Demand-Pull Inflation: Causes and Examples

Demand-pull inflation occurs when the demand for goods or services is greater than the supply being produced. It’s often described as too much money chasing too few goods. Prices are theoretically determined by the relationship between aggregate demand and aggregate supply. So when the relationship isn’t in equilibrium, then prices generally increase.

- Written by Toby Walters, CFA®

Toby Walters, CFA®

Chartered Financial Analyst and Paraplanner

Toby Walters, CFA®, has over 25 years of financial research experience. With a knowledge and understanding of researching and analyzing financial data, he has developed a unique and experienced viewpoint on money matters. He has been a chartered financial analyst since 2003, and most recently a portfolio analyst and paraplanner.

Read More- Edited By

Savannah Pittle

Savannah Pittle

Senior Financial Editor

Savannah Pittle is a professional writer and content editor with over 16 years of professional experience across multiple industries. She has ghostwritten for entrepreneurs and industry leaders and been published in mediums such as The Huffington Post, Southern Living and Interior Appeal Magazine.

Read More- Financially Reviewed By

Stephen Kates, CFP®

Stephen Kates, CFP®

Certified Financial Planner™ Professional and Founder of Clocktower Financial Consulting

Stephen Kates is a Certified Financial Planner™ professional and personal finance expert with over a decade of experience working with individuals and families who need help with their finances. With experience as a financial advisor for two of the largest financial firms in the country, Stephen has worked with hundreds of clients to build comprehensive financial plans to grow and protect their wealth.

Read More- Published: March 28, 2023

- Updated: July 10, 2023

- 9 min read time

- This page features 5 Cited Research Articles

Key Takeaways- Two types of inflation are demand-pull inflation and cost-push inflation. Both can have impacts on retirement savings, particularly when savings aren’t adjusted for higher-than-expected expenses.

- The Federal Reserve, which targets inflation at 2%, has various ways of lowering inflation. Those tools, such as increasing interest rates, can affect not only your saving for retirement but also your income and expenses while in retirement.

- There are some benefits to demand-pull inflation, particularly when interest rates rise. Taking advantage of these may ease the burden of higher expenses.

- Demand-pull inflation can have a larger impact on retirees since income sources are limited in most cases to Social Security and withdrawals from retirement plans, either of which may not keep up with rising prices.

What Is Demand-Pull Inflation?

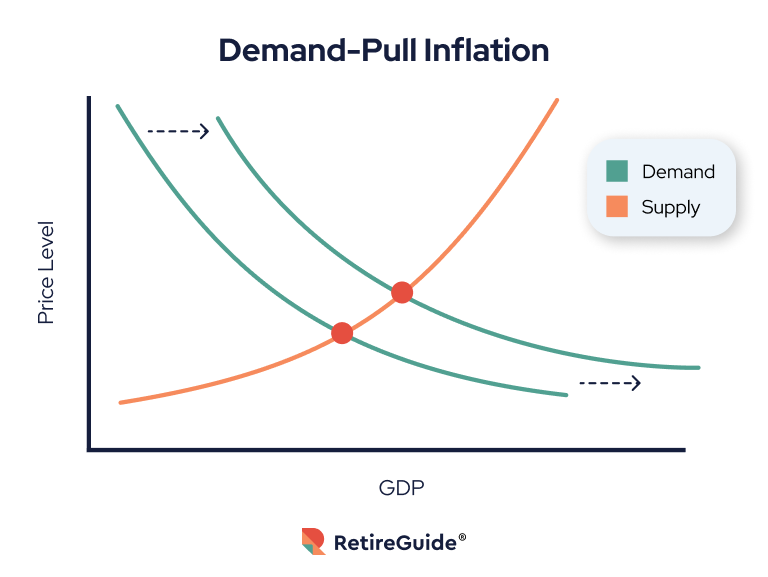

As you may have learned in microeconomics, prices of anything that can be purchased are theoretically determined by the relationship between aggregate demand and aggregate supply. When demand for a particular product is greater (or increases faster) than supply and the relationship isn’t in equilibrium (a state of balance), then prices (as measured by inflation) increase.

One effect is that the Federal Reserve, which has a target inflation rate of 2%, will raise interest rates to slow down economic activity. By making borrowing money more expensive, purchasing demand is reduced and theoretically should mitigate demand-pull inflation. However, this is a hit-or-miss strategy and there’s a possibility that interest rates rise too quickly or too high, resulting in more of a slowdown in the economy (such as rising unemployment) than hoped for.

Besides Social Security, retirees very often have to pay for their expenses by withdrawing from retirement accounts that aren’t growing faster than what they’re taking out. On top of that, their investments probably don’t increase as much as the rate of inflation. As a result, they may not have as much buying power as they anticipated when they were planning their retirement. It’s easier than you think to underestimate your anticipated living expenses in retirement because of not fully accounting for inflation.

Specific examples of demand-pull inflation include rising house prices. When mortgage rates are low, monthly interest payments are reduced and real estate is seen as more affordable. This leads to more consumers interested in purchasing homes with the supply of existing homes being fixed and not enough new homes being built or not constructed fast enough. This greater demand leads to higher home prices.

Many examples also occurred during the pandemic. One was when medical experts were recommending people frequently wash their hands. Since it was inconvenient (and unrealistic) for most to wash their hands often, hand sanitizers became popular as a substitute. Although they existed before the pandemic, the encouraged use of hand sanitizers resulted in a large increase in demand with sales rising by 73% in February 2020, leading to higher prices.

Demand-pull inflation, like any cause for inflation, results in rising prices. From a consumer perspective, this can create an incentive to purchase large ticket items sooner to avoid future rising costs. From an investor perspective, it can create the incentive to purchase assets now to capture future higher values. Balancing the needs in your life for consuming versus investing is important to maintain a healthy financial condition.What Causes Demand-Pull Inflation?

When prices are expected to grow at an increasing rate in the future, consumers may buy more in the present when prices are relatively less (compared to the anticipated forthcoming higher prices). Also, if the Federal Reserve expands the money supply to boost the economy, consumers will have more disposable income and will generally spend it rather than save it.

But demand isn’t confined to just individual consumers. When the government (whose spending makes up about 25% of the Gross Domestic Product (GDP)) increases its spending, that also results in increased demand which may not be accompanied by an increase in supply to mitigate it.

Several factors can contribute to demand-pull inflation. One is the Federal Reserve setting low interest rates (so that borrowing is cheaper) which can cause consumer spending to increase more than producers can increase production. An increase in real wages (wages increasing faster than the rate of inflation) can also cause consumer spending to increase.

Is Your Retirement Plan on Track?Explore annuity solutions that align with your planning needs.

*Ad: Clicking will take you to our partner Annuity.org.How Does Demand-Pull Inflation Affect Retirement Plans?

For those currently contributing to retirement plans, the goal is to save a certain amount in today’s dollars for retirement expenses. But the purchasing power of the amount saved will be less after the effects of inflation reduce what that amount can pay for in your retirement. As a result, what’s been saved for retirement can be underestimated if inflation isn’t fully accounted for and current savings may need to be increased.

Although Social Security benefits have cost of living adjustments (COLA), inflation can still decrease the effects of COLA. For example, Medicare Part B premiums, which historically have increased more than COLA, are deducted from Social Security benefits.

Inflation in any form erodes your purchasing power since you’re able to buy less as prices increase. What you can purchase for a dollar today is more than what you can buy for a dollar tomorrow if the prices of goods and services increase. Demand-pull inflation can cause prices to increase more than wages, resulting in real wages (income adjusted for inflation) declining. As a result, you end up spending more on goods and services.

Demand-Pull Inflation vs. Cost-Push Inflation

Cost-push inflation can occur when the demand for a good or service remains static (or decreases) while the price increases (which could occur from a supply shortage). As such, the price increase comes from the supply side, usually in the form of rising production prices. An example of this was supply chain interruptions during the pandemic when consumers were still purchasing products but manufacturing facilities weren’t operating at full capacity, often because of workplace shutdowns. This led to higher costs of production and raw materials.

Both an increase in demand and a decrease in supply can lead to inflation. Demand-pull inflation is caused by consumers wanting to buy more of a service or good without a corresponding increase in supply. Cost-push inflation is caused by an increase in supply costs which are forwarded on to the consumer. If the demand of consumers doesn’t decrease, prices will continue to rise.

AdvertisementPros and Cons of Demand-Pull Inflation

Pros of Demand-Pull Inflation- Demand-pull inflation is often countered by the Federal Reserve raising interest rates. Retirees investing in CDs or other interest-bearing investments such as money market accounts will receive higher interest rates.

- Real estate prices tend to increase during inflation so the value of retirees’ homes also increases, creating more wealth (at least on paper). Even if you are still paying off your mortgage with a fixed-rate mortgage, you’re paying it off with lower real interest rates (actual interest rate adjusted for the effects of inflation).

- Also, since income tax brackets are indexed to inflation, retirees may be able to withdraw more than their required minimum distributions from their retirement accounts before hitting the next-highest tax bracket (and having to pay more in taxes). And to benefit those not itemizing on their tax forms, the standard deduction is also indexed for inflation.

Cons of Demand-Pull InflationTaxes in Retirement- The effect of price increases has a greater adverse impact on those with fixed incomes. Retirees may not have more money available to them besides their savings and Social Security but the cost of living is still rising.

- Retirees also tend to have more bonds and other fixed-income instruments in their investment portfolios. Bond prices have an inverse relationship with interest rates so when interest rates go up (as they do to slow down inflation), the prices of bonds decline.

- Although Social Security benefits are tax-free for incomes not exceeding $32,000 for couples (and $25,000 for individuals), these thresholds haven’t increased in some time, which could mean less tax-free income.

Strategies for Dealing with Demand-Pull Inflation

Reviewing Your Retirement PlanInflation tends to affect asset classes in different ways. For example, commodities and real estate tend to do better since they both benefit directly from higher prices. Although these may not be thought of as part of an investment portfolio, that’s why it’s important to have well-diversified investments that include asset classes such as these to help insulate you against the adverse effects of rising prices.

When saving for retirement, make sure to account for inflation. If you don’t, you could end up underestimating your retirement expenses and how much you need to save for them. If you’re trying to match your savings with expenses, then you may have to save more than you originally thought. But the earlier you realize this, the less you’ll have to increase your savings.

Also, keep in mind that inflation is a moving target. The causes of inflation change from time to time so you’ll have to continue to monitor its impact on your savings.

A financial advisor can help determine if you’re saving enough for retirement. Advisors have experience modeling the future effects of inflation and how your spending may change in retirement. This can give you a better idea of how much you may need to set aside now so you won’t be caught short when saving for retirement expenses.

Don’t let underestimating the effects of inflation leave a nasty surprise in retirement! You can have peace of mind by thinking about this well ahead of time. Adjusting your savings now can bring many benefits in your retirement, leaving you to enjoy that stage of life to its fullest.

If you have any concerns about the effects of demand-pull inflation and how it could affect your plans for retirement savings, consult a financial advisor. With available tools and experience, they can help answer your questions and alleviate your worries.

Frequently Asked Questions About Demand-Pull Inflation

What are the three main causes of demand-pull inflation?A strong economy (growing gross domestic product) and low unemployment) generally leads to higher income, which increases demand. Another main cause is an increase in the money supply, which leads to too much money chasing too few goods. And if people expect inflation to increase in the future, they may buy more now before goods and services cost even more later on.Is inflation caused by demand-pull or cost-push?Inflation can be caused by both. If consumers demand more and are willing to pay for it, resulting in higher prices, then it’s demand-pull inflation. But if the costs of production increase and are passed on to consumers, which results in higher prices, then inflation is cost-push. These aren’t necessarily mutually exclusive and can be concurrent, making it difficult at times to determine in real time what type of inflation is occurring.What is a recent example of demand-pull inflation?One recent example of demand-pull inflation was the $931 billion in stimulus checks provided by the Economic Impact Payments. This increased aggregate demand at a point when supply chain shortages were causing supply-push price increases. Inflation that many considered to be transient instead remained stubbornly high.AdvertisementConnect With a Financial Advisor Instantly

Our free tool can help you find an advisor who serves your needs. Get matched with a financial advisor who fits your unique criteria. Once you’ve been matched, consult for free with no obligation.

Last Modified: July 10, 2023Share This PageAdvertisement5 Cited Research Articles

- U.S. Government Accountability Office. (2022, June 29). Stimulus Checks: Direct Payments to Individuals during the COVID-19 Pandemic. Retrieved from https://www.gao.gov/products/gao-22-106044

- Pettinger, T. (2021, May 15). Demand-Pull Inflation. Retrieved from https://www.economicshelp.org/blog/27613/inflation/demand-pull-inflation/

- Munnell, A. & Muldoon, D. (2008, October). The Impact of Inflation on Social Security Benefits. Retrieved from https://crr.bc.edu/briefs/the-impact-of-inflation-on-social-security-benefits/

- Taylor, C. (2020, March 3). Sales of Hand Sanitizer are Skyrocketing Due to the Coronavirus, Leading to Rationing and Price Hikes. Retrieved from https://www.cnbc.com/amp/2020/03/03/coronavirus-hand-sanitizer-sales-surge-leading-to-price-hikes.html

- U.S. Treasury Fiscal Data. (n.d.). How Much Has the U.S. Government Spent This Year? Retrieved from https://fiscaldata.treasury.gov/americas-finance-guide/federal-spending/

- Edited By

Calling this number connects you to one of our trusted partners.

If you're interested in help navigating your options, a representative will provide you with a free, no-obligation consultation.

Our partners are committed to excellent customer service. They can match you with a qualified professional for your unique objectives.

We/Our Partners do not offer every plan available in your area. Any information provided is limited to those plans offered in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

844-359-1705Your web browser is no longer supported by Microsoft. Update your browser for more security, speed and compatibility.

If you need help pricing and building your medicare plan, call us at 844-572-0696