated: July 10, 2023

- 17 min read time

- This page features 19 Cited Research Articles

Investing grows your money over time. When you invest, you allocate funds toward assets — such as stocks, bonds, mutual funds or real estate. Investors do this expecting a return or profit in the future.

All investments carry risk, but diversifying your portfolio hedges against unstable markets and potentially devastating losses.

Your 20s are the perfect time to begin your investment journey. You may have recently graduated college or landed your first well-paying full-time job. Allocating this new income wisely builds wealth and freedom to live the life you’ve always wanted.

Before You Invest

Investing when you’re young is important — but so is laying a stable financial foundation.

Before you invest, improve your financial literacy and use that knowledge. This includes establishing savings, paying down credit card debt and creating long-term goals.

Create Emergency Savings

Most financial planners recommend reserving at least three to six months of living expenses in cash. Emergency savings cover essentials such as rent and food if you lose your job or your car breaks down.

The only way you can lose in high-quality, long-term investments is if you have to take that money out early for an emergency.A young investor should never rely on investments as a safety net, according to Robert Rosen, a Florida-based financial advisor with Edward Jones.

“The only way you can lose in high-quality, long-term investments is if you have to take that money out early for an emergency,” Rosen said.

Investments can be difficult to access quickly — and doing so ahead of schedule can result in stiff fees and penalties.

Liquid cash in your savings account lets you handle emergencies without tapping your investments or plunging into debt.

Paying Off Credit Card Debt

If you’re young, you probably have debt. You don’t need to eliminate all of it before you start investing — but paying down high-interest credit cards should be a priority.

Quick FactIf you earn a 7 or 8 percent return in the stock market but pay 20 percent on credit card interest, you significantly reduce your net earnings.Source: Robert Rosen, Edward JonesMany experts recommend paying off your credit cards in full each month. But if you owe more than $1,000, this may be challenging.

Figure out how much you need to pay each month to delete this debt in a reasonable time, perhaps six months to two years. Chipping away at a credit card balance can make it feel more manageable.

The same rule doesn’t necessary apply to student loans. Federal student loan interest rates tend to be lower than private loans or credit cards and offer benefits such as income-driven repayment plans.

Never miss a student loan payment, but evaluate if eliminating this debt ahead of schedule significantly benefits you.

“In a perfect world, you should pay down all your debt — but everyone’s situation is different,” Rosen said. “You may not want to miss out on investing for retirement because you spend all your extra money paying down student loan debt.”

Budget Management

You can’t invest your way out of poor spending habits.

If it feels like your money goes out as soon as it comes in, create a budget.

List fixed expenses, such as your cell phone bill, rent, car payment and internet. Give yourself enough wiggle room for variable expenses such as utilities, food and entertainment to create a couple realistic spending goals each month.

Examining past debit and credit card statements can help you understand how much you really spend on new clothes, take-out or drinks with friends after work.

Where can you trim? Be honest and start cutting.

There are numerous resources online for budget management. The Federal Trade Commission offers a helpful resource guide on topics such as making a budget and paying for your first apartment.

Apps such as Mint or Wally are other tools you can use to track your spending habits.

Develop Your Goals

Before you start investing, it’s helpful to develop some short-term and long-term goals.

Short-term goals can include saving up to buy a home, a new car or a dream vacation to Europe. Long-term goals can include retirement or creating a college fund for your future children.

Many financial planners offer this advice: Save for the short-term, invest for the long-term.

3 Minute Quiz: Can You Retire Comfortably?Take our free quiz & match with a financial advisor in 3 easy steps. Tailored to your goals. Near you or online.Knowing the Basics of Investing

Investing can seem intimidating at first. There’s a lot to learn.

Start with the basics. Set aside time to learn about 401(k)s, stocks, mutual funds and asset allocation. Understand the relationship between risk and reward.

Once you’re familiar with these concepts, pick the best way to invest your money. Thanks to technology, there’s more choices than ever before.

Ways to Invest Your Money- An employer-sponsored 401(k) plan

- Traditional or Roth IRA account

- Online brokerage account (E-Trade, Robinhood)

- Micro-investment apps (Acorns, Stash)

- Robo-advisors (Betterment, Wealthfront)

Retirement Savings Plans

Opening a 401(k) plan or other retirement savings account is one of the easiest ways to start investing in your 20s.

Retirement plans allow you to select specific investments within the account itself. This can include stocks, bonds and target-date funds.

Did You Know?The average cost of retirement is $738,400, according to a March 2017 Merrill Lynch Finances in Retirement Survey.Most employers offer either a 401(k) or 403(b) plan to employees. Some may even offer to match your contributions up to a certain percentage. This is essentially free money for your future.

Saving for retirement may seem unimportant in your 20s because it’s so far away. But retirement is expensive.

Many financial experts recommend allocating at least 10 to 15 percent of your salary to a retirement account. In 2021, you can contribute up to $19,500 a year to a 401(k) plan.

This may not be realistic for you right now, and that’s OK. Contribute what you can, even if it’s only $25 a paycheck.

Did You Know?With some exceptions, if you withdraw 401(k) or IRA funds before turning 59.5 years old, the IRS imposes a 10 percent tax penalty.Source: Internal Revenue ServiceAs you get older and earn more money, chip in more. Increase your contribution percentage after each raise.

Always aim to contribute at least as much as your employer match. This can literally double your retirement nest egg.

To sign up for your 401(k) plan or learn more about what it offers, contact your HR department.

Traditional and Roth IRAs

All employers may not offer a 401(k) plan. If that’s your situation, consider opening a traditional or Roth IRA. There’s also an option for self-employed people called a SEP IRA.

These retirement accounts offer many of the same benefits as 401(k)s but are available through a financial advisor, online brokerage account or micro-investment app. IRAs may offer broader investment choices than 401(k) plans.

Key Differences Between Traditional and Roth IRAs- Traditional IRAs require you to pay taxes when you withdraw money during retirement.

- Roth IRAs are funded with after-tax dollars so you can withdraw money tax-free.

- You’ll likely face a 10 percent IRS penalty for withdrawing traditional IRA funds before age 59.5.

- Roth IRAs offer greater flexibility with withdrawals before age 59.5.

The maximum amount you can contribute to an IRA if you’re under the age of 50 in 2021 is $6,000, which is $13,500 less than you can contribute to a 401(k).

Other Types of IRAs to ConsiderType of IRA Worth Exploring for Young Investors Backdoor Roth IRA Yes Crypto IRA No Education IRA Yes, if you are saving for college Gold IRAs No Inherited IRA Yes, if you are young and inheriting a large IRA Nondeductible IRA Yes, if you are in a high tax bracket Rollover IRA Yes, if you are moving an IRA from one custodian to another Roth IRA for Grandchildren Yes, if you are starting to save for your grandchildren's retirement Self-Directed IRA Yes, if you want more control over your investments SIMPLE IRA Yes, if you work for a small business Spousal IRA Yes, if you are married and your spouse does not have an IRA Mutual, Index and Exchange Traded Funds

Mutual funds, index funds and exchange traded funds allow you to buy small pieces of many different assets in a single purchase.

All three share similarities and a few key differences.

Even small differences in fees can translate into large differences in returns over time.Mutual funds are managed by a professional and come with fees. They allow a group of investors to pool their money to purchase stocks and bonds. They offer convenience, diversification and access to professional money managers.

Index funds and ETFs are often used interchangeably. That’s because many ETFs track an index.

Unlike traditional mutual funds, index funds and ETFs are passively managed and mirror the rise and fall of an index, such as the S&P 500 or Dow Jones Industrial Average.

Index funds and ETFs offer lower fees than mutual funds.

Vanguard’s S&P 500 ETF, for example, has an expense ratio of 0.03 percent, which equals about 30 cents per year for every $1,000 invested. Fidelity’s 500 Index Fund has an even lower expense ratio at 0.015 percent.

Meanwhile, the average expense ratio for a mutual fund is generally between 0.25 and 1.5 percent. This doesn’t include shareholder fees and other costs.

You can purchase a mutual fund, index fund or ETF directly from a mutual fund company or online brokerage.

Stocks

Purchasing individual stocks requires research. When you buy a share, you’re essentially stating that you believe in its future.

You should never purchase single stocks if you’re unfamiliar with the company or its earning potential.

“Buy what you like and what you know,” Rosen advises. “Don’t just buy stocks because people tell you they’re going to be a good investment.”

It’s always smart to review the company’s annual report and read recent news articles on its performance.

Use available tools on your brokerage account to gain a better understanding of how the business compares to similar companies. Explore its position within the overall industry.

Don’t just buy stocks because people tell you they’re going to be a good investment.When it comes to buying stocks, some financial experts suggest starting small. Purchase a small number of affordable shares to get an idea of what it’s like to own one. Grow and diversify your holdings over time.

Finally, don’t be intimidated by market crashes. Instead, Rosen says this volatility creates unique opportunities for young investors.

“Times of great economic uncertainty are great for long-term investors,” Rosen said. “There’s no better time to buy than when the market is down and stocks are cheap.”

Bonds and CDs

Bonds and CDs are low-risk savings vehicles that offer a return of your investment plus interest.

Both work by paying interest for a specific time. When that time is up, you receive your initial deposit or investment back plus interest.

Banks or credit unions offer CDs. You can purchase CDs for various lengths of time, generally from six months to five years.

The interest rate for CDs, like bonds, tends to be low. Sometimes these rates are only slightly higher than high-yield savings accounts.

Bonds are a way for corporations and municipalities to borrow money, similar to an IOU. You purchase the bond, and after a set period of time, the issuer returns your initial investment plus interest.

Unlike CDs, bonds tend to pay interest in regular installments instead of in full at the end. A bond can be sold before it matures, whereas a CD typically cannot.

Bonds can be purchased online directly from a broker or the U.S. government, but many investors opt to buy portions of bonds inside a mutual fund or 401(k) plan.

Did You Know?In December 2020, a 10-year T-bill bond yielded less than 1 percent a year.Source: U.S. Department of the TreasuryCDs and bonds are solid ways to save and diversify your portfolio. However, since rates of return are low, many financial experts recommend focusing on stocks, index funds and ETFs when you’re young because these assets offer higher growth potential.

Home Buying and Real Estate Investment Trusts

Real estate investment trusts, or REITs, allow you to invest in large-scale real estate without actually buying property.

Many REITs are registered with the U.S. Securities and Exchange Commission and are traded on the stock market. Non-publicly traded REITs carry more risk.

REITs let you add diversified real estate to your investment portfolio and may offer higher dividend yields than other investment options.

Buying a home is another way to invest in real estate.

Purchasing a home allows you to build large amounts of equity you can borrow against. Plus, most property values increase over time.

An initial $6,000 down payment on a $250,000 home can result in owning an asset worth $300,000 or more in 30 years.

However, purchasing a home in your 20s has its drawbacks. First, it’s expensive and high mortgage payments may limit your ability to invest elsewhere.

It’s also a major responsibility with ample upkeep and maintenance costs over time.

Finally, the permanence of homeownership makes it difficult to move quickly for a new job or marriage. It’s important to analyze the potential cost benefits before purchasing a home.

Why You Should Invest When You’re Young

Investing in your 20s is like running a race. Starting early gives you a competitive advantage, similar to a 10 second head start over fellow runners.

Even when others join the race and begin investing later, they will have to work much harder just to catch up with you.

Compounding Interest

Albert Einstein once described compounding interest as the eighth wonder of the world.

It’s the phenomenon when the interest you earn on savings or investments builds on itself. It’s like a snowball effect.

Because compounding interest increases with time, young investors get a leg-up on those who wait.

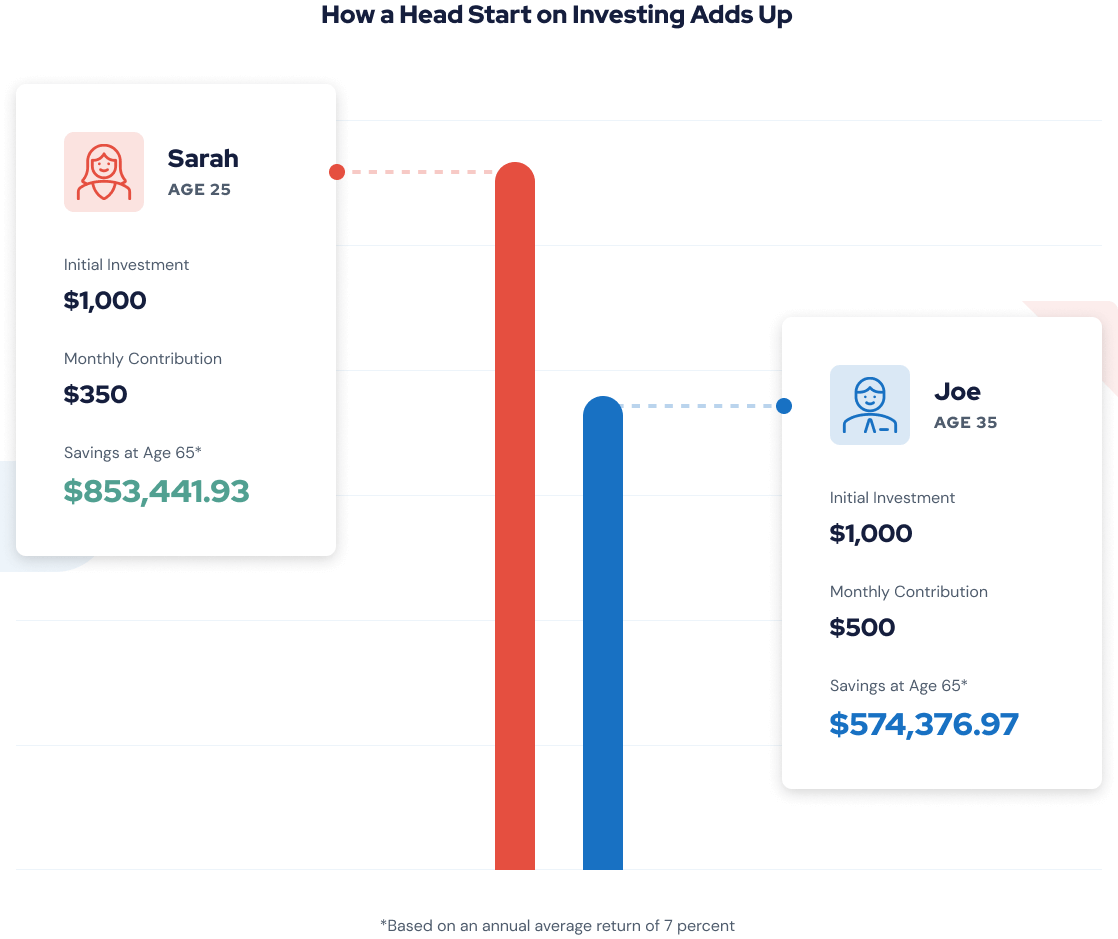

Even with a higher monthly contribution and the same rate of return, Joe only nets about $574,376 by the time he’s 65 years old — about a third less than Sarah.

TipInvestor.gov offers an interactive calculator that lets you see exactly how much your money can grow using the power of compounding interest.Longer Time Horizon

Time is on your side when you’re young. Retirement is still decades away and your investments have room to grow.

A time horizon is how long you plan to hold an asset. Time horizons can range from a few months to decades.

Investors with a longer time horizon tend to perform better than those who focus on short-term gains.

Maintaining a distant time horizon when you’re young can hedge against stock market volatility. You’re less likely to give into fear and sell when stocks plunge because your sights are set on the future.

Higher Risk Tolerance

Risk tolerance is your ability to stomach loss in exchange for greater potential returns.

Time is a safeguard against risk. Longer time horizons give young investors room to bounce back from loss long before retirement.

However, you should reduce your risk as you get older. Market volatility is a bigger threat as you prepare to leave the workforce.

Consider a financial concept known as the 120 rule.

It works by subtracting your age from 120. The resulting number is the percentage you should invest in stocks. The rest goes to bonds.

So, if you’re 25 years old, 95 percent of your investments would be in stocks with just 5 percent in bonds. However, when you’re 55, stocks would make up only 65 percent of your portfolio.

More conservative investors may prefer the 100 rule. In this case, a 25-year-old allocates 75 percent to stocks and 25 percent to bonds.

Pick the asset allocation you’re most comfortable with.

Expert Tips for Young Investors

Christopher Magnussen Expert on Investing

Christopher Magnussen Expert on InvestingChristopher Magnussen is a financial services expert with more than 20 years of investment experience at TD Ameritrade and other institutions. He is currently a financial advisor with Insuractive.

1. Be comfortable with risk — but not too comfortable.I’ve seen some young investors who make trades on online brokerage accounts like people make bets at a casino. You need to understand the consequences of your investment decisions.

2. Do your research.Don’t just buy five shares of trendy stock because your friend says it’s a great idea.

3. Diversify.If you’re allocated across several asset classes and sectors based on your risk profile, you don’t have to know who’s going to win. You own some portion of every winning hand.

4. Look at bond ETFs.Even young investors need fixed income securities, such as bonds, in their portfolio. Bond ETFs, like index ETFs, are an easy and affordable way to invest in multiple assets with a single purchase. Another option is bond mutual funds.

5. Invest in your company’s 401(k).The beautiful thing about that is it automatically takes your money out of your paycheck before you see it. Out of sight, out of mind.

Investing Mistakes to Avoid

Your money is your future, so invest wisely.

One of the biggest mistakes young investors make is procrastinating. As we’ve discussed, waiting to invest can cost you.

But what other obstacles might you encounter on your path to financial independence?

Investment Mistakes to Avoid- Assuming you need a lot of money to get started. This simply isn’t true. Micro-investment apps such as Acorns allow you to start investing with as little as $1 a month. There’s also plenty of brokerage accounts and automated investment services with no minimum balances.

- Watching investments too closely. Checking your brokerage account every day, especially during market crashes, can lead to impulsive selling and potentially devastating losses. It’s important to monitor your portfolio, but don’t obsess over it. You’re in this for the long haul.

- Not doing your homework. Always research potential stocks, brokerage accounts, financial planners and all other aspects of investing. Ask questions. Educate yourself on all available options before making a big decision.

- Investing sporadically. Don’t make investing an afterthought. Many experts suggest setting up automatic transfers and withdrawals from your checking account to your brokerage account, or from your paycheck to your 401(k) plan. Doing so helps you learn to live on less. It also makes sure you save and invest at a consistent rate.

Not in Your 20s? It’s Not Too Late

You put off investing in your 20s and are now worried about your retirement nest egg.

It’s ideal to start young, but really, it’s never too late.

If you’re in your 30s or 40s, many of the same rules of investing apply. The big difference is how much money you must now allocate to reach your goals.

You’ll likely earn more money in your 30s and 40s than you did right out of college. That’s good — you need to save and invest at a higher rate to make up for lost time.

Other things you can do in your 30s and 40s:- Max out your employer 401(k) contributions. In 2021, this is $19,500 a year.

- Put leftover funds in a separate traditional or Roth IRA account.

- Consider a side job for extra income.

- Cut spending.

- Speak with a Certified Financial Planner (CFPⓇ).

Additional Resources for Young Investors

- BetterInvesting

- This 501(c)(3) nonprofit, formerly known as the National Association of Investment Clubs, helps individuals learn to build wealth through stock investing. They offer investor education articles, free videos and other resources on their website.

- Morningstar Investing Classroom

- Morningstar is an investment research firm that compiles and analyzes fund, stock and other market data. Its Investment Classroom offers free courses on investing as well as other financial topics.

- Podcasts from The Wall Street Journal

- The Wall Street Journal offers a number of free business and investing related podcasts with insightful coverage on relevant financial topics reported by professional journalists and industry experts.

Last Modified: July 10, 2023Share This Page19 Cited Research Articles

- Internal Revenue Service. (2020, February 13). Topic No. 558 Additional Tax on Early Distributions from Retirement Plans Other than IRAs. Retrieved from https://www.irs.gov/taxtopics/tc558

- Bernard, T. S. (2020, February 10). The Young Person’s Guide to Investing. Retrieved from https://www.nytimes.com/2020/02/10/smarter-living/the-young-persons-guide-to-investing.html

- Hicks, C. (2019, December 5). ETF vs. Index Fund: The Difference and Which to Use. Retrieved from https://money.usnews.com/investing/investing-101/articles/etf-vs-index-fund-the-difference-and-which-to-use

- Massa, A. (2019, October 10). Brokers Profit From You Even If They Don’t Charge for Trading. Retrieved from https://www.bloomberg.com/news/articles/2019-10-10/brokers-profit-from-you-even-if-they-don-t-charge-for-trading

- Friedberg, B. (2019, August 21). How to Choose Between Bonds vs. CDs. Retrieved from https://money.usnews.com/investing/bonds/articles/how-to-choose-between-bonds-vs-cds

- Adamczyk, A. (2019, June 17). How to invest and pay off your student loans, according to the Broke Millennial. Retrieved from https://www.cnbc.com/2019/06/17/should-you-pay-off-your-student-loans-or-invest.html

- Merriman, P. (2019, March 6). This is the most important investment decision you’ll ever make. Retrieved from https://www.marketwatch.com/story/young-investors-this-is-the-most-important-investment-decision-youll-ever-make-2019-03-06

- Rose, J. (2019, January 19). How To Invest In Your 20's: Financial Advisors Share Their Best Tips. Retrieved from https://www.forbes.com/sites/jrose/2019/01/19/financial-advisors-share-their-best-tips-on-how-to-invest-in-your-20s/#db1427231d5e

- Connick, W. (2017, April 27). The average cost of retirement is $738,400: Will you have enough? Retrieved from https://www.usatoday.com/story/money/personalfinance/retirement/2017/04/27/the-average-cost-of-retirement-is-738400-will-you-have-enough/100738100/

- Polyak, I. (2015, June 10). Age and risk tolerance key to mastering asset allocation. Retrieved from https://www.cnbc.com/2015/06/10/age-and-risk-tolerance-key-to-mastering-asset-allocation.html

- CNN Money. (n.d.). What's the difference between Roth and traditional IRAs? Retrieved from https://money.cnn.com/retirement/guide/IRA_Basics.moneymag/index2.htm

- Federal Trade Commission. (n.d.). Managing Your Money. Retrieved from https://www.consumer.gov/section/managing-your-money

- Hochwald, L. (n.d.). The 11 Worst Mistakes First-Time Investors Make. Retrieved from https://www.rd.com/list/mistakes-first-time-investors-make/

- U.S. Securities and Exchange Commission. (n.d.). What are REITs? Retrieved from https://www.investor.gov/introduction-investing/investing-basics/investment-products/real-estate-investment-trusts-reits

- U.S. Securities and Exchange Commission. Compounding Interest Calculator. Retrieved from https://www.investor.gov/financial-tools-calculators/calculators/compound-interest-calculator

- U.S. Securities and Exchange Commission. (n.d.). Financial Navigating in the Current Economy: Ten Things to Consider Before You Make Investing Decisions. Retrieved from https://www.sec.gov/investor/pubs/tenthingstoconsider.htm

- U.S. Securities and Exchange Commission. (n.d.). Mutual Funds and Exchange-Traded Funds (ETFs) – A Guide for Investors. Retrieved from https://www.sec.gov/reportspubs/investor-publications/investorpubsinwsmfhtm.html#Fees

- Vanguard. (n.d.). Broaden your portfolio with CDs & Bonds. Retrieved from https://investor.vanguard.com/investment-products/cds

- U.S. Department of the Treasury. (n.d.). Daily Treasury Yield Curve Rates. Retrieved from https://www.treasury.gov/resource-center/data-chart-center/interest-rates/pages/textview.aspx?data=yield

- Edited By

Your web browser is no longer supported by Microsoft. Update your browser for more security, speed and compatibility.

If you need help pricing and building your medicare plan, call us at 844-572-0696