Annuity Regulations

Annuity products and sales are primarily regulated by state insurance commissioners, but certain products and activities are also governed by federal regulators, such as the SEC and FINRA, to offer consumers robust resources and protections.

- Written by Lena Muhtadi Borrelli

- Edited By

Lamia Chowdhury

Lamia Chowdhury

Financial Editor

Lamia Chowdhury is a financial content editor for RetireGuide and has over three years of marketing experience in the finance industry. She has written copy for both digital and print pieces ranging from blogs, radio scripts and search ads to billboards, brochures, mailers and more.

Read More- Reviewed By Aamir M. Chalisa, MBA, LUTCF, MDRT

- Published: August 13, 2024

- Updated: May 20, 2025

- 6 min read time

- This page features 11 Cited Research Articles

- Annuities are regulated primarily by state insurance commissioners, with federal oversight by the SEC and FINRA for certain products like variable and structured annuities.

- Inter-state organizations, such as the NAIC and NOLHGA, provide guidelines for state regulators and uniform compliance standards for insurance carriers and agents.

- Recent regulatory updates, such as the Department of Labor's Retirement Security Rule and the NAIC's Suitability in Annuity Transactions Model Regulation, aim to standardize agent conduct across states.

Introduction to Annuity Regulations

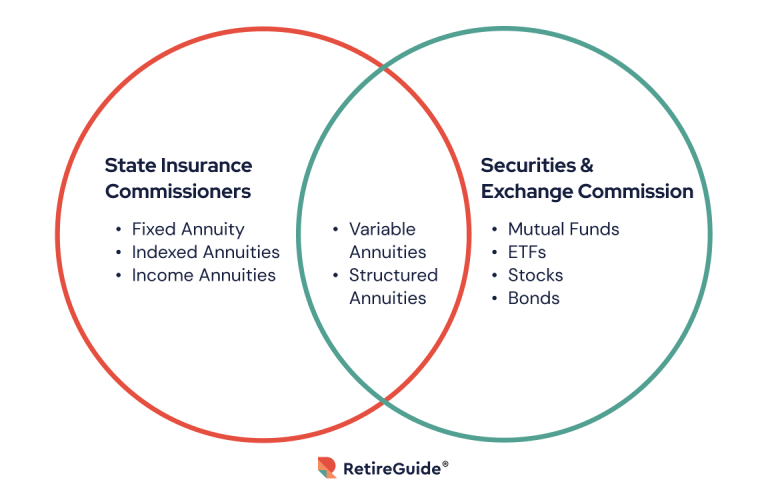

Like all financial products, annuities are subject to strict rules and regulations regarding their structure, marketing and sales. As insurance products, annuities are primarily regulated by each state’s insurance commissioner. However, certain types of annuities also fall under federal regulation through the Securities and Exchange Commission (SEC) and are overseen by the Financial Industry Regulatory Authority (FINRA).

Organizations like the National Association of Insurance Commissioners (NAIC) and the National Organization of Life and Health Insurance Guaranty Associations (NOLHGA) are multi-state collective associations that provide consumer protections and recommend regulatory proposals for adoption by multiple states.

My clients always ask about who has oversight on annuities they are buying. I always explain to them that on fixed products such as fixed and indexed annuities, the state department of insurance has oversight. On variable annuities SEC and FINRA come into play. Also, I explain to the clients about protection and coverage in case of insolvency. IN the sale itself, suitability guidelines are provided by state regulations as well, along with replacement and best interest rules. Having regulations are for the protection of the annuity buyer and I tell them that. They do feel better knowing that the industry is regulated and that agents have a fiduciary responsibility to make sure that the sale is in the best interest of the insured.

Federal Annuity Regulations

While individual states handle most of the regulatory burden of overseeing insurance companies and insurance agents, federal regulation plays an important role with certain annuity products that stretch beyond insurance products and become securities products.

Variable annuities and structured annuities, also known as registered-index linked annuities (RILAs), are the two types of annuities subject to both state and federal regulation.

Department of Labor Retirement Security Rule

Effective September 23, 2024, the Retirement Security Rule redefines when a person is considered a fiduciary financial advisor, requiring them to adhere to fiduciary standards when providing consumer guidance and advice.

The new rule will impact any professional financial advisor, including insurance agents, who work with retirement investors and offer recommendations for a fee or other direct or indirect compensation.

Note: As of this writing, this rule is currently being challenged in court. Changes or amendments to the final rules may occur depending on the outcome of the pending litigation.

State Annuity Regulations

Each state is responsible for regulating its own insurance market and the insurance carriers operating within its borders. This allows for some variation in rules and standards of practice between states.

However, the National Association of Insurance Commissioners (NAIC) supports state insurance commissioners by establishing best practices, sharing research and reports and conducting peer reviews. The NAIC is not a national regulator and has no regulatory authority. All licensing, investigative and regulatory authority rests solely with each state insurance commissioner.

The insurance industry is broad and complex, and each state insurance commissioner is responsible for overseeing all different types of insurance, including life, health, property and casualty, long-term care, workers’ compensation and more.

Regarding annuities specifically, state regulators are primarily focused on the licensure of agents, sales practices and the compliance of insurance carriers with the rules surrounding financial stability.

*Ad: Clicking will take you to our partner Annuity.org.

Key Regulatory Bodies and Their Roles

The insurance and annuity industry has numerous regulatory and consumer protection organizations, each playing a vital role in the marketplace.

National Association of Insurance Commissioners (NAIC)

As a collective organization, the NAIC consists of insurance commissioners from each state, the District of Columbia and five U.S. territories. Together, these members establish common standards and coordinate efforts on regulation and best practices.

Although the NAIC primarily supports the chief regulators of each state, it also offers significant benefits to insurers and agents. It simplifies compliance for insurance companies and agents by providing uniform standards across states, reducing the complexity of navigating varying state-specific business practices.

Financial Industry Regulatory Authority (FINRA) and the Security Exchange Commission (SEC)

The Securities and Exchange Commission (SEC) is a government agency responsible for regulating the securities market and creating rules for it. Its mission is to protect consumers and ensure an orderly and efficient marketplace. Annuities that include securities, such as variable annuities and structured annuities, are subject to the same securities laws as stocks and mutual funds.

The Financial Industry Regulatory Authority (FINRA) also regulates variable and structured annuities on a federal level. Unlike the SEC, which is a government agency, FINRA is a self-regulatory organization supported by U.S. broker-dealers. While FINRA’s members agree to follow its rules, it has no authority over non-members. FINRA cannot create laws or set federal policy—that responsibility lies with the SEC.

Consumer Protections

One of the most important roles of insurance regulatory bodies is to establish a strong foundation for consumer education and protection. Central to the duties of state insurance commissioners and federal regulators is their commitment to safeguarding consumers. Their responsibilities encompass overseeing financial stability, setting licensing standards and enforcing sales practice rules, all aimed at fostering confidence and stability within the industry.

Both regulatory organizations and insurance companies produce extensive educational materials for consumers. In addition to buyers’ guides, there are stringent regulations designed to protect consumers from both unethical practices and their own potential missteps.

- ‘Free Look’ Period

- A free look period is the timeframe during which a consumer can cancel their new insurance policy without penalty. Required by law in every state, the free look period typically lasts 10 or more days.

- Licensing Information

- Insurance agents must pass a licensing exam to demonstrate their competency. Each agent receives a unique identifier known as a National Producer Number (NPN), with detailed information about each licensee available for online review.

- Consumer Insights and Complaint Records

- The National Association of Insurance Commissioners (NAIC) aggregates complaint data and provides access to consumer reports from all state insurance departments.

NAIC’s Suitability in Annuity Transactions Model Regulation (#275)

The NAIC’s Suitability in Annuity Transactions Model Regulation (#275) establishes uniform standards for states to follow when governing insurance agents’ conduct during sales and service interactions with consumers. This regulation mandates that insurance professionals clearly explain product details, disclose any conflicts of interest and adhere to a duty of care that prioritizes recommending solutions that are in the best interest of the consumer.

These standards have been adopted by 48 states, with four more states pending adoption as of June 2024. New York has not adopted these rules but has implemented its own regulations governing annuity transactions.

The National Organization of Life and Health Insurance Guaranty Associations (NOLHGA)

NOLHGA membership includes all 50 states and the District of Columbia and supports the guaranty associations underpinning the insurance markets of each state. In the case that an insurer is unable to pay their policies or becomes insolvent, each state guaranty association exists to provide a financial backstop for consumers’ contracts. A state would place an insurer in receivership, and the guaranty association would cover the benefits owed to consumers up to the state mandated limits. Each state has its own limits on the amount guaranteed per person and per policy.

For more information on state guarantees, research your state.

How To Stay Informed

At Annuity.org, our team is dedicated to providing high-quality, unbiased analysis of the annuity landscape for both consumers and professionals. For more personalized advice, an agent or financial advisor can serve as a trusted resource to help you navigate the most relevant financial information.

If you prefer to stay directly informed, keeping up with regulatory changes and industry updates has never been easier. Beyond traditional news sources, regulators offer their own online news and resources, including interactive lessons to help you stay current with the latest guidance.

Writer Lena Borrelli contributed to this article.

Connect With a Financial Advisor Instantly

Our free tool can help you find an advisor who serves your needs. Get matched with a financial advisor who fits your unique criteria. Once you’ve been matched, consult for free with no obligation.

11 Cited Research Articles

- National Organization of Life & Health Insurance Guaranty Associations. (2023, August 22). Benefit Limits - State Comparison Report. Retrieved from https://www.nolhga.com/factsandfigures/main.cfm/location/lawdetail/docid/8

- National Association of Insurance Commissioners. (2020, Spring). Suitability in Annuity Transactions Model Regulation (#275). Retrieved from

- https://content.naic.org/sites/default/files/inline-files/MDL-275.pdf

- U.S. Securities and Exchange Commission. (2019, September 18). Investor Alerts and Bulletins. Retrieved from https://www.sec.gov/oiea/investor-alerts-and-bulletins/ib_variableannuities

- National Association of Insurance Commissioners. (n.d.). Annuities. Retrieved from https://content.naic.org/insurance-topics/annuities

- National Association of Insurance Commissioners. (n.d.). Consumer. Retrieved from

- https://content.naic.org/consumer

- National Association of Insurance Commissioners. (n.d.). Insurance Directory. Retrieved from https://content.naic.org/sites/default/files/publication-ins-ou-insurance-directory.pdf

- National Association of Insurance Commissioners. (n.d.). Membership List. Retrieved from

- https://content.naic.org/sites/default/files/regulator-membership-list.pdf

- National Association of Insurance Commissioners. (n.d.). Regulator. Retrieved from https://content.naic.org/regulator

Calling this number connects you to one of our trusted partners.

If you're interested in help navigating your options, a representative will provide you with a free, no-obligation consultation.

Our partners are committed to excellent customer service. They can match you with a qualified professional for your unique objectives.

We/Our Partners do not offer every plan available in your area. Any information provided is limited to those plans offered in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

866-923-9782