What Is the Primary Reason for Buying an Annuity?

Annuities provide tax-deferred growth, guaranteed lifetime income and potential death benefits, with customizable options and riders. They protect against outliving retirement savings, offer high contribution limits, limit market risk and can guarantee payouts through specific riders.

- Written by Stephen Kates, CFP®

Stephen Kates, CFP®

Principal Financial Analyst for RetireGuide.com

Stephen Kates is a Certified Financial Planner™ professional and personal finance expert with over a decade of experience working with individuals and families who need help with their finances. With experience as a financial advisor for two of the largest financial firms in the country, Stephen has worked with hundreds of clients to build comprehensive financial plans to grow and protect their wealth.

Read More- Edited By

Michael Santiago, CRPC™

Michael Santiago, CRPC™

Senior Financial Editor

Michael Santiago, a senior financial editor, joined RetireGuide in 2023. With over 10 years of professional writing and editing experience, he brings a wealth of expertise in creating content for diverse industries, including travel and healthcare. Having traveled to more than 40 countries across five continents and lived in Europe and Asia for several years, Michael's global perspective enriches his work. He combines his strong writing skills, editorial judgment and passion for crafting accurate and engrossing content to enhance the user experience on RetireGuide.

Read More- Reviewed By John Stevenson, CFF

- Published: August 14, 2024

- Updated: March 7, 2025

- 5 min read time

- This page features 3 Cited Research Articles

- Edited By

- Investors primarily buy annuities for guaranteed lifetime income and to protect against the risk of outliving their retirement savings.

- Annuities offer tax-deferred growth, high contribution limits, guaranteed lifetime income and potential death benefits, with numerous options and riders to tailor to individual needs.

- Annuities provide income and asset protection, which can help balance the risk of fluctuating market-based portfolio withdrawals during periods of negative performance.

Annuities are insurance products that provide owners with a contractually guaranteed stream of income, either immediately or in the future. Some types of annuities offer fixed or variable accumulation benefits before the contracts are converted into an income stream. The main benefits of annuities include tax-deferred growth, guaranteed payments over a lifetime or a specified period and potential death benefits for heirs.

Annuities come in many variations and offer numerous contract riders that can provide additional guarantees or customizations. Unlike many purely market-based retirement vehicles, such as IRAs or 401(k)s, annuities can be tailored to the specific needs of the owner.

Why People Choose Annuities

The primary reason investors purchase annuities is to secure guaranteed lifetime income that will not deplete, regardless of how long they live. As an insurance product, income annuities benefit from the collective premiums of thousands of investors, which the insurance carrier uses to provide guarantees that offset certain unknown future risks. Unlike life insurance—typically used to mitigate the risk of premature death—annuities are designed to protect against the risk of longevity, which could otherwise deplete one’s retirement savings.

Income Diversification

One of the biggest unknowns in retirement planning is the length of retirement. If we knew exactly how long we would live, retirement planning would be a straightforward budgeting exercise. In reality, there are many factors to consider when planning for the unknown length of time we might live and the uncertain expenses we will incur along the way. Annuities, along with other sources of guaranteed income such as Social Security and pensions, provide much-needed income reliability and offer a counterbalance to fluctuating withdrawals from an invested portfolio.

The traditional “three-legged stool” of retirement—consisting of Social Security, a pension and personal savings—has become less relevant due to the decline in pension availability.

Today, this concept can be repurposed into a new three-legged stool:

- Guarantees

- All retirees need some level of guaranteed income to cover their non-negotiable or essential expenses. When Social Security does not cover all essential expenses, it is prudent to consider additional sources of guaranteed income to close the gap.

- Growth

- Market-based investments, such as a mix of stocks and bonds, have historically served as a reliable hedge against inflation. While short-term fluctuations and declines in value are possible, over the long term, these investments generally produce higher returns compared to fixed investments.

- Flexibility

- Cash and cash equivalents provide safety of principal and easy access to funds when needed. A well-funded savings account can cover unexpected expenses and serve as an alternative to withdrawals from investment accounts during recessionary periods.

*Ad: Clicking will take you to our partner Annuity.org.

Additional Benefits of Annuities

While annuities are primarily used to guarantee income, they offer a range of benefits through various contract types and use cases, such as tax deferral, limiting market risk and creating a guaranteed inheritance.

Tax-Deferred Growth

Annuities offer two unique features that other retirement vehicles do not: nearly unlimited contributions and tax deferral. Unlike IRAs or 401(k)s, annuities are not subject to IRS contribution limits, though insurance carriers may impose their own internal limits.

For high-income investors, annuities can provide a way to shield additional savings from taxable investment income once other tax-deferral options have been exhausted. Multi-year guaranteed annuities (MYGAs) serve as a viable alternative to CDs, typically offering both tax deferral and higher interest rates. Investment-only variable annuities can also help boost retirement savings when other contribution limits have been reached.

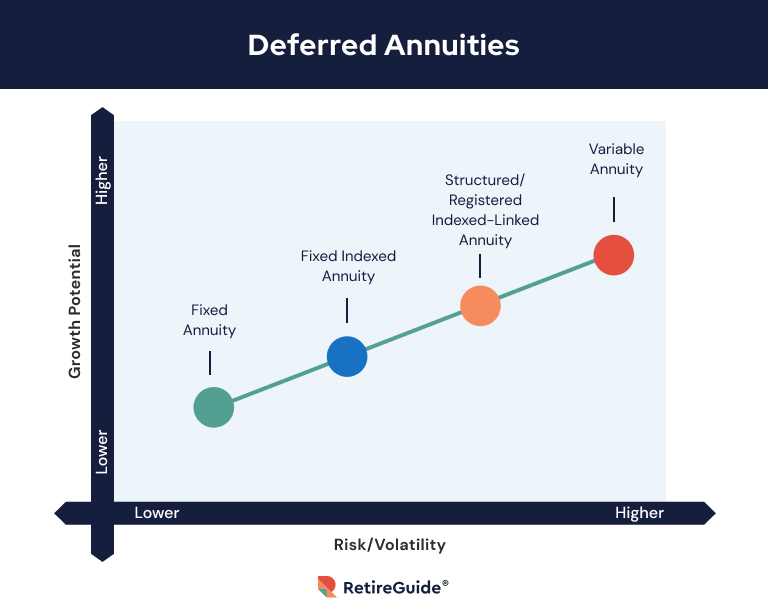

Limiting Market Risk

The fluctuations of the stock and bond markets can make many pre-retirees uneasy. Annuities offer options to limit or eliminate the downside risk of these markets while still allowing for some potential upside. Products like fixed index annuities or registered index-linked annuities (also known as structured annuities) provide peace of mind by protecting your money from downturns during the critical years leading into retirement.

Guaranteed Inheritance

Many investors worry that annuities aren’t worth it if they end when the owner dies. However, this concern only applies to contracts structured in that way. It’s easy to add specific riders to annuities that ensure a guaranteed return for a specified period or provide a guaranteed death benefit to heirs.

- Riders: Adding riders such as period certain or cash refund to an income annuity ensures that, regardless of how long the owner lives, a specified amount of money will be paid out of the contract—either to the owner or to the heirs. Death benefit riders can also be added to variable or fixed index annuities to guarantee a minimum amount for beneficiaries, regardless of the investment performance of the annuity.

- Estate Planning: Additionally, sophisticated estate planning strategies can combine trust accounts, annuities and life insurance to provide various benefits to heirs. If you are interested in maximizing death benefits for your heirs, consult with an estate attorney or financial advisor who specializes in these areas.

Balancing Income, Growth and Personal Goals

Annuities provide stress-free retirement income for life, but they also offer additional benefits when used as saving and accumulation vehicles. Retirement planning involves more than just the numbers in your financial accounts; it requires balancing your emotional need for safety with your financial need for growth to achieve a happier and healthier financial plan.

For personalized advice on creating a retirement income plan tailored to your specific needs, work with a financial advisor. Begin by understanding your needs and goals, and then align solutions to meet those goals. Remember, no two retirement plans are identical because no two individuals are exactly the same.

Writer Anna Baluch contributed to this article.

Connect With a Financial Advisor Instantly

Our free tool can help you find an advisor who serves your needs. Get matched with a financial advisor who fits your unique criteria. Once you’ve been matched, consult for free with no obligation.

3 Cited Research Articles

- Internal Revenue Service. (2024, June 12). Topic no. 410, Pensions and annuities. Retrieved from https://www.irs.gov/taxtopics/tc410

- American Academy of Actuaries. (2024). Welcome to the Actuaries Longevity Illustrator.Retrieved from https://www.longevityillustrator.org/

- New York Life. (n.d.). What is the difference between an annuity and an IRA? Retrieved from https://www.newyorklife.com/articles/annuity-vs-ira

Calling this number connects you to one of our trusted partners.

If you're interested in help navigating your options, a representative will provide you with a free, no-obligation consultation.

Our partners are committed to excellent customer service. They can match you with a qualified professional for your unique objectives.

We/Our Partners do not offer every plan available in your area. Any information provided is limited to those plans offered in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

866-923-9782Your web browser is no longer supported by Microsoft. Update your browser for more security, speed and compatibility.

If you need help pricing and building your medicare plan, call us at 844-572-0696