Facts About Life Insurance: Must-Know Statistics in 2023

Buying life insurance is a big decision. Updating yourself on current knowledge about the life insurance industry can help you choose the right insurance policy and protect your loved ones. Learn more about current statistics such as the average cost, average payout and current trends.

- Written by Lindsey Crossmier

Lindsey Crossmier

Financial Writer

Lindsey Crossmier is an accomplished writer with experience working for The Florida Review and Bookstar PR. As a financial writer, she covers Medicare, life insurance and dental insurance topics for RetireGuide. Research-based data drives her work.

Read More- Edited By

Lamia Chowdhury

Lamia Chowdhury

Financial Editor

Lamia Chowdhury is a financial content editor for RetireGuide and has over three years of marketing experience in the finance industry. She has written copy for both digital and print pieces ranging from blogs, radio scripts and search ads to billboards, brochures, mailers and more.

Read More- Reviewed By

Eric Estevez

Eric Estevez

Owner of HLC Insurance Broker, LLC

Eric Estevez is a duly licensed independent insurance broker and a former financial institution auditor with more than a decade of professional experience. He has specialized in federal, state and local compliance for both large and small businesses.

Read More- Published: November 17, 2021

- Updated: January 2, 2025

- 7 min read time

- This page features 9 Cited Research Articles

Key Facts About the Life Insurance Industry

A record-breaking 39% of consumers plan on buying a life insurance policy by 2024, according to LIMRA.- 52% of adults reported owning life insurance in 2023, and 41% of adults (both insured and uninsured) don’t think they have enough coverage.

- 90 million families rely on life insurance policies to protect their financial security.

- Life insurance companies pay out $2.5 billion to families and businesses a day, according to the American Council of Life Insurers.

- 80% of adults overestimate the cost of a life insurance policy, according to LIMRA and Life Happens.

- The life insurance industry generates 2.8 million jobs in the United States.

- Texas has the most active life insurance policies in the United States, with an average of $163,000 in coverage.

- 71% of insured parents feel financially secure, versus 48% of uninsured parents, according to LIMRA.

- 23% of adults haven’t purchased a life insurance policy because they don’t know which type to purchase or how much coverage they need.

- Life insurers invest 7.9 trillion in the U.S. economy.

Current Trends in the Life Insurance Industry

There are three main trends in the life insurance industry in 2023; younger generations are shopping for life insurance for the first time; there is an increase in single mothers needing coverage; and fewer companies are reporting COVID-19-related mortalities.

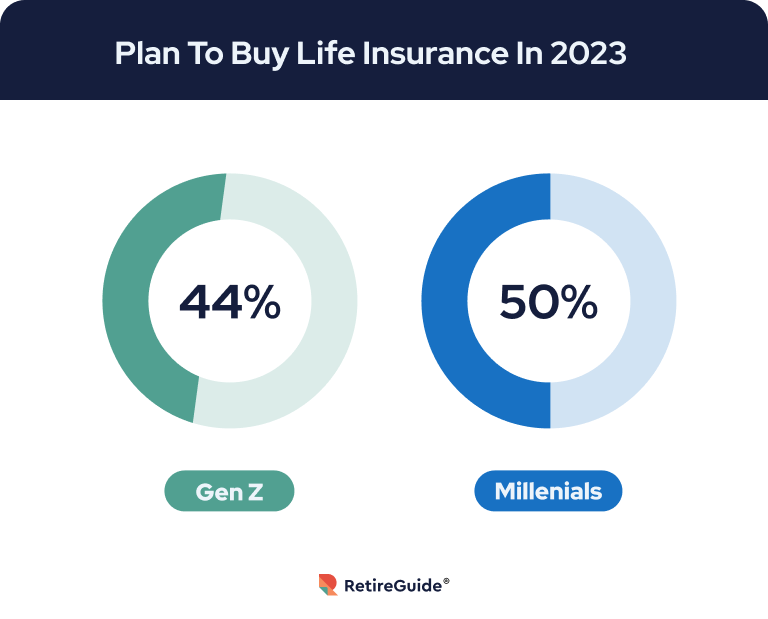

Gen Z adults and millennials are reaching life events — like getting married, starting careers and having children. These events can make them consider life insurance coverage. 44% of Gen Z adults and 50% of millennials intend to buy life insurance coverage by 2024. Gen Z and Millennials prefer to buy life insurance online, with assistance from a financial professional or through their work.

The number of single-mother households has increased by 40% since 1980. Single mothers are now a key market to consider life insurance coverage. 38% of single mothers intend to purchase a life insurance policy in 2023, according to LIMRA.

In addition, in 2023, S&P Global predicts mortality risk will continue to improve and life insurance companies should no longer experience claims related to COVID-19.

Average Life Insurance Cost

The average cost of life insurance varies depending on your age, health, sex and the type of insurance you’re looking for. For example, term life coverage will be more affordable than whole or permanent life insurance.

Term Life vs. Permanent LifeTerm Life Insurance Permanent Life Insurance Provides temporary coverage Lifelong coverage Terms often last 10, 20 or 30 years Builds cash value More affordable than whole life Can be up to 10 times more expensive than term life policies No matter which type of policy you sign up for, you’ll have to pay a life insurance premium each month to keep the coverage. Look at average life insurance rates by age to get an idea of how much you may pay per month.

Average Term Policy CostsTerm Length/Age 30 40 50 60 70 10-Year Term $36.16 $53.17 $111.79 $239.50 $706.94 20-Year Term $52.25 $82.71 $179.44 $456.70 $1,727.95 30-Year Term $86.54 $137.88 $303.14 N/A N/A Source: U.S. News*These quotes are based on a healthy woman looking for $1 million of coverage for 20 years. If you want less coverage, expect lower premiums.

Anticipate permanent life insurance premiums to be over $100 each month. For instance, on average, a healthy 40-year-old woman can get a permanent universal policy with $1 million in coverage for $578.85 a month, according to U.S. News.

Average Life Insurance Payout

Data from Statista shows an overall average life insurance payout in the U.S. of $168,000. However, keep in mind that every insurance company will likely have different averages for life insurance based on their location and typical customer demographic.

For example, in California, the average life insurance death benefit is $276,000; in Alabama, the average death benefit is $64,000. Use The American Council of Life Insurers 2023 report to help determine what a payout could look like in your state.

Your payout value, or face amount, is the sum of money that will be paid to your beneficiaries if you pass away, so it’s important to determine how much you’ll want to leave behind. Maybe it will only be around $168,000, or maybe you’d rather leave closer to $1 million. Whatever you decide, make sure it’s right for your family and circumstances.

Life Insurance Coverage You Can Count On*.You may qualify for up to $2M in coverage with no medical exams required. Policies are issued by highly rated insurers, and, like us, they’re not going anywhere.

*We may be compensated if you click this ad.Life Insurance Ownership Statistics

52% of adults report owning life insurance in 2023, according to LIRMA. In the same study, statistics were calculated on life insurance ownership by generation and parenthood.

Percentage of Groups That Own Life Insurance- 40% of Gen Z adults

- 48% of Millennials

- 41% of Single Mothers

- 59% of Parents

AdvertisementLife Insurance Coverage by State

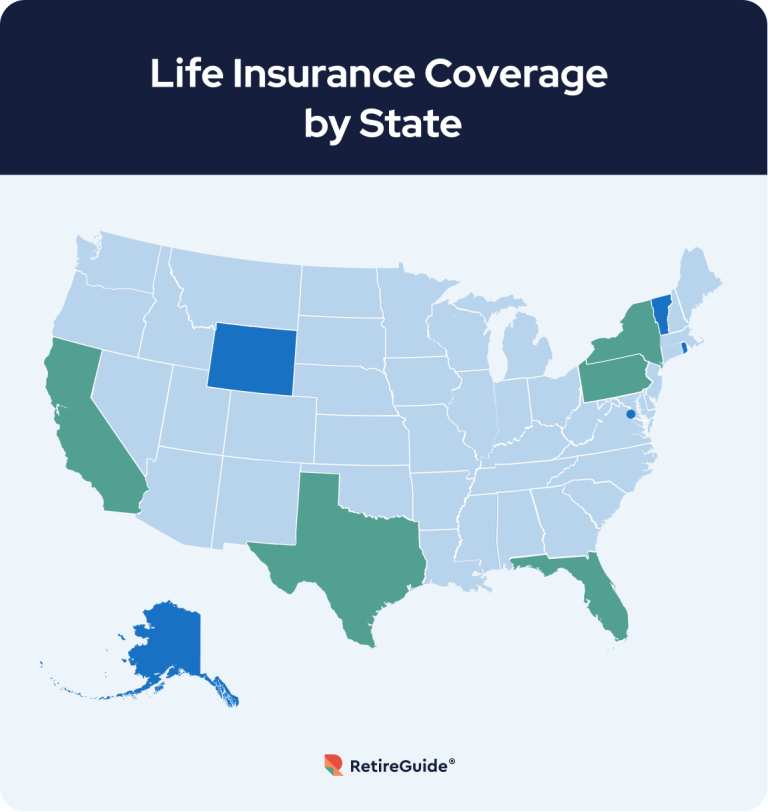

While life insurance companies account for different market shares, the same is true for individual states. States with larger populations typically have more active life insurance policies compared to states with a smaller population.

Greatest Amount of Policies in Force (in millions) Least Amount of Policies in Force (in thousands) Texas - 10.9 Alaska - 171 California - 10.3 Wyoming - 218 Florida - 7.5 Vermont - 232 New York - 7.1 District of Colombia - 249 Pennsylvania - 6.1 Rhode Island - 354 *Note that while this information was published in the ACLI’s 2023 report, the information is from 2021.

Life Insurance Claims Statistics

According to the most recent information from the Insurance Information Institute, life insurance death benefits and claims for 2022 totaled $797.7 billion – over a $50 billion increase from 2020. Of that total, Americans collected over $88 billion from death benefits alone.

Life Insurance Companies by Market Cap

Market capitalization is the total value of a company traded on the stock market. Companies with a large capitalization (often $10 billion or more) are more established and well known.

According to Statista, MetLife is the largest life insurance company in the U.S. based on their market capitalization of $42.4 billion, as of May 2023.

Other leading companies with a high market cap are American International Group(AIG), Prudential Financial and Aflac.

Life Insurance Myths

When shopping for life insurance, it’s easy to be bombarded with information. Knowing what’s fact and fiction can help you make an informed decision about your life insurance policy.

Common Life Insurance Myths- I can’t afford life insurance.

- Why it’s false: 80% of the U.S. population overestimates the cost of life insurance. If you can only afford a smaller coverage amount, you can always start with a smaller policy and work up to a larger one as your income increases.

- My beneficiaries will have to pay taxes on money received from my life insurance policy.

- Why it’s false: According to the Internal Revenue Service (IRS), life insurance payouts received from the death of the person insured are generally not taxable and won’t be considered part of your beneficiaries’ gross income. However, any interest that may accrue from the payout should be reported on annual tax returns.

- I no longer need life insurance once my kids are 18.

- Why it’s false: Life insurance payouts aren’t always just for replacing an income if you pass away. Payouts can also act as an inheritance for your grown children – or they can help pay for final expenses or estate taxes.

- I’m a stay-at-home mom with no income so I don’t need life insurance.

- Why it’s false: While you may not have any income that would need to be replaced if you passed away, your loved ones would likely need someone to fill your role. For example, if you have young kids, the money from your life insurance policy could pay for childcare while your surviving spouse works during the day.

- I’m not married and don’t have kids so I don’t need life insurance.

- Why it’s false: Proceeds from your life insurance policy can help pay for your burial or any debts left behind so your loved ones won’t be burdened by these expenses.

Life Insurance vs. Other Coverage

There are important benefits to having one of the many different types of life insurance, such as the peace of mind knowing that your family will be taken care of. However, there are also other types of insurance you can consider to make sure you’re prepared for any emergency.

Other insurance plans include health coverage, renters or homeowners insurance, dental insurance and car insurance. In addition, if you’re 65 or older, you can benefit from government-sponsored health coverage, otherwise known as Medicare.

Purchasing a life insurance policy is one of the best ways to protect your family in case something were to happen to you. It’s also an essential part of any healthy retirement plan. If you have additional questions about different policies, talk with a life insurance expert to learn more.

Editor Malori Malone contributed to this article.

Last Modified: January 2, 2025Share This PageAdvertisement9 Cited Research Articles

- LIMRA. (2023, April 24). New Study Shows Interest in Life Insurance at All-Time High in 2023. Retrieved from https://www.limra.com/en/newsroom/news-releases/2023/new-study-shows-interest-in-life-insurance-at-all-time-high-in-2023/

- LIMRA. (2023). Securing the Future: Life Insurance Needs of Younger Adults. Retrieved from https://info.limra.com/gen-zy-barometer

- Johnson, H. (2023, March 1). What Is Whole Life Insurance? Retrieved from https://www.cnn.com/cnn-underscored/money/what-is-whole-life-insurance

- Nyerges, S. (2023, January 23). How Much Does Life Insurance Cost? Retrieved from https://www.usnews.com/insurance/life-insurance/how-much-does-life-insurance-cost

- S&P Global. (2023, January 3). US Life Outlook 2023: Mortality To Improve; Capital Levels in Focus; LDTI Reform. Retrieved from https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/us-life-outlook-2023-mortality-to-improve-capital-levels-in-focus-ldti-reform-73478453

- American Council of Life Insurers. (2023, January). Life Insurers Across America. Retrieved from https://www.acli.com/-/media/public/pdf/about-the-industry/life_insurance_infographic_li_facts.pdf

- Life Happens. (2022, April). 2022 Insurance Barometer Study. Retrieved from https://lifehappens.org/research/owning-life-insurance-provides-a-clear-path-to-financial-security/

- Internal Revenue Service. (2022, September 7). Life Insurance & Disability Insurance Proceeds. Retrieved from https://www.irs.gov/faqs/interest-dividends-other-types-of-income/life-insurance-disability-insurance-proceeds

- Insurance Information Institute. (2022). Facts + Statistics: Life insurance. Retrieved from https://www.iii.org/fact-statistic/facts-statistics-life-insurance

- Edited By

Your web browser is no longer supported by Microsoft. Update your browser for more security, speed and compatibility.

If you need help pricing and building your medicare plan, call us at 844-572-0696