Medicare vs. Social Security

While similar, Medicare and Social Security are different programs. Medicare provides health insurance, while Social Security offers a monthly income. They both help older and disabled Americans lead comfortable lifestyles. However, they differ in eligibility, funding and administration.

- Written by Terry Turner

Terry Turner

Senior Financial Writer and Financial Wellness Facilitator

Terry Turner has more than 35 years of journalism experience, including covering benefits, spending and congressional action on federal programs such as Social Security and Medicare. He is a Certified Financial Wellness Facilitator through the National Wellness Institute and the Foundation for Financial Wellness and a member of the Association for Financial Counseling & Planning Education (AFCPE®).

Read More- Edited By

Lamia Chowdhury

Lamia Chowdhury

Financial Editor

Lamia Chowdhury is a financial content editor for RetireGuide and has over three years of marketing experience in the finance industry. She has written copy for both digital and print pieces ranging from blogs, radio scripts and search ads to billboards, brochures, mailers and more.

Read More- Reviewed By

Toby Walters, CFA®

Toby Walters, CFA®

Chartered Financial Analyst and Paraplanner

Toby Walters, CFA®, has over 25 years of financial research experience. With a knowledge and understanding of researching and analyzing financial data, he has developed a unique and experienced viewpoint on money matters. He has been a chartered financial analyst since 2003, and most recently a portfolio analyst and paraplanner.

Read More- Published: April 27, 2022

- Updated: September 22, 2023

- 7 min read time

- This page features 8 Cited Research Articles

- Edited By

Both Medicare and Social Security provide assistance to older Americans but it’s important to know the differences as well as the similarities.

What Medicare and Social Security Have in Common

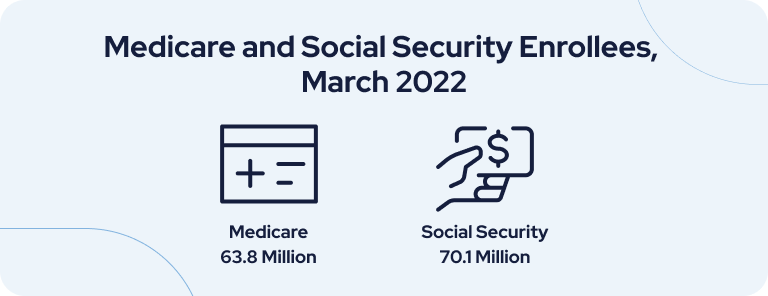

Medicare and Social Security have several things in common since they are both federally funded insurance programs that provide assistance to similar groups of people.

Most people who are on Medicare also receive Social Security benefits. But some people may be enrolled in one program, but not the other.

The most notable cross over between Medicare and Social Security is that you have to enroll in Medicare through the Social Security Administration. This causes some confusion — leading people to believe that they are the same.

But once you enroll, all your Medicare services are handled through the Centers for Medicare and Medicaid Services. All your Social Security services are handled by the Social Security Administration. These are distinctly different federal agencies with different missions.

How Social Security and Medicare Differ

The biggest difference between Social Security and Medicare is that Social Security provides financial assistance that can be used to cover cost of living expenses for retirees and people with disabilities while Medicare helps cover health care costs.

- Medicare

- Medicare provides federal health insurance — that covers hospitalization, doctor services, outpatient care, preventative services and medical supplies — to its beneficiaries. Medicare is available to people who are 65 and older, certain younger people with disabilities, people with End-Stage Renal Disease, people with ALS (Lou Gehrig's Disease) and those who meet certain other eligibility requirements.

- Social Security

- Social Security was created primarily to provide a guaranteed lifetime income for retired workers 65 or older. It also provides survivor benefits for families of deceased workers and disability insurance for workers with disabilities and their families. Social Security also provides Supplemental Security Income for people with limited income who are 65 or older, blind or disabled. SSI payments are also available to children who are blind or living with disabilities.

In short, Medicare provides medical and hospital insurance to help cover health care bills. Social Security provides you with a source of income when you retire or cannot work due to certain conditions or situations.

Eligibility for Medicare and Social Security

Medicare and Social Security have different eligibility requirements — but some of them are linked. You’ll need to understand some of the basics of Medicare and of Social Security before signing up. But you’ll need to sign up for both separately.

You sign up for both Social Security and Medicare through the Social Security Administration. You can apply online or by telephone. Office visits were curtailed as a result of the COVID-19 pandemic but you can check with the Social Security Administration to request an in-person visit.

- Apply for Social Security retirement, spouse’s, or disability benefits or for Medicare online at the Social Security Administration’s website

- Call Social Security toll free at 1-800-772-1213 (TTY at 1-800-325-0778) to apply over the phone

Eligibility for Social Security

You can sign up for Social Security benefits if you are 62 or older, disabled or blind — and have enough work credits.

Work credits are based on how long you have worked — and paid Social Security taxes — and on how much you earned at your job. You earn up to four work credits per year — up to a maximum of 40 credits after 10 years of work.

Even though you are eligible for Social Security benefits at age 62, you will only receive a percentage of them until you turn 67 and waiting until you are older means your Social Security benefits will be higher each month. This can make a difference of several thousand dollars per year.

Eligibility for Medicare

You may be eligible for Medicare if you are 65 or older and have certain disabilities or medical conditions or if you are younger than 65 but have disabilities, ALS or End-Stage Renal Disease.

Medicare has an eligibility and premium calculator on its website to help you determine if you meet eligibility requirements and how much your Medicare Part A and Part B premiums will be.

Most people don’t have to pay Part A premiums. You should only have to pay Part A premiums if you or your spouse have not paid Medicare taxes for at least 10 years.

Everyone who opts for Part B premiums is required to pay for them. Your Medicare Part B premiums are deducted from your Social Security, Railroad Retirement or Civil Service Retirement check each month. If you are not receiving any of these payments, you’ll get a bill for your Part B premiums every three months.

Funding for Medicare and Social Security

Medicare and Social Security are both paid for through payroll taxes withheld from your paycheck — but Medicare also receives funding from other sources. You can see how much you pay by looking at the Social Security and Medicare withholding lines on your pay stub.

The Social Security tax is 6.2% of your gross wages. The Medicare tax is 1.45% of your gross wages. Your employer matches this amount as well. The total rate for both is 15.30% if you are self-employed. You do not pay Social Security taxes on income over $147,000.

Medicare also receives funding from other sources including income taxes paid on your Social Security benefits, interest paid on investments made by the Medicare Trust Fund, premiums paid on Medicare Parts A and B, and other funds Congress authorizes.

Both Medicare and Social Security deposit some of the funds they collect into multiple trust funds.

How the Medicare Trust Funds Work

Your taxes and money from other funding sources go into two Medicare trust funds — the Hospital Insurance (HI) Trust Fund and the Supplementary Medical Insurance (SMI) Trust Fund. Both funds are held by the U.S. Treasury.

- Hospital Insurance Trust Fund

- The HI Trust pays for your Medicare Part A hospital insurance benefits. These include inpatient hospital care, skilled nursing facility care, hospice care and some home health care.

- Supplementary Medical Insurance Trust Fund

- The SMI Trust pays for your Medicare Part B medical insurance benefits. These include doctor visits, outpatient care and other health care services outside inpatient settings. It also pays for administering the Medicare Part D program — private plans that provide prescription drug coverage.

Some of the money in each trust fund also pays for the costs of administering the Medicare program.

- Processing and paying benefits

- Collecting Medicare taxes

- Fighting Medicare fraud and abuse

Social Security then issues payments to beneficiaries from one of these two funds.

- OASI Trust Fund

- The Old-Age and Survivors Insurance Trust Fund makes payments to people currently receiving retirement and survivors’ benefits from Social Security.

- DI Trust Fund

- The Disability Insurance Trust Fund makes payments to people currently receiving disability benefits from Social Security.

The Social Security trust funds can only be used to pay benefits to people on Social Security or the programs’ administrative costs.

If there is money left over in the trust funds at the end of the year, the law requires Social Security to invest it in special Treasury bonds guaranteed by the federal government. When they reach maturity, the money — and interest earned on it — are redeemed and returned to the trust funds.

8 Cited Research Articles

- U.S. Centers for Medicare & Medicaid Services. (2021, December 15). NHE Fact Sheet. Retrieved from https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/NationalHealthExpendData/NHE-Fact-Sheet

- U.S. Social Security Administration. (2020, July). Who Do I Contact — Social Security or Medicare? Retrieved from https://www.ssa.gov/benefits/assets/materials/medicare/medicare-flyer.pdf

- Hartman, R. (2019, December 4). How Social Security and Medicare Work Together. Retrieved from https://money.usnews.com/money/retirement/social-security/articles/how-social-security-and-medicare-work-together

- Benefits.gov. (n.d.). Social Security Medicare Program. Retrieved from https://www.benefits.gov/benefit/4394

- U.S. Centers for Medicare & Medicaid Services. (n.d.). What’s Medicare? Retrieved from https://www.medicare.gov/what-medicare-covers/your-medicare-coverage-choices/whats-medicare

- U.S. Social Security Administration. (n.d.). About Social Security and Medicare. Retrieved from https://www.ssa.gov/osss/prd/html/en/moreInfoLink01.html

- U.S. Social Security Administration. (n.d.). What Are the Trust Funds? Retrieved from https://www.ssa.gov/news/press/factsheets/WhatAreTheTrust.htm

- U.S. Social Security Administration. (n.d.). What Is Social Security? Retrieved from https://www.ssa.gov/people/materials/pdfs/EN-05-10230.pdf

Calling this number connects you to one of our trusted partners.

If you're interested in help navigating your options, a representative will provide you with a free, no-obligation consultation.

Our partners are committed to excellent customer service. They can match you with a qualified professional for your unique objectives.

We/Our Partners do not offer every plan available in your area. Any information provided is limited to those plans offered in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

888-694-0290Your web browser is no longer supported by Microsoft. Update your browser for more security, speed and compatibility.

If you need help pricing and building your medicare plan, call us at 844-572-0696