Free Tax Preparation Resources & Help for Seniors

Filing taxes when you’re older can be complicated and challenging. There are many rules surrounding Social Security benefits, retirement accounts and pensions. Free local resources from the IRS and AARP are available in communities across the country to help make tax time less stressful.

- Written by Lindsey Crossmier

Lindsey Crossmier

Financial Writer

Lindsey Crossmier is an accomplished writer with experience working for The Florida Review and Bookstar PR. As a financial writer, she covers Medicare, life insurance and dental insurance topics for RetireGuide. Research-based data drives her work.

Read More- Edited By

Lamia Chowdhury

Lamia Chowdhury

Financial Editor

Lamia Chowdhury is a financial content editor for RetireGuide and has over three years of marketing experience in the finance industry. She has written copy for both digital and print pieces ranging from blogs, radio scripts and search ads to billboards, brochures, mailers and more.

Read More- Reviewed By

Ebony J. Howard, CPA

Ebony J. Howard, CPA

Credentialed Tax Expert at Intuit

Ebony J. Howard is a certified public accountant and freelance consultant with a background in accounting, personal finance, and income tax planning and preparation. She specializes in analyzing financial information in the health care, banking and real estate sectors.

Read More- Published: February 26, 2021

- Updated: January 22, 2025

- 17 min read time

- This page features 10 Cited Research Articles

Do Seniors Have to File Taxes?

Just like everyone else, seniors must file their taxes if their income exceeds certain limits. However, this isn’t to say that all seniors must file taxes.

Whether you need to file depends on your finances, government benefits and other contributing factors — but not your age.

Once you exit the workforce, you will no longer owe payroll taxes — but you may still be subject to income taxes at the federal or state level.

Others may need to navigate IRS rules related to retirement account withdrawals, annuities or pension payments.

Typically, you only need to file a federal tax return if:- You’re unmarried

- You’re at least 65 years or older, and

- Your gross income is $14,600 or more.

It’s important to understand the impact of taxes on your retirement to ensure you have a well-structured retirement plan.

Below are some additional questions that older adults should ask themselves around tax time.

Do Seniors on Social Security Have To File Taxes?

An estimated 56% of retirees will owe federal income taxes on their Social Security benefits between 2015 and 2050, according to the Social Security Administration. But if Social Security is your only income, your gross income equals zero, so there’s no need to file a federal income tax return.

But if you earn any other income — such as from a part-time job or retirement account distributions — some of your Social Security benefits may be taxable.

If half of your annual Social Security benefits plus all other income exceeds $25,000, or $34,000 for married couples filing jointly, then a portion of your Social Security benefits are included in your gross income.

However, there are some states that don’t tax Social Security at all. If you’re planning on moving soon, consider looking into the best states to retire tax-wise.

How Many Years Can You Go Without Filing Taxes?

There isn’t a legal number of years you can go without filing taxes. You should always strive to file your taxes in a timely manner. You could face failure-to-pay penalties, interest from the IRS and potential jail time if you don’t file your taxes.

Pro TipIf you can’t afford to pay what you owe in taxes, request an installment agreement, or try to qualify for an offer in compromise from the IRS.Source: IRSTaxation of Retirement Accounts

Each type of retirement account is taxed differently. Some investments are purchased with after-tax dollars while others are pre-tax, which affects taxation rules.

Learn how IRAs, 401(k)s, annuities, investment incomes and pensions are taxed to have a better understanding of how much you could potentially owe.

IRA and 401(k) Withdrawals

Most people will pay some tax when they withdraw money from their retirement accounts.

Distributions from traditional IRA, 401(k), 403(b) or 457 plans are taxed as ordinary income — like income from a job — according to your current tax bracket.

Distributions from traditional 401(k) and <a href=”IRA accounts are taxed on an incremental basis. You can begin withdrawing money from your traditional 401(k) or IRA without penalty once you turn 59 1/2.

You are forced to start taking required minimum distributions from your traditional retirement accounts when you’re 72 and retired.

Withdrawals from Roth IRA and Roth 401(k) plans are different. Distributions are typically tax-free in retirement as long as the account is at least five years old.

Annuity Distributions and Taxation

An annuity is taxed when you withdraw money from the account or receive regular payments.

Annuities purchased through a traditional 401(k) or IRA are considered qualified annuities. Payments from a qualified annuity are fully taxable as ordinary income.

One exception is if you purchased an annuity inside a Roth IRA or Roth 401(k) plan. Because the annuity is purchased with after-tax dollars, payments you receive in retirement are tax-free.

If you purchased an annuity on your own with after-tax dollars, then typically only the earnings or interest is taxed.

Annuity taxation can be complex, but to summarize, if you buy an annuity with pretax money, the entire balance is taxable as income. If you used after-tax funds to purchase the annuity, then only the earnings are taxable.

STEP 1STEP 2STEP 3How soon are you retiring?

STEP 1STEP 2STEP 3What is your goal for purchasing an annuity?

Select all that apply

Learn About Top Annuity Products & Get a Free Quote

Find out how an annuity can offer you guaranteed monthly income throughout your retirement. Speak with one of our qualified financial professionals today to discover which of our industry-leading annuity products fits into your long-term financial strategy.

For fastest service, call now!

866-219-2282Call NowOr fill out the form

STEP 1STEP 2STEP 3Investment Income

Just like before retirement, you’ll owe taxes on investment dividends, interest and capital gains after you leave the workforce.

Investment income is reported on a 1099 tax form each year.

Interest on investments in taxable brokerage accounts is taxed at your regular income tax rate. So are short-term capital gains, or investments sold a year or less after purchase.

But other investment income — including your long-term capital gains and qualifying dividends — are taxed at the capital gains rate. This ranges between 0% to 20%, depending on your tax bracket.

2025 Tax Year Capital Gains Rates for Single FilersLong-Term Capital Gains Tax Rate Your Income 0% $0 - $47,025 15% $47,026 - $518,900 20% $518,801 or more Source: IRSPension Income

You must pay income tax on pension payments for the year you received the money.

According to the Financial Industry Regulatory Authority, your former employer will withhold some taxes from your pension payments, so at least some of what you owe will already be prepaid.

Retirees with high amounts of monthly pension income will likely pay taxes on 85% of their Social Security benefits.

Make sure to check the pension taxation rules in your state. Some states don’t tax pension payments, but others do.

You can also use a tool from the IRS to determine if your pension payment, annuity from an employer-sponsored retirement plan or nonqualified annuity is taxable.

Is Your Retirement Plan on Track?Explore annuity solutions that align with your planning needs.

*Ad: Clicking will take you to our partner Annuity.org.2025 Tax Rate in Retirement

The United States uses a progressive tax rate that consists of seven tax brackets. The brackets apply only to the amount of taxable income that remains after subtracting any deductions and exemptions that you’re entitled to claim.

The tax rates gradually increase across the seven tiers, with high-income earners paying higher tax rates.

Christie Tornikoski, AFC®, founder of Spire Financial Consulting LLC, provided context on tax rates in retirement.

“It’s incremental,” Tornikoski told RetireGuide. “As the money goes up, a higher tax rate is applied.”

Single FilersTax Rate Taxable Income Bracket Taxes Owed 10% $11,925 or less 10% of the taxable income 12% $11,926 to $48,475 $1,192.50 plus 12% of the amount over $11,925 22% $48,476 to $103,350 $5,578.50 plus 22% of the amount over $48,475 24% $103,351 to $197,300 $17,651 plus 24% of the amount over $103,350 32% $197,301 to $250,525 $40,199 plus 32% of the amount over $197,300 35% $250,526 to $626,350 $57,231 plus 35% of the amount over $250,525 37% $626,351 or more $188,769.75 plus 37% of the amount over $626,350 Source: IRSMarried, Filing JointlyTax Rate Taxable Income Bracket Taxes Owed 10% $23,850 or less 10% of the taxable income 12% $23,851 to $96,950 $2,385 plus 12% of the amount over $23,850 22% $96,951 to $206,700 $11,157 plus 22% of the amount over $96,950 24% $206,701 to $394,600 $35,302 plus 24% of the amount over $206,700 32% $394,601 to $501,050 $80,398 plus 32% of the amount over $394,600 35% $501,051 to $751,600 $114,462 plus 35% of the amount over $501,050 37% $751,601 or more $202,154.50 plus 37% of the amount over $751,600 Source: IRSFor example, if your taxable income is $29,450, the entire amount isn’t taxed at 12%.

Rather, you would pay 10% of $11,925 in the first tax bracket, then 12% on the remaining taxable income in the second tax bracket.

“However, what you actually owe the IRS may be much lower if you requested your part-time employer or the Social Security Administration to withhold earnings,” Tornikoski said.

“The first step is to calculate how much of your Social Security benefit is taxable.”

Remember, up to 85% of your Social Security income may be taxable, but depending on your overall income, you may not owe taxes on it.

You can figure this out by adding up your other source of income and using 50% of your Social Security benefits in your calculation. The IRS provides an online tool to help you determine how much of your Social Security benefits are taxable.

Once you determine potential Social Security taxes, you’ll need to consider your other forms of income to see which tax bracket you fall into.

Deductions To Consider

The IRS allows you to chip away at your final taxable income with either the standard deduction or itemized deductions.

If you take the standard deduction — and most people do — your taxable income decreases by $15,000 if you’re a single filer and by $30,000 for married couples filing jointly for the 2025 tax year.

Being a senior comes with perks — including at tax time. Everyone 65 and older automatically qualifies for a $2,000 boost to the standard deduction. If you’re legally blind or permanently disabled, you qualify for more, according to Kiplinger.

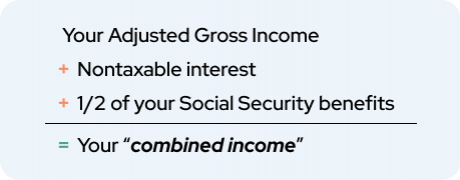

Calculating Your Combined Income While Working After Retirement

If you already collect Social Security but are still working after retirement and earning income, a portion of your benefits may be taxed.

Whether you owe income tax on your benefits will depend on how much overall retirement income you and your spouse receive, and whether you file joint or separate tax returns.

A formula, known as combined income, determines the amount of your Social Security check that’s taxable.

Typically, the higher your total income amount, the greater the taxable part of your benefits.

Combined income is a combination of:- Your adjusted gross income (the amount you get paid at work — before taxes are taken out — minus adjustments, such as contributions to certain retirement accounts, HSAs and other applicable deductions)

- Your nontaxable interest

- Half of your yearly Social Security benefit

If your combined income is less than $25,000 for an individual, then your Social Security benefits aren’t taxable.

However, for individuals with a combined income between $25,000 and $34,000, up to 50% of benefits may be taxable.

If your combined income exceeds $34,000, up to 85% of your benefits are taxable.

If you file a joint return, you’ll face higher combined income limits.

Pro TipThe Social Security Administration provides details on how to calculate combined income and how it can affect your tax bill.Source: Social Security AdministrationExpert Tips for Seniors Filing Taxes

Brad Martin Tax Expert

Brad Martin Tax ExpertBrad Martin is the Volunteer Income Tax Assistance (VITA) program coordinator for United Way of Southwest Alabama, where he operates three VITA sites. He has over a decade of tax preparation experience and has helped train hundreds of IRS-certified volunteers.

1. Get organized.Every year start a folder with tax information as it arrives. Social Security statements, retirement forms and brokerage statements arrive at different times, and throughout the year you should be tracking deductible expenses such as gifts to charity and medical bills. Keeping everything in one tax folder makes it easy to find what you need come tax time.

2. Social Security may be partially taxable.A common misconception is that Social Security benefits aren't taxable. In many cases they aren't — but depending on how much additional income you receive during the year, a portion of those benefits can be taxable income.

3. Filing a separate return from your spouse usually results in paying more taxes.If you are married, filing a joint return with your spouse will often result in a lower tax bill than filing separate returns. This is because in many cases, filing separately means that 85 percent of your Social Security benefits are taxable, while filing jointly could actually result in paying taxes on less of that amount, or even none of it at all.

4. Try to learn a little about the tax laws in your state.Does your state require a tax return? Not all states have state income tax. Is your retirement income taxable to your state? Are there special credits in your state that might require additional documentation to be kept? Can you itemize your deductions on your state return even if you don't itemize on your federal return? A good tax advisor can help you understand the important bits of information that are state specific.

5. Ask questions.If you usually get a refund, but this year you have a balance due, or if your refund is much higher than it was last year, don't be afraid to ask why the change happened. There may be a perfectly good explanation, but you deserve to understand your return. After all, whether you prepare your return or use the services of a tax preparer, you sign a statement that says under penalty of perjury you are responsible for the information on that return. So understand your return before you file.

6. Consider how future plans might affect next year's taxes.If you know you're going to do something out of the norm with your finances, such as withdrawing a large sum of money from a retirement account or taking on a part-time job, consider how that will affect your tax situation. The increased income could cause the taxable amount of your Social Security benefits to increase, and you might want to withhold extra taxes to prepare for the change. Similarly, if you have emptied an IRA and will no longer receive income from it, you may be able to decrease the amount of withholding you've had from your Social Security benefits or your pension.

7. Be sure to get a copy of your return.Whether you file your own return or someone files it for you, you should always have a copy of your return at the end of the experience. You may need it if you later have to file an amended return or if the IRS questions any of the information on it. And if a preparer will not give you a copy of your return, consider that a huge red flag. Do not consent to having it filed and walk away. An unscrupulous preparer's unwillingness to provide you with a return raises concerns that he or she may alter the return after you leave, usually to increase the refund and pocket the difference.

Tax Help for Seniors from the IRS

Navigating your taxes after retirement can be challenging. Filing a return can take hours and tax laws are always changing.

Luckily, several free resources across the country are available to help.

The resources below can help you file the following tax documents:- Wages from your W-2

- State tax refunds

- Interest income, dividends and capital gains/losses

- Unemployment benefits

- IRA distributions

- Pension income

- Social Security benefits

- Home sale proceeds

- Self-employment income

- Health savings accounts

- Health insurance statements

- Education credits

- Child Tax Credit

- Earned income credit

If you need assistance navigating complex tax rules, you can take advantage of free preparation and advice from the IRS, the AARP Foundation and other organizations.

Tax Counseling for the Elderly (TCE)

The Tax Counseling for the Elderly, or TCE, program from the IRS provides free tax assistance specifically tailored to people 60 and older.

No application is required to receive tax help at a TCE site, but most locations require an appointment.

Contact InformationTo find the nearest TCE site, call 800-906-9887, email TCE.Grant.Office@irs.gov or use the VITA/TCE Locator Tool.Source: IRSWhile the program is operated by the IRS, community and nonprofit organizations across the country administer the program at the local level.

Volunteer Income Tax Assistance (VITA)

Volunteer Income Tax Assistance, or VITA, is another federal grant program that offers free tax help from IRS-certified volunteers.

This program shares similarities with TCE but helps a wider group of people.

The program is generally available to taxpayers who make $60,000 or less a year, people with disabilities and taxpayers who speak limited English.

Help is provided at community and neighborhood centers, libraries, schools, shopping malls and other accessible locations. The IRS also offers a publication on what to expect during your VITA or TCE appointment, as well as which documents to bring with you.

IRS Free File

About 70% of taxpayers qualify to file free federal tax returns online through the IRS Free File system, according to an article from CNBC.

This public-private partnership connects single filers and families with an annual income of $73,000 or less with free filing software from partners such as TaxAct and TurboTax.

You can use the IRS Free File Online Lookup Tool to refine the offers you may qualify for, or you can select the “Browse All Offers” option.

Once you make a selection, you will be redirected to the tax provider’s website.

Did You Know?Help is also available at local IRS offices that host a Taxpayer Assistance Center. Services vary by location. Use this online locator tool to find a site near you.AARP Tax Aide: Free Tax Preparation for Seniors

AARP Tax Aide is a free national program that provides in-person and virtual tax assistance from Feb. 1 through April 15. Each site is staffed by IRS-certified volunteers.

The program caters to taxpayers who are age 50 or older and those with low to moderate incomes.

However, anyone can make an appointment. You don’t have to be an AARP member to get free tax help.

AARP Tax-Aide locations can help you file a variety of income tax forms and schedules, including:- Wages

- Interest, dividends and capital gains/losses

- Unemployment compensation

- Pensions and other retirement income

- Social Security benefits

- Limited self-employment income

- Itemized deductions

- Most tax credits

- Repayment of first-time homebuyer credit

- Estimated tax payments

- Health savings accounts (HSAs)

- Amendments to filed returns.

- Tax returns for the last three years.

In addition to assisting you with your federal return, AARP tax experts can help you prepare state tax returns for the state in which the site is located.

However, AARP Tax Aide volunteers can’t help with every tax issue.

To find a location near you, visit the Tax Aide Locator Tool and review a list of documents to take with you.

Additional Resources for Seniors Preparing and Filing Their Taxes

IRS Publication 554: Tax Guide for Seniors This comprehensive guide from the IRS includes a “What’s New” section that describes the latest tax changes impacting seniors. It also provides an overview of tax deductions and credits available to adults 65 and older, as well as an FAQ on topics related to Social Security benefits, home sales, retirement accounts and more. Form 1040-SR, U.S. Tax Return for Seniors The IRS created a new tax form, Form 1040-SR, with seniors in mind. It features larger print and a standard deduction chart. It also allows income reporting from other sources common to older Americans, including investment income, Social Security benefits and distributions from qualified retirement plans and annuities. Get Help with Your Taxes from USA.gov This website from the U.S. government provides information and links to the IRS VITA and TCE programs, as well as links to helpful free tax-filing information such as the IRS resource center and interactive tax tools. AdvertisementConnect With a Financial Advisor Instantly

Our free tool can help you find an advisor who serves your needs. Get matched with a financial advisor who fits your unique criteria. Once you’ve been matched, consult for free with no obligation.

Last Modified: January 22, 2025Share This Page10 Cited Research Articles

- Internal Revenue Service. (2023, May 17). Filing Past Due Tax Returns. Retrieved from https://www.irs.gov/businesses/small-businesses-self-employed/filing-past-due-tax-returns

- Internal Revenue Service. (2023, April 4). Topic No. 409, Capital Gains and Losses. Retrieved from https://www.irs.gov/taxtopics/tc409

- Internal Revenue Service. (2023, March 20). Topic No. 153, What to Do if You Haven't Filed Your Tax Return. Retrieved from https://www.irs.gov/taxtopics/tc153

- Mengle, R. (2023, March 13). What's the 2023 Standard Deduction? Retrieved from https://www.kiplinger.com/taxes/tax-deductions/602223/standard-deduction

- Dore, K. (2023, February 2). Roughly 70% of Taxpayers Are Eligible for IRS Free File, but Only 2% Used It in 2022. Retrieved from https://www.cnbc.com/2023/02/02/heres-how-to-file-your-federal-taxes-for-free-with-irs-free-file.html

- Internal Revenue Service. (2023, January 23). Free Tax Return Preparation for Qualifying Taxpayers. Retrieved from https://www.irs.gov/individuals/free-tax-return-preparation-for-qualifying-taxpayers

- Social Security Administration. (2023). Income Taxes And Your Social Security Benefit. Retrieved from https://www.ssa.gov/benefits/retirement/planner/taxes.html

- Social Security Administration. (2022, October 14). Must I Pay Taxes on Social Security Benefits? Retrieved from https://faq.ssa.gov/en-us/Topic/article/KA-02471

- Internal Revenue Service. (2022, December 13). Publication 501 (2022), Dependents, Standard Deduction, and Filing Information. Retrieved from https://www.irs.gov/publications/p501#en_US_2022_publink1000220687

- Purcell, P. (2015, December). Income Taxes on Social Security Benefits. Retrieved from https://www.ssa.gov/policy/docs/issuepapers/ip2015-02.html

- Edited By

Calling this number connects you to one of our trusted partners.

If you're interested in help navigating your options, a representative will provide you with a free, no-obligation consultation.

Our partners are committed to excellent customer service. They can match you with a qualified professional for your unique objectives.

We/Our Partners do not offer every plan available in your area. Any information provided is limited to those plans offered in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

844-897-8632Your web browser is no longer supported by Microsoft. Update your browser for more security, speed and compatibility.

If you need help pricing and building your medicare plan, call us at 844-572-0696