Annuities by State

Annuities are regulated by state insurance commissioners, leading to distinct state-by-state differences. Consumers should educate themselves about their state annuity regulations by checking the Department of Insurance or NAIC.org for updates on rules, guarantee limits and consumer notices.

- Written by Stephen Kates, CFP®

Stephen Kates, CFP®

Principal Financial Analyst for RetireGuide.com

Stephen Kates is a Certified Financial Planner™ professional and personal finance expert with over a decade of experience working with individuals and families who need help with their finances. With experience as a financial advisor for two of the largest financial firms in the country, Stephen has worked with hundreds of clients to build comprehensive financial plans to grow and protect their wealth.

Read More- Edited By

Michael Santiago, CRPC™

Michael Santiago, CRPC™

Senior Financial Editor

Michael Santiago, a senior financial editor, joined RetireGuide in 2023. With over 10 years of professional writing and editing experience, he brings a wealth of expertise in creating content for diverse industries, including travel and healthcare. Having traveled to more than 40 countries across five continents and lived in Europe and Asia for several years, Michael's global perspective enriches his work. He combines his strong writing skills, editorial judgment and passion for crafting accurate and engrossing content to enhance the user experience on RetireGuide.

Read More- Published: July 15, 2024

- Updated: March 5, 2025

- 7 min read time

- This page features 9 Cited Research Articles

- Edited By

- States regulate insurance independently, with some overarching federal standards. They monitor insurance carriers' financial stability and have Guaranty Associations to cover contract obligations up to state limits.

- Organizations such as the National Association of Insurance Commissioners and The National Organization of Life and Health Insurance Guaranty Associations provide consumer education and protection.

- The NAIC's Suitability in Annuity Transactions Model Regulation provides uniform consumer protection rules and has been adopted by 48 states.

- 2024 saw record annuity sales, marking the third year in a row with record-high annuity sales, according to preliminary results from LIMRA.

Insurance products, including annuities, are primarily regulated by each state’s insurance commissioner, which can lead to differences between states. Most states coordinate to provide some uniform standards for insurance companies to abide by. However, a variety of factors may impact the rules surrounding annuities by state, including the size of the insurance market, existing consumer protections and taxes.

Consumers should educate themselves about their own home state’s regulations before buying any insurance product. Along with this state-specific annuity guide, state insurance commissioners produce public information about relevant rule changes, state guarantee limits and consumer notices.

*Ad: Clicking will take you to our partner Annuity.org.

State Annuity Regulations

State annuity regulations, while governed individually by each Insurance Commissioner, have created a level of nationwide uniformity through commonly adopted rules and certain federal regulations. Outside of these agreed-upon rules, the states are responsible for monitoring and overseeing all licensed individuals and businesses within their state.

One of the most important protections states provide is the regulation of the financial stability of its insurance carriers. Each state has robust procedures for monitoring and addressing financial instability. Ideally, routine annual compliance reporting will discover an insurance carrier’s financial issues early.

However, if an insurance carrier fails to cover its obligations, each state has a Guaranty Association designed to cover a certain amount of each contract. Consumers are guaranteed the expected value of their contract or the state guarantee limit, whichever is less.

NAIC’s Suitability in Annuity Transactions Model Regulation (#275)

The National Association of Insurance Commissioners (NAIC) has established standards of care that document the basis for recommendations and ensure compliance with consumer protections. These rules require insurance professionals to thoroughly explain product details, share conflicts of interest and demonstrate a duty of recommending solutions that are in the best interest of the consumer.

As of February 2025, 48 states have adopted these standards, with adoption pending in four additional states. New York State, however, has opted not to adopt these rules, instead establishing its own regulations for annuity transactions.

Department of Labor Retirement Security Rule

Passed on April 23, 2024, and effective on September 23, 2024, the Retirement Security Rule redefines when a person is considered a fiduciary financial advisor, requiring them to abide by fiduciary standards when offering guidance and advice to consumers.

The new rule impacts any professional financial, including insurance agents, who work with retirement investors and offer recommendations for a fee or other direct or indirect compensation.

Starting in June 2024, however, the courts are facing challenges to the rule. As of February 2025, the judge in the case has given the Department of Labor two months to decide whether it will appeal the universal stays that were placed on this former President Joe Biden-era rule.

Tax Implications

Your state’s income tax code significantly affects the variation in annuity taxes on a state-by-state basis. While all annuities are subject to federal taxes, state income taxes vary. Additionally, seven states and Puerto Rico impose additional taxes on certain annuities.

An annuity contract is a product that does not change the tax status of the money contributed to it. Therefore, all rules and requirements that apply to IRA taxation also apply to annuities funded by qualified retirement money. If you funded your annuity contract using money from a Traditional IRA, all income or withdrawals will be taxable as income. If funded with funds from a Roth IRA, income or withdrawals will be tax-free. When an annuity is funded from a non-qualified source, such as a taxable brokerage account, specific rules apply to income and withdrawal taxation. Income from an annuitized contract will be taxable proportionately based on the amount of untaxed growth in the contract.

An unannuitized contract follows a Last In First Out (LIFO) standard. This means that when withdrawing funds, the growth (or gains) accumulated most recently in the contract will be withdrawn first, and all this growth will be taxable as income. Only after withdrawing all growth can the holder withdraw the original contributions or tax basis, which are not taxable.

Select states and Puerto Rico also place additional taxes on certain annuity contracts, but normally the insurance company itself pays these taxes. Consumers should assume that the company will pass this expense on to them indirectly as part of the commissions paid to the agent and insurance carrier.

| State/Territory | Qualified Annuity Premium Tax Rate | Nonqualified Annuity Premium Tax Rate | Additional Notes |

|---|---|---|---|

| California | 0.50% | 2.35% | |

| Colorado | 0% | 2.00% | |

| Florida | 1.00% | 1.00% | |

| Maine | 0% | 2.00% | No tax on certain historical annuities, retirement annuities issued by certain nonprofit companies or annuities issued in connection with deferred compensation plans or certain retirement accounts qualified or exempt under federal law. |

| Nevada | 0% | 3.50% | |

| Puerto Rico | 1.00% | 1.00% | |

| South Dakota | 0% | 1.25% | For nonqualified annuities, a 1.25% tax on the first $500,000 and a 0.08% tax on everything above $500,000 applies. |

| West Virginia | 1.00% | 1.00% | |

| Wyoming | 0% | 1.00% |

Annuity Market Conditions

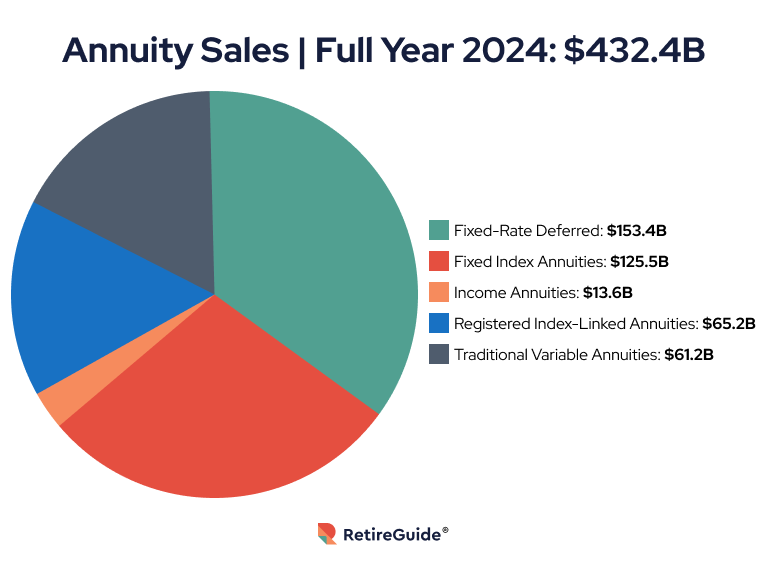

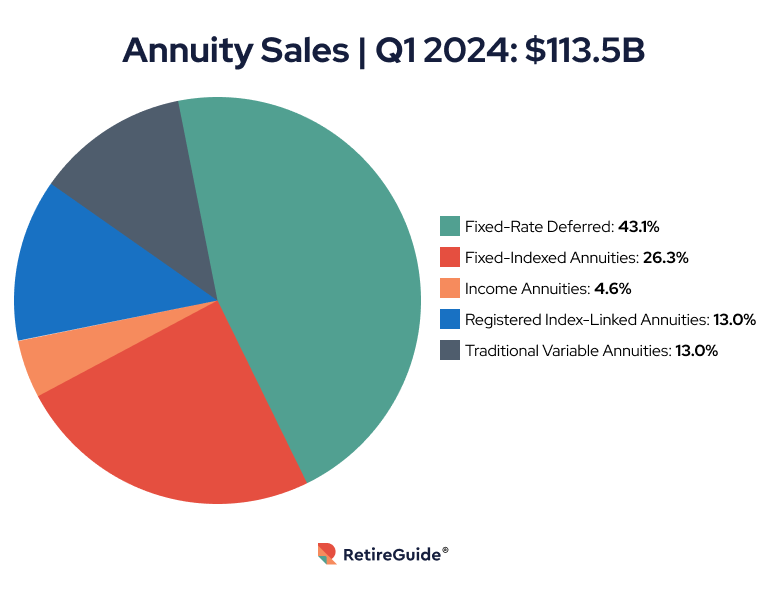

Annuity sales continued to grow in 2024, marking the third year in the row with record breaking annuity sales. There were $432.4 billion worth of sales in 2024, which was up 12% from 2023, according to LIMRA’s U.S. Individual Annuity Sales Survey. This survey represents 83% of the annuity market in the U.S.

According to LIMRA, lower interest rates in the second half of 2024 undermined the demand for fixed rate deferred and income annuities in the last three months of the year. This caused the total annuity sales to fall 13% to $100.4 billion year over year.

*Ad: Clicking will take you to our partner Annuity.org.

Exploring State and Federal Resources for Understanding Annuity Regulations

There are many state and federal resources for consumers to understand the available products and state annuity regulations of their home state.

National Association of Insurance Commissioners (NAIC)

The NAIC has the most comprehensive data on all state insurance departments. You can search for your specific state or review all the state directory information.

The National Organization of Life and Health Insurance Guaranty Associations (NOLHGA)

NOLHGA membership includes all 50 states and the District of Columbia and supports the guaranty associations underpinning the insurance markets of each state. Guaranty associations step in to cover the benefits owed to consumers when an insurance company fails. Each state has its own laws and limits on the amounts that qualify, which you can research specific to your state.

Financial Industry Regulatory Authority (FINRA) and the Security Exchange Commission (SEC)

Annuities that involve marketable securities, such as Variable Annuities and Structured Annuities (otherwise known as Registered Index Linked Annuities), are also regulated by the Financial Industry Regulatory Authority (FINRA) and the Securities and Exchange Commission (SEC). Both organizations produce educational materials and consumer notices to keep investors informed about rules and regulatory actions.

How To Choose an Annuity Based on State

The regulation and sale of annuities is based on your home state. You will need to work with an agent and insurance carrier licensed to work in your state, which may include both national and regional carriers.

One of the major differences between states is the free look period. A free look period is the length of time a buyer can cancel an annuity without penalty after purchase. This allows consumers a chance to review the contract and make a final decision without pressure. Free look periods vary by state but typically last between 10 and 30 days.

State guaranty association protections also differ by state. Most states offer guarantees that range from $250,000 to $500,000. Before purchasing any contract, check the limits of your state guarantees and the financial stability of the insurance carrier.

If you’re unsure about the type of product or service you need, it can be beneficial to speak with a professional financial advisor about your current situation and income needs.

Due to the significant differences in sales trends and regulatory frameworks across states, being well-informed about your state’s specific rules and regulations is important for making informed decisions that best suit your and your family’s needs. Utilize resources provided by NAIC or NOLHGA, or consult with a trusted financial advisor who can offer comprehensive guidance on integrating annuities into your financial strategy. Advisors familiar with your state’s regulations can expertly navigate available products to ensure a tailored approach.

Editor Sierra Campbell contributed to this article.

Connect With a Financial Advisor Instantly

Our free tool can help you find an advisor who serves your needs. Get matched with a financial advisor who fits your unique criteria. Once you’ve been matched, consult for free with no obligation.

9 Cited Research Articles

- Waddell, Melanie. (2025, Feb. 20). Judge Gives DOL 60 Days to Mull Fiduciary Rule Appeal. Retrieved from https://www.thinkadvisor.com/2025/02/20/judge-gives-dol-60-days-to-mull-fiduciary-rule-appeal-/

- National Association of Insurance Commissioners. (2025, February). The NAIC Annuity Suitability “Best Interest” Model Regulation. Retrieved from https://content.naic.org/sites/default/files/government-affairs-brief-annuity-suitability-best-interest-model.pdf

- LIMRA. (2025, Jan. 28). LIMRA: 2024 Retail Annuity Sales Power to a Record $432.4 Billion. Retrieved from https://www.limra.com/en/newsroom/news-releases/2025/limra-2024-retail-annuity-sales-power-to-a-record-$432.4-billion/

- Federal Register. (2024, April 25). Retirement Security Rule: Definition of an Investment Advice Fiduciary. Retrieved from https://www.federalregister.gov/documents/2024/04/25/2024-08065/retirement-security-rule-definition-of-an-investment-advice-fiduciary

- National Association of Insurance Commissioners. (2023, December). Retaliation Guide. Retrieved from https://content.naic.org/sites/default/files/publication-ret-zu-retaliation-volume-one.pdf

- National Organization of Life & Health Insurance Guaranty Associations. (2023, August 22). Benefit Limits - State Comparison Report. Retrieved from https://www.nolhga.com/factsandfigures/main.cfm/location/lawdetail/docid/8

- National Association of Insurance Commissioners. (n.d.). Annuities. Retrieved from https://content.naic.org/insurance-topics/annuities

- National Association of Insurance Commissioners. (n.d.). Insurance Directory. Retrieved from https://content.naic.org/sites/default/files/publication-ins-ou-insurance-directory.pdf

- National Association of Insurance Commissioners. (n.d.). Regulator. Retrieved from https://content.naic.org/regulator

Calling this number connects you to one of our trusted partners.

If you're interested in help navigating your options, a representative will provide you with a free, no-obligation consultation.

Our partners are committed to excellent customer service. They can match you with a qualified professional for your unique objectives.

We/Our Partners do not offer every plan available in your area. Any information provided is limited to those plans offered in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

844-897-8632Your web browser is no longer supported by Microsoft. Update your browser for more security, speed and compatibility.

If you need help pricing and building your medicare plan, call us at 844-572-0696