Period Certain Annuity

A period certain annuity is a financial contract between you and an insurance company. It guarantees income distributions for a specific number of years, rather than your lifetime. You get to decide how many years the distributions will last. If you die before the specified period elapses, remaining distributions are made to your beneficiaries.

- Written by Thomas Brock, CFA®, CPA

- Edited By

Lamia Chowdhury

Lamia Chowdhury

Financial Editor

Lamia Chowdhury is a financial content editor for RetireGuide and has over three years of marketing experience in the finance industry. She has written copy for both digital and print pieces ranging from blogs, radio scripts and search ads to billboards, brochures, mailers and more.

Read More- Reviewed By

Stephen Kates, CFP®

Stephen Kates, CFP®

Principal Financial Analyst for RetireGuide.com

Stephen Kates is a Certified Financial Planner™ professional and personal finance expert with over a decade of experience working with individuals and families who need help with their finances. With experience as a financial advisor for two of the largest financial firms in the country, Stephen has worked with hundreds of clients to build comprehensive financial plans to grow and protect their wealth.

Read More- Published: September 27, 2023

- Updated: May 20, 2025

- 7 min read time

- This page features 4 Cited Research Articles

- Reviewed By

- A period certain annuity is a financial contract between an individual and an insurance company.

- In exchange for an upfront contribution or a set of installment contributions, the contract guarantees income distributions for a specified period. If the annuitant dies prior to the expiration of the specified period, income distributions continue to be made to named beneficiaries.

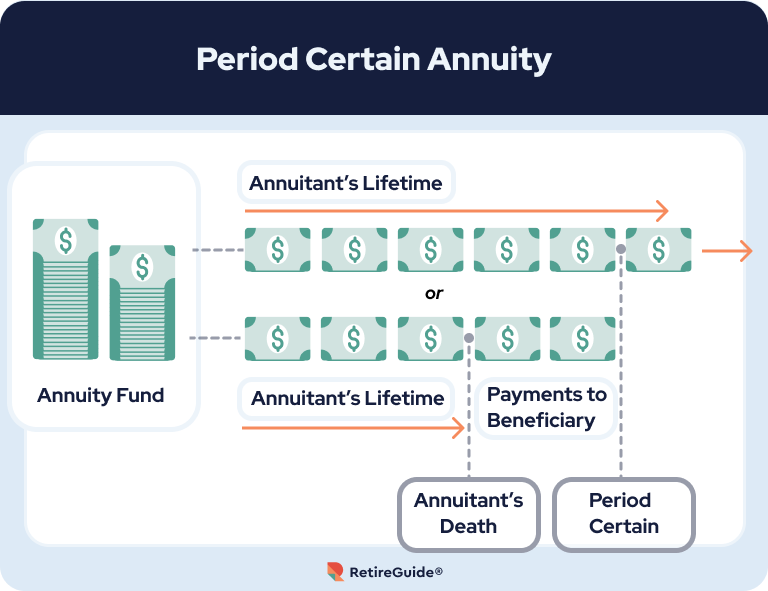

- A period certain annuity differs from a lifetime annuity. The latter is structured to generate income distributions for the life of the annuitant, rather than for a specified term.

- Period certain annuities can be used to strategically enhance a retirement plan; however, they are not appropriate for everyone.

What Is a Period Certain Annuity?

A period certain annuity, which is also known as a fixed-period annuity, is a contract between an individual, the contract owner and a life insurance company (the issuer). In exchange for an upfront payment or a set of installment payments, the issuer provides a named annuitant, usually the contract owner, a future stream of income distributions for a specified period, usually, 10 to 20 years. This differs from a lifetime annuity, which makes income distributions for the duration of an annuitant’s life.

A period certain annuity is designed for the investor who wants a reliable stream of income and assurance that the beneficiaries will receive the balance of the annuity contract in the event of an earlier-than-anticipated death. Essentially, this type of contract ensures any leftover money in an annuity is transferred to your loved ones rather than to the issuing insurer.

How Do They Work?

A period certain annuity can be structured to begin making income distributions immediately or following a specified accumulation period. Regardless of the distribution structure, the payment frequency is fixed, and the payouts end when the specified period expires.

If the annuitant dies prior to expiration, payouts are made to named beneficiaries for the balance of the period. This ensures the entire value of the annuity contract is distributed, regardless of the longevity of the annuitant.

The disbursement framework for a period certain annuity is contrasted with that of a lifetime annuity below.

There are a lot of uses for a period certain annuity, given its structured setup and guaranteed payback of the investment principal. Unlike a lifetime annuity which won’t be appropriate for investors over a certain age, period certain annuities can offer the same 20-year payout whether the annuitant is 60 or 80 years old.

Types of Period Certain Annuities

Annuities are marketed in a variety of ways with an assortment of structural features and limitations. At the highest level, there are three types of annuities – fixed, indexed and variable. All offer period certain optionality, but their terms and interest crediting potential vary widely from one issuer to the next.

- Fixed Annuities

- Fixed annuities are the safest type of annuity because they offer stable, guaranteed interest rates. They are relatively low-yielding but can generate more income than certificates of deposit and U.S. Treasuries.

- Fixed Index Annuities

- Fixed indexed annuities, or indexed annuities, are riskier. They usually offer higher returns than fixed annuities, but they can exhibit volatility. Fortunately, most contracts provide downside protection.

- Variable Annuities

- Variable annuities are the highest-returning type of annuity but also the riskiest. They entail investment positions in volatile assets, such as stocks and bonds, which exposes investors to potential loss of principal.

Key Features of a Period Certain Annuity

Beyond the various product distinctions, it is important to understand the key features of a period certain annuity. Foundational information that is common to all period certain annuities is outlined below.

- The fixed term is the specified duration of the income distribution period of your annuity. Usually, the term spans between 10 and 20 years.

- Guaranteed income is a phrase describing the fact that income payouts will continue throughout the fixed term.

- The absence of a lifetime component refers to the fact a period certain annuity is not designed to generate income distributions for the life of an annuitant. An annuitant can outlive the fixed term.

- A period certain annuity is flexible, allowing you to customize the contract via add-on features. These optional riders are used to target specific risk exposures, such as inflation.

- A designated beneficiary is the individual you elect to receive your income distributions in the event you die during the fixed term. Some annuities have multiple beneficiaries.

*Ad: Clicking will take you to our partner Annuity.org.

Pros and Cons of Period Certain Annuities

As with any financial instrument, the benefits and risks of period certain annuities should be carefully considered prior to investment. They offer investors some valuable benefits, but they are exposed to several risks that warrant caution.

- Full payout of contract value – The most attractive aspect of a period certain annuity is the fact you and/or your beneficiaries will receive the full value of your annuity contract. There is no chance of forfeiting any value due to death.

- Tax-deferred growth – The money invested in a deferred annuity is allowed to grow on a tax-deferred basis. You will not pay taxes on the earnings until you begin taking income distributions.

- Possible inflation hedge – In some instances, a period certain annuity can be structured to make income distributions that keep pace with inflation, thereby preserving the purchasing power of your money.

- Complexity – Period certain annuities are complicated, and their various provisions and terms can be confusing to the average investor. This is especially problematic when unscrupulous salespeople push these products without considering the unique circumstances of market participants.

- High fees – Period certain annuities can be costly relative to other investment options. Purchasing one entails a commission. Then, you will incur ongoing mortality and expense risk charges, administrative fees and, in some cases, fund management fees associated with your investment selections. Collectively, the ongoing fees can easily amount to 3% to 4% per year.

- Surrender charges – With deferred period certain annuities, if you withdraw money earlier than the contract allows, you will likely incur a surrender charge. Early in the contract, it can be as high as 10% of the withdrawal.

Alternatives to Period Certain Annuities

A period certain annuity is sensible for a conservative investor that wants a reliable source of income and assurance that he or she (or named beneficiaries) will receive the full value of the financial contract. However, there are alternatives to this structure.

Whether you favor fixed, indexed or variable annuities, you may want to establish a lifetime annuity contract, a joint-and-survivor annuity contract or a hybrid solution, rather than a period certain contract.

A lifetime annuity contract provides guaranteed income for the remainder of the annuitant’s life, rather than for a fixed period. This type of contract makes sense for individuals that value lifelong financial security above all else.

A joint-and-survivor annuity contract provides guaranteed income for the remainder of the annuitant’s life and a secondary annuitant’s life (usually, the annuitant’s spouse). The inclusion of a second annuitant extends the duration of the payout phase, which reduces the size of the periodic distributions, but it can provide invaluable peace of mind for your family unit.

A hybrid solution exists when an annuity contract blends the benefits of a lifetime annuity and a period certain annuity. This is possible via a life annuity (single-life or joint-life) with a period certain add-on. For example, if you purchase a single-life annuity contract with a 20-year period certain rider and pass away 10 years later, your beneficiary will collect income benefits for another 10 years.

As you assess your investment options, do not lose sight of your unique circumstances. Thoughtful investment objectives and a clear understanding of your tolerance for risk should underpin all investment decisions. If you lack a holistic investment strategy, consult with a fiduciary financial advisor. He or she can help you plan for retirement and make sensible investment decisions.

*Ad: Clicking will take you to our partner Annuity.org.

Other Frequently Asked Questions About Period Certain Annuities

Writer Lena Borrelli contributed to this article.

4 Cited Research Articles

- Birken, E.G. (2023, January 13). How Do Annuities Work Upon Death? Retrieved from https://www.centerforasecureretirement.com/en/posts/how-do-annuities-work-upon-death

- Financial Industry Regulatory Authority. (2022, July 14). The Complicated Risks and Rewards of Indexed Annuities. Retrieved from https://www.finra.org/investors/insights/complicated-risks-and-rewards-indexed-annuities

- U.S. Securities and Exchange Commission. (2020, July 31). Updated Investor Bulletin: Indexed Annuities. Retrieved from https://www.sec.gov/oiea/investor-alerts-and-bulletins/ib_indexedannuities

- U.S. Securities and Exchange Commission. (n.d.). Annuities. What Are Annuities? Retrieved from https://www.investor.gov/introduction-investing/investing-basics/investment-products/insurance-products/annuities

Calling this number connects you to one of our trusted partners.

If you're interested in help navigating your options, a representative will provide you with a free, no-obligation consultation.

Our partners are committed to excellent customer service. They can match you with a qualified professional for your unique objectives.

We/Our Partners do not offer every plan available in your area. Any information provided is limited to those plans offered in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

866-923-9782Your web browser is no longer supported by Microsoft. Update your browser for more security, speed and compatibility.

If you need help pricing and building your medicare plan, call us at 844-572-0696