Medicare for Expats: Guide and Moving Abroad Checklist

If you’re an expat, someone who lives outside their home country, you can enroll in Medicare from abroad once you’re eligible. However, there’s limited coverage outside of the United States. This guide helps you decide which Medicare plans are best for you and includes a moving abroad checklist.

- Written by Lindsey Crossmier

Lindsey Crossmier

Financial Writer

Lindsey Crossmier is an accomplished writer with experience working for The Florida Review and Bookstar PR. As a financial writer, she covers Medicare, life insurance and dental insurance topics for RetireGuide. Research-based data drives her work.

Read More- Edited By

Lee Williams

Lee Williams

Senior Financial Editor

Lee Williams is a professional writer, editor and content strategist with 10 years of professional experience working for global and nationally recognized brands. He has contributed to Forbes, The Huffington Post, SUCCESS Magazine, AskMen.com, Electric Literature and The Wall Street Journal. His career also includes ghostwriting for Fortune 500 CEOs and published authors.

Read More- Published: June 14, 2021

- Updated: March 21, 2025

- 11 min read time

- This page features 8 Cited Research Articles

- Edited By

Retiring abroad is becoming an increasingly popular option for Americans who want a lifestyle change. Moving to another country is an exciting prospect, but it also requires preparation.

If you decide to move abroad, you’ll need to consider how it will affect your current Medicare coverage. Since Medicare benefits are limited outside the United States, you may need to widen your coverage with additional plans.

This guide goes over how Medicare works overseas and how to choose plans based on your length of stay. It also features a moving abroad checklist to help you plan your move.

Medicare Enrollment for Expats

If you’re currently overseas and want to sign up for Medicare, the standard Medicare eligibility requirements still apply for you, but the enrollment periods and process can be slightly different.

- The 50 states

- District of Columbia

- Puerto Rico

- The U.S. Virgin Islands

- Guam

- American Samoa

- The Northern Mariana Islands

Once you’re eligible for Medicare, you can sign up from abroad or choose to delay enrollment until you return to the United States. In some circumstances, you may qualify for a special enrollment period that starts upon your return.

Additionally, you can be automatically enrolled only if you’re new to Medicare and in the country.

Those who aren’t eligible for premium-free Part A coverage won’t be able to sign up for Medicare from abroad. In that case, you get a penalty-free period of three months to sign up for Medicare upon returning to the United States.

Your employment status may also affect your enrollment process for Part B.

If you’re no longer working, you can choose to pay Medicare Part B premiums while you’re overseas or delay enrollment until you come back to the country. However, you may have to pay a late-enrollment fee.

- Employer-sponsored health insurance

- National health insurance

- Any of the above coverage through your spouse

- Organization-sponsored health insurance for volunteers

You can then enroll in Medicare during a penalty-free special enrollment period that lasts eight months once your current coverage ends.

If you want the prescription drug plan and enroll within two to three months of returning to the United States, your coverage will start the first day after the month you enroll.

Medicare Coverage When Living Abroad Temporarily

If you’re living abroad temporarily and plan to travel back to the United States, it would be beneficial to enroll in Medicare. That way, you’ll be able to access Medicare benefits upon your return.

To sign up for Medicare abroad, you can contact your closest U.S. Embassy or Consulate. The contact information for offices in different countries is listed on the Social Security website.

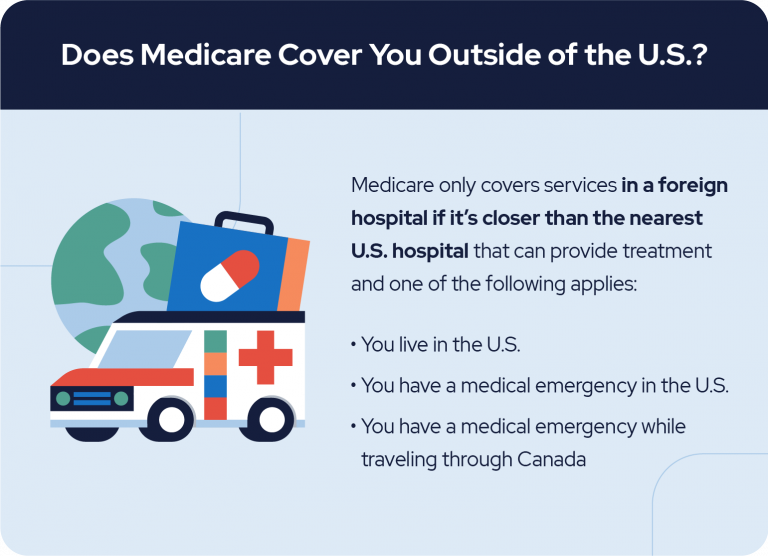

- Medical emergency:

- You experience a medical emergency when you're in the United States, but a foreign hospital is closer to you than any domestic hospitals that can treat you.

- Medical emergency while traveling:

- You experience a medical emergency when traveling through Canada “without unreasonable delay” via the most direct route between Alaska and another state, and the Canadian hospital is closer than the nearest U.S. hospital that can treat you.

- Non-medical emergency:

- You live in the United States but the foreign hospital is closer than the nearest U.S. hospital that can treat your medical condition.

If one of the situations above applies to you, you would pay the same amount out-of-pocket as you would if those services were accessed in the United States.

However, you may be responsible for the full cost of care if the foreign hospital doesn’t submit the Medicare claim for you. This situation could occur because foreign hospitals, unlike U.S. hospitals, are not required to do so.

In that case, you’d have to submit an itemized bill to Medicare for the health care services you accessed.

To get more coverage outside the United States, you could look into Medigap Plans C, D, F, G, M or N. Those supplemental insurance plans cover medical emergencies that Medicare doesn’t cover during the first 60 days of your trip.

Medicare For People Who Live Abroad But Plan to Move or Fly Back Frequently

As with Medicare benefits, you’re also able to collect Social Security benefits while living abroad in most countries if you’re eligible. Receiving or being eligible for Social Security benefits can qualify you for premium-free Medicare Part A.

Social Security considers you living abroad once you’ve stayed in a foreign country for at least 30 consecutive days. Once you return to the United States and stay for more than 30 consecutive days, you’re no longer deemed living abroad.

Social Security has a screening tool for determining your eligibility to receive payments overseas.

When deciding on your Medicare plans, consider your budget and how often you’ll be returning to the United States. It may be more convenient to keep your coverage if you plan to move back eventually. This will prevent you from having to go through the enrollment process again. However, you’ll have to pay the premiums while living overseas.

For example, a retiree who plans to travel abroad for several years but flies back several times a year to visit family can keep their current Original Medicare plan and get additional travel health insurance to ensure they have coverage regardless of their location.

In some cases, you may qualify for a special enrollment period that allows you to delay enrollment without penalty until you return to the country.

Medicare For People Who Permanently Live Overseas

If you plan on living abroad for an extended period of time, you should keep your premium-free Part A if you have it and consider enrolling in — or keeping — Part B.

If you don’t fly back to the United States often, it may not be worth it to pay the Part B premiums for coverage you can’t use overseas. However, if you don’t apply for Part B when you’re first eligible but decide to sign up at a later date, you’ll incur the late enrollment penalty.

To cancel a current Part B plan, you must contact Social Security and continue paying the premiums for one more month after notifying Social Security.

Before your move abroad or while living abroad, you may want to explore other health insurance options that will provide the most extensive coverage — both within the United States and abroad — the compare costs.

Additional Health Insurance Options for Expats

If you live abroad, you may want to explore local health insurance plans as well as international plans to find a policy that best supports your needs.

- International health insurance:

- This type of health insurance offers wide-scope coverage. International health insurance can be convenient for those who plan to travel widely while abroad.

- National health insurance:

- Once you fulfill certain residency or work requirements in a country, you may be eligible for government-sponsored health insurance. Consult the local government website to find out if you qualify for coverage.

- Local private health insurance:

- This type of insurance allows you to access private health care within the country. Local insurance may be less expensive than international health insurance and may be ideal for people who plan to stay in one location.

- Travel health insurance:

- Travel health insurance typically covers medical emergency costs during your trip. For those who plan to travel for a period of time, this can be a flexible and budget-friendly option.

Needless to say, two insurance policies means two premiums, so it will most likely be more economical to commit to one plan.

Checklist for Preparing to Move and Retire Abroad

Moving abroad requires careful preparation. To simplify the process, our printable checklist includes plans and arrangements you should make before moving.

- Check out the Department of State’s country information page to see whether you require a visa to travel or live in your destination country.

- Apply for your visa online or visit your local embassy or consulate to apply.

- Passport (valid for at least the next six months)

-

Medical records

- Information on any pre-existing health conditions

- Immunization records

- Check whether you need vaccinations before arriving in your destination country.

- Book any necessary vaccine appointments.

- Inform your current bank about your move.

- Set up an account you can use overseas or create a local bank account once you move.

- Figure out a plan for your Medicare coverage.

- If you want to enroll from abroad, find the nearest U.S. embassy or consulate office to your destination.

- If you want to disenroll, contact your plan provider, Medicare or Social Security.

- If you want to keep your Medicare plan, find a method to pay for your premiums overseas.

- Decide whether you want to rent or buy property.

- Book or make arrangements for accommodations ahead of time.

FAQs: Medicare and Living Abroad

If you signed up for Medicare, you still have to pay the premiums while living abroad. If you get Social Security or Railroad Retirement Board benefits, your Part B premium is automatically deducted from benefit payments.

Other ways to pay premiums include paying through your Medicare account, your online banking service or Medicare Easy Pay.

Additional Resources

You will inevitably run into money-related obstacles beyond health care coverage when embarking upon this adventure. The life of an expatriate is full of discovery and excitement, but it’s also packed with the hassle of practical matters you simply can’t escape.

So before you follow that wanderlust, make sure you’re ready.

- Social Security Payments Outside the United States:

- This extensive Social Security document covers the logistics of collecting payment overseas, the rules and restrictions for payments to continue, and things to report to Social Security.

- Checklist for Older Travelers:

- The Department of State has a downloadable checklist for older travelers, which includes tips on dealing with common travel issues that older adults may face, such as scams, medical incidents and accessibility issues.

- Tax Guide for Americans Living Abroad:

- This resource from the Internal Revenue Service details where and how to file taxes while overseas. It also explains how foreign income taxes and foreign tax credits work.

You can sign up for or keep your Medicare coverage outside the United States, but you can only access benefits within the country unless you meet the exceptions.

It could be worth keeping your Medicare if you plan to move or frequently return to the United States. If you plan on living abroad permanently, consider getting additional health insurance to meet your health care needs.

Connect With a Financial Advisor Instantly

Our free tool can help you find an advisor who serves your needs. Get matched with a financial advisor who fits your unique criteria. Once you’ve been matched, consult for free with no obligation.

8 Cited Research Articles

- U.S. Centers for Medicare & Medicaid Services. (2021, January). Medicare Coverage Outside the United States. Retrieved from https://www.medicare.gov/Pubs/pdf/11037-Medicare-Coverage-Outside-United-States.pdf

- Social Security Administration. (2020, June). Your Payments While You Are Outside the United States. Retrieved from https://www.ssa.gov/pubs/EN-05-10137.pdf

- American Association of Retired Persons. (2020, September 8). Can you live outside the U.S. and collect Social Security? Retrieved from https://www.aarp.org/retirement/social-security/questions-answers/collecting-social-security-abroad.html

- O’Brien, S. (2019, August 30). Retiring overseas? How Medicare may (or may not) fit into your plans. Retrieved from https://www.cnbc.com/2019/08/08/retiring-overseas-how-medicare-may-or-may-not-fit-into-your-plans.html

- Peddicord, K. (2018, July 17). How to Choose Health Insurance for Retirement Overseas. Retrieved from https://money.usnews.com/money/blogs/on-retirement/articles/2018-07-17/how-to-choose-health-insurance-for-retirement-overseas

- American Association of Retired Persons. (n.d.). Can I get Medicare if I live overseas? Retrieved from https://www.aarp.org/health/medicare-qa-tool/medicare-if-living-outside-united-states/

- U.S. Centers for Medicare & Medicaid Services. (n.d.). Top 5 things you need to know about Medicare Enrollment. Retrieved from https://www.cms.gov/Outreach-and-Education/Find-Your-Provider-Type/Employers-and-Unions/Top-5-things-you-need-to-know-about-Medicare-Enrollment

- Medicare.gov. (n.d.). When can I sign up for Medicare? Retrieved from https://www.medicare.gov/basics/get-started-with-medicare/sign-up/when-can-i-sign-up-for-medicare

Calling this number connects you to one of our trusted partners.

If you're interested in help navigating your options, a representative will provide you with a free, no-obligation consultation.

Our partners are committed to excellent customer service. They can match you with a qualified professional for your unique objectives.

We/Our Partners do not offer every plan available in your area. Any information provided is limited to those plans offered in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

888-694-0290Your web browser is no longer supported by Microsoft. Update your browser for more security, speed and compatibility.

If you need help pricing and building your medicare plan, call us at 844-572-0696