Transamerica Life Insurance

Transamerica is one of the top 10 biggest life insurance companies in the country. Their life insurance products include term life, whole life and universal life with extra coverage options available. Compared to other life insurance companies, the pricing of their products is fair to average.

- Written by Lindsey Crossmier

Lindsey Crossmier

Financial Writer

Lindsey Crossmier is an accomplished writer with experience working for The Florida Review and Bookstar PR. As a financial writer, she covers Medicare, life insurance and dental insurance topics for RetireGuide. Research-based data drives her work.

Read More- Edited By

Lamia Chowdhury

Lamia Chowdhury

Financial Editor

Lamia Chowdhury is a financial content editor for RetireGuide and has over three years of marketing experience in the finance industry. She has written copy for both digital and print pieces ranging from blogs, radio scripts and search ads to billboards, brochures, mailers and more.

Read More- Reviewed By

Eric Estevez

Eric Estevez

Owner of HLC Insurance Broker, LLC

Eric Estevez is a duly licensed independent insurance broker and a former financial institution auditor with more than a decade of professional experience. He has specialized in federal, state and local compliance for both large and small businesses.

Read More- Published: April 6, 2022

- Updated: December 18, 2024

- 7 min read time

- This page features 10 Cited Research Articles

About Transamerica Life Insurance

Transamerica was acquired by the Aegon Group, one of the world’s leading providers of life insurance, in 1999. Since then, Transamerica now offers life insurance policies to over 30 million customers worldwide. Transamerica’s products are term life insurance, whole life insurance, universal life insurance and final expense insurance. Riders can also be added on to most plans, providing extra coverage.

How do I contact Transamerica life insurance?Call 855-288-4181 to connect to an insurance agent.Transamerica life insurance provides financial assistance if you have debt, own a business, have a child or grandchild to care for or if you simply want to provide financial security for your loves ones once you’re gone. All of Transamerica’s products vary for coverage options, so it’s best to compare which fit your lifestyle and needs.

Term Life Insurance

Transamerica offers two term life insurance policies — the Trendsetter Super and Trendsetter LB. Term policies are the cheaper option compared to other life insurance policies, providing you coverage ranging between 10 to 30 years. Your death benefit amount and premium costs are locked once you choose your term option. Both policies are generally tax free.

If you’re at risk, nonmedical underwriting is likely available for both term policies. You can qualify if you’re 18 to 45 years old through a $2 million coverage amount or if you’re between ages 46 to 55 through a $1 million coverage amount.

Though the two Transamerica term plans are similar, there are key differences that could make one better suited for you than the other.

Differences Between Trendsetter Super and Trendsetter LBTrendsetter Super Trendsetter LB Policy’s face amount must be under $100,000 to skip medical exam Policy’s face amount must be under $250,000 to skip medical exam Four rider add-ons available Five rider add-ons available Up to $10 million in coverage Up to $2 million in coverage Living Benefits Source: TransamericaThe Trendsetter Super policy offers up to $10 million in coverage, though you can choose a coverage amount as low as $25,000. If you have a death benefit amount below $100,000, you do not need to undergo a medical exam to convert your Trendsetter Super plan to a permanent life policy. This could save you time in waiting for the transition for lifetime coverage, since underwriting can take weeks to process.

You have five rider options for extra coverage with a Trendsetter Super policy — the income protection option, disability waiver of premium rider, children benefit rider and accidental death benefit rider.

The Trendsetter LB policy offers up to $2 million in coverage for your death benefit protection, though you can choose a coverage amount as low as $25,000. The Trendsetter LB policy also has living benefits. This means you can access your death benefit before you have passed.

You have five rider options for extra coverage with a Trendsetter LB policy — the monthly disability income rider, income protection option, disability waiver of premium rider, children’s benefit rider and the accidental death benefit rider.

Whole Life Insurance

Transamerica Lifetime is a whole life insurance policy that provides you coverage for your entire life. With this policy, your death benefit amount is tax free, your premiums don’t fluctuate, and you have a guaranteed tax-free cash value that grows over time.

Transamerica Lifetime also has access to Express Protect Underwriting, which can get your application approved in one day for immediate coverage. You can access Express Protect Underwriting through Transamerica’s iGo e-App.

You have the option to add nine riders for extra coverage with a Transamerica Lifetime policy.

Rider Options for Whole Life Insurance- Critical illness accelerated death benefit rider

- Chronic illness accelerated death benefit rider

- Terminal illness accelerated death benefit rider

- Disability waiver of premium rider

- Income protection option

- Guaranteed insurability rider

- Children’s benefit rider

- Accidental death benefit rider

Universal Life Insurance

Index universal life insurance offers lifetime coverage with growing tax-free cash value options and living benefits. If you have lifestyle changes, this flexible policy allows you to change your death benefit amount and premium costs.

Index universal life insurance also includes Transamerica Financial Foundation IUL, which takes care of accumulating cash value accounts. Transamerica offers three different account options to help increase tax-free cash value — an S&P 500 index account, a global index account and a basic interest account. Keep in mind that the floor and cap for index interest varies by each account type.

Transamerica has 13 rider options, and with Index universal life insurance, you can add on any rider. This is unlike other policies, like whole life insurance, which you can choose from nine of the 13.

Expand

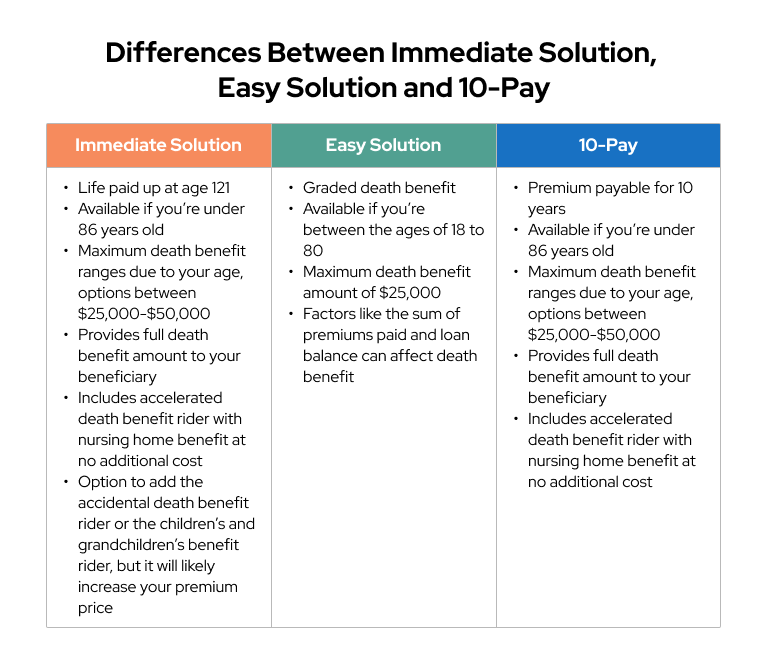

ExpandTransamerica offers a quote tool specifically for these three final expense policies to help you determine costs.

AdvertisementInsurance Riders

Although some life insurance companies have many free rider add-ons, it isn’t typically a free option for Transamerica. Confirm your costs before adding riders since they typically increase your premium price.

There are 13 riders available through Transamerica life insurance.

Rider Options for Whole Life Insurance- Terminal illness accelerated death benefit rider

- Chronic illness accelerated death benefit rider

- Critical illness accelerated death benefit rider

- Overloan protection rider

- Guaranteed insurability benefit rider

- Base insured rider

- Children’s benefit rider

- Additional insured rider

- Accidental death benefit rider

- Disability waiver of monthly deductions rider

- Disability waiver of premium rider

- Income protection option

- Concierge Planning Rider

The Concierge Planning Rider can be added to some plans at no additional cost. This rider offers funeral planning services like will preparations, price quoting and 24/7 support from Everest Funeral Concierge.

Average Cost of Transamerica Life Insurance

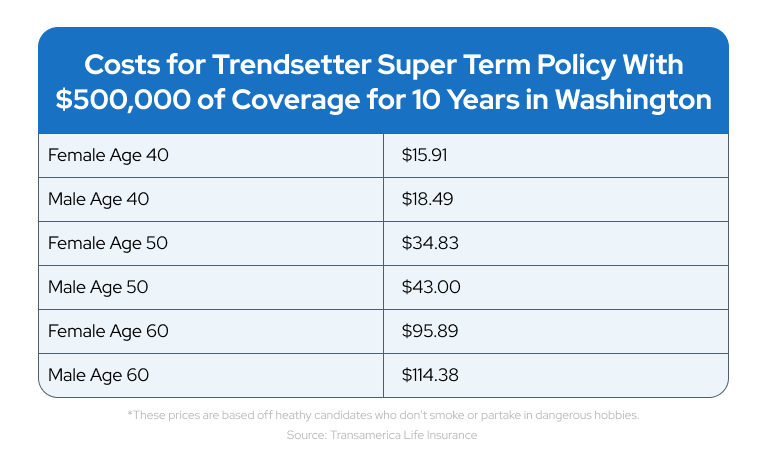

Your age, overall health, smoking habits, dangerous hobbies and sex affect your premium costs with Transamerica. Smoking is one of the biggest factors. For a healthy 40-year-old woman, a Trendsetter Super term policy would be $15.91 for 10 years of coverage with a $500,00 death benefit. But if you smoke, your premium automatically increases to $61.92. If you’re struggling with finding an affordable life insurance plan know that term life insurance is the cheapest option compared to other policies.

Since prices practically triple at age 60 with Transamerica, it is best practice to pick a life insurance policy before then.

Pros and Cons of Life Insurance from Transamerica

The biggest benefit of Transamerica is that they offer fair prices compared to competitors, with a wide range of customizable products. Transamerica also offers two online quote tools, one specifically for final expense insurance options and another to get quotes for all other policies. There are three steps to Transamerica’s quote tool for term, whole and universal products — find the policy that suits you, determine how much coverage you need and then you will be provided a quote.

With some policies, your beneficiary can receive a portion of your death benefit in as little as 72 hours after your paperwork has been received. The Concierge Planning Rider is also unique to Transamerica, making funeral preparations easier for beneficiaries.

However, a downside is that their quote tool for term, whole and universal products can be misleading. If you follow the steps to see which policy suits you — they don’t offer an online quote. Instead, their website will redirect you to call an agent for information. Quotes are only available online for term policies. The final expense insurance quote tool does work properly, offering quotes for all options. Additionally, some customer ratings for Transamerica are lower than average, compared to competitors.

Average Rating of Transamerica

AM Best gave Transamerica an A rating for Financial Strength Rating and A+ for Long-Term Issuer Credit Rating as of October 29, 2021. This means, Transamerica is considered to have a good operating performance and offers little risk. S&P Global rated Transamerica an A+ due to their strong financial dependability with Aegon, which has strong capital and earnings.

Some reviews are lower than average. On the Better Business Bureau website, Transamerica was rated 1.09 out of 5 stars. Most had issues with long wait time to speak to the claims department, documents getting lost in the mail and slow communication.

Last Modified: December 18, 2024Share This PageAdvertisement10 Cited Research Articles

- International Association of Better Business Bureau. (2022). Customer Reviews. Retrieved from https://www.bbb.org/us/ia/cedar-rapids/profile/insurance-companies/transamerica-life-insurance-company-0664-100119/customer-reviews

- AM Best Company. (2021, October 29). Best’s Credit Rating Disclosure Form. Retrieved from https://ratings.ambest.com/DisclosurePDF.aspx?AMBNum=6095

- Transamerica Life Insurance Company. (2021, April). The Power of Preparation. Retrieved from https://cdn.bfldr.com/86JM1UOD/as/qf9nis-a2apt4-7ntwm0/Final_Expense_Consumer_Brochure.pdf

- Standard & Poor’s Financial Services. (2021, March 10). Aegon USA Group. Retrieved from https://www.transamerica.com/sites/default/files/files/e070d/sp-global-aegon-usa-report.pdf

- Transamerica Life Insurance Company. (2021, February). A Guide To The Transamerica Financial Foundation Life Insurance Policy. Retrieved from https://assets2.brandfolder.io/bf-boulder-prod/fr3f3mr2qrjm7sr5q7h9hm/v/52909846/original/258820R3_0221_FFIUL%20Consumer%20Brochure%20-%20Ratings%20Update_FINAL_DIGITAL2%20(1).pdf

- Transamerica Life Insurance Company. (2019, November). A Field Guide to Term Life Insurance. Retrieved from https://transact.transamerica.com/shared_docs/pdf/133038_1119_Field_Guide_to_Term_Life_Insurance_Consumer_Brochure_FINAL_DIGITAL.pdf

- Transamerica Life Insurance Company. (2019, October). Transamerica Lifetime Whole Insurance Policy. Retrieved from https://cdn.brandfolder.io/86JM1UOD/at/qfaexh-3er7tk-96yjyt/126940_10-19_Lifetime_WL_Consumer_Brochure_Final_Digital.pdf

- Transamerica Life Insurance Company. (n.d.). Financial Strength. Retrieved from https://www.transamerica.com/why-transamerica/financial-strength

- Transamerica Life Insurance Company. (n.d.). Insurance Plan Explorer. Retrieved from https://www.transamerica.com/planexplorer/plan-predictor/intro

- Transamerica Life Insurance Company. (n.d.). Index Universal Life Insurance. Retrieved from https://www.transamerica.com/insurance/index-universal-life-insurance

- Edited By

Your web browser is no longer supported by Microsoft. Update your browser for more security, speed and compatibility.

If you need help pricing and building your medicare plan, call us at 844-572-0696