Health Costs in Retirement

Declining health and the high out-of-pocket costs for health care can have a negative effect on retirement. The average couple needs $295,000 at age 65 to cover health care costs in retirement. Know what health costs to expect so these expenses don’t upend your retirement plans.

- Written by Terry Turner

Terry Turner

Senior Financial Writer and Financial Wellness Facilitator

Terry Turner has more than 35 years of journalism experience, including covering benefits, spending and congressional action on federal programs such as Social Security and Medicare. He is a Certified Financial Wellness Facilitator through the National Wellness Institute and the Foundation for Financial Wellness and a member of the Association for Financial Counseling & Planning Education (AFCPE®).

Read More- Edited By

Matt Mauney

Matt Mauney

Financial Editor

Matt Mauney is an award-winning journalist, editor, writer and content strategist with more than 15 years of professional experience working for nationally recognized newspapers and digital brands. He has contributed content for ChicagoTribune.com, LATimes.com, The Hill and the American Cancer Society, and he was part of the Orlando Sentinel digital staff that was named a Pulitzer Prize finalist in 2017.

Read More- Financially Reviewed By

Ebony J. Howard, CPA

Ebony J. Howard, CPA

Credentialed Tax Expert at Intuit

Ebony J. Howard is a certified public accountant and freelance consultant with a background in accounting, personal finance, and income tax planning and preparation. She specializes in analyzing financial information in the health care, banking and real estate sectors.

Read More- Published: April 30, 2020

- Updated: August 14, 2023

- 4 min read time

- This page features 16 Cited Research Articles

- Edited By

The cost of health care in retirement is more of an issue today than in generations past because, even more than pensions, retiree health insurance is becoming extinct.

Between 1988 and 2018, the share of large companies offering retiree health plans dropped from 66 percent to 18 percent, according to the Kaiser Family Foundation.

Among those firms offering retiree health insurance, 67 percent continue the insurance after the retiree reaches Medicare eligibility. Kaiser reports that 88 percent of firms offering retiree health insurance extend that coverage to spouses.

Health Insurance Costs in Retirement

Some workers are worried about their ability to afford health insurance as they approach retirement, according to a poll by the Institute for Healthcare Policy & Innovation at the University of Michigan.

According to that poll, 45 percent of people aged 50 to 64 are concerned they won’t be able to afford insurance in retirement, and 68 percent are concerned about federal changes to health insurance.

The same poll, released in January 2019, found 19 percent of workers aged 50 to 64 saying they stayed in their current job, rather than retiring or changing jobs, to keep their health care coverage.

Another 8 percent of people in their early 60s were putting off medical procedures until they could receive Medicare at age 65.

Limitations of Medicare

Many misunderstand the limitations of Medicare, the federal health insurance program for people 65 and older. Medicare does not cover dental, vision or hearing care. And there’s a charge for prescription drug coverage, also known as Medicare Part D.

In addition, expect to pay a premium for Medicare Part B and Medicare Advantage plans to cover eye care and dental.

For these reasons and others, it’s worthwhile to consider supplemental health insurance — or Medigap — to make up for some of the gaps in coverage, and to pick up deductibles and coinsurance.

If you’re new to Medicare, make sure you sign up for benefits three months before you turn 65. This will enable you to start receiving the benefit as soon as you’re eligible.

If you sign up late, you may have to pay a late enrollment penalty for as long as you are on Medicare.

*Ad: Clicking will take you to our partner Annuity.org.

Out-of-Pocket Retirement Health Costs

In 2019, the average health care cost in retirement was $135,000 for men and $150,000 for women, according to an annual estimate by Fidelity.

Couples retiring at age 65 needed $285,000 to cover health care costs, assuming they were enrolled in Original Medicare (Parts A and B) and had Part D prescription drug coverage. The estimates also include medical expenses that Medicare doesn’t cover, such as vision care and hearing aids.

This amount includes out-of-pocket costs including premiums, deductibles, coinsurance and copays.

Medicare premiums are typically the single biggest health care cost in retirement — and also the most unpredictable.

While most people pay nothing for Medicare Part A hospital insurance, you will have to pay Medicare Part B medical insurance’s monthly premiums — and that cost is tied to inflation.

Medicare Part B premiums shot up 14.5% in 2022 over the previous year. It was one of the largest jumps in Medicare’s history, according to the Kaiser Family Foundation. The cost of Medicare Part B premiums rose 70% between 2012 and 2022, according to the foundation.

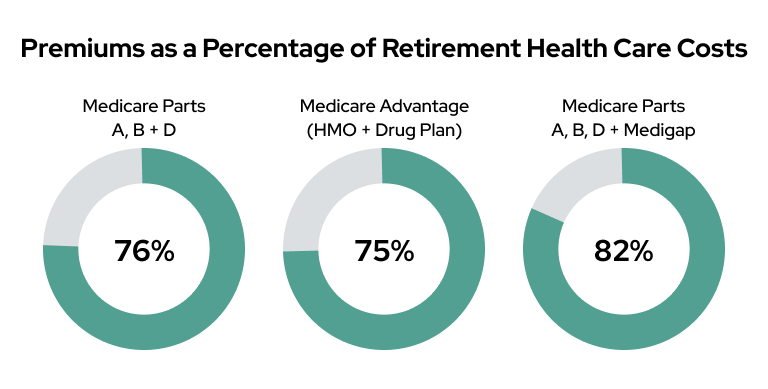

Depending on what combination of plans you have, health insurance premiums can add up to 75% to 82% of your total health costs in retirement, according to a 2021 white paper from T. Rowe Price.

Not factored into these estimates is long-term care such as nursing home or assisted living expenses.

When long-term care costs are added in, the picture becomes even bleaker. It’s estimated that retiree households will face about $100,000 in out-of-pocket medical expenses — including long-term care — from their early 70s and older. The top 5 percent will have to pay about $300,000.

Analysts at the National Bureau for Economic Research found that retirees who had initially good health had higher total spending on health care than those in poor health, because healthy retirees tend to live longer, and medical expenses increase with age.

However, those who are initially in nursing homes have higher expenses because of the high costs of those facilities.

The average monthly cost of nursing home care in 2020 is $7,513 for a semi-private room and $8,517 for a private room, according to Genworth, an insurance company based in Virginia.

In-home care is estimated at more than $4,200 per month in 2020, based on a 44-hour work week.

These estimates are expected to be much higher by the time younger people reach retirement age, though health care costs have only risen modestly in recent years with a 3.6 percent increase from 2017 to 2019.

16 Cited Research Articles

- Neuman, T., Cubanski, J., and Freed, M. (2022, January 12). Monthly Part B Premiums and Annual Percentage Increases. Retrieved from https://www.kff.org/medicare/slide/monthly-part-b-premiums-and-annual-percentage-increases/

- Banerjee, S. (2021, March). A New Way to Calculate Retirement Health Care Costs. Retrieved from https://www.troweprice.com/content/dam/fai/Collections/DC%20Resources/a-new-way-to-calculate-retirement-health-care-costs/CalculateRetirementHealthCareCosts.pdf

- Exley, R. (2020, October 3). Here’s How Much Health Insurance Costs if You Retire Early. Retrieved from https://www.cnbc.com/2020/10/03/how-much-health-insurance-premiums-cost-if-you-retire-early.html

- Lankford, K. (2020, August 7). Preparing for Medical Expenses in Retirement. Retrieved from https://money.usnews.com/money/retirement/aging/articles/preparing-for-medical-expenses-in-retirement

- Fidelity. (2020, August 3). How to plan for rising health care costs. Retrieved from https://www.fidelity.com/viewpoints/personal-finance/plan-for-rising-health-care-costs

- Genworth. (2019, November 21). Cost of Care Survey 2019. Retrieved from https://www.genworth.com/aging-and-you/finances/cost-of-care.html

- O’Brien, E. (2019, April 2). Here's the Shocking Amount a Couple Retiring Today Will Spend on Health Care. Retrieved from https://money.com/health-care-in-retirement-average-costs/

- Jones, J. B., et al. (2019, July). The Lifetime Medical Spending of Retirees. Retrieved from https://www.nber.org/papers/w24599

- Anspach, D. (2019, January 6). How to Plan for Health Care Costs in Retirement. Retrieved from https://www.thebalancemoney.com/how-to-plan-for-health-care-costs-in-retirement-2388478

- Sackett, V. (2018, October 24). Nursing Home Costs Top $100,000 a Year. Retrieved from https://www.aarp.org/caregiving/financial-legal/long-term-care-cost-calculator/

- Baily, J., et al. (2018, July). The Lifetime Medical Spending of Retirees. Retrieved from https://www.nber.org/papers/w24599

- Farrell, C. (2018, June 28). The Truth About Health Care Costs In Retirement. Retrieved from https://www.forbes.com/sites/nextavenue/2018/06/28/the-truth-about-health-care-costs-in-retirement/#282a035d4401

- LongTermCare.gov. (2017, October 10). How Much Care Will You Need? Retrieved from https://acl.gov/ltc/basic-needs/how-much-care-will-you-need

- Hiltzik, M. (2016, May 11). Your vanishing health coverage: Employers are cutting retiree health benefits at a rapid rate. Retrieved from https://www.latimes.com/business/hiltzik/la-fi-hiltzik-retiree-health-insurance-20160511-snap-story.html

- Mather, M. (2016, January 13). Fact Sheet: Aging in the United States. Retrieved from https://www.prb.org/resources/fact-sheet-aging-in-the-united-states/

- Lobosco, K. (2015, December 30). Don’t Freak Out About Health Care Costs in Retirement. Retrieved from https://money.cnn.com/2015/12/30/retirement/retirement-health-care-costs/

Calling this number connects you to one of our trusted partners.

If you're interested in help navigating your options, a representative will provide you with a free, no-obligation consultation.

Our partners are committed to excellent customer service. They can match you with a qualified professional for your unique objectives.

We/Our Partners do not offer every plan available in your area. Any information provided is limited to those plans offered in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

844-359-1705Your web browser is no longer supported by Microsoft. Update your browser for more security, speed and compatibility.

If you need help pricing and building your medicare plan, call us at 844-572-0696