The 10 Best States for Military Retirees for 2023

Military personnel often don’t have a say in where they are stationed during their service. Upon retirement, they face an opportunity to choose where they want to settle down. To help, we identified the best states for military retirees based on statistical data highlighting important needs of veterans and retirees in general.

- Written by Michael Santiago, CRPC™

Michael Santiago, CRPC™

Senior Financial Editor

Michael Santiago, a senior financial editor, joined RetireGuide in 2023. With over 10 years of professional writing and editing experience, he brings a wealth of expertise in creating content for diverse industries, including travel and healthcare. Having traveled to more than 40 countries across five continents and lived in Europe and Asia for several years, Michael's global perspective enriches his work. He combines his strong writing skills, editorial judgment and passion for crafting accurate and engrossing content to enhance the user experience on RetireGuide.

Read More- Edited By

Lamia Chowdhury

Lamia Chowdhury

Financial Editor

Lamia Chowdhury is a financial content editor for RetireGuide and has over three years of marketing experience in the finance industry. She has written copy for both digital and print pieces ranging from blogs, radio scripts and search ads to billboards, brochures, mailers and more.

Read More- Published: September 8, 2022

- Updated: May 7, 2025

- 9 min read time

- This page features 21 Cited Research Articles

- Edited By

The Department of Defense reports that there are almost 2.2 million military retirees in the United States, each receiving an average monthly payment of $2,361. It’s important to note that, unlike most civilian retirement plans, military pensions begin the day you retire, no matter your age.

Identifying the best place to live upon retirement is a challenge for most people. For veterans, there are additional factors that should be considered when leaving the service. States vary in their tax policies on military benefits and access to U.S. Department of Veterans Affairs (VA) mental and physical health care facilities.

To better assist service personnel in finding the optimal retirement location, we’ve ranked the best states for veterans in their retirement.

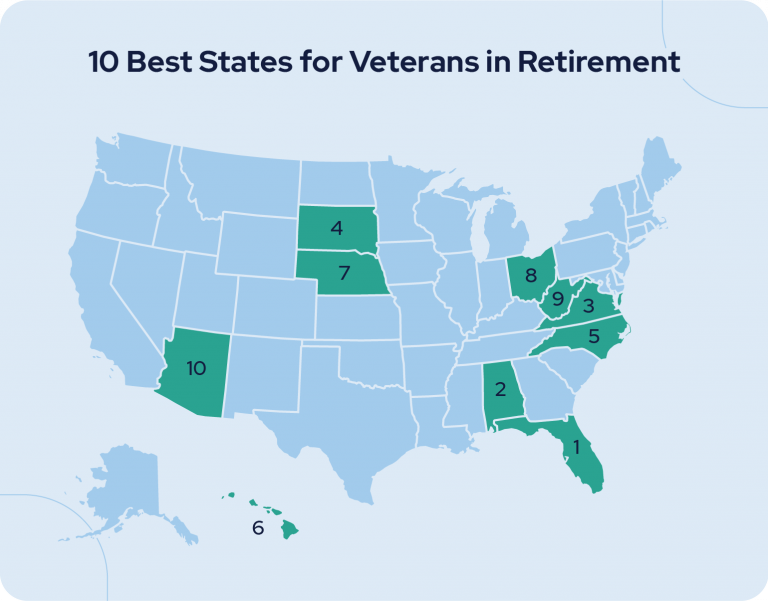

- Florida

- Alabama

- Virginia

- South Dakota

- North Carolina

- Hawaii

- Nebraska

- Ohio

- West Virginia

- Arizona

We compared all 50 states against 13 key metrics in three categories to rank the best states for military retirees. Our research analyzed these data points as important factors for veterans to consider in making their choice:

- State taxation on military retirement pay

- State funding per veteran

- Total quantity of VA facilities

- Veteran suicide rate

- Veteran population

- Rate of cost-burdened renters and homeowners paying over 30% of income for housing

- One-year home appreciation rates

- Average assisted living costs

- Cost of living index

- Overall health care rating

- Mental health care rankings

- Community well-being index scores

- Population of adults over 65

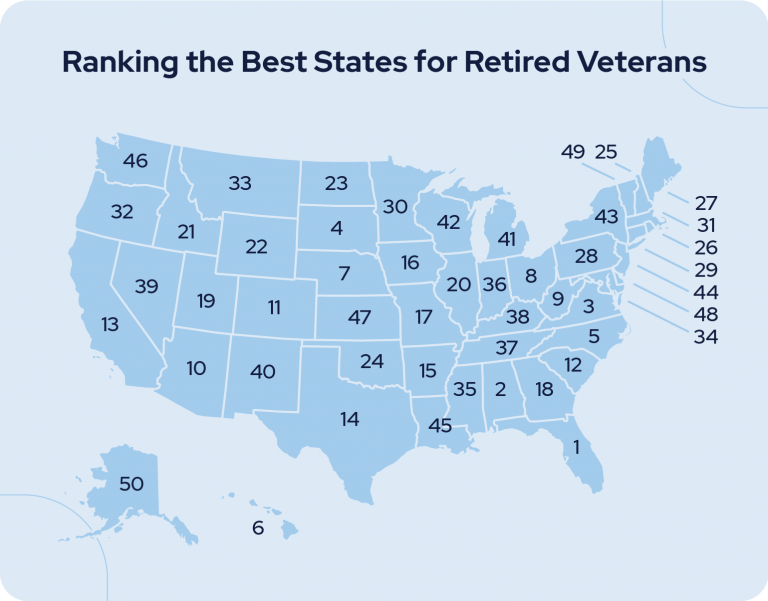

The map below highlights the top 10 states for military retirees.

Let’s take a closer look at the top ten states to better understand what makes them stand out.

*Ad: Clicking will take you to our partner Annuity.org.

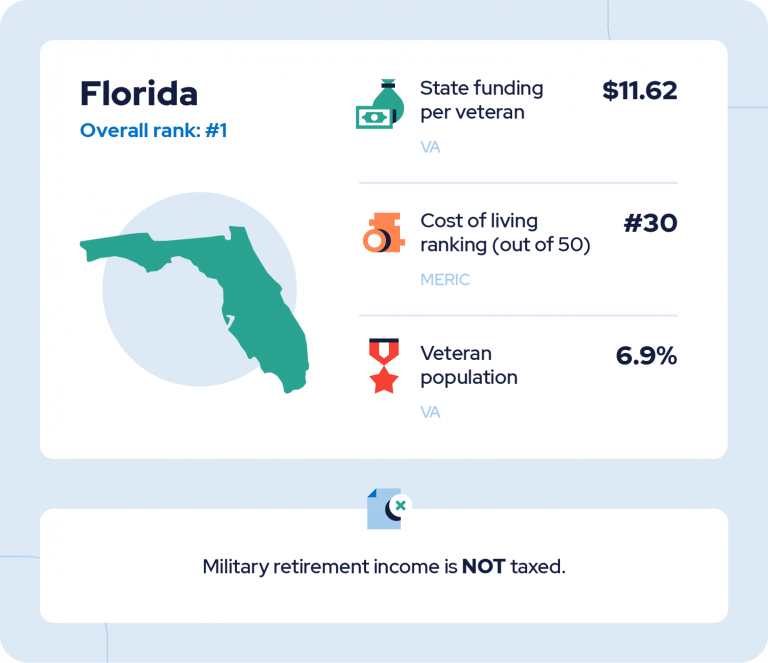

1. Florida

Sunny Florida takes the top spot on our list, thanks in part to a lack of taxes, easy access to a variety of VA services and improving home values.

As one of nine states with no income tax, military retirement income is also not subject to any taxation. The general lack of taxes appeals to many, including the 21.3% of the state’s population that are over the age of 65. Not surprisingly, Florida is home to the highest percentage of older adults among the states on this top 10 list.

Florida also ranks first among all 50 states in two other categories important to veterans. The state features the largest number of VA facilities per capita, 11.2, offering vital support services for military retirees and their families. And the state has seen the highest appreciation rate in home values over the past year at 29.8%. Improving home equity is a valuable asset when planning for retirement.

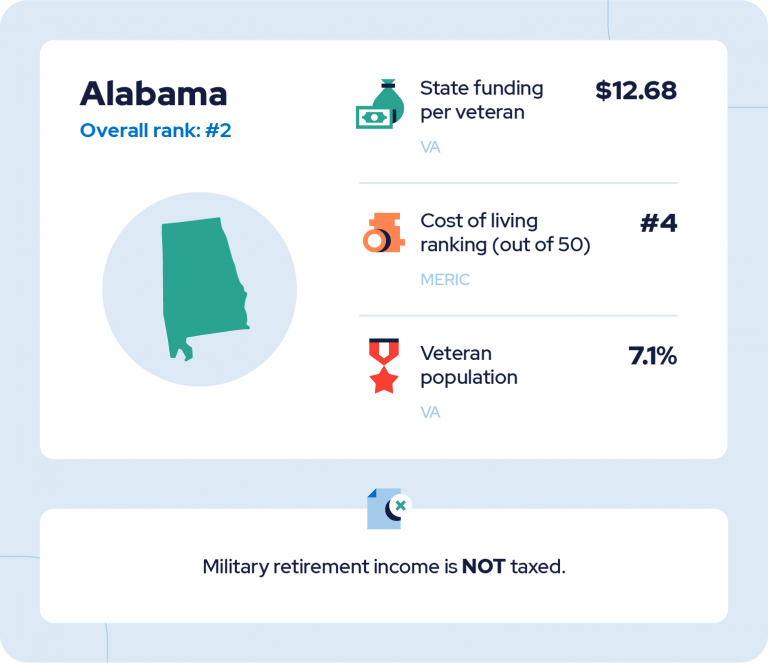

2. Alabama

Alabama comes in as the second best state for retired veterans with a lower cost of living than any other state in the top 10. With relatively low housing, health care and transportation costs, the Missouri Economic Research and Information Center ranked the state as having the fourth best cost of living score in the nation. Senior housing options are an important consideration for many retirees. Alabama averages $3,503 per month for assisted living costs, ranking seventh among all 50 states.

In addition to the reasonable cost of living and housing access, Alabama is one of the 26 states that does not tax military retirement income. Veterans can benefit from this tax break and enjoy access to 3.8 VA facilities per capita, the fifth best rate in the country.

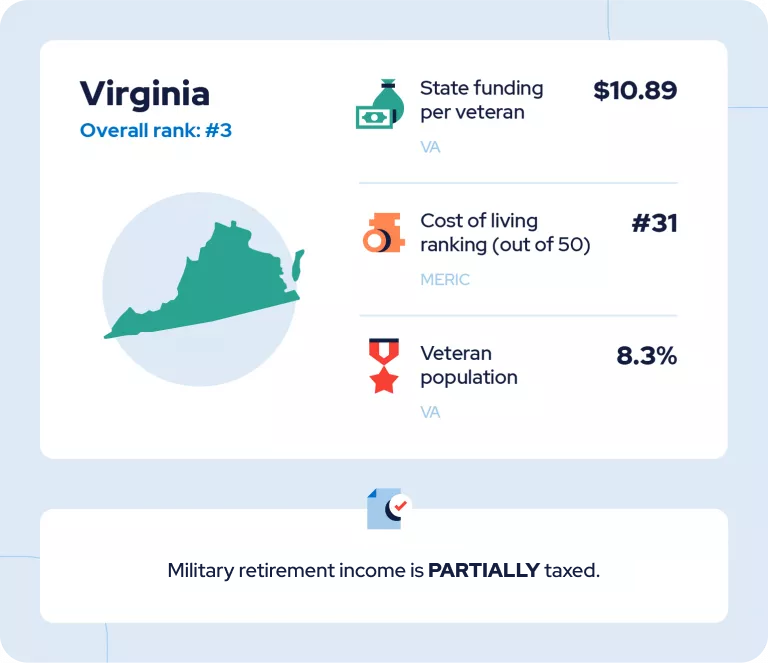

3. Virginia

Virginia’s military retirement income used to be fully taxed. Starting in 2022, up to $10,000 of military retirement pay is tax-free for retirees 55 and older. The tax-free amount increases by $10,000 each year, until 2025 when up to $40,000 is deductible. In 2023, $20,000 of military retirement pay is tax-free in Virginia.

This will be good news for the large population of veterans living in Virginia — 8.25% of the state’s total population, the second highest proportion in the United States (and the highest among the top 10). The number of veterans living in the state provides ample opportunity for building a community with fellow servicepeople.

*Ad: Clicking will take you to our partner Annuity.org.

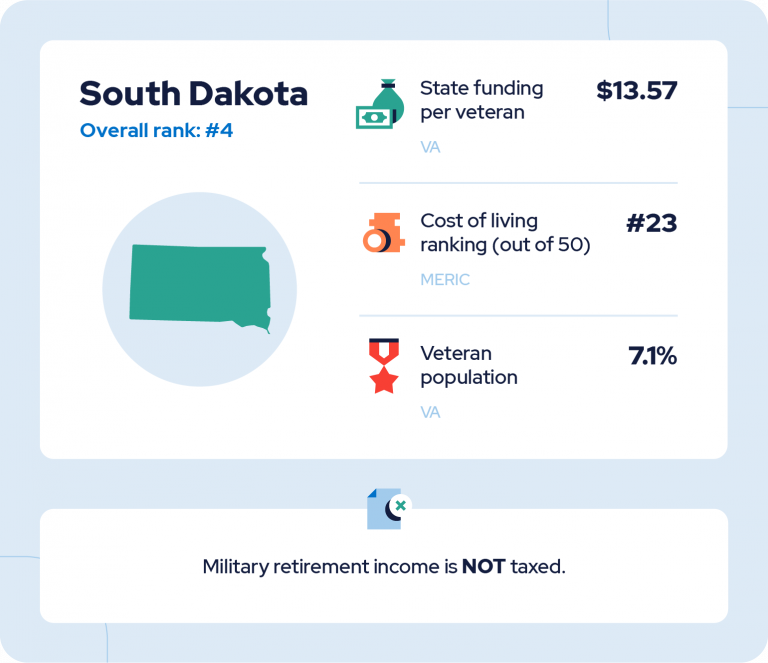

4. South Dakota

Another state without income tax, South Dakota does not apply any taxes to military retirement income. Combine that with the state’s spending $12.68 per veteran for services and state-run programs (the seventh best expenditure rate in the nation), and you can see why many military retirees find South Dakota appealing.

The state’s reasonable housing costs are another big draw. It ranks third in the U.S. for lowest cost-burden rates for renters and homeowners, at 21.8%. That translates to over 78% of residents paying less than 30% of their income toward housing costs. This statistic aligns with the state’s also being home to the second best assisted living costs in America, averaging $3,350 per month.

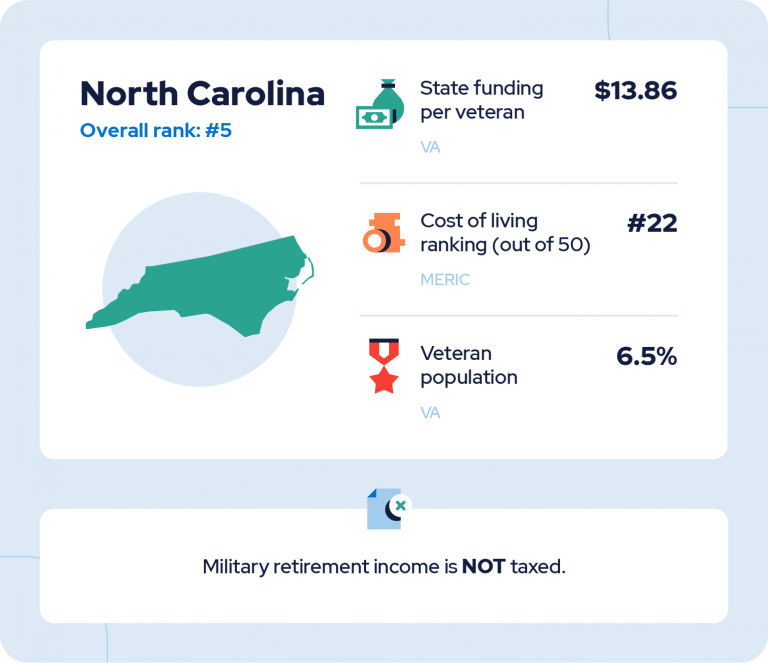

5. North Carolina

Veterans residing in North Carolina enjoy a variety of benefits, including property tax exemptions, education assistance, hunting and fishing license privileges and state employment preferences. The state also does not tax military retirement income. Its growing residential property appreciation rates (up 23.4% over the past year) are some of the best in the nation.

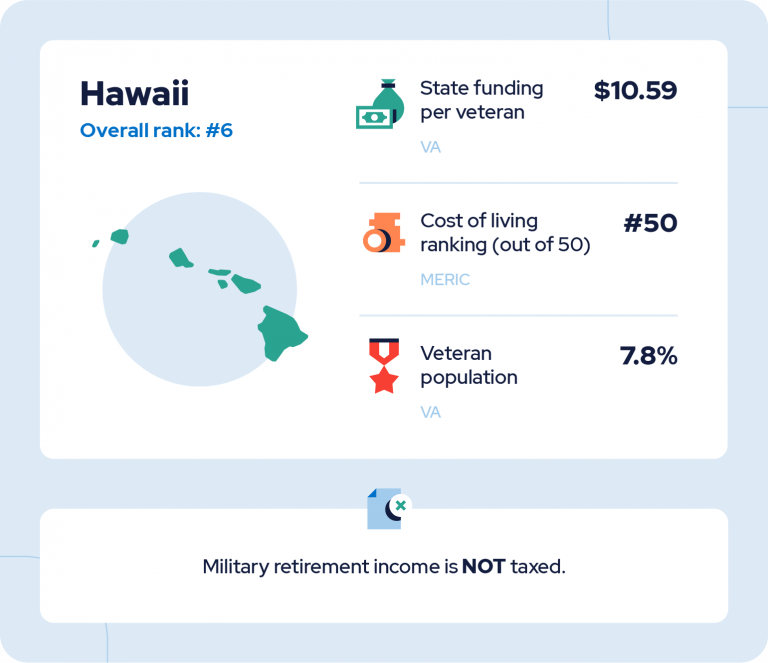

6. Hawaii

Hawaii is a popular state for vets, with 7.8% of the islands’ population made up of veterans enjoying tax-free military retirement income. The overall allure of Hawaii may seem self-explanatory, with its beautiful beaches and pleasant climate. Our research validates the excellent quality of life there, with the state ranking second in overall community well-being in the country. And both health care and mental health care ranked at the top as well, in first and seventh, respectively. Both are important, considering that the state has the country’s second lowest rate of veteran suicide.

But life in Hawaii also comes with some challenges, evidenced by its ranking in last place of all 50 states for cost of living. Housing costs — both in cost-burden rates and assisted living costs — are some of the highest in the United States. And state expenditures per veteran are at the lowest amount of all the states on our list, at only $10.59.

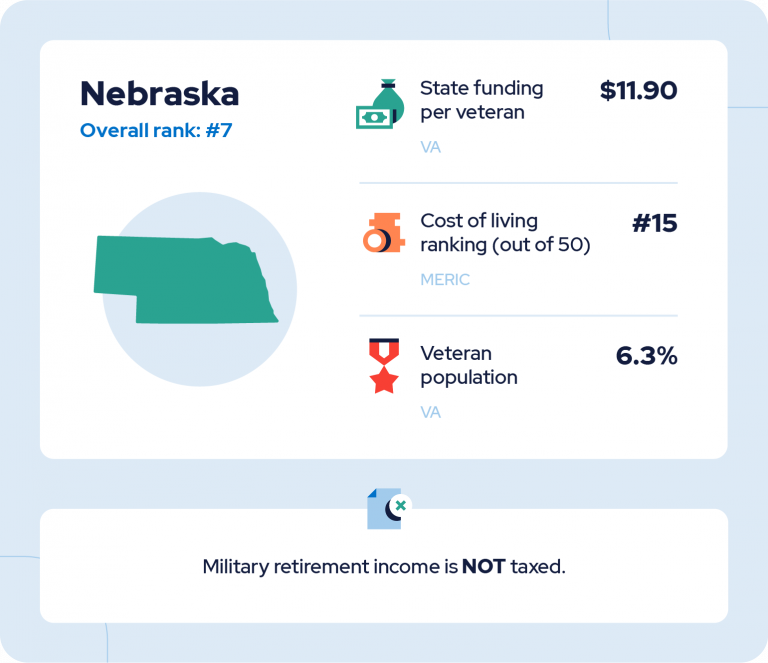

7. Nebraska

The rolling plains of Nebraska offer an affordable option for vets and their families. Only 23.8% of the population are paying over 30% of their income toward housing costs, the 10th best ratio in the country. While one-year home appreciation rates (14.6%) are the lowest among our top 10 states, the state’s assisted housing options for veterans are promising. There are four Veterans Homes in the state, offering multi-level care for those who qualify and their loved ones. And military retirement pay is not taxed in Nebraska.

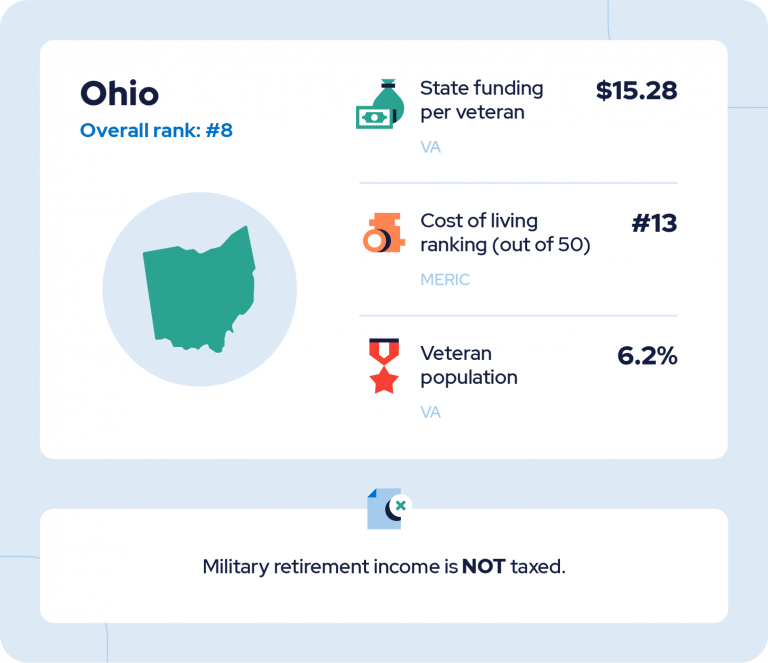

8. Ohio

Ohio veterans benefit from both a lack of taxation on their military retirement income and the state government’s high-value spending on veterans programs and services. Ranking second in the country (only behind West Virginia, also on our list below) in these state expenditures, the $15.28 per veteran provides employment assistance, scholarships, burial benefits and more.

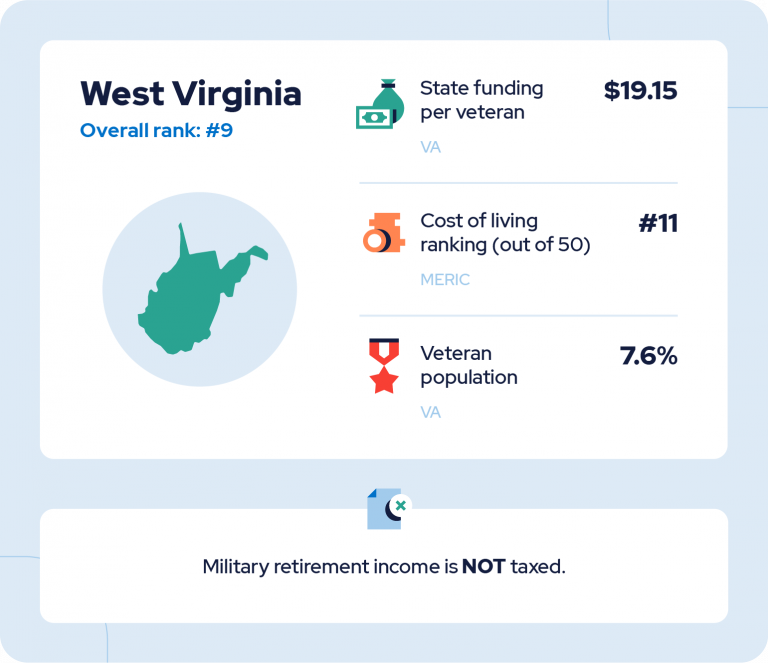

9. West Virginia

West Virginia boasts both the highest amount of state funding for veterans services (at $19.15 per veteran) and the lowest percentage of residents paying over 30% of their income toward housing costs (at 21%). Retired military personnel also benefit from facing no taxation on their retirement pay.

The state also has the second best cost of living score among the top 10 states on this list, thanks to low housing and utilities costs. That may be a factor in the high proportion of residents over the age of 65 (21% of the state’s population) residing in West Virginia.

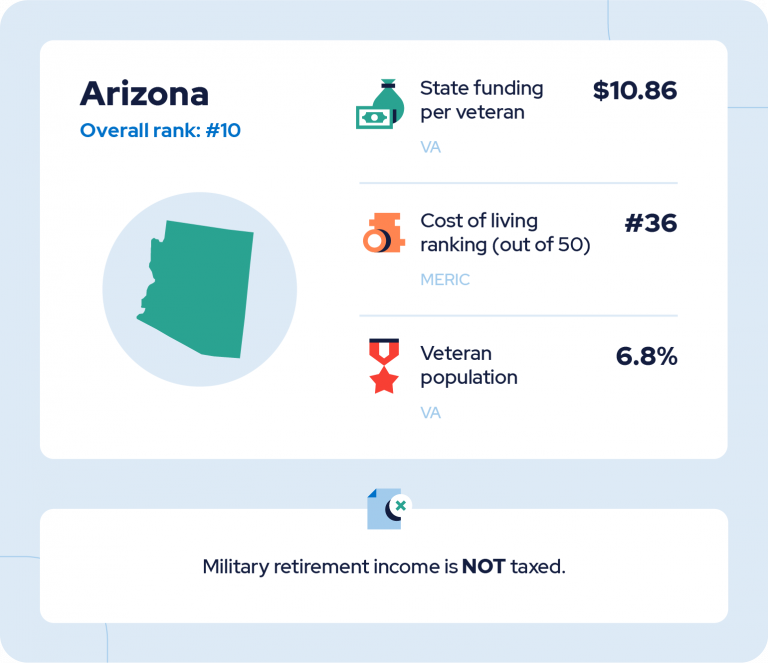

10. Arizona

Arizona rounds out our top 10 list. It offers the nation’s third highest number of VA facilities per capita (7.95) and the second highest residential property appreciation after one year (27.5%). Military retirees are not required to pay taxes on their retirement income, which leaves more cash in the bank to assist in their ongoing retirement planning.

How All 50 States Rank for Military Retirees

Across the country, many states have programs and services available to specifically support veterans as they transition to retired civilian life that go beyond straightforward senior discounts. Multiple states provide education and job support, free or discounted hunting and fishing licenses and property tax discounts.

- Florida

- Alabama

- Virginia

- South Dakota

- North Carolina

- Hawaii

- Nebraska

- Ohio

- West Virginia

- Arizona

- Colorado

- South Carolina

- California

- Texas

- Arkansas

- Iowa

- Missouri

- Georgia

- Utah

- Illinois

- Idaho

- Wyoming

- North Dakota

- Oklahoma

- New Hampshire

- Rhode Island

- Maine

- Pennsylvania

- Connecticut

- Minnesota

- Massachusetts

- Oregon

- Montana

- Maryland

- Mississippi

- Indiana

- Tennessee

- Kentucky

- Nevada

- New Mexico

- Michigan

- Wisconsin

- New York

- New Jersey

- Louisiana

- Washington

- Kansas

- Delaware

- Vermont

- Alaska

The needs of American military retirees can vary greatly — from understanding Medicare to treating PTSD to buying a dream home. Every state in the country offers tailored programs and services to support veterans, but identifying the best states for military retirees requires measured consideration and strategic retirement planning. This list can help find the perfect fit for vets and their families.

Methodology

To identify the best states for military retirees in America, we compared 13 different data points on all 50 states (excluding Washington, D.C., due to insufficient data availability for certain metrics). We ranked each state on a weighted scale based on the following standards:

- State taxation on military retirement pay - 10 points

- State funding per veteran - 10 points

- Total quantity of VA facilities - 10 points

- Veteran suicide rate - 5 points

- Veteran population - 5 points

- Rate of cost-burdened renters and homeowners paying over 30% of income for housing - 5 points

- One-year home appreciation rate - 5 points

- Assisted living costs - 5 points

- Cost of living index - 10 points

- Overall health care rating - 10 points

- Mental health care rankings - 10 points

- Community well-being index scores - 10 points

- Population of adults over 65 - 5 points

We collected the veterans concerns statistics from the Department of Veteran Affairs. Our housing data sets were gathered from the Federal Housing Finance Agency, Harvard’s Joint Center for Housing Studies and the Genworth Cost of Care Survey. The quality of life metrics were pulled from the Missouri Economic Research and Information Center, ShareCare’s Community Well-Being Index, Mental Health America, the Population Reference Bureau and U.S. News & World Report.

21 Cited Research Articles

- Absher, J. (2022, January 11). 5 More States Make Military Retirement Tax Free. Retrieved from https://www.military.com/daily-news/2022/01/10/five-more-states-make-military-retirement-tax-free.html

- Absher, J. (2021, February 22). The Military Retirement System. Retrieved from https://www.military.com/benefits/military-pay/the-military-retirement-system.html

- Congressional Budget Office. (2022, May). Military Retirement. Retrieved from https://www.cbo.gov/system/files/2022-05/51303-2022-05-militaryretirement.pdf

- Department of Veterans Affairs. (2022, May). Geographic Distribution of VA Expenditures for Fiscal Year 2021. Retrieved from https://www.va.gov/vetdata/docs/GDX/GDX_FY21.xlsx

- Department of Veterans Affairs. (2021, November 3). Locations: Facilities by State. Retrieved from https://www.va.gov/directory/guide/allstate.asp

- Department of Veterans Affairs. (2022, February 10). Mental Health: Veteran Suicide Data and Reporting. Retrieved from https://www.mentalhealth.va.gov/suicide_prevention/data.asp

- Department of Veterans Affairs. (2022, March 3). National Center for Veterans Analysis and Statistics. Retrieved from https://www.va.gov/vetdata/maps.asp

- Federal Housing Finance Agency. (2022). Change in FHFA State House Price Indexes (Seasonally Adjusted, Purchase-Only Index, 2022Q1). Retrieved from https://www.fhfa.gov/DataTools/Tools/Pages/House-Price-Index-%28HPI%29.aspx

- Genworth. (2022, January 31). Genworth Cost of Care Survey. Retrieved from https://pro.genworth.com/riiproweb/productinfo/pdf/282102.pdf

- Joint Center for Housing Studies. (2022). The State of the Nation’s Housing 2022. Retrieved from https://www.jchs.harvard.edu/state-nations-housing-2022

- Kilduff, L. (2021, December 22). Which U.S. States Have the Oldest Populations? Retrieved from https://www.prb.org/resources/which-us-states-are-the-oldest/

- Lombardo, T. (2022, June 1). State Tax Update: Latest on Grassroots Work to Exempt Military Retirement. Retrieved from https://www.moaa.org/content/publications-and-media/news-articles/2022-news-articles/state-tax-update-latest-on-grassroots-work-to-exempt-military-retirement/

- Mental Health America. (2022). Adult Ranking 2022. Retrieved from https://www.mhanational.org/issues/2022/ranking-states

- Missouri Economic Research and Information Center. (2022). Cost of Living Data Series. Retrieved from https://meric.mo.gov/data/cost-living-data-series

- ShareCare. (2022). Community Well-Being Index. Retrieved from https://wellbeingindex.sharecare.com/interactive-map/

- Unites States Army. (2021, September 20). Nebraska Military and Veterans Benefits. Retrieved from https://myarmybenefits.us.army.mil/Benefit-Library/State/Territory-Benefits/Nebraska

- Unites States Army. (2021, December 29). North Carolina Military and Veterans Benefits. Retrieved from https://myarmybenefits.us.army.mil/Benefit-Library/State/Territory-Benefits/North-Carolina

- Unites States Army. (2022, July 7). Ohio Military and Veterans Benefits. Retrieved from https://myarmybenefits.us.army.mil/Benefit-Library/State/Territory-Benefits/Ohio

- U.S. News & World Report. (2022). Health Care Rankings. Retrieved from https://www.usnews.com/news/best-states/rankings/health-care

- Virginia's Legislative Information System. (2022). SB 381 Income Tax, State; Exempts Military Retirement Income of a Veteran. Retrieved from https://lis.virginia.gov/cgi-bin/legp604.exe?221+sum+SB381

- Waggoner, J. (2022, March 9). 9 States That Don't Have an Income Tax. Retrieved from https://www.aarp.org/money/taxes/info-2020/states-without-an-income-tax.html

Calling this number connects you to one of our trusted partners.

If you're interested in help navigating your options, a representative will provide you with a free, no-obligation consultation.

Our partners are committed to excellent customer service. They can match you with a qualified professional for your unique objectives.

We/Our Partners do not offer every plan available in your area. Any information provided is limited to those plans offered in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

866-923-9782Your web browser is no longer supported by Microsoft. Update your browser for more security, speed and compatibility.

If you need help pricing and building your medicare plan, call us at 844-572-0696