10 Important Medicare Dates to Remember (Timeline)

It's important to be aware of the different enrollment periods for Medicare, which may vary depending on the type of plan you get and your birthday. Enrolling during those periods can help you reduce health care costs. Other important dates include your coverage start dates and your window for switching or updating your plan.

- Written by Christian Simmons

Christian Simmons

Financial Writer

Christian Simmons is a writer for RetireGuide and a member of the Association for Financial Counseling & Planning Education (AFCPE®). He covers Medicare and important retirement topics. Christian is a former winner of a Florida Society of News Editors journalism contest and has written professionally since 2016.

Read More- Edited By

Lee Williams

Lee Williams

Senior Financial Editor

Lee Williams is a professional writer, editor and content strategist with 10 years of professional experience working for global and nationally recognized brands. He has contributed to Forbes, The Huffington Post, SUCCESS Magazine, AskMen.com, Electric Literature and The Wall Street Journal. His career also includes ghostwriting for Fortune 500 CEOs and published authors.

Read More- Reviewed By

Michael Jones

Michael Jones

Medicare Expert and Owner of Grand Anchor Insurance Solutions

Michael Jones is a licensed insurance agent who manages his own agency called Grand Anchor Insurance Solutions. In addition to being a Medicare expert, Michael specializes in other insurance products such as voluntary benefits for employees of businesses.

Read More- Published: May 13, 2021

- Updated: December 19, 2024

- 10 min read time

- This page features 11 Cited Research Articles

Timeliness is important when it comes to enrolling in and shopping for Medicare plans.

Signing up for Medicare during enrollment periods allows you to get coverage at the optimal price. Missing certain enrollment dates may mean higher premiums, late penalties and fewer plan options.

Once your Medicare coverage starts, managing your plan involves being aware of appointment dates and notice periods.

To help you keep track of when enrollment periods and other Medicare activities take place, this guide highlights 10 important Medicare dates to remember.

Variable Medicare Dates

Certain Medicare enrollment periods differ among beneficiaries because they are determined by your 65th birthday or current employee health insurance.

Other Medicare dates are relative to your coverage start date, such as when you receive your Medicare card and when to go for your initial preventive visit.

Pay close attention to your initial enrollment period (IEP) and general enrollment period (GEP). If you miss enrolling in Medicare during those periods you will be subject to monthly penalties that will stay with you your entire life.1. Medicare Initial Enrollment Period

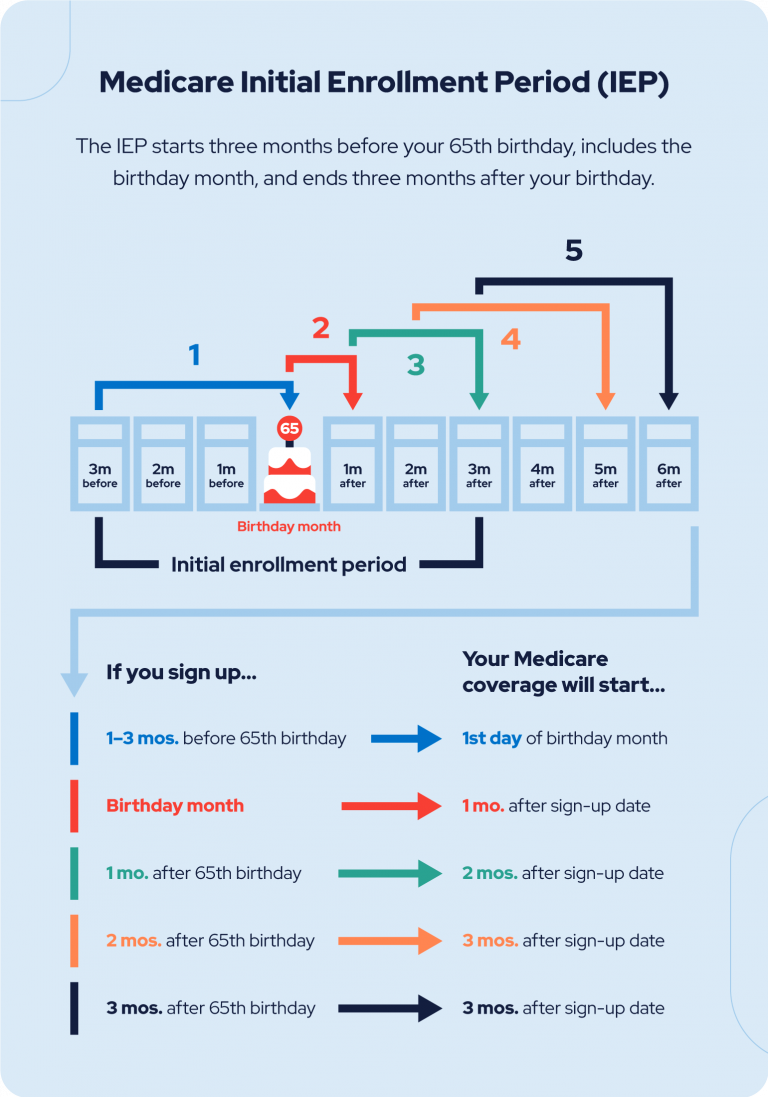

The initial enrollment period (IEP) includes the three months before and after your 65th birthday as well as your birthday month.

If you sign up for Medicare during the first three months of your IEP, your coverage starts the first day of your birthday month.

For example: Sam’s 65th birthday is on August 15. If he signs up for Medicare in May, June or July, his coverage will start on August 1.

For those whose birthdays fall on the first day of the month, Medicare coverage will begin on the first day of the previous month.

For example: Kim’s 65th birthday is on October 1. If she signs up for Medicare in June, July or August, her coverage will start on September 1.

TipYou can also sign up for a Medicare Advantage plan or drug plan during your IEP.A common enrollment mistake is missing the IEP. If that happens, you can enroll during the general enrollment period. Note that missing both enrollment periods could result in late enrollment penalties or higher monthly premiums.

2. Medicare Enrollment if You Have Employer Healthcare Coverage

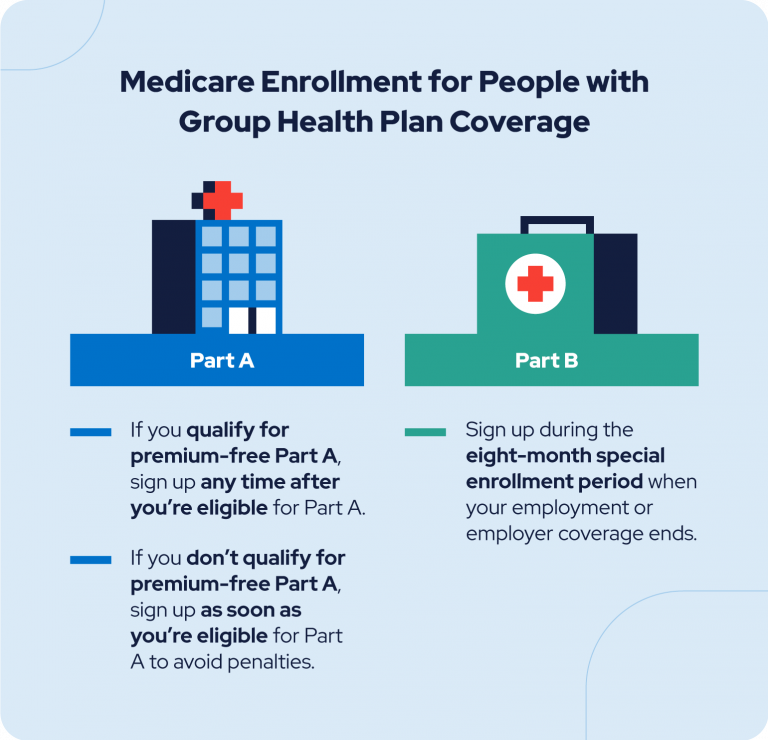

It’s important to determine whether your health coverage qualifies as group health plan coverage according to the Internal Revenue Service. A group health plan typically provides coverage to employees as well as their families.

If you have group health coverage, you may be able to delay enrollment in Original Medicare without having to pay penalties.

If you decide to get Medicare, you can enroll during the following periods.- Part A: Any time after you’re eligible for Medicare

- If you meet the requirements to get premium-free Part A coverage, you can get retroactive coverage going back six months from the date you applied for Medicare, but not before the first month you qualified for Medicare. If you’re not eligible for premium-free Part A and you don’t buy it when you’re first eligible, your monthly premium may increase by 10 percent.

- Part B: Any time after you’re eligible for Medicare or during the eight-month period after your employment or employer coverage ends

- If you chose to delay signing up for Medicare after you became eligible because you were covered by your employer’s plan, you have eight months to sign up for Part B penalty-free after your employment or your employer health coverage ends.

TipIt is recommended that you stop contributions to your health savings account (HSA) at least six months before applying for Medicare since you can’t contribute to your HSA if you have Medicare.Not enrolling during that eight-month period may result in a coverage gap in your health care. You’ll have to wait until the general enrollment period from January to March to apply and wait for your coverage to start on July 1.

3. Medigap Open Enrollment Period

The Medigap open enrollment period depends on your 65th birthday and your Part B enrollment status.

Medigap Open Enrollment- If you’re turning 65: Six-month period starting the first day of the month you turn 65 and are enrolled in Part B

- The optimal time to buy a Medigap plan is during this open enrollment period when plans are priced better. Your Medigap options may be more limited and expensive after the open enrollment period.

- If you’re 65 or older: Six-month period starting once you’re enrolled in Part B

- In this case, your open enrollment period can’t be changed or repeated.

Did you know?Connecticut, Massachusetts, and New York have continuous open enrollment periods.Applying for Medigap beyond your open enrollment period might require a medical underwriting process, during which the insurance company decides whether to accept your application based on your health and medical history.

4. Medicare Card Delivery Date

Once you get your Medicare card, you’ll need to present it to your health care provider when accessing care or services under Medicare.

Medicare Card Delivery- Automatically enrolled: 3 months before Medicare coverage starts or 25th month of getting disability benefits

- Not automatically enrolled: two weeks after signing up for Medicare or Social Security benefits

If you’re not automatically enrolled in Medicare, you’ll get a Medicare welcome package that includes your Medicare card about two weeks after you sign up for Medicare or Social Security benefits.

Medicare enrollees who qualify based on disability will get this package two weeks after getting the SSDI application approved.

Have you selected your 2025 Medicare plan?Maximize your Medicare savings by connecting with a licensed insurance agent.5. ‘Welcome to Medicare’ Visit

Once you’re signed up for Medicare Part B, you’re covered for a “Welcome to Medicare” preventive visit that will take place within the first year of your plan.

This visit includes a review of your medical and health history as well as an opportunity to discuss and review your future Medicare insurance plan with your health care provider.

You should bring these documents to the appointment:- Your medical records

- Your family’s health history

- A list of any medications you take

If your health care provider accepts payment from Medicare, you won’t have to pay for your visit unless you get additional testing or services during your visit.

Did you know?After having Medicare Part B for more than a year, you’re entitled to yearly wellness visits to create or update your current care roadmap.Fixed Medicare Dates

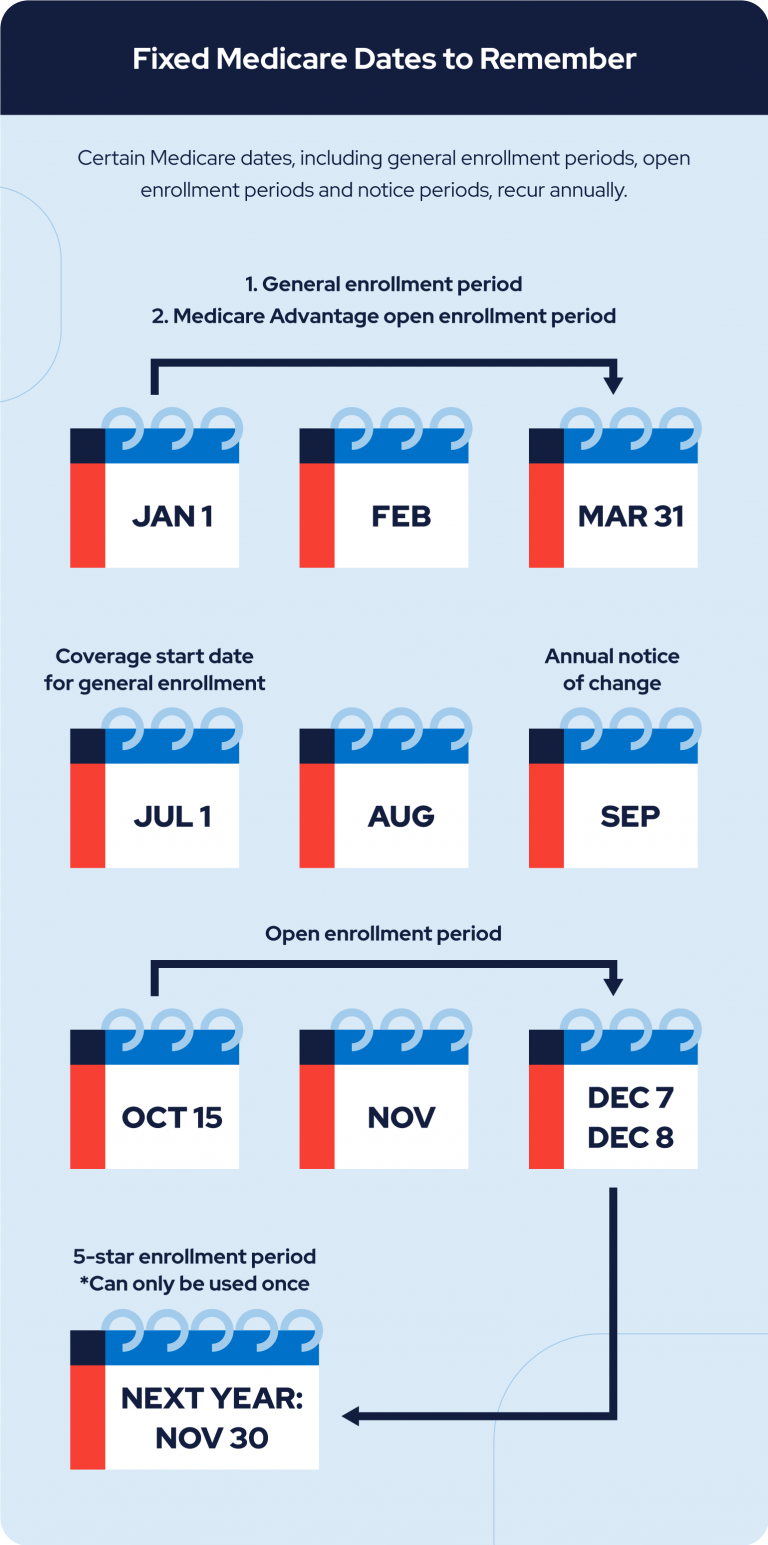

Certain enrollment and notice periods recur every year. Mark them on your calendar ahead of time so you can make any necessary preparations ahead of time.

6. General Enrollment Period

January 1 – March 31

If you miss your IEP, you can sign up for Medicare Part A — if you don’t qualify for the premium-free plan — and Part B during the annual general enrollment period. Keep in mind that delaying Medicare enrollment may result in higher premiums.If you sign up for Medicare plans during the general enrollment period, your insurance will begin on July 1.

TipYou can sign up for Medicare Part A by contacting Social Security.7. Medicare Advantage Open Enrollment Period

January 1 – March 31

During this period, if you have a Medicare Advantage plan, you’re allowed to:- Switch to another Medicare Advantage plan

- Opt out of your current plan and return to Original Medicare

- Enroll in a drug plan

However, during this period you can’t switch from Original Medicare to a Medicare Advantage plan or join a drug plan if you have Original Medicare.

If you enrolled in a Medicare Advantage plan during your IEP, you may switch to another Medicare Advantage plan or return to Original Medicare during the first three months of your plan’s effective date.

8. Annual Notice of Change

Each Year in September

Your plan provider will send you a “Plan Annual Notice of Change” (ANOC) every September, detailing any changes in coverage, costs and providers that will take place starting in January of the following year.You should review the changes to decide whether the plan still meets your needs for the next year. Contact your plan provider if you don’t receive an ANOC by the end of September.

9. Open Enrollment Period

October 15 – December 7

During this time, you can make changes to your current Medicare plans.Here’s what you can do during this period:- Switch from Original Medicare to Medicare Advantage

- Switch from Medicare Advantage to Original Medicare

- Switch to a different Medicare Advantage plan

- Join, switch or drop a Medicare prescription plan

If you decide to enroll in a new Medicare plan after reviewing your ANOC, the sooner you start comparing your options, the better.

Although the sheer number of available plans can be overwhelming — which may be why less than half of beneficiaries explore open enrollment options — you might be able to find a more economical solution.

As long as your plan administrator receives your request before the end of the open enrollment period, your coverage will begin on January 1.

10. 5-Star Special Enrollment Period

December 7 – November 30

Medicare Advantage plans, drug plans and Medicare Cost plans are given a rating between one and five stars — five being the best — based on beneficiaries’ satisfaction surveys and information from plan and health care providers.The 5-star special enrollment period, which can be used only once, allows you to switch from your current Medicare plan to a five-star Medicare plan if it’s available in your area.

Here’s how it works for beneficiaries with Medicare Advantage:- If you switch to a Medicare drug plan, you’ll go back to Original Medicare and no longer have your Medicare Advantage plan.

- If your current plan has drug coverage and you switch to a plan that doesn’t, you may lose your drug coverage. You’ll have to wait to enroll in Part D, and you might incur the late enrollment penalty.

Medicare plan ratings are updated every fall for the following year.

Frequently Asked Questions About Medicare Dates

Does Medicare start the month of your 65th birthday?Medicare starts the month of your birthday if you enrolled during the three months before your 65th birthday. If you enrolled after your birthday, your coverage will start one month after you signed up.Do I automatically get Medicare when I turn 65?It depends on whether you’re getting Social Security benefits. You’re automatically enrolled in Original Medicare if you’re getting benefits from Social Security or the Railroad Retirement Board at least four months before your 65th birthday.Can you sign up for Medicare at any time?Generally, you have to sign up for Medicare plans during certain enrollment periods, which may be fixed or dependent on your birthday. However, you may be able to delay enrollment if you qualify for a special enrollment period.What is the special enrollment period for Medicare?Special enrollment periods are periods outside of the IEP when you can sign up for Medicare penalty-free or change your Medicare Advantage and drug plan if you meet certain conditions. For example, if you move to a location outside of your coverage area, you can change to a different Medicare Advantage or drug plan during a special enrollment period. If you have employer-sponsored health insurance, you could also qualify for an eight-month special enrollment period.

Does Medicare start the month of your 65th birthday?Medicare starts the month of your birthday if you enrolled during the three months before your 65th birthday. If you enrolled after your birthday, your coverage will start one month after you signed up.Do I automatically get Medicare when I turn 65?It depends on whether you’re getting Social Security benefits. You’re automatically enrolled in Original Medicare if you’re getting benefits from Social Security or the Railroad Retirement Board at least four months before your 65th birthday.Can you sign up for Medicare at any time?Generally, you have to sign up for Medicare plans during certain enrollment periods, which may be fixed or dependent on your birthday. However, you may be able to delay enrollment if you qualify for a special enrollment period.What is the special enrollment period for Medicare?Special enrollment periods are periods outside of the IEP when you can sign up for Medicare penalty-free or change your Medicare Advantage and drug plan if you meet certain conditions. For example, if you move to a location outside of your coverage area, you can change to a different Medicare Advantage or drug plan during a special enrollment period. If you have employer-sponsored health insurance, you could also qualify for an eight-month special enrollment period.It’s important to keep the different Medicare enrollment periods in mind so that you can join or change your plans according to your needs. The best time to enroll is during the IEP, but you can also enroll in certain plans during general enrollment, open enrollment or special enrollment periods.

Once you’re signed up for Medicare, also remember to sign up for the initial preventive visit and review your ANOC to stay informed about your care plan and coverage options.

Last Modified: December 19, 2024Share This Page11 Cited Research Articles

- Medicare.gov. (2022). 5-star special enrollment period. Retrieved from https://www.medicare.gov/sign-upchange-plans/when-can-i-join-a-health-or-drug-plan/5-star-special-enrollment-period

- Medicare.gov. (2022). When will my coverage start? Retrieved from https://www.medicare.gov/basics/get-started-with-medicare/sign-up/when-does-medicare-coverage-start

- Medicare.gov. (2021, November). Understanding Medicare Advantage & Medicare Drug Plan Enrollment Periods. Retrieved from https://www.medicare.gov/Pubs/pdf/11219-understanding-medicare-part-c-d.pdf

- Centers for Medicare & Medicaid Services. (2016, August). Important Dates for Health Insurance from Medicare, the Health Insurance Marketplace, Medicaid, and CHIP. Retrieved from https://www.cms.gov/Outreach-and-Education/American-Indian-Alaska-Native/AIAN/Downloads/Important_Dates_Fact_Sheet_909384-N_Web.pdf

- Medicare.gov. (n.d.). Working past 65. Retrieved from https://www.medicare.gov/basics/get-started-with-medicare/medicare-basics/working-past-65

- Medicare.gov. (n.d.). Joining a health or drug plan. Retrieved from https://www.medicare.gov/sign-up-change-plans/joining-a-health-or-drug-plan#

- Medicare.gov. (n.d.). Part A & Part B sign up periods. Retrieved from https://www.medicare.gov/basics/get-started-with-medicare/sign-up/when-can-i-sign-up-for-medicare

- Medicare.gov. (n.d.). Should I get Parts A & B? Retrieved from https://www.medicare.gov/basics/get-started-with-medicare/sign-up/how-do-i-sign-up-for-medicare

- Medicare.gov. (n.d.). "Welcome to Medicare" preventive visit. Retrieved from https://www.medicare.gov/coverage/welcome-to-medicare-preventive-visit

- Medicare.gov. (n.d.). When can I buy Medigap? Retrieved from https://www.medicare.gov/supplements-other-insurance/when-can-i-buy-medigap

- Medicare.gov. (n.d.). Yearly "Wellness" visits. Retrieved from https://www.medicare.gov/coverage/yearly-wellness-visits

- Edited By

Calling this number connects you to one of our trusted partners.

If you're interested in help navigating your options, a representative will provide you with a free, no-obligation consultation.

Our partners are committed to excellent customer service. They can match you with a qualified professional for your unique objectives.

We/Our Partners do not offer every plan available in your area. Any information provided is limited to those plans offered in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

888-694-0290Your web browser is no longer supported by Microsoft. Update your browser for more security, speed and compatibility.

If you need help pricing and building your medicare plan, call us at 844-572-0696