Crediting Methods and Performance Limitations

A fixed index annuity (FIA) is a type of deferred annuity contract commonly used during the accumulation period of retirement planning. These products offer a variety of options for crediting growth based on the needs of the owner.

- Written by Stephen Kates, CFP®

Stephen Kates, CFP®

Principal Financial Analyst for RetireGuide.com

Stephen Kates is a Certified Financial Planner™ professional and personal finance expert with over a decade of experience working with individuals and families who need help with their finances. With experience as a financial advisor for two of the largest financial firms in the country, Stephen has worked with hundreds of clients to build comprehensive financial plans to grow and protect their wealth.

Read More- Edited By

Lamia Chowdhury

Lamia Chowdhury

Financial Editor

Lamia Chowdhury is a financial content editor for RetireGuide and has over three years of marketing experience in the finance industry. She has written copy for both digital and print pieces ranging from blogs, radio scripts and search ads to billboards, brochures, mailers and more.

Read More- Reviewed By Thomas Brock, CFA®, CPA

- Published: October 23, 2024

- Updated: May 21, 2025

- 8 min read time

- This page features 2 Cited Research Articles

- Edited By

- Fixed index annuities offer a unique way to grow retirement savings while maintaining downside protection, making them ideal for those seeking stability over high-risk investments.

- Understanding the different crediting methods, such as point-to-point, high-water mark and monthly sum is crucial to determining if this investment product is right for you and your retirement goals.

- FIAs guarantee against losses and often offer contract options such as lifetime income riders.

- Familiarizing yourself with participation rates, growth caps and performance spreads will help you set realistic expectations for your investment.

Introduction to Fixed Index Annuities (FIAs)

A fixed index annuity (FIA) is a type of deferred annuity contract between the issuing insurance company and an individual (owner) that ties the growth of the annuity to an underlying stock or bond market index. The owner of the annuity is not actually investing in the market index, so these products are not considered securities. Like most annuities, fixed index annuities are regulated by state insurance commissioners. All annuities, including fixed index annuities, offer tax-deferred growth on the contract premiums for as long as the money remains in the contract.

Fixed index annuities are most commonly used during the accumulation period of retirement planning. They are a specialized investing tool that limits risk and can offer owners peace of mind during the lead up to retirement. They are not replacements for the growth potential of a purely market-based portfolio and due to their guarantees, they have structural limitations on both upside and downside built into the contract.

These annuities provide investors with the ability to save and invest for retirement with less risk than a pure market-based investment vehicle, thanks to the downside risk protection offered through the insurance contract. Understanding these mechanisms is key to deciding whether these investments might be right for you. Insurance companies can provide these guarantees against negative returns multiple ways and many offer supplemental contract riders that will provide lifetime income benefits.

*Ad: Clicking will take you to our partner Annuity.org.

Understanding Crediting Methods

Unlike investing in mutual funds, ETFs or stocks, participating in the market through a fixed index annuity has limitations on both the upside and downside. This means you will not gain as much as the underlying market index nor lose as much as the underlying market index (most fixed index annuities have a floor at 0% and will not go negative).

No product on the market offers uncapped upside with no downside. These types of annuities are not meant to be proxies for equity-like returns, and will not offer the same level of long-term growth as investing in a stock index fund. These products are used primarily by investors who are seeking protection and less volatility than the market overall.

Fixed index annuities can come in varying contract lengths. The length of the contract term will impact how performance is measured and how often the crediting details will change over time. Issuers may adjust minimum performance rates as well as performance limitation components at each contract renewal period.

For most consumers, the array of performance limiters and crediting methods associated with index annuities can be very confusing. To keep things simple, I generally recommend purchasing annuities with a straightforward participation rate and opting for a point-to-point crediting method. The combination of these features is easy-to-understand and likely to ensure the highest possible realization of interest income.

Popular Crediting Methods

The method of crediting your growth will determine how much you may gain during positive periods. Different methods can yield very different results. We illustrate some of the most popular methods in the following charts.

Point-to-Point Crediting

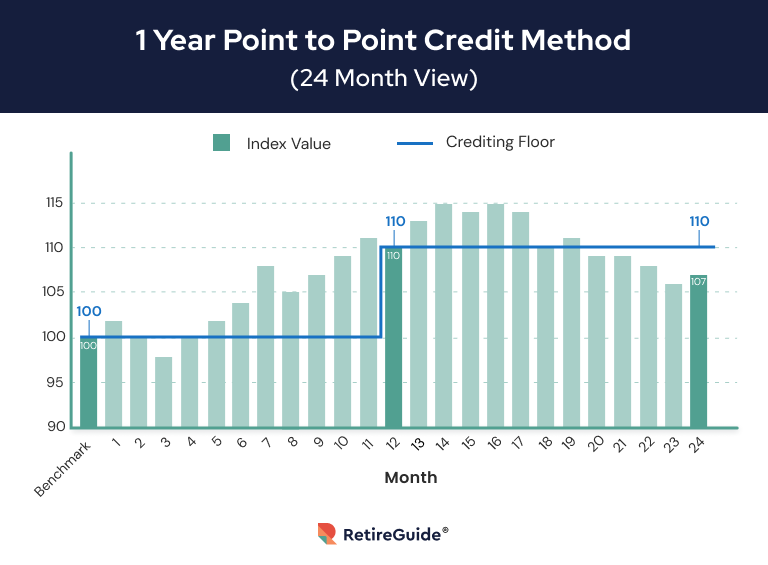

Annual or 1-year point-to-point crediting is the most common method for assigning returns to the annuity contract. This method involves comparing the initial index value with the value on the anniversary date of the contract purchase. The percentage change over this period is then measured against the performance limitations. This process repeats each year.

In the example above, a 10% growth is credited on the year 1 anniversary date. However, on the year 2 anniversary date, the index is lower than on the year 1 anniversary date, resulting in no growth being credited. The contract remains at the new crediting floor established on the year 1 anniversary date.

High-Water Mark Crediting

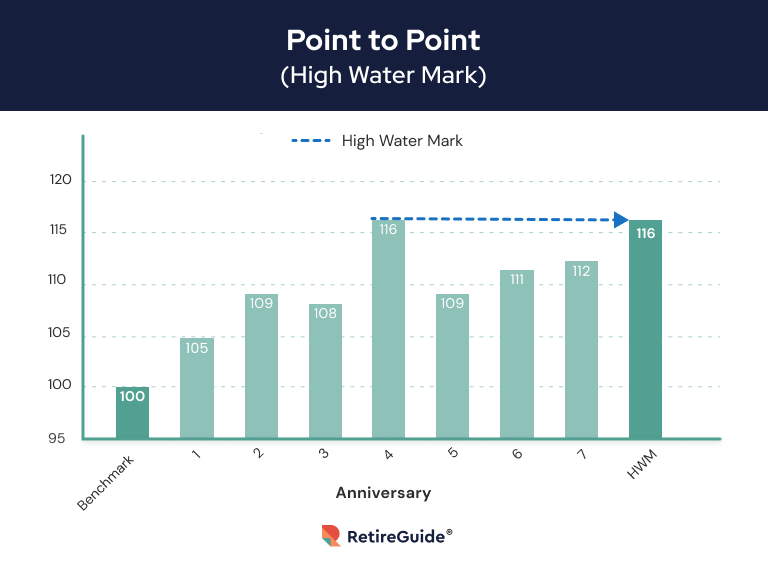

The index value for the high-water mark crediting method is tracked annually on the anniversary of the contract. At the end of the annuity guarantee period, the highest anniversary value serves as the high-water mark. The difference between this high-water mark and the benchmark value is used to determine the growth rate applied to the annuity over the term.

In the example above, a seven year guarantee period is used. After seven years, the high-water Mark was in year 4 (index value of 116). 16% growth is then applied to the contract: (116 – 100) ÷ 100 = 16%.

Monthly Sum Crediting

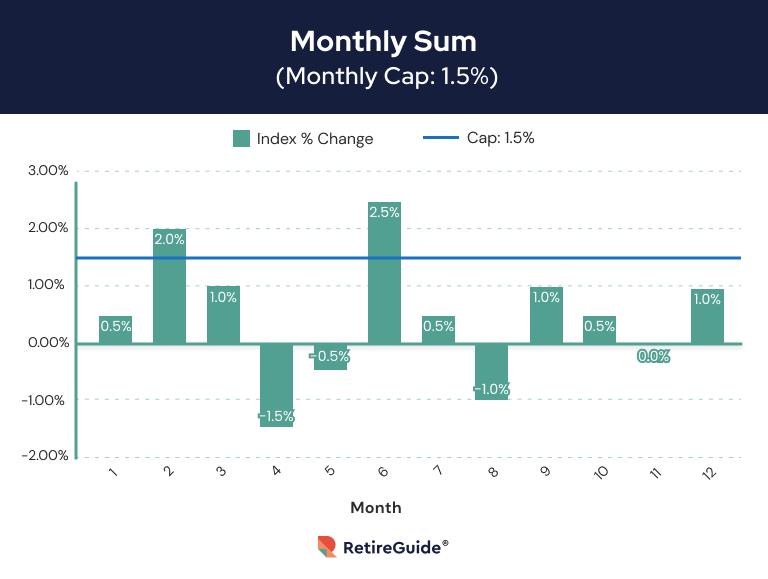

Monthly sum is one of the more complicated calculation methodologies. It is the most volatility sensitive of all the credit methods. In the example that follows, a cap on the monthly growth is included as it is the most common limiting factor used with monthly sum.

| Index Growth | 0.5% | 2.0% | 1.0% | -1.5% | -0.5% | 2.5% | 0.5% | -1.0% | 1.0% | 0.5% | 0.0% | 1.0% | 6.0% |

| Credited Growth | 0.5% | 1.5% | 1.0% | -1.5% | -0.5% | 1.5% | 0.5% | -1.0% | 1.0% | 0.5% | 0.0% | 1.0% | 4.5% |

Each month’s performance is tracked and measured against a monthly performance cap and recorded. In this example the cap is 1.5%, and any monthly performance that exceeds the cap will be limited to 1.5% as that month’s recorded performance. After 12 months, all recorded performance metrics are added together which gives the final growth that is applied to the annuity. In the monthly sum crediting method, negative performance on a monthly basis is included in the calculation, but annual performance below 0% will only yield 0% or the contractual minimum.

The total uncapped performance of the underlying index is 6%. However, the applied performance is only 4.5% because months two and six were capped at 1.5%.

*Ad: Clicking will take you to our partner Annuity.org.

Performance Limitations

In conjunction with the crediting methods, each contract will have limitations on the upside growth allowed within a given credit period. These components work like a speed limiter on a car by not allowing growth to proceed too fast regardless of the performance on the index. While this makes the fixed index annuity a less growth-oriented investment, it is what makes the loss protection possible.

In the explanations below, a point-to-point crediting method is used for illustrating the way in which the components impact annuity performance. Other crediting methods are also used with these components in real world contracts and may demonstrate different results.

Types of Performance Limitations

The three most common types of performance limitations are participation rate, growth cap and performance spread. Under similar market conditions, the performance results may not be consistent across contracts with different components. Read on for more detailed information about each one.

| Index Performance | Participation Rate (80%) | Growth Cap (8%) | Performance Spread (2%) |

|---|---|---|---|

| 20% | 16% | 8% | 18% |

| 10% | 8% | 8% | 8% |

| 5% | 4% | 5% | 3% |

| -5% | 0% | 0% | 0% |

Participation Rate

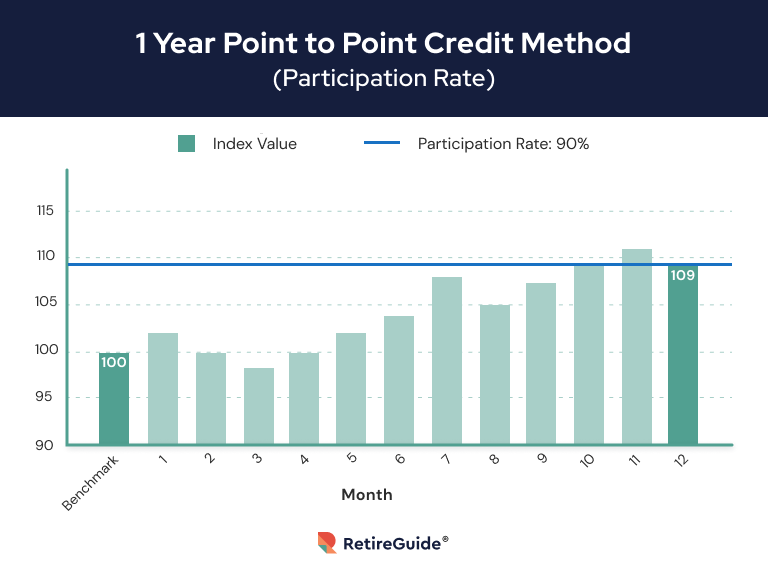

The participation rate is assigned as a percentage of growth and will usually be between 50% to 100% of the index growth. Participation rate is not a hard cap and therefore can be beneficial in high-growth situations.

In the example below, the index grew by 10% on the anniversary date of the contract. The 90% participation rate means that the credited growth is 90% of the 10% index growth, or 9%. 9% growth will be credited to the annuity and become the new crediting floor. If the index had grown by 20%, then the credited amount would be 90% x 20% = 18%.

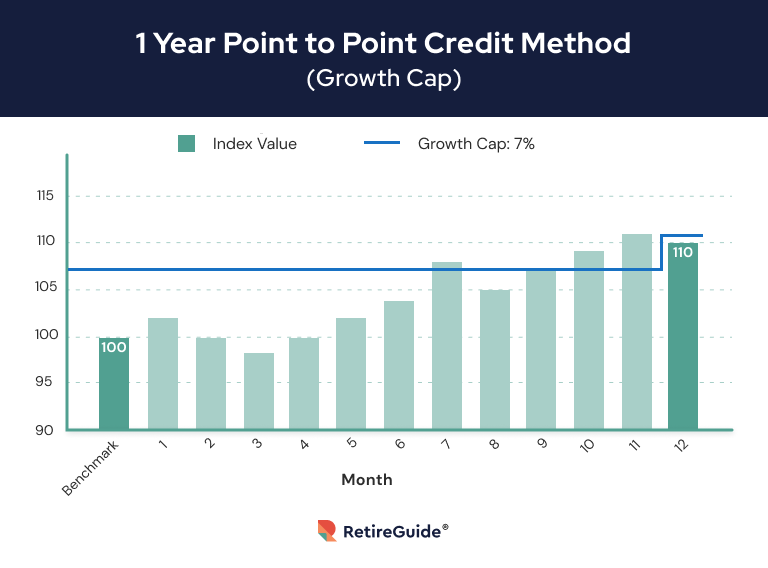

Growth Cap

The growth cap is a hard cap on the credited growth of the index. Any growth above the cap will yield the same amount of credited growth.

In the example above, the index grew by 10% on the anniversary date of the contract. The 7% growth cap, means that the credited growth will be limited to 7% only and that will be the new credting floor. If the index had grown by 20%, only 7% would be credited. If the index had grown by 5%, all 5% would be credited because it is below the growth cap.

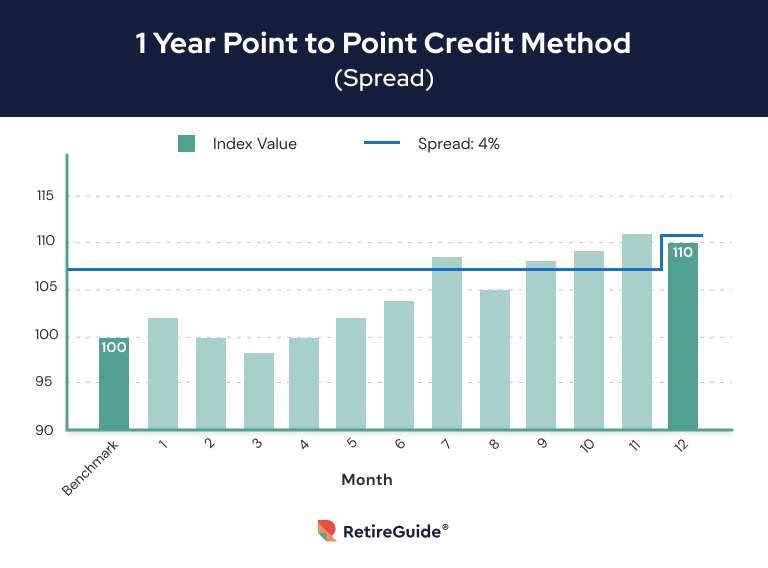

Performance Spread

The performance spread is a buffer on the credited growth of the index. Any growth will be discounted by the amount of the performance spread but cannot go below 0% (or the minimum growth rate assigned to the contract).

In the example above, the index grew by 10% on the anniversary date of the contract. The spread is 4%, so 10% – 4% = 6%. 6% is credited to the annuity contract and becomes the new crediting floor. If the index had grown by 20%, 16% would be credited. If the index had grown by 3%, 0% or the minimum growth rate would be credited because subtracting the 4% spread would yield a negative result.

Editor Norah Layne contributed to this article.

Editor Hannah Alberstadt contributed to this article.

Connect With a Financial Advisor Instantly

Our free tool can help you find an advisor who serves your needs. Get matched with a financial advisor who fits your unique criteria. Once you’ve been matched, consult for free with no obligation.

2 Cited Research Articles

- National Association for Fixed Annuities. (2020, April). Annuity Crediting Strategies: Cap Strategy. Retrieved from https://nafa.com/wp-content/uploads/NAFA_Educational_Series_Cap_Strategy.pdf

- Cannex. (n.d.). Main Page. Retrieved from https://www.cannex.com/

Calling this number connects you to one of our trusted partners.

If you're interested in help navigating your options, a representative will provide you with a free, no-obligation consultation.

Our partners are committed to excellent customer service. They can match you with a qualified professional for your unique objectives.

We/Our Partners do not offer every plan available in your area. Any information provided is limited to those plans offered in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

866-923-9782Your web browser is no longer supported by Microsoft. Update your browser for more security, speed and compatibility.

If you need help pricing and building your medicare plan, call us at 844-572-0696