Average Cost of Long-Term Care by State + How To Plan

Alaska tops the charts as the state with the most expensive long-term care, and Louisiana is the most affordable. Find out the average cost of long-term care in the U.S. for your state, plus tips on planning for these expense

- Written by Christian Simmons

Christian Simmons

Financial Writer

Christian Simmons is a writer for RetireGuide and a member of the Association for Financial Counseling & Planning Education (AFCPE®). He covers Medicare and important retirement topics. Christian is a former winner of a Florida Society of News Editors journalism contest and has written professionally since 2016.

Read More- Edited By

Savannah Pittle

Savannah Pittle

Senior Financial Editor

Savannah Pittle is a professional writer and content editor with over 16 years of professional experience across multiple industries. She has ghostwritten for entrepreneurs and industry leaders and been published in mediums such as The Huffington Post, Southern Living and Interior Appeal Magazine.

Read More- Published: September 21, 2023

- Updated: April 16, 2025

- 10 min read time

- This page features 5 Cited Research Articles

- Edited By

With an aging population and shifting health care landscapes, the financial burden of long-term care is a pressing concern for individuals and families across the United States. Americans spend $475.1 billion on long-term care a year — these are costly expenses that directly impact the lives and financial well-being of countless seniors and their families.

In this guide, find out how your state ranks in terms of long-term care costs, plus explore helpful tips to plan for these expenses. Additionally, check out our assisted living cost calculator to help determine the best care option.

While these average figures provide a valuable starting point, it’s important to remember that individual circumstances, the level of care required, and access to resources can significantly impact the actual costs of long-term care.

- Nursing home care is the most expensive form of long-term care, costing an average of $108,405 annually.

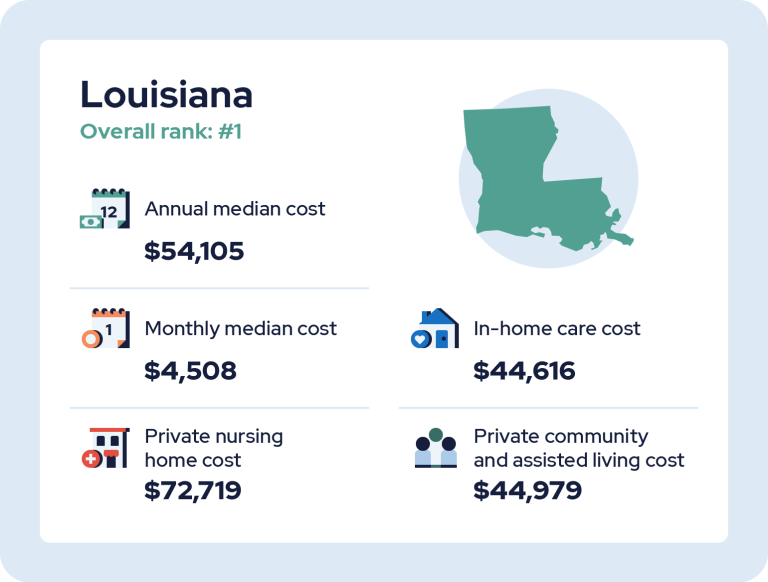

- Louisiana has the most affordable long-term care on average at $54,105 annually.

- The state with the most expensive long-term care on average is Alaska at $176,247 annually.

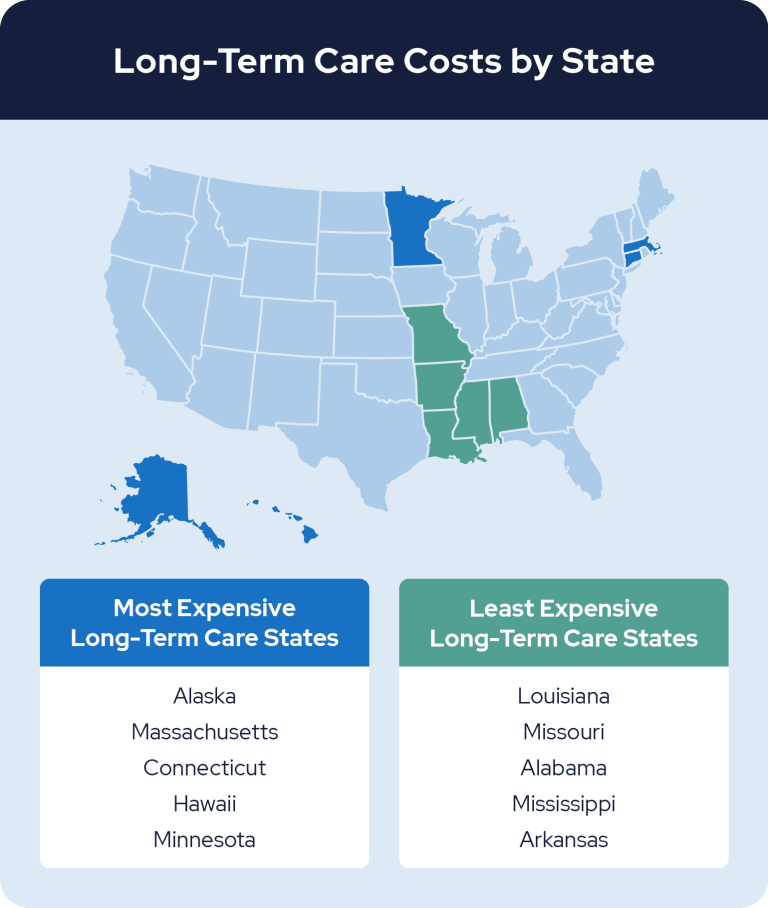

- The top five states with most affordable long-term care in the country include Louisiana, Missouri, Alabama, Mississippi, and Arkansas.

Average Cost of Long-Term Care: State Breakdown

In the United States, long-term care costs between $35,000 and $108,000 a year in 2021. Out of the three different types of long-term care we compared, private rooms in nursing homes are the most costly, with an average of $108,405 a year.

Alaska leads the U.S. with the most expensive long-term care, exceeding the U.S. average by 136%. On the other end of the spectrum, Louisiana is the state with the most affordable long-term care, sitting at 38% below the national average.

| State | Annual Median Community + Assisted Living Cost (Private Room)* | Annual Median In-Home Health Aide Cost* | Annual Median Nursing Home Cost (Private Room)* | Annual Average Adult Day Care Cost** |

|---|---|---|---|---|

| U.S. (state total average) | $54,000 | $61,776 | $108,405 | $34,675 |

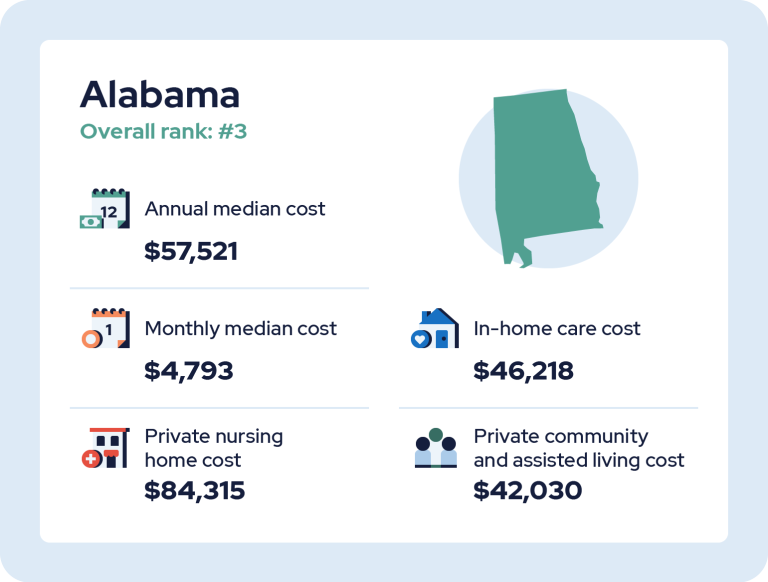

| Alabama | $42,030 | $46,218 | $84,315 | N/A |

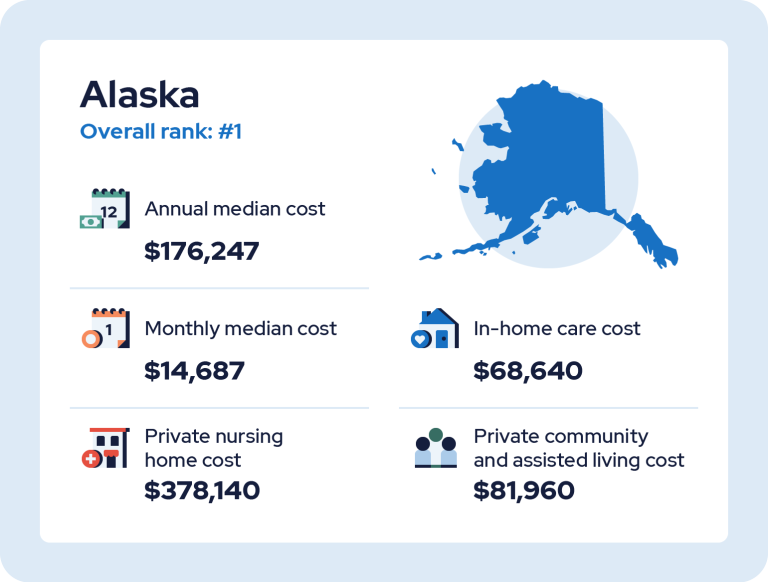

| Alaska | $81,960 | $68,640 | $378,140 | N/A |

| Arizona | $48,000 | $65,208 | $96,360 | $50,735 |

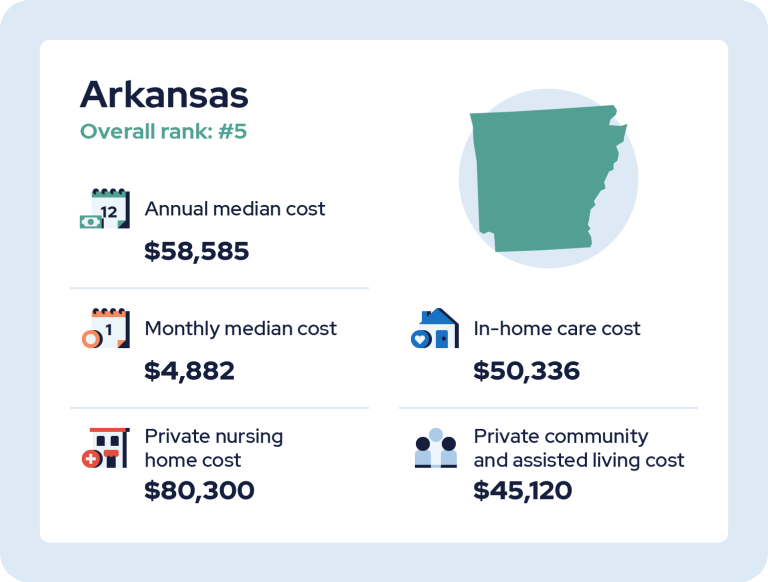

| Arkansas | $45,120 | $50,336 | $80,300 | N/A |

| California | $63,000 | $73,216 | $146,000 | $29,565 |

| Colorado | $57,000 | $76,648 | $116,709 | $29,930 |

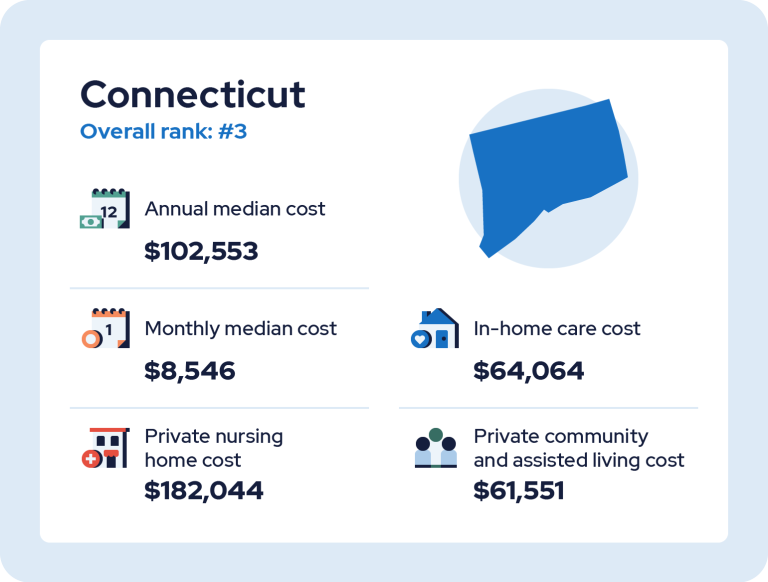

| Connecticut | $61,551 | $64,064 | $182,044 | $41,245 |

| Delaware | $71,940 | $64,064 | $150,928 | $22,995 |

| District of Columbia | $83,730 | $66,924 | $125,925 | N/A |

| Florida | $48,000 | $57,200 | $115,523 | $29,565 |

| Georgia | $42,420 | $52,624 | $91,250 | $61,685 |

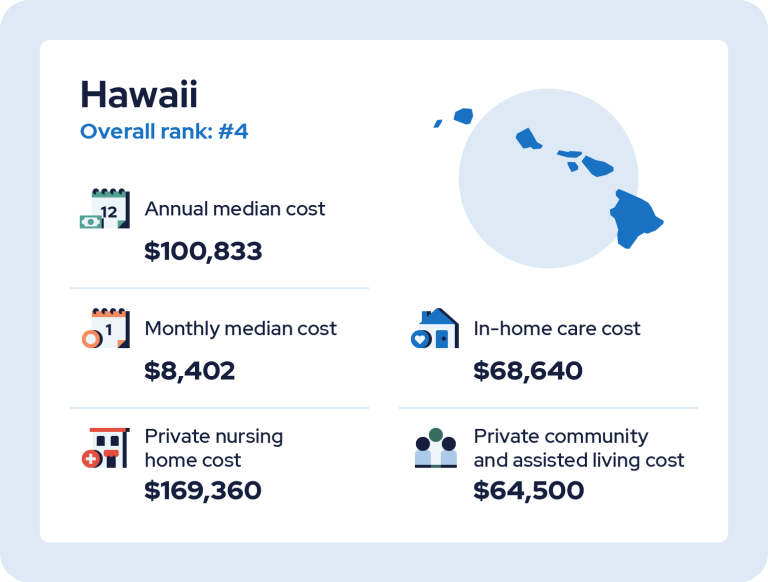

| Hawaii | $64,500 | $68,640 | $169,360 | $29,565 |

| Idaho | $46,050 | $65,208 | $109,500 | N/A |

| Illinois | $53,850 | $64,064 | $85,866 | $34,310 |

| Indiana | $51,390 | $57,200 | $104,405 | $58,400 |

| Iowa | $52,404 | $66,924 | $89,425 | N/A |

| Kansas | $54,960 | $56,056 | $81,760 | $36,865 |

| Kentucky | $41,370 | $57,200 | $95,630 | $27,010 |

| Louisiana | $44,979 | $44,616 | $72,719 | N/A |

| Maine | $70,380 | $68,640 | $135,050 | $58,765 |

| Maryland | $58,800 | $62,776 | $146,000 | $27,740 |

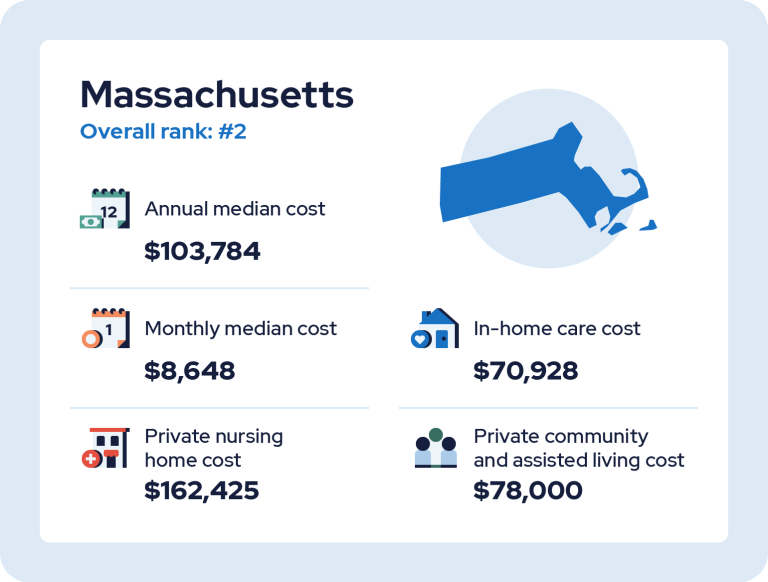

| Massachusetts | $78,000 | $70,928 | $162,425 | $32,850 |

| Michigan | $51,000 | $66,352 | $118,260 | $38,690 |

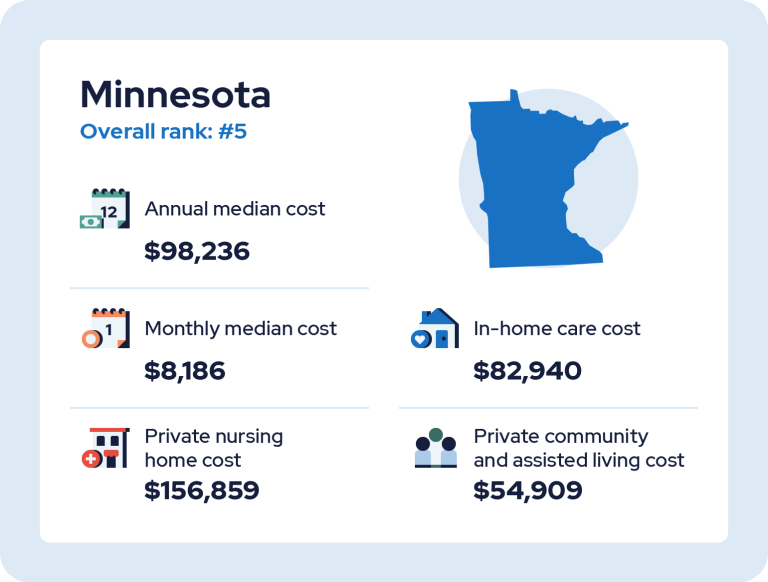

| Minnesota | $54,909 | $82,940 | $156,859 | $36,135 |

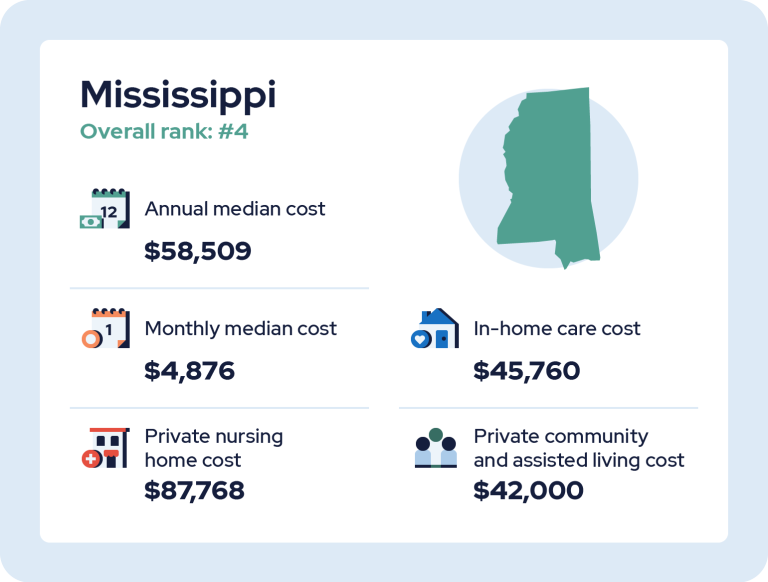

| Mississippi | $42,000 | $45,760 | $87,768 | N/A |

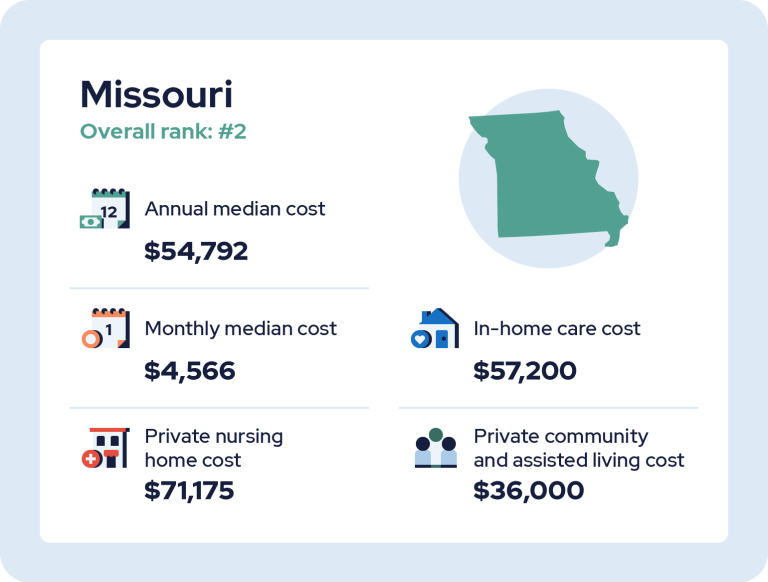

| Missouri | $36,000 | $57,200 | $71,175 | N/A |

| Montana | $53,400 | $64,064 | $96,725 | N/A |

| Nebraska | $48,915 | $64,064 | $99,463 | N/A |

| Nevada | $45,000 | $61,776 | $120,085 | $27,375 |

| New Hampshire | $72,630 | $74,360 | $144,175 | $36,865 |

| New Jersey | $77,940 | $68,526 | $145,818 | $36,865 |

| New Mexico | $53,970 | $55,827 | $100,375 | N/A |

| New York | $54,960 | $66,352 | $158,797 | $47,085 |

| North Carolina | $48,120 | $52,624 | $98,550 | $27,010 |

| North Dakota | $40,695 | $68,274 | $151,041 | N/A |

| Ohio | $55,620 | $60,632 | $98,550 | $25,915 |

| Oklahoma | $46,260 | $58,344 | $73,000 | $25,915 |

| Oregon | $60,540 | $73,216 | $133,360 | $38,690 |

| Pennsylvania | $49,200 | $59,488 | $133,882 | $27,010 |

| Rhode Island | $81,915 | $71,500 | $120,450 | N/A |

| South Carolina | $43,338 | $53,768 | $95,813 | $28,470 |

| Tennessee | $49,260 | $54,912 | $91,980 | $35,770 |

| Texas | $47,970 | $54,912 | $85,107 | $26,645 |

| Utah | $42,000 | $68,640 | $109,500 | N/A |

| Vermont | $63,000 | $68,640 | $133,225 | N/A |

| Virginia | $63,000 | $59,442 | $109,865 | $35,770 |

| Washington | $72,000 | $78,936 | $125,597 | $43,070 |

| West Virginia | $49,920 | $42,900 | $146,548 | N/A |

| Wisconsin | $55,200 | $68,640 | $116,800 | $29,930 |

| Wyoming | $50,025 | $66,352 | $91,615 | N/A |

5 States With the Most Expensive Long-Term Care

On average, these top five most expensive states for long-term care have an annual median cost that is 55% more expensive than the national average. The top 5 most and least expensive states for health care were calculated by taking the average of the median costs. Explore the costs of these states below.

Below are the top five states with the most expensive long-term care costs:

1. Alaska

Alaska is the state with the most expensive average long-term care costs in the country, which is 136% more expensive than the country’s annual median cost. Private community and assisted living is 51% more expensive compared to the U.S. average. Additionally, a private nursing home in Alaska costs almost three and a half times as much as the national average.

2. Massachusetts

Next on the list is Massachusetts, with an annual median cost that is 39% more expensive than the U.S. average. Although the average long-term care costs are more affordable compared to Alaska, their in-home care costs are 3% more costly.

3. Connecticut

Connecticut is also high on the list and is above the U.S. annual median cost. However, the state is only slightly above for in-home care costs, which is a 4% difference. Private rooms in a nursing home remain the most expensive out of the other care types and are 68% more expensive than the U.S. average private nursing home cost.

4. Hawaii

Hawaii is the fourth most costly state for long-term care and is 35% more expensive than the U.S. annual median cost. Additionally, Hawaii’s in-home care costs more than Connecticut’s and the same cost as Alaska’s. Hawaii’s nursing homes are 56% more expensive than the national average.

5. Minnesota

Last on the list for the top most expensive states for long-term care is Minnesota. Although it’s fifth on the list, it has the most expensive in-home care cost out of all the states and is 34% above the U.S. average. Within these top five states, Minnesota has the most affordable private community and assisted living cost, which is only about $900 more than the U.S. average.

5 States With the Least Expensive Long-Term Care

Although long-term care costs are very high nationwide, several states have costs that are below the national average. Read below to explore the five states with the most affordable long-term care:

1. Louisiana

Louisiana is the state with the most affordable long-term care in the country, with an annual median cost that is 28% below the national average. This state also has the second lowest costs for both in-home care and private nursing homes.

2. Missouri

Although Missouri doesn’t rank as the number one most affordable state for long-term care, it does rank as the most affordable for both private nursing homes and private community and assisted living out of all the states. The average cost for long-term care in Missouri is 27% below the average in the U.S.

3. Alabama

Alabama’s annual average cost for long-term care is 23% below the national average. Also, the state’s private nursing home costs are around $24,000 less than the national average. In-home care costs are 44% less expensive than Minnesota’s, which is the highest in the country.

4. Mississippi

Another affordable state on the list for long-term care is Mississippi. The average annual median cost is 22% less than the national average, and the cost for in-home care is 26% cheaper.

5. Arkansas

Arkansas is the fifth most affordable state for long-term care and has the fourth most affordable private nursing home costs in America. The average annual median cost is 22% less than the national average. Arkansas private nursing home care is also 79% cheaper than Alaska’s, the highest in the nation.

Most and Least Expensive States for Nursing Homes

As of 2022, 1,157,714 Americans were living in nursing homes in the U.S. — and they come at a very high cost. Private rooms in nursing homes cost an average of $108,405 annually, or $9,033 a month. Read on for a breakdown of the most and least expensive states for nursing homes.

The top five most expensive states include:

- Alaska

- $378,140 annually

- $31,511 monthly

- Connecticut

- $182,044 annually

- $15,170 monthly

- Hawaii

- $169,360 annually

- $14,113 monthly

- Massachusetts

- $162,425 annually

- $13,535 monthly

- New York

- $158,797 annually

- $13,233 monthly

The top five least expensive states include:

- Missouri

- $71,175 annually

- $5,931 monthly

- Louisiana

- $72,719 annually

- $6,059 monthly

- Oklahoma

- $73,000 annually

- $6,059 monthly

-

Arkansas

- $80,300 annually

- $6,691 monthly

- Kansas

- $81,760 annually

- $6,813 monthly

Most and Least Expensive States for In-Home Care

In-home care is a type of service that assists seniors with daily activities or medical care. Rather than moving to a nursing home or assisted living facility, these seniors can receive care in the comfort of their own homes. This in-home care costs Americans an average of $61,776 per year.

Learn more about the most and least expensive states for in-home care below.

The top five most expensive states include:

- Minnesota

- $82,940 annually

- $6,911 monthly

- Washington

- $78,936 annually

- $6,578 monthly

- Colorado

- $76,648 annually

- $6,387 monthly

- New Hampshire

- $74,360 annually

- $6,196 monthly

- California

- $73,216 annually

- $6,101 monthly

The top five least expensive states include:

- West Virginia

- $42,900 annually

- $3,575 monthly

- Louisiana

- $44,616 annually

- $3,718 monthly

- Mississippi

- $45,760 annually

- $3,813 monthly

- Alabama

- $46,218 annually

- $3,851 monthly

- Arkansas

- $50,336 annually

- $4,194 monthly

Most and Least Expensive States for Community and Assisted Living

For older people who need help with daily tasks but who want to keep some independence, community and assisted living facilities are an essential form of care. Compared to private nursing homes and in-home care, community and assisted living facilities are the most affordable option at a median annual cost of $54,000.

The top five most expensive states include:

- District of Columbia

- $83,730 annually

- $6,977 monthly

- Alaska

- $81,960 annually

- $6,803 monthly

- Rhode Island

- $81,915 annually

- $6,826 monthly

- Massachusetts

- $78,000 annually

- $6,500 monthly

- New Jersey

- $77,940 annually

- $6,495 monthly

The top five least expensive states include:

- Missouri

- $36,000 annually

- $3,000 monthly

- South Dakota

- $40,200 annually

- $3,350 monthly

- North Dakota

- $40,695 annually

- $3,391 monthly

- Kentucky

- $41,370 annually

- $3,447 monthly

- Mississippi

- $42,000 annually

- $3,500 monthly

Most and Least Expensive States for Adult Day Care

Adult daycare is a structured program designed to provide older adults and individuals with disabilities a safe and supportive environment during the day while their primary caregivers, often family members or working caregivers, are at work or need respite. The average cost of adult day care in the U.S. is $34,675.

The top five most expensive states include:

- Georgia

- $61,685 annually

- $5,140 monthly

- Maine

- $58,765 annually

- $4,897 monthly

- Indiana

- $58,400 annually

- $4,866 monthly

- Arizona

- $50,735 annually

- $4,227 monthly

- New York

- $47,085 annually

- $3,932 monthly

The top five least expensive states include:

- Delaware

- $22,995 annually

- $1,916 monthly

- Oklahoma

- $25,915 annually

- $2,160 monthly

- Ohio

- $25,915 annually

- $2,160 monthly

- Texas

- $26,645 annually

- $2,220 monthly

- Pennsylvania

- $27,010 annually

- $2,250 monthly

8 Tips To Plan for Long-Term Care Costs

Planning for long-term care costs is an essential part of financial planning, especially as you age. Here are eight tips to help you plan for long-term care costs:

- Start early: Plan for long-term care costs well before you anticipate needing care. The earlier you start, the more options you'll have for funding and lower premiums for insurance.

- Review your options: Research the various long-term care options available, such as in-home care, assisted living, and nursing homes. Each option has different costs associated with it. Nursing homes are the most expensive form of long-term care (~$9,000 per month), so take this into consideration.

- Estimate your costs: Calculate your potential long-term care costs based on your chosen option and location. Consider factors like the level of care you might need and inflation rates. Online calculators and financial advisors can assist with these estimates

- Purchase long-term care insurance: Obtain long-term care insurance to help cover future expenses. This insurance can help protect your assets and reduce the financial burden on your family — compare policies, premiums, and benefits to find one that suits your needs. The average cost of long-term care insurance premiums are around $950.

- Save and invest wisely: Create a dedicated savings plan for long-term care costs. You can use tools like Health Savings Accounts (HSAs) or annuities to set aside money for health care expenses. Invest your savings wisely to maximize growth.

- Create a comprehensive estate plan: Work with an attorney to create a comprehensive estate plan that includes provisions for long-term care. This may involve setting up a trust, designating a power of attorney, and establishing health care directives.

- Explore government programs: Look into government programs like Medicaid, especially if your resources are limited. Medicaid can help cover long-term care costs for those who qualify.

- Monitor your health: Leading a healthy lifestyle can reduce the risk of needing long-term care. Regular exercise and a balanced diet can help maintain your physical and mental health.

Prepare for Long-Term Care

Understanding the wide variation in long-term care costs across states is crucial for anyone planning their financial future or the care of their loved ones. Whether you’re in a high-cost or low-cost state, thoughtful planning, including insurance, savings, and a comprehensive estate plan, is key to securing a financially stable and comfortable long-term care journey. Contact a financial advisor today to help you prepare.

Methodology

Our research team collected, calculated, and compared data from all 50 states to identify the least and most expensive long-term care costs for Americans (including Washington, D.C.). The data used in the long-term care cost calculations was extracted from the Genworth Cost of Care Survey and The Federal Long Term Care Insurance Program Cost of Care Survey.

We analyzed the data in five different categories, including the overall average, private community and assisted living, in-home, and private nursing home, and adult day care costs. An average of the median cost of private community and assisted living, in-home health aide, and private nursing homes for each state was taken to determine the top 5 most and least expensive states for long-term care.

5 Cited Research Articles

- KFF. (2022). Total Number of Residents in Certified Nursing Facilities. Retrieved from https://www.kff.org/other/state-indicator/number-of-nursing-facility-residents/

- American Association for Long-Term Care Insurance. (2023, March 6). 2023 Long-Term Care Insurance Price Index Released. Retrieved from https://www.aaltci.org/news/long-term-care-insurance-association-news/2023-long-term-care-insurance-price-index-released

- Genworth. (2022, January 31). Genworth Cost of Care Survey. Retrieved from https://pro.genworth.com/riiproweb/productinfo/pdf/282102.pdf

- The Federal Long Term Care Insurance Program. (2021). The Federal Long Term Care Insurance Program 2021 Cost of Care Survey. Retrieved from https://cdn.ltcfeds.com/planning-tools/downloads/Cost-of-Care-Survey.pdf

- Congressional Research Service. (2022, June 15). Who Pays for Long-Term Services and Supports? Retrieved from https://crsreports.congress.gov/product/pdf/IF/IF10343

Your web browser is no longer supported by Microsoft. Update your browser for more security, speed and compatibility.

If you need help pricing and building your medicare plan, call us at 844-572-0696