Multiyear Guaranteed Annuity (MYGA)

Multiyear guaranteed annuities, or MYGAs, are a type of fixed annuity that protects your premium and accumulates interest at a guaranteed rate for a specific amount of time. MYGAs can help you create additional income during retirement by supplementing Social Security benefits and any investment accounts you hold.

- Written by Terry Turner

Terry Turner

Senior Financial Writer and Financial Wellness Facilitator

Terry Turner has more than 35 years of journalism experience, including covering benefits, spending and congressional action on federal programs such as Social Security and Medicare. He is a Certified Financial Wellness Facilitator through the National Wellness Institute and the Foundation for Financial Wellness and a member of the Association for Financial Counseling & Planning Education (AFCPE®).

Read More- Edited By

Lee Williams

Lee Williams

Senior Financial Editor

Lee Williams is a professional writer, editor and content strategist with 10 years of professional experience working for global and nationally recognized brands. He has contributed to Forbes, The Huffington Post, SUCCESS Magazine, AskMen.com, Electric Literature and The Wall Street Journal. His career also includes ghostwriting for Fortune 500 CEOs and published authors.

Read More- Reviewed By

Ebony J. Howard, CPA

Ebony J. Howard, CPA

Credentialed Tax Expert at Intuit

Ebony J. Howard is a certified public accountant and freelance consultant with a background in accounting, personal finance, and income tax planning and preparation. She specializes in analyzing financial information in the health care, banking and real estate sectors.

Read More- Published: November 29, 2021

- Updated: February 28, 2025

- 4 min read time

- This page features 2 Cited Research Articles

- Edited By

Similar to certificates of deposit in function, MYGAs provide a contractually determined annual yield amount. However, they also provide a guaranteed rate of interest and currently yield higher returns than CDs.

Whether you are looking to diversify your portfolio or for a safer product to grow your retirement income, understanding how MYGAs work and the benefits they provide can help you determine whether they are the right solution for you.

What Is a MYGA?

When you purchase an MYGA, you sign a contract with an insurance company to pay a lump-sum premium in exchange for a guaranteed fixed interest rate on your contribution for a specified period, typically three to 10 years.

Think of MYGAs as an industry equivalent to CDs; you purchase them from an insurance company rather than a bank or a broker, but like CDs, they offer a contractual annual yield for an amount of time you choose.

The major advantage of MYGAs compared to CDs, though, is that you can grow your interest tax-deferred — plus, they typically offer higher rates of return. At the end of the accumulation period, you can collect the premium you originally paid to purchase the annuity and the interest earned. In some cases, you can instead opt to renew the contract.

*Ad: Clicking will take you to our partner Annuity.org.

Are MYGAs Safe?

A type of fixed annuity, MYGAs are a safer way to grow your money than investments such as stocks and bonds. This is because they’re not tied to the market, which means they’re not vulnerable to market volatility.

MYGA contracts also typically guarantee the premium, meaning you won’t lose the money you used to purchase the annuity, and they allow you to grow your money during an agreed-upon guaranteed interest rate period that will not fluctuate.

MYGA Risks

While risks are low with MYGAs, financial products always have some level of risk.

MYGAs are not insured by the Federal Deposit Insurance Corp. or any other federal agency. Because annuities are issued by insurance companies, the federal government cannot guarantee that you won’t lose your money in the unlikely event that the issuing company goes bankrupt.

However, MYGAs are protected at the state level by state guaranty associations to which insurance companies must belong. These guaranty associations will pay claims up to your state’s statutory limit, which is $250,000 on average, according to the National Organization of Life & Health Insurance Guaranty Associations.

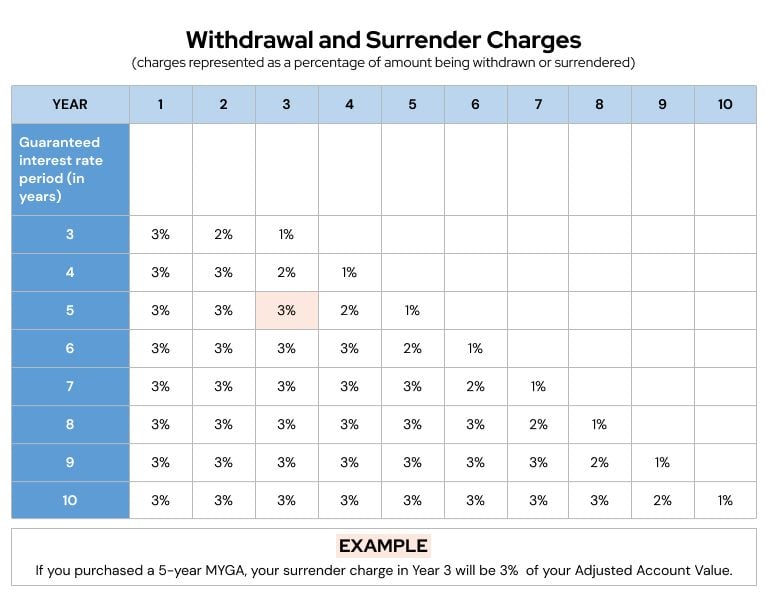

Additionally, if for some reason you need to make a withdrawal from the account prior to the end of the contract, you may be subject to withdrawal and surrender fees. It’s important to check your contract, as some insurers will allow you to withdraw a certain amount for free after the first year, depending on your age.

MYGA Annuity Rates

MYGA rates change daily and are likely to differ from one carrier to another. Today, MYGAs pay higher rates than comparable CDs, and they compound yearly.

As of Nov. 22, 2021, you could earn up to 3.05% a year on a 10-year MYGA and up to 2.95% on a seven-year contract, according to data provided by RetireGuide’s partner Senior Market Sales. The best MYGA rate was 2.95% for a five-year surrender period, 2.35% for a three-year surrender period and 2.15% for a two-year surrender period.

*Ad: Clicking will take you to our partner Annuity.org.

What Is a MYGA Ladder?

Because the interest rates on MYGAs change based on the length of the contract, you might consider laddering them. MYGA ladders involve purchasing a portfolio of MYGA annuities with staggered rate guarantee periods over several years.

For example, if you have $100,000, you could consider putting $25,000 each into three-year, five-year, seven-year and nine-year MYGA contracts. Visualize each annuity as one rung of a ladder. Beginning in Year 3, you’d have money coming in every two years, which you could then reinvest into another MYGA to continue climbing the ladder.

The biggest benefit of MYGA laddering is that it provides protection against rising interest rates.

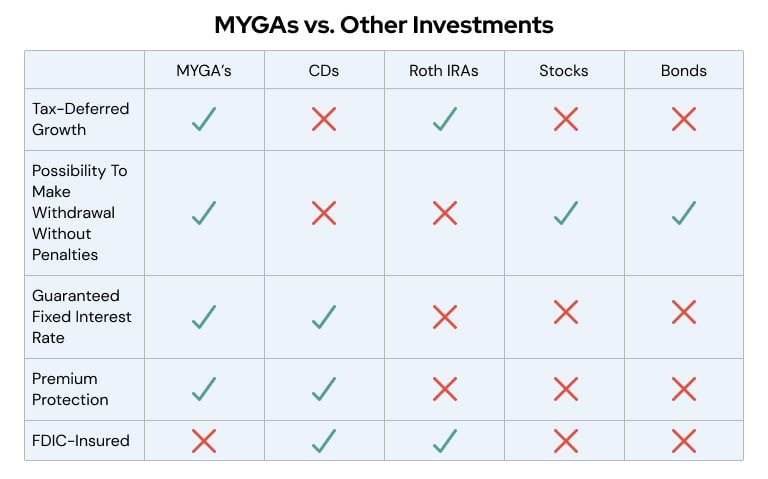

MYGAs vs. Other Retirement Investments

When it comes to investing your money and saving for retirement, you have many options to choose from. Each has its pros and cons. Here’s a breakdown of how MYGAs compare to other popular retirement savings options.

It’s important to evaluate your personal financial goals prior to purchasing a MYGA, another type of annuity or a different financial product entirely. The best first step is to consult a financial advisor who can help you to determine how much you should allocate toward saving vehicles to fit your financial strategy.

Editor Hannah Alberstadt contributed to this article.

Connect With a Financial Advisor Instantly

Our free tool can help you find an advisor who serves your needs. Get matched with a financial advisor who fits your unique criteria. Once you’ve been matched, consult for free with no obligation.

2 Cited Research Articles

- CNN Money. (n.d.). What Do I Need To Know About Taxes and Retirement?. Retrieved from https://money.cnn.com/retirement/guide/investing_taxes.moneymag/

- Powell, R. (2016, March 6). Is a Fixed-Index Annuity Smart or Safe? Retrieved from https://www.usatoday.com/story/money/columnist/powell/2016/03/06/fixed-index-annuity-smart-safe/79542156/

Calling this number connects you to one of our trusted partners.

If you're interested in help navigating your options, a representative will provide you with a free, no-obligation consultation.

Our partners are committed to excellent customer service. They can match you with a qualified professional for your unique objectives.

We/Our Partners do not offer every plan available in your area. Any information provided is limited to those plans offered in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

844-897-8632Your web browser is no longer supported by Microsoft. Update your browser for more security, speed and compatibility.

If you need help pricing and building your medicare plan, call us at 844-572-0696