Average Retirement Spending in 2025: Typical Expenses + Budgeting Tips

Understanding the average spending habits of current retirees will help inform your retirement savings plan and avoid accumulating debt. Our guide will cover everything you need to know about the latest retirement spending trends and budgeting tips to prepare for your golden years.

- Written by Christian Simmons

Christian Simmons

Financial Writer

Christian Simmons is a writer for RetireGuide and a member of the Association for Financial Counseling & Planning Education (AFCPE®). He covers Medicare and important retirement topics. Christian is a former winner of a Florida Society of News Editors journalism contest and has written professionally since 2016.

Read More- Edited By

Lamia Chowdhury

Lamia Chowdhury

Financial Editor

Lamia Chowdhury is a financial content editor for RetireGuide and has over three years of marketing experience in the finance industry. She has written copy for both digital and print pieces ranging from blogs, radio scripts and search ads to billboards, brochures, mailers and more.

Read More- Published: March 29, 2023

- Updated: March 21, 2025

- 8 min read time

- This page features 8 Cited Research Articles

- Edited By

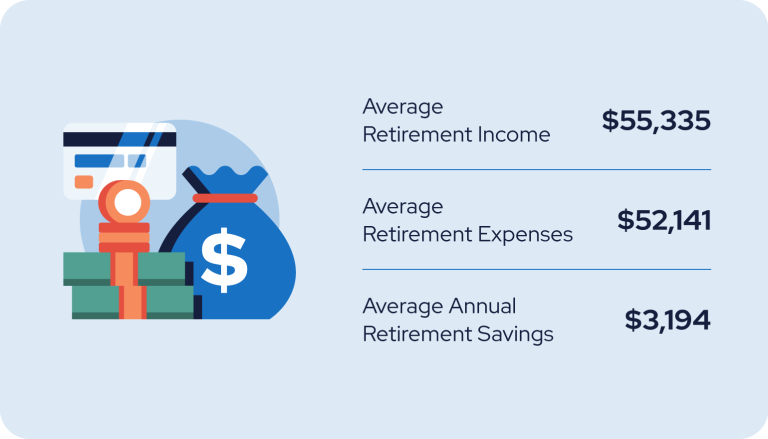

According to the Bureau of Labor Statistics, on average, people ages 65 and older spent $52,141 in 2021 — about $14,000 less than the $66,928 spending average of the general population. This suggests that one year of retirement spending amounts to 80% of your annual preretirement income.

The more you understand about current retiree spending trends, the easier it will be to prepare for your own retirement. To help inform your savings plan, we’ll look at average retirement spending habits for current retirees and their largest expenses and outline helpful budgeting and savings tips.

- In 2021, the average spending for those aged 65 or older was $52,141 per year, which comes down to $4,345 monthly. This covers various costs like housing, food, health care, and entertainment.

- Of the retirees surveyed, 48% spent under $2,000 monthly, 1 in 3 spent $2,000-$3,999, and 18% spent over $3,999 in 2022..

- On average, retirees reported that 25% of their monthly spending went toward food expenses in 2022.

- Food costs were reported as the fastest-growing expense by 44% of seniors in 2021.

Typical Spending in Retirement

On average, people ages 65 and older spend only about $3,000 less than their total income each year.

- People ages 65 and older had an average income of $55,335 in 2021.

- Average annual expenses for people ages 65 and older totaled $52,141 in 2021.

- 48% of retirees surveyed reported spending less than $2,000 a month in 2022.

- 1 in 3 retirees reported spending between $2,000 and $3,999 per month.

- 18% reported spending more than $3,999 per month.

Recently, the average cost of retirement per month has become more affordable for more retirees. While monthly living expenses in retirement were less than $2,000 for 42% of retirees in 2020, that number increased to 48% in 2022.

*Ad: Clicking will take you to our partner Annuity.org.

Housing Costs

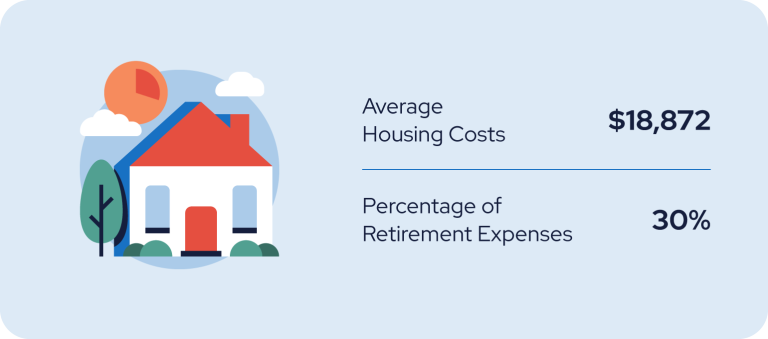

While about 80% of people ages 65 and older own their homes, almost a third of monthly spending expenses for retirees goes toward housing.

On average, people ages 65 and older spent a total of $18,872 on housing in 2021. Below is a breakdown of their different housing costs.

| Housing Expense | Average Spending |

|---|---|

| Owned Dwellings | $6,864 |

| Rented Dwellings | $2,759 |

| Other Types of Lodging | $763 |

| Housing Supplies | $820 |

| Household Operations | $1,442 |

| House Furnishings and Equipment | $2,303 |

- On average, people ages 65 and older spent $3,921 on utilities, fuels and public services in 2021.

- Housing costs were reported as the fastest-growing expense by 24% of seniors in 2021.

While housing costs were one of the fastest-growing expenses for almost a fourth of seniors in 2021, that was also the year where housing appreciation peaked at an all-time high of 17.8%. Since housing only appreciated by 5% in 2023, housing expenses likely aren’t increasing as fast today.

Health Care Costs

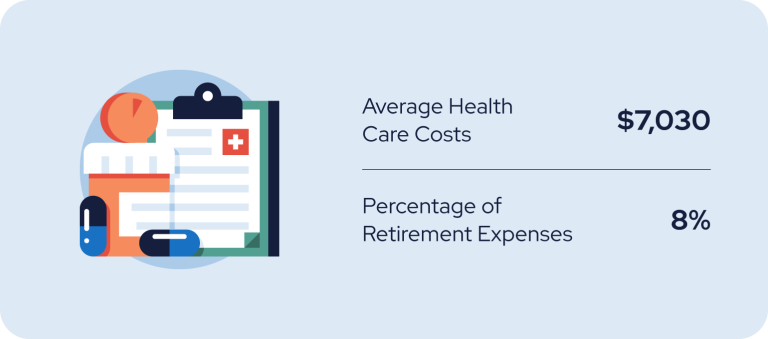

Health care costs are one of the most important budgeting categories you need to plan for. With the right retirement savings plan, you can ensure you’re able to afford necessary health care coverage.

- On average, retirees reported that 5% of their monthly spending went toward out-of-pocket medical costs and 8% went toward medical and health insurance in 2022.

- 20% of adults ages 65 and older reported out-of-pocket medical expenses of more than $2,000 in 2021.

- The baseline monthly premium for Medicare Part B is $164.90 in 2023.

- On average, people ages 65 and older spent $7,030 on health care in 2021.

- Medical costs were reported as the fastest-growing expense by 19% of seniors in 2021.

In total, you could end up spending over 10% of your annual income on medical costs and insurance.

Transportation Expenses

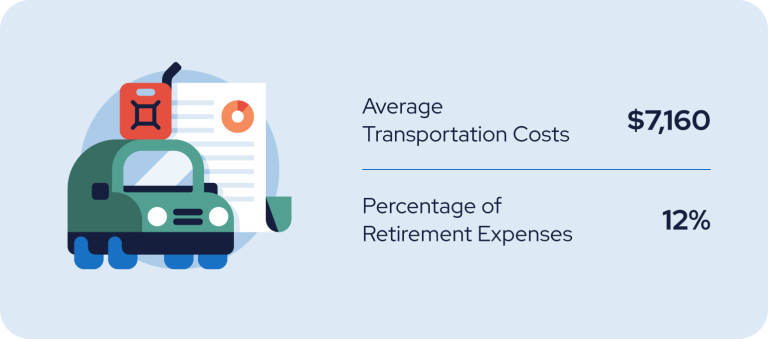

While fewer retirees are licensed to drive than younger individuals, many continue to spend a considerable amount on transportation costs in their golden years. In fact, according to the Federal Highway Administration, in 2020, there were about 31 million licensed drivers ages 70 and older.

On average, people ages 65 and older spent $7,160 on transportation in 2021. Below is a full breakdown of transportation expenses.

| Transportation Expense | Average Spending |

|---|---|

| Vehicle Purchases | $2,777 |

| Vehicle Purchases | $1,396 |

| Other Vehicle Expenses | $2,707 |

| Public Transportation | $279 |

- On average, retirees reported that 12% of their monthly spending went toward transportation expenses in 2022.

- Transportation costs were reported as the fastest-growing expense by 7% of seniors in 2021.

Research suggests that mobility limitations impact over 35% of persons ages 70 and older. To keep yourself socially engaged as you age, it’s a good idea to carve out a budget for accessible transportation services.

*Ad: Clicking will take you to our partner Annuity.org.

Cost of Food

Food was the most common fastest growing expense reported by seniors in 2021. 73% of the average food budget for people ages 65 and older was spent on food at home, whereas about 30% was spent on eating out.

On average, retirees reported that 25% of their monthly spending went toward food expenses in 2022. Below is a further breakdown of food expenses.

| Food Expense | Average Spending |

|---|---|

| Food at Home | $4,497 |

| Poultry, Fish, Meat and Eggs | $936 |

| Baking Products and Cereal | $594 |

| Dairy Products | $450 |

| Fruits and Vegetables | $884 |

| Other Types of Food at Home | $1,633 |

| Dining Out | $1,994 |

- On average, retirees reported that 25% of their monthly spending went toward food expenses in 2022.

- People ages 65 and older spent an average of $439 on alcoholic beverages in 2021.

- 19% of seniors surveyed reported visiting a food pantry or applying for food stamps in 2021.

- Food costs were reported as the fastest-growing expense by 44% of seniors in 2021.

One easy way to keep your food budget down during retirement is to limit the amount you eat out. Preparing food at home can help you improve your health and conserve your retirement savings.

Cost of Debt

The most common form of debt among retirees was credit card debt. While the majority of retirees had some type of debt, over 80% described their debt as either “easily manageable” or “manageable.”

Among retirees, 96% reported having debt in 2022. Below is a full breakdown of senior debt:

| Debt Type | Percentage of Seniors With Debt |

|---|---|

| Credit Card | 40% |

| Mortgage | 30% |

| Car Loan | 23% |

| Medical | 11% |

| Home Equity Loan | 7% |

| Student Loan Debt | 4% |

- About 11% of retirees reported their debt was at an “unmanageable” or “crushing” level in 2022.

- 46% of retirees described their debt as “easily manageable” in 2022.

- 43% of retirees described their debt as “manageable” in 2022.

Debt can be easy to accrue but difficult to pay off. If you’re feeling overwhelmed by your debt level, consider reevaluating your budget, enrolling in a debt management program or postponing your retirement until you’re more financially stable.

Other Retirement Expenses

Other notable retirement expenses include entertainment and clothing. The former costs 8% of a retiree’s monthly budget on average, while the latter costs 7%.

- On average, people ages 65 and older spent $2,850 on personal insurance and pensions in 2021.

- On average, people ages 65 and older spent $2,889 on entertainment in 2021.

- On average, retirees reported that 8% of their monthly spending went toward entertainment expenses in 2022.

- On average, people ages 65 and older spent $986 on apparel and services in 2021.

- On average, retirees reported that 7% of their monthly spending went toward clothing expenses in 2022.

- On average, people ages 65 and older spent $138 on reading materials in 2021.

- On average, people ages 65 and older spent $280 on education in 2021.

While education isn’t as costly as housing or food, it can significantly impact your budget if you plan to help pay for part of your grandchildren’s education. Consider investing in a Roth IRA for your grandchildren to help set them up for success down the road.

Typical Retirement Budget + Planning Tips

The average retirement expenses above will help you create a budget of your own. Use the printable budgeting worksheet below to estimate your future retirement expenses and determine the total sum you should have saved.

If you’re having trouble saving for your goal sum, try following the following budgeting tips:

- Avoid loans: Debt can build up fast, and loans can accrue compound interest over long periods of time. Try to pay for things up front instead of taking a loan when possible.

- Sleep on large purchases: When making a large purchase, take some time to think about its pros and cons. If its cost isn’t worth its value, pass on the purchase.

- Don’t use credit cards: Credit cards are another easy way to rack up debt. Either lower your credit card limit or don’t use a credit card at all.

- Be realistic: While it’s tempting to create lofty savings goals, it’s important to stay realistic so you don’t get discouraged.

- Avoid recurring fees: Monthly subscription services are easy to forget about and can drain your income fast. When you subscribe to a service, it’s a good idea to set a recurring reminder in your phone about the payment so you remember to cancel when it’s not needed.

The more you know about average retirement costs, the easier it is to budget for your golden years. To figure out whether you’re on track to retire, it’s a good idea to consult a financial advisor.

Connect With a Financial Advisor Instantly

Our free tool can help you find an advisor who serves your needs. Get matched with a financial advisor who fits your unique criteria. Once you’ve been matched, consult for free with no obligation.

8 Cited Research Articles

- BLS.gov (2021). Consumer Expenditure Surveys. Retrieved from https://www.bls.gov/opub/reports/consumer-expenditures/2021/home.htm#:~:text=Consumer%20Expenditure%20Surveys%2C-,2021%C2%A0,-%5B%2B%5DTable%2015

- Bearden, B. (2022, October 6). 2022 Spending in Retirement Survey: Understanding the Pandemic’s Impact. Retrieved from https://www.ebri.org/docs/default-source/ebri-issue-brief/ebri_ib_572_spendinginret-6oct22.pdf

- Census.gov (2023, January 26). Quarterly Residential Vacancies and Home Ownership, Fourth Quarter 2022. Retrieved from https://www.census.gov/housing/hvs/current/index.html

- The Senior Citizens League (2021). 2021 Retirement Survey. Retrieved from https://seniorsleague.org/older-consumers-report-food-as-fastest-growing-cost-in-2021/

- The Commonwealth Fund (2021, October 1). When Costs Are a Barrier to Getting Health Care: Reports from Older Adults in the United States and Other High-Income Countries. Retrieved from https://www.commonwealthfund.org/publications/surveys/2021/oct/when-costs-are-barrier-getting-health-care-older-adults-survey

- Medicare.gov (2023). Medicare costs. Retrieved from https://www.medicare.gov/basics/costs/medicare-costs

- U.S. Department of Transportation (2022, January). Highway Statistics. Retrieved from https://www.fhwa.dot.gov/policyinformation/statistics/2020/dl22.cfm

- Frontiers in Physiology (2020). Mobility in Older Community-Dwelling Persons: A Narrative Review. Retrieved from https://www.frontiersin.org/articles/10.3389/fphys.2020.00881/full

Calling this number connects you to one of our trusted partners.

If you're interested in help navigating your options, a representative will provide you with a free, no-obligation consultation.

Our partners are committed to excellent customer service. They can match you with a qualified professional for your unique objectives.

We/Our Partners do not offer every plan available in your area. Any information provided is limited to those plans offered in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

844-897-8632Your web browser is no longer supported by Microsoft. Update your browser for more security, speed and compatibility.

If you need help pricing and building your medicare plan, call us at 844-572-0696