How To Choose a Medicare Plan

Choosing a Medicare plan that’s right for you requires you to consider plan costs, your ability to choose your doctor and several other options. It also requires you to compare different Medicare plan options to find the one that best fits your health care needs and budget.

- Written by Terry Turner

Terry Turner

Senior Financial Writer and Financial Wellness Facilitator

Terry Turner has more than 35 years of journalism experience, including covering benefits, spending and congressional action on federal programs such as Social Security and Medicare. He is a Certified Financial Wellness Facilitator through the National Wellness Institute and the Foundation for Financial Wellness and a member of the Association for Financial Counseling & Planning Education (AFCPE®).

Read More- Edited By

Lamia Chowdhury

Lamia Chowdhury

Financial Editor

Lamia Chowdhury is a financial content editor for RetireGuide and has over three years of marketing experience in the finance industry. She has written copy for both digital and print pieces ranging from blogs, radio scripts and search ads to billboards, brochures, mailers and more.

Read More- Reviewed By

Eric Estevez

Eric Estevez

Owner of HLC Insurance Broker, LLC

Eric Estevez is a duly licensed independent insurance broker and a former financial institution auditor with more than a decade of professional experience. He has specialized in federal, state and local compliance for both large and small businesses.

Read More- Published: August 17, 2022

- Updated: October 18, 2023

- 11 min read time

- This page features 10 Cited Research Articles

- Edited By

What Should You Consider When Choosing a Medicare Plan?

There are several things you should consider when choosing a Medicare plan. These range from costs to your health condition to other medical needs you expect to have over the course of your retirement.

Each of these weigh into any final decision on which Medicare plan is best for you.

- Costs

- Consider premiums, deductibles and all other out-of-pocket costs. These can add up differently for different plans. For example, There is no maximum out-of-pocket (MOOP) limit each year with Original Medicare — unless you also have Medigap. Medicare Advantage plans have annual limits.

- Coverage

- Make sure the plan gives you the best coverage for your needs. Original Medicare includes Medicare Part A, which covers hospital inpatient costs, and Medicare Part B, which covers medical costs such as doctor visits. Medicare Advantage plans cover everything Original Medicare does, but some may cover additional services — such as vision, dental and hearing.

- Doctor and hospital choice

- With Original Medicare, you can go to any doctor or hospital in the United States who accepts Medicare. With Medicare Advantage plans, you must go to a doctor within your plan’s network.

- Prescription drugs

- Original Medicare covers prescription drugs you’re given while you’re in a hospital but does not cover the cost of prescription drugs you take at home. You can buy a Medicare Part D prescription drug plan to help with medication costs. Most Medicare Advantage plans include Part D drug coverage.

- Quality of care

- Quality of care can vary between Medicare plans. Be sure to compare Medicare ratings between the plans you are considering before committing to a plan.

- Travel

- Original Medicare does not cover medical care outside of the United States. Most Medicare Advantage plans don’t usually cover medical care outside the U.S. either. But you may be able to buy supplemental insurance or travel insurance that includes medical coverage abroad if you plan to travel internationally.

- Your other coverage

- You can have other medical coverage — including VA benefits, private insurance or another secondary payer — that works with Medicare. You can also buy supplemental insurance — Medigap — to help cover out-of-pocket costs with Original Medicare. You can’t get Medigap with a Medicare Advantage plan, but Medicare Advantage plans may be more cost effective if your out-of-pocket expenses are lower with one of those plans.

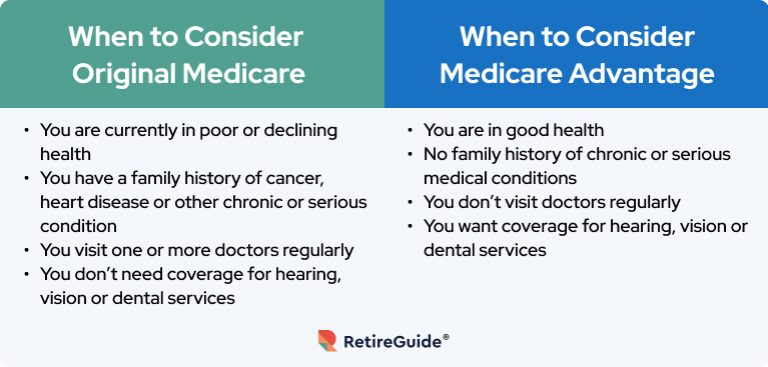

How Do Your Medical Conditions Influence Your Options?

Your medical conditions can play a major role in determining which plan is best for you. Your medical condition and family medical history can both play a role in overall costs and quality of care.

If you take prescription drugs, you should consider a Medicare Part D prescription drug plan if you opt for Original Medicare; If you opt for a Medicare Advantage plan, make sure it includes Part D coverage.

Medicare Advantage Special Needs Plan (SNP)

Medicare Special Needs Plans (SNP) are a type of Medicare Advantage plan that limits membership to people who have specific diseases.

You can purchase an SNP from a private insurer, just like you would with other Medicare Advantage plans. Special needs plans tailor coverage — benefits, doctor/hospital choices and available prescription drugs — to your particular condition and medical needs.

Some SNPs cover out-of-network health care providers. Check with the plan administrator first to see if this is an option.

Under 65 With a Disability

Though Medicare is typically seen as health insurance for people 65 and older, Medicare is also available for people with disabilities, ALS and end-stage renal disease.

If you are under 65 — and get Social Security disability benefits — Social Security will automatically enroll you in Medicare Part A and Part B coverage. You may also be eligible for certain Medicare Advantage plans once you qualify for Social Security disability benefits.

Typically, you must have received Social Security Disability Insurance (SSDI) for 24 months if you are under 65 with a disability.

How Do Costs of Medicare Plans Differ?

When choosing a Medicare plan — or a combination of Medicare plans — it’s important to consider all the costs associated with each. This includes monthly premiums, deductibles, coinsurance and copayments and any other out-of-pocket costs.

You should also take into consideration whether you’ll need to buy supplemental insurance — Medigap — or Medicare Part D prescription drug coverage before comparing plans.

Premiums

Premiums for Original Medicare are set each year. The standard monthly Part B premium is $185 in 2025. The cost is higher for people with higher incomes. Most people don’t have to pay a premium for Medicare Part A hospital insurance.

If you want to join a Medigap or Medicare Part D prescription drug plan, you will have to pay monthly premiums for both.

If you choose a Medicare Advantage plan, you will still have to pay the Medicare Part B premium. Some Medicare Advantage plans have a $0 premium on top of that — some may even pay part of your Part B premium.

Out-of-Pocket Expenses

Medicare Part A has a $1,676 deductible for each benefit period in 2025. You also pay a daily deductible if you are hospitalized for more than 60 days during a benefit period.

The Medicare Part B deductible is $257 for 2025. After you meet that deductible, you pay 20% coinsurance for the Medicare-approved amount of doctor services, outpatient therapy and durable medical equipment.

Medicare Advantage plans’ out-of-pocket costs vary from plan to plan so it’s important to understand exactly how much you’ll be paying when comparing plans.

Your out-of-pocket expenses for Medicare Part D drug coverage varies depending on the plan. It can also vary based on the plans formulary and drug tier pricing.

Yearly Limits on Out-of-Pocket Costs and Other Coverage

Original Medicare has no yearly limits on out-of-pocket costs — unless you have Medigap.

Medigap can help pay your remaining out-of-pocket costs if you have Original Medicare. The amount that it pays differs depending on which Medigap plan you choose. You shouldn’t need Medigap if you choose a Medicare Advantage plan.

You can also use coverage from a health insurance individual or group plan through your employer or union to help cover out-of-pocket costs.

Medicare Advantage plans have yearly limits on what you must pay out of pocket for hospital and medical expenses. These vary from plan to plan.

Which Plans Have Additional Benefits?

Medicare Advantage plans offer additional benefits that Original Medicare does not cover. These typically include prescription drug coverage, hearing, vision and dental services.

- Eyeglass exams and glasses

- Dental care

- Fitness benefits

- Hearing aids and exams

- Over-the-counter drug benefits

- Transportation

- Hospital meal benefit

- Bathroom safety benefits

- In-home support

Neither Original Medicare nor most Medicare Advantage plans cover nursing home care or similar long-term care. But Medicare Advantage plans may cover some related services.

Typically, you should consider long-term care insurance if you are looking for nursing home coverage in the future.

Medicare Plans That Offer the Largest Network Size

Original Medicare has the largest network of health care providers in the United States — about 97% of practitioners nationwide — according to the Kaiser Family Foundation. You can go to any doctor, hospital or other health care provider anywhere in the United States, as long as they accept Medicare.

Medicare Advantage plans have specific networks of doctors, hospitals and other health care providers you must use to receive full coverage. But the largest networks can provide nationwide coverage.

| Medicare Advantage Plan | ||

|---|---|---|

| Blue Cross Blue Shield/Anthem | ||

| Cigna HealthSpring | ||

| United Healthcare/AARP | ||

| Aetna/CVS | ||

| Humana |

If you get medical or hospital care outside the plan’s network, you may have to pay more for your care.

Some Medicare Advantage networks may be small, and you may not have providers when you need them if you travel in the United States away from where you live. It’s important to familiarize yourself with a plan’s network when choosing a Medicare plan.

How Does When You Enroll Impact Your Plan Options?

There are certain times you can enroll in a Medicare plan. Delaying enrollment when you are first eligible can result in penalties later when you enroll in Medicare Part B medical insurance and Medicare Part D prescription drug plans.

Delays can also make it more difficult to enroll in certain plans. In some cases, private insurers can deny you coverage if you wait too long to enroll.

There are four enrollment periods for Medicare — initial, general, open and special enrollment periods.

Initial enrollment period

When it is: The month you turn 65, plus the three months before and after your birthday month (coverage begins based on the month you enroll and may be delayed by three months).

What you can do: You can enroll in Medicare Part A, Part B, a Medicare Advantage plan, Medigap or Medicare Part D drug plan.

What to know: If you don’t have employer-sponsored coverage during this period and choose not to enroll in Medicare Part B when you’re first eligible, you can face a Part B late enrollment penalty. This will raise your Part B monthly premium 10% for each 12-month period you wait to enroll. If you do not have qualifying drug plan coverage, then you can also face a penalty added to your Part D plan when you do enroll.

You can also buy a Medigap plan during the initial enrollment period regardless of your health condition. You pay the same premiums as anyone in good health.

General enrollment period

When it is: Jan. 1 through March 31 each year (coverage starts on July 1).

What you can do: Sign up for Medicare plans if you missed your initial enrollment period.

What to know: If you don’t sign up for Medicare when you’re first eligible — during your initial enrollment period — and you don’t qualify for a special enrollment period, you may have to wait until the next general enrollment period to sign up. You will likely have to pay late enrollment penalties.

There is no guarantee that an insurer will sell you a Medigap policy if you don’t meet the medical underwriting requirements during this period unless you meet certain conditions.

Open enrollment period

When it is: Oct. 15 through Dec. 7 every year (coverage starts on Jan. 1).

What you can do: You can change your existing Medicare plans and prescription drug coverage for the following year.

What to know: You already have to be enrolled in a Medicare plan to take advantage of the open enrollment period. Each year, the costs and coverage of Medicare plans change. Open enrollment allows you to change your coverage for another plan that better suits your needs. Medigap companies have to sell you a plan at the same price as healthy people if you buy a policy during open enrollment.

Special enrollment period

When it is: At any time after 65 when you are no longer covered by an employer-provided group health care plan.

What you can do: Enroll in Medicare plans if you were not required to enroll during your initial enrollment period.

What to know: If you have qualifying health insurance through your employer or your spouse’s employer during your initial enrollment period, you can keep it and may be able to wait to enroll in Medicare plans without late enrollment penalties. However, the employer must have 100 or more employees to qualify for the special enrollment period. Employer coverage for retirees and COBRA coverage does not qualify you to wait and enroll during a special enrollment period. In those cases, you may still owe late enrollment penalties if you wait. You may have to pay more for a Medigap policy or insurers may not sell you one based on medical underwriting conditions.

Variations in Plan Availability and Flexibility to Change Plans

Original Medicare — both Medicare Part A and Medicare Part B — is available throughout the United States. It is a federal health insurance plan. This includes all 50 states as well as the District of Columbia, Puerto Rico, the U.S. Virgin Islands, American Samoa and Guam. You can take your Original Medicare coverage with you if you move within the United States.

Medigap plans are standardized in most states. But different insurers sell different Medigap plans in different states. Not all Medigap plans may be available in all counties within a state or in all states.

Medicare Advantage plans and Medicare Part D prescription drug plans rely on health care provider networks. Some plans may have nationwide coverage, but others may not be available in all states or even in all counties within a state.

Even if you move within a state, you should check with your plan to make sure it will cover you with providers in your new hometown. If your plan will not work where you move, you may be eligible for a special enrollment period — allowing you to enroll in a new plan in your new location.

10 Cited Research Articles

- Centers for U.S. Medicare & Medicaid Services. (2023, October 12). 2024 Medicare Parts A & B Premiums and Deductibles. Retrieved from https://www.cms.gov/newsroom/fact-sheets/2024-medicare-parts-b-premiums-and-deductibles

- U.S. Centers for Medicare & Medicaid Services. (2022, September 27). 2023 Medicare Parts A and B Premiums and Deductibles 2023 Medicare Part D Income-Related Monthly Adjustment Amounts. Retrieved from https://www.cms.gov/newsroom/fact-sheets/2023-medicare-parts-b-premiums-and-deductibles-2023-medicare-part-d-income-related-monthly

- Ochleng, N., Schwartz, K. and Neuman, T. (2020, October 22). How Many Physicians Have Opted Out of the Medicare Program? Retrieved from https://www.kff.org/medicare/issue-brief/how-many-physicians-have-opted-out-of-the-medicare-program/

- U.S. Centers for Medicare & Medicaid Services. (n.d.). Consider These 7 Things When Choosing Coverage. Retrieved from https://www.medicare.gov/what-medicare-covers/your-medicare-coverage-choices/consider-these-7-things-when-choosing-coverage

- U.S. Centers for Medicare & Medicaid Services. (n.d.). Preventive and Screening Services. Retrieved from https://www.medicare.gov/coverage/preventive-screening-services

- U.S. Centers for Medicare & Medicaid Services. (n.d.). Special Needs Plans (SNP). Retrieved from https://www.medicare.gov/sign-upchange-plans/types-of-medicare-health-plans/special-needs-plans-snp

- U.S. Centers for Medicare & Medicaid Services. (n.d.). What Medicare Health Plans Cover. Retrieved from https://www.medicare.gov/what-medicare-covers/what-medicare-health-plans-cover

- U.S. Centers for Medicare & Medicaid Services. (n.d.). What Part A Covers. Retrieved from https://www.medicare.gov/what-medicare-covers/what-part-a-covers

- U.S. Centers for Medicare & Medicaid Services. (n.d.). What Part B Covers. Retrieved from https://www.medicare.gov/what-medicare-covers/what-part-b-covers

- U.S. Centers for Medicare & Medicaid Services. (n.d.). What’s Not Covered by Part A and Part B. Retrieved from https://www.medicare.gov/what-medicare-covers/whats-not-covered-by-part-a-part-b

Calling this number connects you to one of our trusted partners.

If you're interested in help navigating your options, a representative will provide you with a free, no-obligation consultation.

Our partners are committed to excellent customer service. They can match you with a qualified professional for your unique objectives.

We/Our Partners do not offer every plan available in your area. Any information provided is limited to those plans offered in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

888-694-0290Your web browser is no longer supported by Microsoft. Update your browser for more security, speed and compatibility.

If you need help pricing and building your medicare plan, call us at 844-572-0696