Guide to Medicare for People With Disabilities: A Step-by-Step Checklist

Individuals under 65 with certain disabilities may qualify for Medicare. If you have end-stage renal disease (ESRD), you are eligible for Medicare at any age. You’re automatically enrolled in Medicare if you have amyotrophic lateral sclerosis (ALS) and receive disability benefits, or if you have received disability benefits for at least two years.

- Written by Matt Mauney

Matt Mauney

Financial Editor

Matt Mauney is an award-winning journalist, editor, writer and content strategist with more than 15 years of professional experience working for nationally recognized newspapers and digital brands. He has contributed content for ChicagoTribune.com, LATimes.com, The Hill and the American Cancer Society, and he was part of the Orlando Sentinel digital staff that was named a Pulitzer Prize finalist in 2017.

Read More- Edited By

Lee Williams

Lee Williams

Senior Financial Editor

Lee Williams is a professional writer, editor and content strategist with 10 years of professional experience working for global and nationally recognized brands. He has contributed to Forbes, The Huffington Post, SUCCESS Magazine, AskMen.com, Electric Literature and The Wall Street Journal. His career also includes ghostwriting for Fortune 500 CEOs and published authors.

Read More- Published: April 16, 2021

- Updated: December 20, 2024

- 15 min read time

- This page features 15 Cited Research Articles

- Edited By

Medicare coverage isn’t only limited to people 65 and older. While senior citizens have increased medical needs, there are also many younger individuals who need health care services due to their disabilities.

To serve the health care needs of the population, Medicare also offers plans to people with certain disabilities.

As of 2022, Medicare covered more than 7 million Americans under age 65 with disabilities.

You can qualify for Medicare under age 65 if you have end-stage renal disease (ESRD), amyotrophic lateral sclerosis (ALS) or if you’ve received disability benefits for at least 24 months.

This guide covers Medicare eligibility requirements for people with disabilities, the coverage for different types of disabilities and a checklist on how to sign up for Medicare.

What Disabilities Qualify for Medicare?

In some cases, individuals under 65 may qualify for Medicare if they have certain disabilities. Depending on the disability, there may be a 24-month waiting period before individuals can enroll in Parts A and B.

- Amyotrophic lateral sclerosis (ALS)

- End-stage renal disease (ESRD)

- Qualified for Social Security retirement benefits and received Social Security Disability Insurance (SSDI) for 24 months

- Qualified for certain disability benefits from the Railroad Retirement Board for 24 months

Amyotrophic Lateral Sclerosis (ALS)

If you’re diagnosed with ALS, you’re eligible for Medicare as soon as your SSDI benefits start, so you don’t have to wait 24 months before qualifying for Medicare.

The Original Medicare plan covers certain home health care services for ALS patients, including part-time skilled nursing care, physical therapy and part-time home health aide services.

- You must be under the care of a doctor and must be receiving services under a plan created and reviewed by a doctor.

- A doctor must certify that you are homebound, which means you’re unable to leave your home without assistance.

- A doctor must certify that you need part-time skilled nursing care or therapy services.

- The care must be provided through a Medicare-approved home health agency.

In addition to home health care services, Medicare also covers some medication costs for ALS patients. For example, if you take edaravone, also known by the brand name Radicava, Part B typically covers some of the costs for IV infusions done at a doctor’s office or hospital outpatient setting.

For those who want to do home infusion treatments, you may need to sign up for Medicare Part D, which covers the cost of the drug itself but not any infusion supplies or equipment.

End-Stage Renal Disease (ESRD)

ESRD-based Medicare coverage differs from coverage for other eligibility types. You can receive retroactive Medicare coverage that starts up to 12 months before you enroll.

You’ll need to enroll in both Medicare Part A and Part B in order to cover dialysis and kidney transplant services. You can choose between getting Original Medicare or Medicare Advantage once you’re eligible.

Under Medicare Part B, your transplant drugs and most of the dialysis drugs will be covered. However, if you need additional prescriptions for other health conditions, you may need to sign up for Medicare Part D to help with drug costs not covered by Part B.

- Up to three months before you qualify for Medicare

- The month you qualify for Medicare

- Up to three months after the first month you qualify for Medicare

Prior to the start of your Medicare coverage, you’ll have to pay out of pocket for any necessary surgeries or services to prepare for dialysis. Medicare coverage usually begins on the first day of the fourth month of dialysis treatments, regardless of whether you’ve signed up for Medicare.

- During the first three months of your dialysis treatments, you enroll in a Medicare-certified home dialysis training program.

- Your doctor expects you to be able to perform self-dialysis treatments after completing training.

If you’re getting a kidney transplant, Medicare coverage begins the month you’re admitted to a Medicare-certified hospital if your surgery is scheduled for that month or during the next two months.

Medicare coverage can start two months before your transplant date if it was postponed for more than two months after you’ve been admitted to the hospital for pre-surgery health care services.

Disabilities Under Social Security Disability Insurance (SSDI)

One of the requirements to qualify for Social Security disability benefits is that you must have a medical condition that’s expected to last at least one year. It must also significantly limit your ability to perform basic work activities, such as sitting, standing and remembering. You also have to meet earnings requirements based on your work history.

If your medical condition meets the criteria of a listing in the U.S. Social Security Administration’s list of impairments, you have a qualifying disability. Medical experts outlined the objective medical or physical findings needed to satisfy the criteria for each listing. The impairments are organized into categories such as neurological disorders, respiratory disorders and immune system disorders.

- Multiple sclerosis

- Parkinson's disease

- Lupus

- Depression, bipolar and related mental illnesses

- Cystic Fibrosis

- Autism spectrum disorder

After submitting your application with your personal, medical and work history information and receiving approval, there’s a five-month waiting period before you can start receiving disability benefits.

However, you’re exempt from the waiting period if you have ALS and you were approved for benefits on or after July 23, 2020.

Medicare for Children with Disabilities

Unlike private health coverage, Medicare coverage does not extend to dependents — they must be individually eligible in order to receive Medicare coverage.

Medicare defines a child as an unmarried person under the age of 22, or a person between ages 22 and 26 who meets other requirements.

- Developed a disability before age 22

- Are unmarried

- Have at least one parent who receives Social Security retirement benefits

Children under 20 can only qualify for Medicare if they have ESRD. In those cases, they must require regular dialysis treatments or a kidney transplant, and they must have at least one parent who receives or is eligible for Social Security retirement benefits.

For children who receive Medicare due to permanent kidney failure, their Medicare coverage will end 12 months after the last dialysis treatment or 36 months after a kidney transplant unless they meet certain requirements.

Children under the age of 19 may qualify for Medicaid or the Children’s Health Insurance Program (CHIP) if you meet a certain income threshold determined by the state.

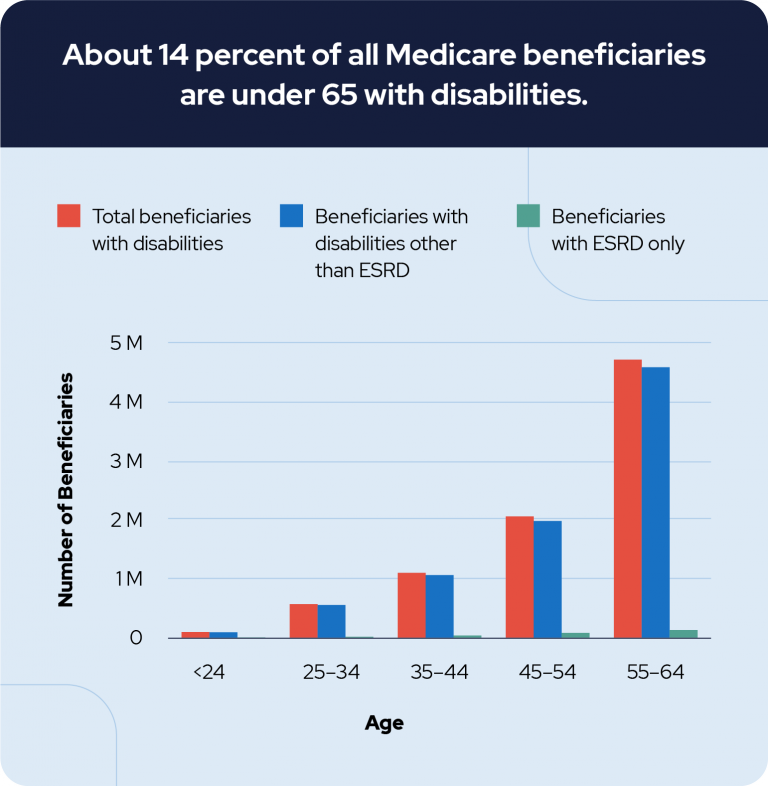

Medicare Beneficiaries By Age

The majority of Medicare beneficiaries are 65 or over. According to data from the Centers for Medicare & Medicaid Services, out of the 58 million people who received Original Medicare in 2021 — the most recent year for which numbers are available — more than 7.3 million beneficiaries were under 65 with disabilities.

For those under 65, the number of Medicare beneficiaries with disabilities increases with each age group, with over half of the beneficiaries between 55 and 64 years old, and only 1 percent being 24 and younger.

In Medicare’s latest count (2021), there were 545,956 beneficiaries with ESRD, accounting for less than 1% of the total number of Medicare enrollees, and 245,382 of them are under 65 making up 3% of Medicare enrollees under 65.

As the baby boomer generation continues to shift from private health insurance to Medicare, it’s projected that there will be 75 million people enrolled in the Medicare program by 2028.

According to a 2022 report by health care and aging firm ATI, 11.5 million Medicare beneficiaries — 18% of people enrolled in Medicare — are dually eligible for Medicaid, which provides coverage for low-income individuals and individuals with disabilities.

You’re allowed to enroll in both Medicare and Medicaid if you meet the requirements for the two programs.

Checklist: How to Apply for Medicare with a Disability

Applying for Medicare may seem like a complicated process, but it can be broken down into simpler steps. Follow the steps and requirements in the checklist below to sign up for Medicare depending on the type of disability you have.

When To Sign up for Medicare for Disabilities

After receiving disability benefits for 24 months, you’re automatically enrolled in Medicare Parts A and Part B.

However, if you want to sign up for Medicare Advantage (Part C) or a drug plan (Part D), you can do so during the initial enrollment period (IEP). If you’re over 65, this seven-month period starts three months before you turn 65, includes the month you turn 65 and ends three months later.

If you’re under 65 with a disability, your IEP starts three months before your 25th month of getting disability benefits, includes your 25th month of getting disability benefits and ends three months after.

If you’re planning to enroll in a drug plan, it’s important to do so before the IEP ends to avoid getting a late enrollment penalty, which occurs if there’s a period of 63 days or more after your IEP when you don’t have Medicare drug coverage or any other creditable drug coverage.

This penalty is permanently added to your drug plan premium, and may change from year to year depending on the national base beneficiary premium that year.

Signing up for Medicare While Working with a Disability

If you decide to return to work, you can still access certain Medicare benefits. Additionally, you can sign up for government programs that support workers with disabilities.

Can You Work If You Are on Medicare Disability?

You can go back to work while still retaining Medicare Part A and Part B coverage for eight and a half years, after which you’ll have to start paying premiums for Part A.

Social Security Disability Trial Work Period (TWP)

The trial work period (TWP) is a period where you can test your ability to work for at least nine months — though they don’t have to be consecutive — in a rolling five-year period while still being considered disabled. You can start your TWP the first month you’re entitled to SSDI benefits or the month you file for benefits, whichever is later.

Once you start working, if your monthly earnings exceed the threshold monthly earning, that month of work counts toward a trial work period. In 2022, the monthly earnings threshold is $970, but it tends to increase every year.

During your TWP, you continue to receive SSDI payments and Medicare coverage regardless of how much you earn as long as you report your work activity. After your TWP ends and you have not improved medically, the Extended Period of Medicare Coverage begins, allowing you to keep Medicare coverage for more than seven years.

Even if you no longer receive SSDI payments because you’re able to work at the substantial gainful activity level, you still get this extended coverage, but you’ll be billed every three months for the insurance premiums.

After your premium-free Medicare coverage ends due to work, you can buy continued Medicare coverage as long as you still have a medical disability and are under 65.

Qualified Disabled Working Individual Program

The Qualified Disabled Working Individual (QDWI) program is one of four state-run Medicare Savings Programs that pays for Medicare Part A premiums for working individuals with disabilities.

- You’re a working person with disabilities under the age of 65.

- You lost your premium-free Part A coverage due to work.

- You aren’t getting state-issued medical assistance.

- You meet the income and resource limits set by your state, which change from year to year.

Examples of resources under this program include money in a checking or savings account, stocks or bonds.

You can apply to the QDWI program by calling your state Medicaid program or filling out an application.

Additional Resources on Programs Available to People with Disabilities

- Medicare Savings Programs

- This webpage from Medicare.gov includes information on the four state-run Medicare Savings Programs available to people working under Medicare. It outlines the eligibility requirements and steps to apply.

- Disability Benefits Help

- This organization’s website features a free disability evaluation to determine if you qualify for disability benefits. They also include various resources on Social Security disability programs by state, an FAQ section and a glossary of Social Security terms.

- HealthCare.gov

- This government website goes over different insurance coverage options for people with disabilities, including those who don’t currently have health insurance.

Depending on the type of disability you have, you may qualify for Medicare under age 65 if you receive disability benefits, though there may be a waiting period. If you decide to go back to work, you can still retain Medicare coverage for over eight years as long as you have a medical impairment.

Frequently Asked Questions About Medicare for People With Disabilities

You are automatically enrolled into Original Medicare after receiving disability benefits for 24 consecutive months.

You also have the option to sign up for a Medicare Advantage (Part C) or a drug plan (Part D) during the initial enrollment period (IEP). If you’re under 65 with a disability, your IEP lasts for seven months. The IEP starts three months before, during and three months after your 25th month of getting disability benefits.

15 Cited Research Articles

- ATI. (2022, June). A Profile of Medicare-Medicaid Dual Beneficiaries. Retrieved from https://atiadvisory.com/wp-content/uploads/2022/06/A-Profile-of-Medicare-Medicaid-Dual-Beneficiaries.pdf

- U.S. Centers for Medicare & Medicaid Services. (2021, January 19). Medicare Enrollment Section. Retrieved from https://web.archive.org/web/20220812060813/https://www.cms.gov/research-statistics-data-systems/cms-program-statistics/medicare-enrollment

- Boccuti, C., et al. (2018, July 11). Medigap Enrollment and Consumer Protections Vary Across States. Retrieved from https://www.kff.org/medicare/issue-brief/medigap-enrollment-and-consumer-protections-vary-across-states/

- Social Security. (n.d.). Disability Benefits. Retrieved from https://www.ssa.gov/benefits/disability/

- Medicare.gov. (n.d.). How do I sign up for Medicare? Retrieved from https://www.medicare.gov/basics/get-started-with-medicare/sign-up/how-do-i-sign-up-for-medicare

- Medicare.gov (n.d.). What Part B covers. Retrieved from https://www.medicare.gov/what-medicare-covers/what-part-b-covers

- Medicare.gov (n.d.). Children & End-Stage Renal Disease (ESRD). Retrieved from https://www.medicare.gov/basics/children-and-end-stage-renal-disease

- Medicare.gov (n.d.). 3 ways to avoid the Part D late enrollment penalty. Retrieved from https://www.medicare.gov/drug-coverage-part-d/costs-for-medicare-drug-coverage/part-d-late-enrollment-penalty/3-ways-to-avoid-the-part-d-late-enrollment-penalty

- Social Security. (n.d.). Medicare and Medicaid Employment Supports. Retrieved from https://choosework.ssa.gov/library/fact-sheet-medicare-and-medicaid-employment-supports

- Social Security. (2022). Working While Disabled: How We Can Help. Retrieved from https://www.ssa.gov/pubs/EN-05-10095.pdf

- Social Security. (n.d.). Trial Work Period. Retrieved from https://www.ssa.gov/oact/cola/twp.html

- Social Security. (n.d.). Disability Benefits. Retrieved from https://www.ssa.gov/benefits/disability/approval.html

- Kaiser Family Foundation. (n.d.). Medicare Beneficiaries With End-Stage-Renal Disease (ESRD). Retrieved from https://www.kff.org/medicare/state-indicator/enrollees-with-esrd/

- U.S. Centers for Medicare & Medicaid Services. (2022) CMS Program Statistics — Medicare Total Enrollment (Latest Data Available 2020). https://data.cms.gov/summary-statistics-on-beneficiary-enrollment/medicare-and-medicaid-reports/cms-program-statistics-medicare-total-enrollment

- U.S. Centers for Medicare & Medicaid Services. (n.d.). Young Adults and the Affordable Care Act. Retrieved from https://www.cms.gov/CCIIO/Resources/Files/adult_child_faq

Calling this number connects you to one of our trusted partners.

If you're interested in help navigating your options, a representative will provide you with a free, no-obligation consultation.

Our partners are committed to excellent customer service. They can match you with a qualified professional for your unique objectives.

We/Our Partners do not offer every plan available in your area. Any information provided is limited to those plans offered in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

888-694-0290Your web browser is no longer supported by Microsoft. Update your browser for more security, speed and compatibility.

If you need help pricing and building your medicare plan, call us at 844-572-0696