Joint and Survivor Annuity

A joint and survivor annuity guarantees income distributions to you and a secondary annuitant for the duration of both your lifetimes. The dual-life income stream extends the duration of the annuity’s payout phase and reduces the size of the periodic distributions. Nevertheless, it can provide invaluable peace of mind for your household.

- Written by Thomas Brock, CFA®, CPA

- Edited By

Lamia Chowdhury

Lamia Chowdhury

Financial Editor

Lamia Chowdhury is a financial content editor for RetireGuide and has over three years of marketing experience in the finance industry. She has written copy for both digital and print pieces ranging from blogs, radio scripts and search ads to billboards, brochures, mailers and more.

Read More- Published: October 3, 2023

- Updated: February 28, 2025

- 9 min read time

- This page features 4 Cited Research Articles

- The income distributions from a joint and survivor annuity are tax-deferred and guaranteed, regardless of which annuitant dies first.

- A joint and survivor annuity is sensible for a conservative, hands-off investor who wants to generate a lifelong income stream for both them and a loved one in a tax-advantaged manner.

- A joint and survivor annuity is not an appropriate investment for all couples. Couples who seek higher potential returns, are tolerant of market volatility and are comfortable managing their own assets or paying a fiduciary advisor to do so, may want to consider other annuity options.

What Is a Joint and Survivor Annuity?

A joint and survivor annuity is a financial contract between an individual (the contract owner) and a life insurance company (the contract issuer). In exchange for an upfront payment or a series of payments, the issuer provides a primary annuitant and a secondary annuitant a future stream of income distributions for the duration of both their lives.

This differs from a single life annuity, which only makes income distributions for the duration of one annuitant’s life.

A joint and survivor annuity is designed for the conservative, hands-off investor seeking financial security for themselves and a loved one. Often, this tax-advantaged vehicle is used to bolster a retirement plan.

How Joint and Survivor Annuities Work

You can structure a joint and survivor annuity to begin making income distributions immediately or after a specified accumulation period. Additionally, the annuity contract can take the form of a fixed, index or variable annuity, giving annuitants an array of investment options.

Regardless of the contractual structure, a joint and survivor annuity provides dual-life income distributions that continue whether the primary or secondary annuitant dies first. You are allowed a fair amount of discretion when defining the income distributions, but modification is difficult once a contract is established.

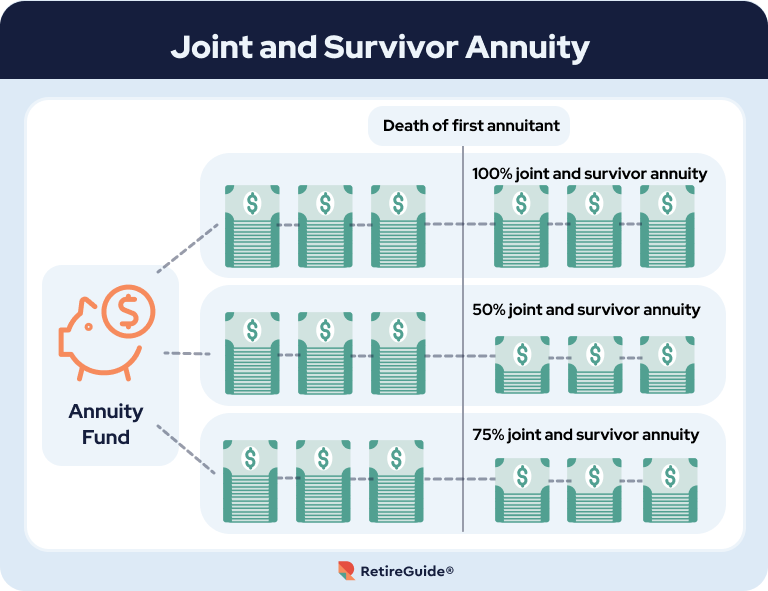

Payout Options

You can structure joint and survivor annuities with a variety of payout options, depending on the issuing company and the nature of the contract. You can structure one to maintain a consistent payment over the lives of both annuitants. Alternatively, you can choose to receive a lower payout amount following the death of one of the annuitants. You can also structure them to distribute an increasingly large amount over time.

- A 100% joint and survivor contract, which is informally referred to as a level payout contract, provides a fixed income payment that remains the same throughout the annuity’s term.

- A 75% joint and survivor contract provides a fixed income payment that is reduced to 75% of the initial payment following the death of an annuitant.

- A 50% joint and survivor contract provides a fixed income payment that is reduced to 50% of the initial payment following the death of an annuitant.

- An inflation-indexed joint and survivor contract provides an increasingly large payout that keeps pace with the rate of inflation.

Generally, 100% joint and survivor contracts have smaller initial payments than reduced payout structures, while inflation-indexed contracts have the smallest starting points. Modifying the starting points of the payment streams in this way allows the issuing insurance companies to make sure the economics of the contract make sense.

Clearly, there is a fair amount of complexity associated with payout options. It is important to carefully review the terms and conditions of a joint and survivor annuity before making a purchase. A financial advisor can help make sense of things.

Tax Treatment

The dual-life payout feature is widely considered the most valuable aspect of a joint and survivor annuity. However, its tax-deferred nature is a close second. The money invested in a joint and survivor annuity is permitted to grow tax-free until distributed. Thanks to the power of compounding interest, this can greatly increase your ability to save for retirement.

That said, the tax treatment of joint and survivor annuities can be complicated. The Internal Revenue Service (IRS) maintains strict guidance for these instruments and taxes income distributions differently, depending on the structure of the annuity and the source of the funds used to purchase the contract.

Structural considerations pertain to the relationship between the primary and secondary annuitant. For married couples, there are no stipulations. However, the IRS imposes special rules if the primary and secondary annuitants are not married.

For example, the secondary annuitant cannot be 10 or more years younger than the primary annuitant and continue to receive 100% of the distribution. Violation of this rule negates any favorable tax treatment and can result in a penalty.

The funding source consideration pertains to whether the money used to purchase the annuity originated from an IRS-qualified fund, which deems it “qualified,” or elsewhere, which deems it “nonqualified.”

- Qualified Annuities

- These are tax-deferred annuity contracts purchased with pre-tax dollars originating from an IRS-qualified fund, such as a regular 401(k) plan, a regular 403(b) plan or a traditional individual retirement account (IRA). With qualified annuities, no taxes are levied until distributions are initiated. At this phase, all cash payments received are generally taxable.

- Nonqualified Annuities

- These are tax-advantaged annuity contracts purchased with after-tax dollars. Because the money used to purchase a nonqualified annuity has already been taxed, it will not be taxed again. However, accumulated earnings will be taxed when distributions begin, unless the annuity was purchased within a Roth-style investment vehicle. Earnings in Roth-style accounts are never taxable.

- Death Benefits

- These are optional features, or riders, available on some joint and survivor annuities. In the event both annuitants die before an annuity’s income distributions exceed the principal investment, a death benefit guarantees a payout to named beneficiaries. The tax treatment of the benefit can vary depending on whether the payment is associated with a qualified or nonqualified annuity.

This is only a cursory recap of the tax treatment of joint and survivor annuities. To understand the full range of tax implications, consult a tax professional or financial advisor.

*Ad: Clicking will take you to our partner Annuity.org.

Pros and Cons of Joint and Survivor Annuities

As with any financial instrument, the benefits and risks of joint and survivor annuities should be carefully considered prior to investment. Joint and survivor annuities offer investors some valuable benefits but also expose them to several risks that warrant caution.

- Dual-life income distribution – The most attractive aspect of a joint and survivor annuity is that you and a secondary annuitant will receive an income distribution for the duration of both your lifetimes, providing invaluable peace of mind.

- Tax-deferred growth – The money invested in a joint and survivor annuity is allowed to grow on a tax-deferred basis. You will not pay taxes on the earnings until you begin taking income distributions.

- Flexibility – You can structure joint and survivor annuities to provide a variety of payout options. This allows you to optimize future cash flows.

- Possible inflation hedge – In some instances, you can structure a joint and survivor annuity to make income distributions that keep pace with inflation, thereby preserving the purchasing power of your money.

- Complexity – Joint and survivor annuities are complicated. Their various provisions and terms can be confusing to the average retirement saver. This is especially problematic when unethical salespeople push these products without regard for the unique circumstances of the market participants.Low returns – Over the long term, joint and survivor annuities rarely offer returns as large as those from growth-oriented investments, such as domestic and international stock funds.

- High fees – Joint and survivor annuities can be costly relative to other investment options. Purchasing one entails a commission. Considering that along with ongoing mortality and expense risk charges, administrative fees and, in some cases, fund management fees associated with your underlying investments, the annual fee drag can easily amount to 3% or 4%.

- Illiquidity – With deferred joint and survivor annuities, if you withdraw money earlier than the contract allows, you will likely incur a surrender charge. Early in the contract, it can be as high as 7% of the withdrawal.

Joint Annuity vs. Joint and Survivor Annuity

A joint annuity is an annuity that is owned jointly by two or more individuals that have an equal claim to the annuity’s contractual value. Distributions from a joint annuity cease upon the death of any of the owners. At that point, the annuity usually pays a death benefit to named beneficiaries.

Conversely, a joint and survivor annuity is an annuity that provides income distributions to two annuitants, a primary annuitant and a secondary annuitant, throughout both their lives.

Frequently Asked Questions About Joint and Survivor Annuities

As you assess your options, do not lose sight of your investment objectives and risk tolerance. If you lack a holistic investment strategy, consult a fiduciary financial advisor. They can help you optimize your finances.

Editors Bianca Dagostino and Lena Borrelli contributed to this article.

Connect With a Financial Advisor Instantly

Our free tool can help you find an advisor who serves your needs. Get matched with a financial advisor who fits your unique criteria. Once you’ve been matched, consult for free with no obligation.

4 Cited Research Articles

- Internal Revenue Service. (2023, August 29). Retirement Topics - Qualified Joint and Survivor Annuity. Retrieved from https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-qualified-joint-and-survivor-annuity

- Wisconsin Department of Employee Trust Funds. (2023, March 29). Choosing an Annuity Option. Retrieved from https://etf.wi.gov/publications/et4117/direct

- U.S. Securities and Exchange Commission. (2023). Annuities. Retrieved from https://www.investor.gov/introduction-investing/investing-basics/investment-products/insurance-products/annuities

- Center for a Secure Retirement. (2022, December 14). What To Know About Joint and Survivor Annuity. Retrieved from https://www.centerforasecureretirement.com/en/posts/what-to-know-about-joint-and-survivor-annuity

Calling this number connects you to one of our trusted partners.

If you're interested in help navigating your options, a representative will provide you with a free, no-obligation consultation.

Our partners are committed to excellent customer service. They can match you with a qualified professional for your unique objectives.

We/Our Partners do not offer every plan available in your area. Any information provided is limited to those plans offered in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

866-923-9782