Medicare Advantage Pros & Cons

Medicare Advantage plans provide expanded coverage beyond what Original Medicare covers, including vision and dental. But there are some limitations that come with opting for a Medicare Advantage plan, so it’s important to figure out if it’s a right fit for your needs.

- Written by Terry Turner

Terry Turner

Senior Financial Writer and Financial Wellness Facilitator

Terry Turner has more than 35 years of journalism experience, including covering benefits, spending and congressional action on federal programs such as Social Security and Medicare. He is a Certified Financial Wellness Facilitator through the National Wellness Institute and the Foundation for Financial Wellness and a member of the Association for Financial Counseling & Planning Education (AFCPE®).

Read More- Edited By

Lamia Chowdhury

Lamia Chowdhury

Financial Editor

Lamia Chowdhury is a financial content editor for RetireGuide and has over three years of marketing experience in the finance industry. She has written copy for both digital and print pieces ranging from blogs, radio scripts and search ads to billboards, brochures, mailers and more.

Read More- Reviewed By

Michael Jones

Michael Jones

Medicare Expert and Owner of Grand Anchor Insurance Solutions

Michael Jones is a licensed insurance agent who manages his own agency called Grand Anchor Insurance Solutions. In addition to being a Medicare expert, Michael specializes in other insurance products such as voluntary benefits for employees of businesses.

Read More- Published: August 9, 2021

- Updated: February 4, 2025

- 11 min read time

- This page features 5 Cited Research Articles

What Are the Pros and Cons of Medicare Advantage Plans vs. Original Medicare?

Medicare Advantage, or Part C, offers all the benefits of Original Medicare without the hassle of juggling coverage from multiple plans. It also includes key features that many people find valuable, like vision and dental coverage. But Medicare Advantage plans may not fit everyone’s personal lifestyles or needs. Here are the pros and cons to switching over from Original Medicare.

Medicare Advantage Pros

- Expanded coverage

- Vision, dental and possibly prescription drugs included

- Lower out-of-pocket costs

Medicare Advantage Cons

- Limited to a network

- You may have to switch doctors or healthcare providers

- There can be additional rules and regulations

Advantages of Medicare Advantage Plans

The biggest pro of opting for a Medicare Advantage plan over Original Medicare is the access to expanded benefits and coverage. Original Medicare strictly covers what is deemed a medical necessity, and its definition can be very narrow.

All-in-One Inclusive Benefit Plan

Medicare Advantage includes everything covered under Original Medicare plus more. With so many limitations on what Original Medicare covers, many tend to lean toward Medicare Advantage plans for the extra coverage.

Some Medicare Advantage plans even include benefits that aren’t strictly medical, such as access to gym memberships. If you’re someone looking for more flexibility in your health care plan, then Medicare Advantage could be a good option for you.

Vision, Dental and Prescription Drugs

Through a Medicare Advantage plan, beneficiaries can have access to vision and dental coverage as well as prescription drugs.

These services are almost entirely excluded from Original Medicare, despite their increasing importance with age. Medicare Advantage plans come in many different forms, giving you a lot of options for this type of coverage.

You can opt for a cheaper plan that includes base levels of dental and vision coverage, like preventive services and exams, or you can choose a more extensive plan that covers different procedures, equipment and operations.

No-Cost Premiums or Deductibles

An added benefit of opting for a Medicare Advantage plan is that it can be cheaper than Original Medicare in some ways. In many parts of the country, there are plans available that come with a $0 premium, meaning, you can get additional benefits like vision or dental without paying more than you would for Original Medicare.

Depending on which plan you select, Medicare Advantage plans can also come with lower out-of-pocket costs than Original Medicare, since all your treatments are within a network. So, those who opt for a Medicare Advantage plan can receive more extensive coverage at a lower cost.

Annual Limit on Out-of-Pocket Costs

Along with lower out-of-pocket costs in general, many Medicare Advantage plans also include a cap on how much you pay. A cap can be key to saving money on your health costs since it can prevent a single treatment, surgery or other service from overwhelming you financially.

According to the U.S. National Library of Medicine, beneficiaries can save money on lab services and medical equipment by switching to Medicare Advantage.

Since Medicare Advantage plans vary in what they cover, it can be difficult to predict exactly what your out-of-pocket costs will be for different services. When selecting a plan, remember that you should not only consider the monthly premium, but also how each plan pays for various services. You can determine your budget by calculating how much you’ve spent on previous years for health care.

Have you selected your 2025 Medicare plan?Maximize your Medicare savings by connecting with a licensed insurance agent.Disadvantages of Medicare Advantage Plans

While Medicare Advantage offers many benefits beyond Original Medicare, there are still some downsides to consider. By understanding all aspects of Medicare Advantage plans, you can determine whether it’s right for you.

Coverage Is Limited to In-Network Providers

Unlike Original Medicare, Medicare Advantage plans will only cover within your plan’s network. Your plan determines what doctors you can see and which facilities you can receive treatment. You may even have to change doctors when you begin your plan if your current healthcare provider is not included.

Medicare Advantage can also include additional rules in some circumstances, like needing a referral to see a specialist, so be sure to research each plan thoroughly.

Coverage Is Limited to Specific Geographical Area

Since Medicare Advantage plans are provided by private insurers instead of the federal government, they are available regionally. With that comes a couple of drawbacks. The first is that your network will likely only extend to the region where your plan was purchased. If you travel a lot, have multiple homes, or plan on moving soon, a Medicare Advantage plan may not make sense for you since you can only receive coverage in one area.

The other drawback is that, unlike Original Medicare, Medicare Advantage plans do not equally blanket the country. Different plans are available in different areas. There tend to be more plans in populated parts of the country, so you may have a harder time finding a plan that best fits your needs if you live in a rural area or smaller state.

Can’t Be Combined with a Medigap Plan

While beneficiaries can purchase a Medigap plan to pair with Original Medicare, It’s not the same case for Medicare Advantage. A Medigap plan cannot pay for your Medicare Advantage deductibles, copayments or other costs.

Since a Medigap plan eventually serves as a supplement to Original Medicare coverage, it should be viewed as an alternative to Medicare Advantage, not something that can be used with it. Although the plans can’t be combined, Medicare Advantage does often include coverage for dental and vision services, which is not available through Medigap.

Plans May Cost More Than Original Medicare

Medicare Advantage plans can vary heavily. While some plans may be more cost effective for your health care needs than Medicare, other plans can be more expensive. You may also encounter some additional costs through a Medicare Advantage plan that you otherwise wouldn’t under Original Medicare.

For example, since Medicare Advantage plans require you to stay within a network, you would likely have to pay to see a doctor outside of that network. You may also encounter drug deductibles and additional costs for visits to specialists.

Medicare Advantage plans may also look for low-cost options if you need treatment or a procedure. Original Medicare will cover you anywhere that’s enrolled in Medicare if your care is deemed medically necessary.

Anne Novak | 0:43 Are there drawbacks to a Medicare Advantage plan? Get Free Help Pricing and Building Your Medicare PlanReplay VideoLearn more about the potential drawbacks of Medicare Advantage Plans from Anne Novak, who is licensed in Life and Annuities, Sickness, Accident and Health by the Nebraska Department of Insurance.

Get Free Help Pricing and Building Your Medicare PlanReplay VideoLearn more about the potential drawbacks of Medicare Advantage Plans from Anne Novak, who is licensed in Life and Annuities, Sickness, Accident and Health by the Nebraska Department of Insurance.Is It Better to Have Medicare Advantage or Medigap?

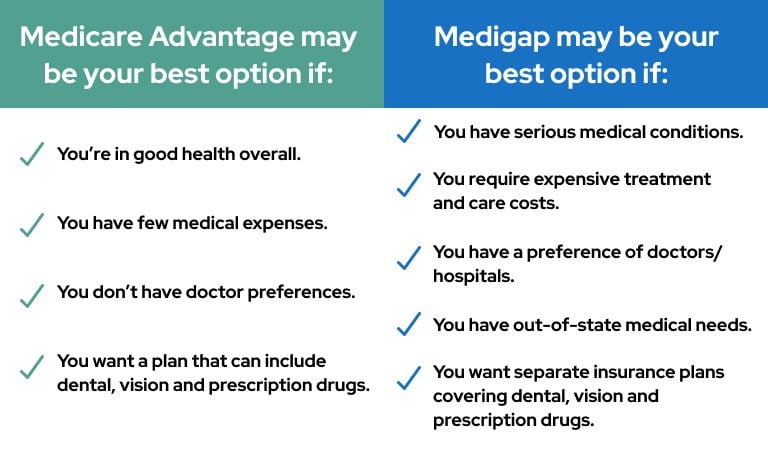

Medigap is a supplementary plan that helps cover additional costs for Original Medicare. This type of plan may make sense if you have a chronic illness or need access to additional providers. With Medigap, your plan will work anywhere in the U.S. and at any doctor who accepts Medicare. Keep in mind that there are differences between Medicare Advantage and Medigap.

For Medigap, you must be enrolled in Original Medicare and will pay a monthly premium. In exchange, it can help cover the costs of your deductibles, coinsurance and copayments.

Is Medicare Advantage Right for You?

Whether a Medicare Advantage plan is right for you depends on your financial situation, health conditions and risks and personal preferences on the type of health care coverage you want.

Medicare Advantage plans tend to be less expensive than Original Medicare but can come with higher out-of-pocket costs if you need frequent medical services or have a chronic or serious medical condition.

Additionally, Medicare Advantage plans limit you to a specific region. If that’s an inconvenience for your lifestyle, then you may opt not to get an Advantage plan.

Best Fit for Medicare Advantage Plans- You are in relatively good health

- You have no medical or family history of cancer, heart disease, or other serious condition

- You seldom visit the doctor

- You have limited financial resources or income

- You don’t mind a limited choice of health care providers within the plan’s network

- You want coverage for hearing, vision or dental services

When considering the best Medicare coverage for you, you should compare Medicare Advantage vs. Medigap along with Medicare Part D plans added to Original Medicare.

How to Choose a Medicare Advantage Plan for Your Needs

Deciding whether to enroll in Medicare Advantage depends on your situation. If vision, dental and potentially prescription drug coverage is important to you and your healthcare, opting for a Medicare Advantage plan may be the best move.

If limiting yourself to a specific region is an inconvenience for your lifestyle or your doctor is not within a plan network, then you may opt not to get an Advantage plan.

While Original Medicare is affordable and helps keep you from being constrained to a specific network or plan, Medicare Advantage offers expanded coverage for more flexibility. It is up to you to decide which plan works best for your health needs.

How to Find the Best Medicare Advantage Plan

If you are planning to enroll in a Medicare Advantage plan, there are several steps you can take to find the one that is best suited for you.

How to Select a Medicare Advantage Plan- Determine which health care needs and services are most important to you.

- Figure out how much money you are willing to spend on health care each year.

- Research plans available in your area.

- Compare the Medicare plans that appeal to you, including their premiums, out-of-pocket costs and the extent of their coverage.

What Is the Most Widely Accepted Medicare Advantage Plan?

United Healthcare has the largest Medicare Advantage network in the United States with more than one million health care providers in its network.

Not only is UnitedHealthcare the largest provider of Medicare Advantage plans, but the company’s plans also are available in all 50 states and the District of Columbia. It also partners with AARP, providing many of the health insurance plans that carry AARP’s name.

Most Highly Rated Medicare Advantage Plans

A total of 73 Medicare Advantage and Medicare Part D plans received five-star ratings from the U.S. Centers for Medicare & Medicaid Services in 2022.

Five stars is the highest rating Medicare gives for plans, and it represents excellent performance. The annual ranking reflects enrollees’ experiences with their plans. The number of plans receiving four and five stars more than tripled over 2020.

Medicare Star RatingsYou can look up the names of the top-rated Medicare Advantage plans in Medicare’s 2022 Part C and D Star Ratings report. You can also check the star rating of your Medicare Advantage plan using the Medicare Plan Finder tool or calling Medicare at 1-800-633-4227.Source: U.S. Centers for Medicare & Medicaid ServicesJ.D. Power surveyed 3,359 Medicare Advantage enrollees in the United States to determine customer satisfaction scores. The rankings were based on cost, coverage and benefits, billing and payment, information and communication with beneficiaries, choice of providers and customer service.

Top Three Medicare Advantage & Part D Plans by Customer SatisfactionRank Provider Rating 1 Kaiser Foundation Health Plan 846 2 Highmark 834 3 HealthSpring 822 Source: J.D. PowerAccording to the study, beneficiary satisfaction with their Medicare Advantage plans also appeared to have increased during the COVID-19 pandemic.

Frequently Asked Questions About the Pros and Cons of Medicare Advantage Plans

What are the advantages and disadvantages of Medicare Advantage plans?Medicare Advantage plans can offer expanded coverage beyond the scope of Original Medicare, including vision and dental. But the plans do often require you to remain within a network.How does Medicare Advantage work?Medicare Advantage is provided through private insurers and replaces Original Medicare. Plans always include at minimum everything that is covered in Original Medicare.Why choose a Medicare Advantage plan?A Medicare Advantage plan can give you access to critical coverage that is excluded from Original Medicare. This includes vision and dental benefits, as well as prescription drug coverage.Can you switch back to Medicare from Medicare Advantage if you don’t like your plan?Yes. If you don’t like your Medicare Advantage plan, you can switch back to Original Medicare during the Medicare Open Enrollment Period. This period runs each year from Oct. 15 to Dec. 7. Your Medicare Advantage plan will continue to cover you for the rest of the year, though you must still pay premiums. Your Original Medicare coverage will start on Jan. 1 of the new year.

You can also switch back to Original Medicare during the Medicare Advantage Open Enrollment Period. This period runs from Jan. 1 through March 31.

In either case, you should remember to sign up for a standalone Medicare Part D prescription drug plan to help cover your prescription medications. Or you can sign up for Medicare Supplement insurance — also called Medigap — when you make the switch.Does getting a Medicare Advantage plan make you lose Original Medicare?A Medicare Advantage plan effectively replaces your Original Medicare coverage. If you get a Medicare Advantage plan, you’ll still have Medicare, but most of your Medicare Part A and Part B coverage will come from the Medicare Advantage plan.

You’ll want to carry your Medicare Advantage card with you to receive Medicare services. But keep your red, white and blue Medicare card in a safe place in case you ever want to switch back to Original Medicare.Last Modified: February 4, 2025Share This Page5 Cited Research Articles

- U.S. Centers for Medicare & Medicaid Services. (2022). Fact Sheet - 2022 Part C and D Star Ratings. Retrieved from https://www.cms.gov/files/document/2022-star-ratings-fact-sheet1082021.pdf

- U.S. National Library of Medicine. (2017, September 5). Physician Reimbursement in Medicare Advantage Compared with Traditional Medicare and Commercial Health Insurance. Retrieved from https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5710575/

- Kaiser Family Foundation. (n.d.). Medicare Advantage. Retrieved from https://www.kff.org/faqs/medicare-open-enrollment-faqs/ive-been-enrolled-in-a-medicare-advantage-plan-for-several-years-but-i-want-to-switch-to-traditional-medicare-can-i-make-that-change-during-the-medicare-open-enrollment-period/

- U.S. Centers for Medicare & Medicaid Services. (n.d.) Medigap and Medicare Advantage Plans. Retrieved from https://www.medicare.gov/supplements-other-insurance/whats-medicare-supplement-insurance-medigap/medigap-medicare-advantage-plans

- U.S. Centers for Medicare & Medicaid Services. (n.d.). Understanding Medicare Advantage Plans. Retrieved from https://www.medicare.gov/Pubs/pdf/12026-Understanding-Medicare-Advantage-Plans.pdf

- Edited By

Calling this number connects you to one of our trusted partners.

If you're interested in help navigating your options, a representative will provide you with a free, no-obligation consultation.

Our partners are committed to excellent customer service. They can match you with a qualified professional for your unique objectives.

We/Our Partners do not offer every plan available in your area. Any information provided is limited to those plans offered in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

888-694-0290Your web browser is no longer supported by Microsoft. Update your browser for more security, speed and compatibility.

If you need help pricing and building your medicare plan, call us at 844-572-0696