Medicare Late Enrollment Penalties

If you don’t sign up for Medicare when you’re first eligible, you may have to pay a late enrollment penalty. The penalty raises your monthly Medicare Part A premium by 10 percent for a fixed period of time. For Medicare Part B, the penalty is 10 percent for every 12-month period you delay.

- Written by Terry Turner

Terry Turner

Senior Financial Writer and Financial Wellness Facilitator

Terry Turner has more than 35 years of journalism experience, including covering benefits, spending and congressional action on federal programs such as Social Security and Medicare. He is a Certified Financial Wellness Facilitator through the National Wellness Institute and the Foundation for Financial Wellness and a member of the Association for Financial Counseling & Planning Education (AFCPE®).

Read More- Edited By

Matt Mauney

Matt Mauney

Financial Editor

Matt Mauney is an award-winning journalist, editor, writer and content strategist with more than 15 years of professional experience working for nationally recognized newspapers and digital brands. He has contributed content for ChicagoTribune.com, LATimes.com, The Hill and the American Cancer Society, and he was part of the Orlando Sentinel digital staff that was named a Pulitzer Prize finalist in 2017.

Read More- Reviewed By

Aflak Chowdhury

Aflak Chowdhury

Medicare Expert

Aflak Chowdhury is a Medicare expert and independent insurance broker specializing in group health insurance. He has worked for major providers including Humana and Principal Financial Group and today works mainly in the small group market.

Read More- Published: May 7, 2020

- Updated: October 10, 2023

- 5 min read time

- This page features 7 Cited Research Articles

Why Does Medicare Have Late Enrollment Penalties?

Like most health insurance plans, Medicare depends on healthy people paying into the program to pay the health care costs of those who are unhealthy.

Delaying enrollment would mean newly eligible people may not sign up until their health declines. This would increase the price of premiums for everyone enrolled in Medicare.

Medicare Parts That Charge Late Enrollment Penalties- Medicare Part A Hospitalization Insurance

- The penalty is based on the length of your delay in enrolling.

- Medicare Part B Medical Insurance

- The penalty continues to rise for every 12 months you wait to enroll.

- Medicare Part D Prescription Drug Insurance

- The penalty is based on a calculation of a base number that is adjusted each year times the number of months you delayed enrollment.

Part A Late Enrollment Penalty

People who don’t qualify for premium-free Medicare Part A hospital insurance have to buy it. If you miss your enrollment period, you will also have to pay a penalty on top of the premium.

The penalty is 10 percent of the monthly premium. You’ll have to pay the penalty for twice as many years as you waited to sign up. So if you waited three years past your enrollment period, you’d have to pay the premium each month for the next three years after signing up.

If you paid Medicare payroll taxes for at least 10 years, you should qualify for premium-free Medicare Part A. There is no late enrollment penalty for that situation.

Medicare Part A and Part B Open EnrollmentYou have seven months around your 65th birthday to sign up for Medicare Part A and/or Part B. Open enrollment begins three months before your 65th birthday month and ends three months after your birthday month.Have you selected your 2024 Medicare plan?Maximize your Medicare savings by connecting with a licensed insurance agent. Annual Enrollment is open until December 7th.Part B Late Enrollment Penalty

If you didn’t sign up for Medicare Part B during your open enrollment period, you will have to pay a 10 percent penalty for each 12-month period you waited to sign up. Medicare Part B covers doctor visits and other medical services.

Most people stuck with the Medicare Part B penalty have to continue paying it every month for as long as they have Medicare Part B.

So if you waited for three years after your open enrollment period, you’d have to pay a penalty equal to 30 percent of your premium on top of that monthly payment for as long as you have Medicare Part B.

Part B Coverage DelayMedicare Part B doesn’t kick in until three months after you enroll. If you wait until your 65th birthday, or anytime in the next three months of your open enrollment, you may experience a gap in medical coverage.Part D Late Enrollment Penalty

Enrolling in Medicare Part D prescription drug coverage is voluntary. But if you don’t sign up for it when you’re first eligible, you may have to pay a penalty if you enroll later. You’ll have to continue paying the penalty for as long as you have Medicare Part D.

John Clark, CLTC®, NSSA® | 0:29 What is the penalty for not signing up for a Medicare Part D drug plan? Have you selected your 2023 Medicare plan?Replay VideoJohn Clark, licensed insurance advisor and owner of Senior Solutions Insurance Agency, explains the penalty for not signing up for a Part D prescription drug plan.

Have you selected your 2023 Medicare plan?Replay VideoJohn Clark, licensed insurance advisor and owner of Senior Solutions Insurance Agency, explains the penalty for not signing up for a Part D prescription drug plan.The Part D late enrollment penalty is determined each year through a math formula. The formula uses something called the “national base beneficiary premium.” This amount is based on an average bid insurers submit to the Part D program and the number of people enrolled in each plan.

For 2022, that figure is $33.37 – up from $33.06 in 2021.

The penalty is determined by multiplying one percent of that figure, rounding up to the nearest $0.10 and multiplying that number by the number of months you waited to sign up.

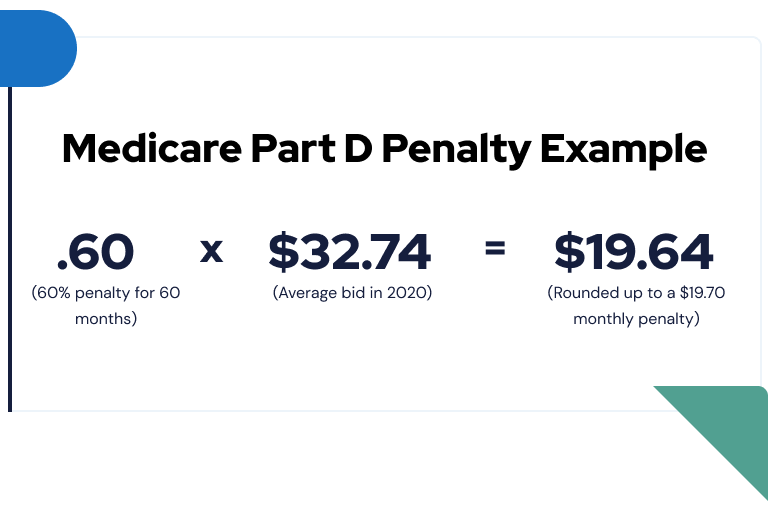

For example, if your open enrollment period ended on New Year’s Eve 2014, but you waited until mid-December 2019 to sign up for Part D, here’s how your penalty would be calculated for 2020 when the penalty was $32.74 per month.

You’d have to pay a $19.70 penalty on top of your premium each month in 2020.

How to Avoid Medicare Late Enrollment

If you don’t have health insurance, the simplest way to avoid Medicare Part A and Part B late enrollment penalties is to sign up during your open enrollment window.

But if you have health coverage through your or your spouse’s employer and want to keep it for the time being, you may qualify for a special enrollment period later on.

If you’re covered under a private group plan, your Medicare Special Enrollment period is either:- Anytime while you are still covered by the group plan.

- In the eight months beginning the month after your employment ends or the group coverage plan ends, whichever occurs first.

How to Avoid the Medicare Part D Late Enrollment Penalty

If you don’t sign up for Medicare Part D prescription drug coverage, or a Medicare Advantage plan that includes drug coverage you could be stuck with a penalty if you change your mind later on.

But there are ways to avoid the penalty.

Four Ways to Avoid Medicare Part D Enrollment Penalties- Sign up for Medicare Part D when you first become eligible three months before your 65th birthday.

- Never go 63 days in a row or more without prescription drug coverage through Medicare or another creditable insurer.

- Keep proof of your prescription drug coverage to show you have had no 63-day gaps in your prescription drug coverage.

- Choose to never enroll in a Medicare Part D drug plan or any Medicare Advantage drug plan.

Last Modified: October 10, 2023Share This Page7 Cited Research Articles

- Morgan-Besecker, T. (2018, October 21). Late Enrollers in Medicare Face a Hefty Penalty. Retrieved from https://apnews.com/1d57b212a0c349b0a955a9d730e0006a

- Jaffe, S. (2017, June 6). Feds to Waive Penalties for Some Who Signed Up Late for Medicare. Retrieved from https://khn.org/news/feds-to-waive-penalties-for-some-who-signed-up-late-for-medicare/

- Centers for Medicare & Medicaid Services. (n.d.). Part A Late Enrollment Penalty. Retrieved from https://www.medicare.gov/basics/costs/medicare-costs/avoid-penalties

- Centers for Medicare & Medicaid Services. (n.d.). Part B Late Enrollment Penalty. Retrieved from https://www.medicare.gov/basics/costs/medicare-costs/avoid-penalties

- Centers for Medicare & Medicaid Services. (n.d.). Part D Late Enrollment Penalty. Retrieved from https://www.medicare.gov/drug-coverage-part-d/costs-for-medicare-drug-coverage/part-d-late-enrollment-penalty

- Centers for Medicare & Medicaid Services. (n.d.). 3 Ways to Avoid the Part D Late Enrollment Penalty. Retrieved from https://www.medicare.gov/drug-coverage-part-d/costs-for-medicare-drug-coverage/part-d-late-enrollment-penalty/3-ways-to-avoid-the-part-d-late-enrollment-penalty

- Centers for Medicare & Medicaid Services. (n.d.). Part A and Part B Sign Up Periods. Retrieved from https://www.medicare.gov/basics/get-started-with-medicare/sign-up/when-does-medicare-coverage-start

- Edited By

Calling this number connects you to one of our trusted partners.

If you're interested in help navigating your options, a representative will provide you with a free, no-obligation consultation.

Our partners are committed to excellent customer service. They can match you with a qualified professional for your unique objectives.

We/Our Partners do not offer every plan available in your area. Any information provided is limited to those plans offered in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

888-694-0290Your web browser is no longer supported by Microsoft. Update your browser for more security, speed and compatibility.

If you need help pricing and building your medicare plan, call us at 844-572-0696