Can I Roll My IRA or 401(k) Into an Annuity?

You can rollover funds from your individual retirement account (IRA) or 401(k) into an annuity to receive a steady income. Doing so creates an IRA annuity – a type of qualified annuity. To do this, your employer moves your 401(k) balance directly to the insurance company. Then, the insurance company will deposit your funds, tax-free, directly into the IRA annuity.

- Written by Terry Turner

Terry Turner

Senior Financial Writer and Financial Wellness Facilitator

Terry Turner has more than 35 years of journalism experience, including covering benefits, spending and congressional action on federal programs such as Social Security and Medicare. He is a Certified Financial Wellness Facilitator through the National Wellness Institute and the Foundation for Financial Wellness and a member of the Association for Financial Counseling & Planning Education (AFCPE®).

Read More- Edited By

Lamia Chowdhury

Lamia Chowdhury

Financial Editor

Lamia Chowdhury is a financial content editor for RetireGuide and has over three years of marketing experience in the finance industry. She has written copy for both digital and print pieces ranging from blogs, radio scripts and search ads to billboards, brochures, mailers and more.

Read More- Reviewed By

Brandon Renfro, Ph.D., CFP®, RICP®, EA

Brandon Renfro, Ph.D., CFP®, RICP®, EA

Retirement and Social Security Expert

Brandon Renfro is a Retirement and Social Security Expert and financial planner. He focuses on helping clients create a secure financial future in retirement and co-owns Belonging Wealth Management. He is also a former finance professor and writes for several publications.

Read More- Published: October 27, 2021

- Updated: December 23, 2024

- 8 min read time

- This page features 7 Cited Research Articles

- Edited By

Why Roll Over Retirement Savings Into an Annuity?

The primary advantage of transferring your retirement savings into an annuity is the assurance of a consistent income stream for the rest of your life. This benefit can seem particularly attractive for those nearing retirement.

- Individual retirement accounts (IRAs)

- 401(k) plans

- 403(b) plans

- A lump sum pension payment

If you decide to roll over your savings, you’ll need to determine how you’ll receive payments from your annuity, how you’ll grow your investment and what’ll happen to it when you pass away.

- Choose Your Payouts

- You have two annuity options – deferred annuities or immediate annuities. You typically buy a deferred annuity before you retire and use it to grow your money. You won’t pay taxes on this growth until you withdraw money from it. Immediate annuities are a better option if you’re close to retirement. You make one lump sum contribution and you have an immediate income stream for the rest of your life.

- Understand Your Investment

- You have three options – a fixed annuity, variable annuity or indexed annuity. A fixed annuity lets your money grow at a steady and guaranteed rate over the time period you select. A variable or indexed annuity is tied to underlying investments; their rate of growth depends on fluctuations in those indexes or other investments. Typically, indexed annuities have more risk and potential return than a fixed annuity, but less risk and potential return than a variable annuity. Generally, indexed annuities have more risk and potential return than a fixed annuity, but less risk and potential return than a variable annuity.

- Consider the Death Benefit

- Not all annuities have death benefits. When you die, some may turn over any remaining money to the insurance company that issued it. If you want to pass on the money left in the annuity, you will need to name a beneficiary. Keep in mind, the death benefit may be taxable. Discuss this thoroughly with the insurer when choosing an annuity.

Benefits & Risks of Rolling Your IRA or 401(k) Into an Annuity

Rolling over your retirement savings into a qualified annuity has many advantages for retirees, such as the sense of security regarding a guaranteed lifetime income. However, it’s important to also consider some of the drawbacks a roll over includes before making this move part of your retirement plan.

| Benefits | Risks |

|---|---|

|

|

There are a few more points to consider before deciding whether to roll over your retirement savings into an annuity. These include the type of annuity you select and the fees that accompany it.

For example, variable annuities usually come with higher fees than fixed annuities. This is because variable annuities typically require more hands-on management. This extra effort can cost you up to 2% more a year than fixed annuity fees, according to the New York State Attorney General.

How soon are you retiring?

What is your goal for purchasing an annuity?

Select all that apply

Learn About Top Annuity Products & Get a Free Quote

Find out how an annuity can offer you guaranteed monthly income throughout your retirement. Speak with one of our qualified financial professionals today to discover which of our industry-leading annuity products fits into your long-term financial strategy.

For fastest service, call now!

866-219-2282Call NowOr fill out the form

How To Roll Your IRA or 401(k) Into an Annuity

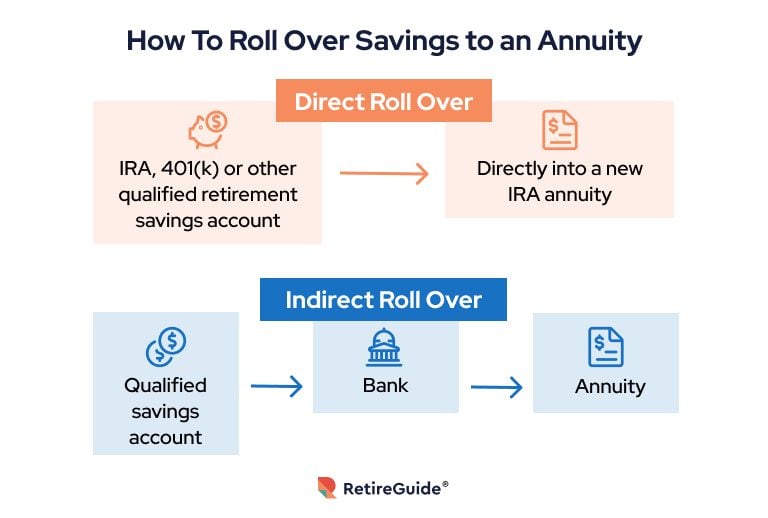

There are two ways to roll over your retirement savings to an annuity – through a direct roll over or an indirect roll over.

Direct roll overs can avoid tax implications and possible penalties. They can also meet Internal Revenue Service (IRS) requirements for required minimum distributions (RMDs). RMDs are when you’re required to begin taking out a certain percentage of your pretax retirement savings each year.

According to the IRS, an RMD kicks in when you turn 73 in 2023. However, the rule doesn’t apply to IRA annuities.

Strategies for Rolling Over Retirement Funds Into an Annuity

There are three strategies you could follow when rolling over your retirement funds into an annuity — delaying your payments, calculating the exact amount to roll over and laddering your annuities.

- Delaying Payments

- Just like Social Security benefits, the longer you delay receiving payments, the bigger your payment amount will be.

- Calculating the Exact Amount

- Don’t put the entirety of your retirement savings into one annuity. Calculate in advance how much of your income you’ll need to cover living expenses when you retire. Social Security and pensions alone likely won’t pay for 100% of your future living expenses and potential long-term care costs. Your annuity can help bridge that gap. Any remaining funds can go towards other high-reward investments, like stocks.

- Laddering Your Annuities

- If you think interest rates will rise in the future, purchase multiple annuities with smaller amounts, instead of one large annuity. This way, you lower the risk of getting locked in a single fixed rate and have the potential for higher income if rates increase.

Tax Implications of Rolling Over Retirement Savings to an Annuity

The most important tax implication to note is the roll over deadline. Once you start the roll over process, you must complete it within 60 days. Miss that deadline and you’ll owe income tax on the amount that’s not rolled over.

Specific tax implications for rolling over your retirement savings into an annuity depend on the type of retirement savings plan you have.

| Rolling Over a 401(k) or Traditional IRA | There should be no tax impact so long as the roll over is completed in 60 days. Deposits into these savings plans are tax deferred – meaning you don’t pay income taxes until you withdraw funds. In this case, the annuity would work the same as your retirement account, so the roll over itself does not count as a withdrawal. |

| Rolling Over a Roth or Roth 401(k) | Money you place in a Roth IRA is not tax deferred – you pay income taxes on the money before depositing it in the Roth IRA. If you roll over your savings into a Roth IRA annuity, you won’t have to pay income taxes on the money you withdraw from the annuity. |

While investments in an annuity are tax deferred until you withdraw money from it, IRAs, 401(k)s, 403(b)s and other retirement savings plans typically offer the same or similar tax advantages. You may want to talk with a tax professional about additional tax benefits you might receive from a roll over.

Annuity Rollover FAQs

Editor Malori Malone contributed to this article.

Connect With a Financial Advisor Instantly

Our free tool can help you find an advisor who serves your needs. Get matched with a financial advisor who fits your unique criteria. Once you’ve been matched, consult for free with no obligation.

7 Cited Research Articles

- Internal Revenue Service. (2023, April 20). Retirement Topics — Required Minimum Distributions (RMDs). Retrieved from https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-required-minimum-distributions-rmds

- Kilroy, A. (2023, April 8). Should I Roll Over My 401(k) Into An Annuity? Retrieved from https://finance.yahoo.com/news/roll-over-401-k-annuity-130055783.html

- Rampton, J. (2023, January 30). What You Need to Know About Annuity Withdrawals. Retrieved from https://www.nasdaq.com/articles/what-you-need-to-know-about-annuity-withdrawals

- Internal Revenue Service. (2022, June 16). Rollovers of Retirement Plan and IRA Distributions. Retrieved from https://www.irs.gov/retirement-plans/plan-participant-employee/rollovers-of-retirement-plan-and-ira-distributions

- FINRA. (n.d.). Annuities. Retrieved from https://www.finra.org/investors/investing/investment-products/annuities

- New York Attorney General. (n.d.). Variable Annuity Investments. Retrieved from https://ag.ny.gov/resources/individuals/investing-finance/variable-annuities

- Office of Investor Education and Advocacy. (n.d.). Variable Annuities. Retrieved from https://www.sec.gov/investor/pubs/sec-guide-to-variable-annuities.pdf

Calling this number connects you to one of our trusted partners.

If you're interested in help navigating your options, a representative will provide you with a free, no-obligation consultation.

Our partners are committed to excellent customer service. They can match you with a qualified professional for your unique objectives.

We/Our Partners do not offer every plan available in your area. Any information provided is limited to those plans offered in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

844-897-8632Your web browser is no longer supported by Microsoft. Update your browser for more security, speed and compatibility.

If you need help pricing and building your medicare plan, call us at 844-572-0696