Life Insurance vs. Annuity

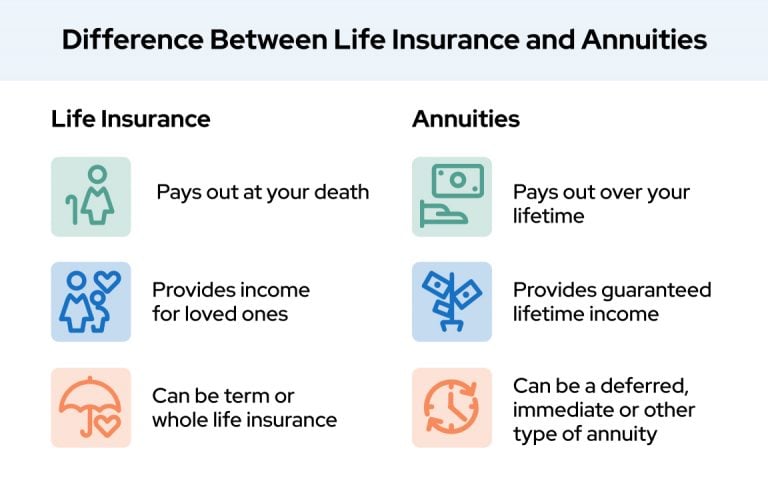

The chief difference between life insurance and annuities is that life insurance provides a cash benefit for your loved ones after you die. In contrast, annuities provide you with a lifetime income until you die. Both include death benefits.

- Written by Terry Turner

Terry Turner

Senior Financial Writer and Financial Wellness Facilitator

Terry Turner has more than 35 years of journalism experience, including covering benefits, spending and congressional action on federal programs such as Social Security and Medicare. He is a Certified Financial Wellness Facilitator through the National Wellness Institute and the Foundation for Financial Wellness and a member of the Association for Financial Counseling & Planning Education (AFCPE®).

Read More - Edited By

Lee Williams

Lee Williams

Senior Financial Editor

Lee Williams is a professional writer, editor and content strategist with 10 years of professional experience working for global and nationally recognized brands. He has contributed to Forbes, The Huffington Post, SUCCESS Magazine, AskMen.com, Electric Literature and The Wall Street Journal. His career also includes ghostwriting for Fortune 500 CEOs and published authors.

Read More - Reviewed By

Eric Estevez

Eric Estevez

Owner of HLC Insurance Broker, LLC

Eric Estevez is a duly licensed independent insurance broker and a former financial institution auditor with more than a decade of professional experience. He has specialized in federal, state and local compliance for both large and small businesses.

Read More - Published: August 11, 2021

- Updated: March 20, 2025

- 8 min read time

- This page features 7 Cited Research Articles

What Is the Difference Between an Annuity and Life Insurance?

You should consider life insurance and an annuity when planning your retirement. Each can play a role in providing long-term financial security for you and your loved ones.

What Are Annuities?

According to the National Association of Insurance Commissioners, annuities are a type of life insurance contract sold by insurance companies. The two main types of annuities are immediate and deferred.

- Immediate annuities are purchased with a one-time contribution or payment to the insurance company. They provide payments to you within one year of purchasing the annuity contract.

- You can buy a deferred annuity with either a single payment or flexible contributions over a more extended period. They provide regular income payments that start at a future date.

| SITUATION | DEFERRED ANNUITIES | IMMEDIATE ANNUITIES |

|---|---|---|

| Why buy this annuity? | Allows you to grow tax-deferred money | Guarantees a steady, lifetime income in retirement but money is only tax-deferred in the early years |

| Type of payout | One-time lump sum payment or lifetime income payments | Lifetime income payments |

| When does this annuity pay out? | When you make withdrawals from the annuity | One period (set by the contract) after you buy the annuity and continues paying until you die |

| Are your benefits taxable income when you receive them? | Only the part of the annuity derived from investment income is taxed – your initial investment is not | Only the part of the annuity derived from investment income is taxed – your initial investment is not |

| Typical age when purchased | 40 to 65 | 55 to 80 |

| Death benefit for your heirs when you die | Yes | Only if the annuity you purchase has a guaranteed-period that does not expire upon your death |

There are different reasons for purchasing different types of annuities. A financial professional can help you compare annuities so you can determine which type is best for your particular financial situation and retirement plans.

How soon are you retiring?

What is your goal for purchasing an annuity?

Select all that apply

Learn About Top Annuity Products & Get a Free Quote

Find out how an annuity can offer you guaranteed monthly income throughout your retirement. Speak with one of our qualified financial professionals today to discover which of our industry-leading annuity products fits into your long-term financial strategy.

For fastest service, call now!

866-219-2282Call NowOr fill out the form

What Is Life Insurance?

There are several different types of life insurance, but all types are designed to pay money to a “named beneficiary” upon your death. The beneficiaries are usually your loved ones but can be one person, multiple people or even a company or other organization.

- Term life insurance is payable only if you die before reaching a specific age or within a specific time – such as five or 10 years.

- Whole life insurance can stay in force for your entire life and pay a death benefit whenever you die.

| SITUATION | TERM LIFE INSURANCE | WHOLE LIFE INSURANCE |

|---|---|---|

| Why buy this type of life insurance? | To provide for you dependents when you die | To provide income for dependents or for estate planning |

| Type of payout | One-time lump sum | One-time lump sum |

| When does this type of life insurance pay out? | Upon your death | Upon your death, when you borrow from the cash value of the policy or when you surrender the policy |

| Are your benefits taxable income when you receive them? | No | No – except if you withdraw more than the total of the premiums you have paid in |

| Typical age when purchased | 25 to 50 | 30 to 60 |

| s there a death benefit for your heirs when you die? | Yes | Yes |

Is an Annuity or Life Insurance Right for Me?

Both life insurance and annuities are long-term investments that can be an important part of your retirement planning. You may want to include both in your long-term financial plan. Or you may decide that one is better for you than the other.

- Do you want a steady income in retirement – something an annuity provides?

- Do you want to provide for your loved ones after you die – something life insurance is designed to do?

- Do you want to provide both forms of financial security – something that may require both or some modified version of either?

When weighing these questions, you’ll need to consider the pros and cons of each option. And ultimately, you may want to talk to a licensed financial advisor to determine how each option may work for you.

Pros and Cons of Annuities?

Annuities are a good option to provide a guaranteed lifetime income – especially if you don’t have a traditional pension through your employer.

But, like any investment, there are potential downsides that you have to consider.

- No annual contribution limit

- You will receive annuity payments for as long as you live

- No taxes on investment gains if you purchase a deferred annuity

- With a variable deferred annuity, your heirs will receive a death benefit

- May be less risky than mutual funds

- You still have an option to invest in the stock market if you have a variable annuity

- Insurance company assumes the risk with a fixed annuity

- You may have to pay high fees for managing your account, your financial advisor or trading

- If you die after reaching the guaranteed amount, the insurer gets to keep any extra money you put in – unless you buy a rider

- You only get to defer taxes on investment gains in the first few years after buying an immediate annuity

- Income from your annuity is taxed as regular income meaning your tax rate may increase

- You don’t get to choose how your money is invested if you have a fixed annuity – making you vulnerable to market volatility

*Ad: Clicking will take you to our partner Annuity.org.

Pros and Cons of Life Insurance?

Life insurance is typically meant to take care of your loved ones once you’re gone. It can provide them with an income in your absence or help them pay off debt.

If you provide the majority of the household income, life insurance can help your loved ones maintain their lifestyle even though they are no longer there.

- Helps your loved ones cover funeral costs

- Term life insurance is relatively inexpensive for the amount of death benefits

- Peace of mind that your loved ones will have some degree of financial security if you die

- If structured correctly, the money in your policy can be tax-free if withdrawn or borrowed within certain rules available to policyholders by the IRS

- Several fees are included with life insurance policies

- Whole life insurance can be far more expensive than term life – making it hard for some people to keep up payments

- You may lose money on a term life policy if you outlive the term unless you continue renewing the policy every year – and at increasingly higher premiums

- If you policy lapses, the company owes you nothing

- You cannot borrow any money from your term life policy, and will have to pay back any money borrowed from your whole life policy – with interest

Making Your Decision on an Annuity or Life Insurance

Deciding on buying life insurance or an annuity – and what type of each – requires you to consider many options.

- Your age

- How long you expect to live in retirement

- The financial security of your family if you should die

- Your financial situation

- Health and financial risks in your life

- How much you can afford to pay

- Tax advantages from annuities or life insurance.

There are other considerations you need to take into account as well. Both life insurance and annuities can be costly and long-term commitments, but the payoff may provide great returns for you or your loved ones.

Risks and benefits of both annuities and life insurance vary from person to person. There are no cookie-cutter or off-the-shelf answers to what is best for you.

Talking to a licensed financial professional will help you get closer to an option that is more of a custom fit for you. A financial professional can help you understand the advantages and disadvantages of life insurance and annuities in your specific situation.

7 Cited Research Articles

- Bauer, E. (2021, July 8). Do You Get Your Money’s Worth From Buying an Annuity? Retrieved from https://www.forbes.com/sites/ebauer/2021/07/08/do-you-get-your-moneys-worth-from-buying-an-annuity/?sh=68dac5562082

- National Association of Insurance Commissioners. (2021, August 25). Annuities. Retrieved from https://content.naic.org/cipr-topics/annuities

- Chorpenning, A. (2020, January 2). Annuities vs. Life Insurance: Key Differences. Retrieved from https://www.yahoo.com/lifestyle/annuities-vs-life-insurance-key-161944046.html

- AIG Direct. (n.d.). Annuities vs. Life Insurance: Key Differences. Retrieved from https://www.aigdirect.com/about-life/planning-for-life-insurance/annuities-vs-life-insurance

- American Family Insurance. (n.d.). Annuity vs. Life Insurance: What You Should Know. Retrieved from https://www.amfam.com/resources/articles/navigating-life-insurance/life-insurance-vs-annuities

- Insurance Information Institute. (n.d.). The Difference Between Annuities and Life Insurance. Retrieved from https://www.iii.org/article/the-difference-between-annuities-and-life-insurance

- State Farm. (n.d.). What’s the Difference Between Life Insurance and an Annuity? Retrieved from https://www.statefarm.com/simple-insights/life-insurance/difference-between-life-insurance-and-annuity