What Are I Bonds?

Series I savings bonds, commonly called I bonds, are issued by the U.S. government to protect your investment from inflation risk. They earn interest from a fixed and variable inflation rate, which is adjusted twice a year. Since I bonds are backed by the full faith and credit of the U.S. government, they are low-risk investment options that keep your retirement savings from losing buying power.

- Written by Lindsey Crossmier

Lindsey Crossmier

Financial Writer

Lindsey Crossmier is an accomplished writer with experience working for The Florida Review and Bookstar PR. As a financial writer, she covers Medicare, life insurance and dental insurance topics for RetireGuide. Research-based data drives her work.

Read More- Edited By

Savannah Pittle

Savannah Pittle

Senior Financial Editor

Savannah Pittle is a professional writer and content editor with over 16 years of professional experience across multiple industries. She has ghostwritten for entrepreneurs and industry leaders and been published in mediums such as The Huffington Post, Southern Living and Interior Appeal Magazine.

Read More- Reviewed By

Toby Walters, CFA®

Toby Walters, CFA®

Chartered Financial Analyst and Paraplanner

Toby Walters, CFA®, has over 25 years of financial research experience. With a knowledge and understanding of researching and analyzing financial data, he has developed a unique and experienced viewpoint on money matters. He has been a chartered financial analyst since 2003, and most recently a portfolio analyst and paraplanner.

Read More- Published: April 21, 2023

- Updated: May 17, 2023

- 6 min read time

- This page features 9 Cited Research Articles

- Edited By

How Do I Bonds Work?

I bonds work as secure government-issued savings vehicles that help your retirement savings keep up with high inflation rates. Every six months, your I bonds interest rate is updated and compounded to reflect the current inflation rates. This means the interest earned within the last six months will added to the principal and start earning interest at the new rate. Simply put, your interest will earn new interest upon itself.

Your I bond will mature at 30 years, but you can cash it in early after a year of ownership. The interest on your I bond is earned as a combination rate, which is calculated based on a fixed rate and an inflation rate.

When Do I Bonds Pay Interest?

Both paper and electronic I bonds pay interest all at once. For paper I bonds, this occurs when you cash in the bond. Electronic I bonds pay interest when you cash in the bond, or automatically after 30 years when the bond reaches maturity if you haven’t already cashed in.

How To Buy & Redeem I Bonds

You can buy an electronic I bond within your TreasuryDirect account online or buy paper I bonds with your tax refund.

To buy a paper I bond, you don’t need a TreasuryDirect account. You’ll need a Form 8888 to file with your tax return to the IRS.

There are different purchase limits for your I bond, depending on which type you purchase. These limits are the maximum combined limit; you can purchase $10,000 in electronic I bonds and an additional $5,000 in paper I bonds with your tax refund.

| I Bond Type | Purchase Limit in One Year |

|---|---|

| Electronic I Bond | $10,000 |

| Paper I Bond | $5,000 (with your tax refund) |

There are different steps to redeeming electronic and paper I bonds.

- Paper I Bonds

- Cash out your paper I bond in person at a participating bank, or:

- Fill out FS Form 1522 and mail it to the address on the form.

- Electronic I Bonds

- Log in to your TreasuryDirect account

- Go to the ManageDirect tab

- Use the link provided for redeeming securities and follow the prompts

Note that if you hold an electronic I bond and wait until maturity to cash out, you’ll automatically receive your earnings as a Certificate of Indebtedness within your TreasuryDirect account. Otherwise, you can redeem your bond and have the funds directly deposited into your bank account.

Tax Implications of I Bonds

The interest you earn on your I bond isn’t subject to state or local income taxes. While your I bond interest is subject to federal income taxes at your normal income tax rate, there are ways to lessen the tax burden.

If you use the interest toward higher education costs, for example, you can avoid paying federal income taxes. However, some restrictions apply to qualify for this tax benefit, including that the owner of the bond must have been at least 24 years old when the bond was issued.

Seek the guidance of a trusted tax professional if you are unsure about the tax implications for your situation.

I Bond Pros and Cons

The main pro with I bonds is their ability to hedge inflation with fluctuating interest rates, while also being fully protected by the U.S. government. This means the government promises to fulfill its financial obligations in a timely manner.

Like any savings vehicle, there are drawbacks to consider. The biggest con is their lower rewards compared to other investment products. Carefully consider each pro and con to determine if an I bond would fit in your retirement plan.

- Hedges inflation

- Higher interest rates than some alternative savings vehicles, like CDs

- Interest rate rises with inflation

- Good for long-term savings goals

- Tax benefits

- Backed by the full faith and credit of the U.S. government

- You’ll lose interest if you cash out your I bond before 5 years of ownership

- Yearly purchase limit

- Lower rewards compared to relatively higher-risk investments, like stocks

- Interest rate declines as inflation declines

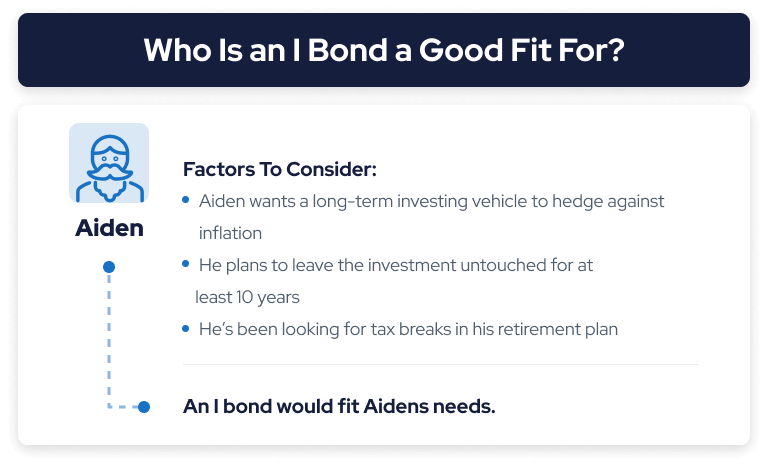

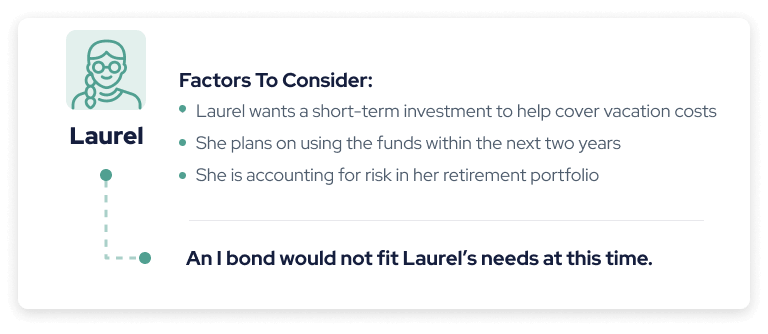

Investing with I Bonds

I bonds afford risk-averse investors the opportunity to retain their savings’ purchasing power and diminish inflation risk. In the prevailing interest rate environment, you can make a modest amount of profit with an I bond while still retaining your money’s worth as general costs of goods and services rise.

I bonds may also offer considerably more attractive interest rates than similar financial products, like CDs. Considering their potential to grow this interest for 30 years under favorable market conditions, I bonds are well-suited for investors comfortable with long-term options. But because of the early withdrawal penalties they carry, they may not be the product for you if you’re looking to withdrawal within the first five years.

If your goal is a high reward from your investments, consider I bonds a piece of your retirement portfolio — not the whole pie. Diversifying your portfolio with other retirement income options, like annuities, CDs or stocks, might be better suited to your investment preferences.

These products each carry different levels of risk and reward you can tailor to your preferences. For example, if you want high rewards and can tolerate the associated risks, you might prefer investment options like stocks and index-linked annuities.

I Bond FAQs

Editor Malori Malone contributed to this article.

Connect With a Financial Advisor Instantly

Our free tool can help you find an advisor who serves your needs. Get matched with a financial advisor who fits your unique criteria. Once you’ve been matched, consult for free with no obligation.

9 Cited Research Articles

- U.S. Inflation Calculator. (2023, May). Current US Inflation Rates: 2000-2023. Retrieved from https://www.usinflationcalculator.com/inflation/current-inflation-rates/

- Federal Deposit Insurance Corporation. (2023, April 217). Retrieved from https://www.fdic.gov/resources/bankers/national-rates/index.html

- TreasuryDirect. (2023). Using Bonds for Higher Education. Retrieved from https://www.treasurydirect.gov/savings-bonds/tax-information-ee-i-bonds/using-bonds-for-higher-education/

- TreasuryDirect. (2023). Cash EE or I Savings Bonds. Retrieved from https://www.treasurydirect.gov/savings-bonds/cashing-a-bond/

- TreasuryDirect. (2023). Tax Information for EE and I Bonds. Retrieved from https://www.treasurydirect.gov/savings-bonds/tax-information-ee-i-bonds/

- TreasuryDirect. (2023). TreasuryDirect FAQ. Retrieved from https://www.treasurydirect.gov/indiv/help/treasurydirect-help/faq/

- Internal Revenue Service. (2022, November 18). Now You Can Buy U.S. Series I Savings Bonds for Anyone With Your Tax Refund. Retrieved from https://www.irs.gov/refunds/now-you-can-buy-us-series-i-savings-bonds-for-anyone-with-your-tax-refund

- TreasuryDirect. (2022). I Bonds Interest Rates. Retrieved from https://www.treasurydirect.gov/savings-bonds/i-bonds/i-bonds-interest-rates/

- TreasuryDirect. (2022). I Bonds. Retrieved from https://www.treasurydirect.gov/savings-bonds/i-bonds/

Calling this number connects you to one of our trusted partners.

If you're interested in help navigating your options, a representative will provide you with a free, no-obligation consultation.

Our partners are committed to excellent customer service. They can match you with a qualified professional for your unique objectives.

We/Our Partners do not offer every plan available in your area. Any information provided is limited to those plans offered in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

844-359-1705Your web browser is no longer supported by Microsoft. Update your browser for more security, speed and compatibility.

If you need help pricing and building your medicare plan, call us at 844-572-0696