Roth IRA for Kids: How To Make Your Grandchildren Millionaires

A custodial Roth IRA is a tax-advantaged investment account for kids, and a great way to help your grandchildren begin saving for retirement early.

- Written by Christian Simmons

Christian Simmons

Financial Writer

Christian Simmons is a writer for RetireGuide and a member of the Association for Financial Counseling & Planning Education (AFCPE®). He covers Medicare and important retirement topics. Christian is a former winner of a Florida Society of News Editors journalism contest and has written professionally since 2016.

Read More- Edited By

Savannah Pittle

Savannah Pittle

Senior Financial Editor

Savannah Pittle is a professional writer and content editor with over 16 years of professional experience across multiple industries. She has ghostwritten for entrepreneurs and industry leaders and been published in mediums such as The Huffington Post, Southern Living and Interior Appeal Magazine.

Read More- Published: April 20, 2022

- Updated: March 24, 2025

- 8 min read time

- This page features 6 Cited Research Articles

- Edited By

It is never too early to begin saving for retirement. That is why you may want to give your grandchildren a head start by opening a Roth IRA for kids.

A custodial Roth IRA is a tax-advantaged investment account for kids that serves as a great way to help your grandchildren begin saving for retirement early.

An adult, usually a parent or relative, can open a custodial Roth IRA for any minor, as long as the minor has earned income. When your grandchild gets their first job as a teen or preteen, they can start saving for retirement right away.

If you are planning for retirement and looking for ways to financially help the young ones in your life, a custodial Roth IRA is worth looking into. Below, we will explain the benefits of a custodial Roth IRA, how to open one and how to help your grandchildren start saving with the help of some free printables.

Types of IRAs for Kids or Grandkids

There are two types of IRAs you might consider for a child: a traditional IRA and a Roth IRA.

- Traditional IRA

- With a traditional IRA, your contributions are pre-tax. When you withdraw the money during retirement, you have to pay income taxes at your applicable tax rate. You do not have to pay taxes on the money or profits from your investments until you withdraw money from the account.

- Roth IRA

- With a Roth IRA, your contributions and earnings are post-tax. You pay taxes on the money you put in upfront and do not have to pay income taxes when you withdraw the money in retirement.

A Roth IRA is the better choice for a child’s retirement savings because most children are in a low or 0 percent income tax bracket. They likely do not make enough money to benefit from the upfront tax break associated with a traditional IRA.

A Roth IRA, on the other hand, is beneficial for those who are currently in a lower tax bracket and are likely to be in a higher tax bracket in the future when they need to withdraw funds. They can also withdraw funds early and penalty-free if used for education or buying a first home.

What is a Custodial Roth IRA?

A Roth IRA for a child typically covers those under the age 18 in some states and 21 in other states.

You will need to open a custodial Roth IRA that is controlled by an adult on behalf of a child. The adult makes the investment decisions and manages the account until the child turns 18 to 25, depending on which state you live in.

Other than that, a custodial Roth IRA functions similarly to any regular Roth IRA.

Custodial Roth IRA Rules

Specific rules pertain to custodial Roth IRAs.

- Eligibility

- You can open a custodial Roth IRA for a child of any age. However, the child must have earned income (taxable income earned through a job or self-employment). For young teens, this can include anything from running a small dog walking business in their neighborhood to working a first job as a lifeguard or waiter. Just make sure to help the child start their business legally by obtaining a permit or license with your county.

- Contributions

- In 2025, the contribution limit is either $7,000 or the child’s total income for the year — the limit is the number that’s lower.

- Withdrawals

- The child can withdraw contributions from their Roth IRA at any time with no penalties. However, there are strict rules when tapping into earnings. Distributions of earnings may face penalty fees and income taxes if the child withdraws them before age 59 ½.

*Ad: Clicking will take you to our partner Annuity.org.

Benefits of Roth IRAs for Kids

So, why go with a Roth IRA instead of a simple savings account for your kids or grandkids? After all, a savings account does not require earned income.

There are several benefits of Roth IRAs for kids, such as post-tax savings and early retirement savings.

Post-tax Savings

Your contributions to a Roth IRA are not tax deductible, like with traditional IRAs. However, the growth of investments is tax-free, and so are qualified distributions in retirement.

When the child contributes to a Roth IRA, they will basically be taxed for it now instead of later. This is a good thing, because a child is likely to be in a much lower tax bracket now than when they are older.

Saving for Retirement Early

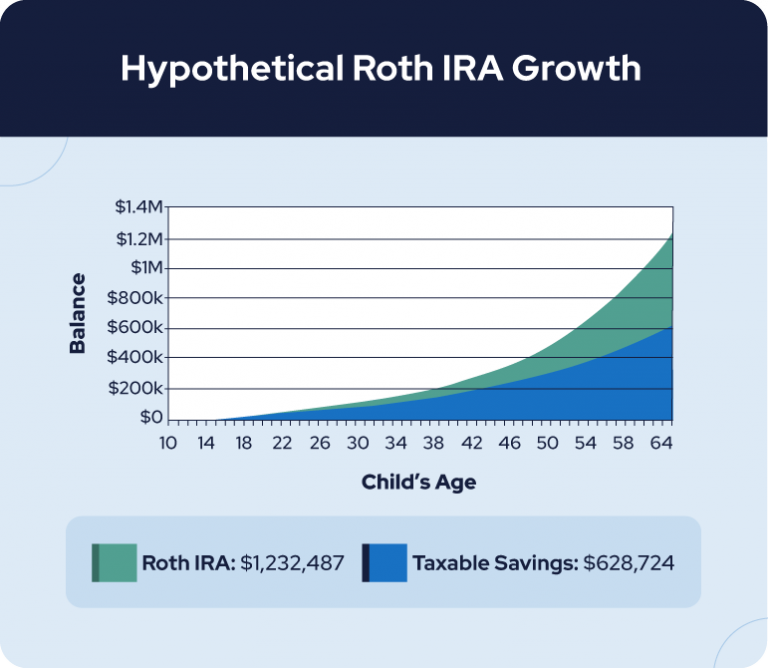

Since children have a long time to grow their money in a Roth IRA, the benefits can be huge when they withdraw the money in retirement. Thanks to compound interest, money left in a Roth IRA until retirement will grow tax-free for many years. Comparatively, a savings account earns interest at a flat rate that often is not very high.

With a Roth IRA, you can choose your investments, which can lead to larger growth. There is always the risk that you can lose money in an investment account, but it is unlikely if you choose a diversified portfolio.

Take the hypothetical example below. Assuming a 7% rate of return, if a child contributes $2,000 annually to a Roth IRA starting at age 10 and does not withdraw until retirement, they could be looking at upwards of $1 million by age 65.

Education Expenses

Although it can be smart for a child to use their Roth IRA for retirement, the money can be useful for other major life expenses, too.

Early withdrawal exceptions include qualified education costs. Once the child has held the Roth IRA for five years, they can take out earnings to use for college tuition, fees, books, supplies and room and board. They will have to pay income tax on the earnings, but there is no early withdrawal penalty.

Buying a House

Another early withdrawal exception is for buying a first house. Once they are older, the child can take out $10,000 in earnings from the Roth IRA to put toward a down payment or closing costs on their first home. This withdrawal is tax-free and comes with no penalties.

Emergencies

After at least five years of holding the account, the child can also withdraw contributions from a Roth IRA early if needed for an emergency. However, they will have to pay income tax and a 10 percent early withdrawal penalty fee.

Financial Literacy and Education

A huge benefit of a custodial Roth IRA for your grandchild is that it will help them learn about financial literacy. Encouraging them to save their money and teaching them the power of compound interest over the years will help them become more invested in their financial future.

*Ad: Clicking will take you to our partner Annuity.org.

How Do I Open a Roth IRA for Kids?

In order to open a custodial Roth IRA on behalf of your grandchild, you will need to go through a financial institution or a licensed financial professional.

The process should not take long; just be ready to provide Social Security numbers, birthdates and other pertinent information for you and your grandchild.

How Do I Fund a Roth IRA for Kids?

As an adult, you can make contributions to the child’s IRA. The child can also contribute if they have earned income that year.

This includes taxable income earned through a job or self-employment. Examples include lawn mowing for neighbors, working as a lifeguard at the local pool and waiting tables. Unfortunately, allowance and investment money does not count.

How do you tell if your child has earned income? They should hopefully get a W-2 or 1099 Form for their work. If they have their own business, like mowing neighbors’ lawns or babysitting, they may not have this paperwork. If that is the case, they should keep thorough records and receipts of the type of work they do, who they do it for, when they do the work and how much they get paid.

It is helpful if they perform work for others outside the family. Or, if you own a business, they can work for you while earning appropriate wages.

How Much Can I Contribute to a Child's IRA?

Parents and grandparents can make direct contributions to a child’s Roth IRA. Just keep in mind that your contributions cannot exceed the child’s earned income. For example, if your grandchild made $3,000 in a given year, $3,000 is all you or the child can invest in the account that year.

Remember that the contribution limit for custodial Roth IRAs is $7,500 or their total income for the year in 2025 (whichever is less).

How To Help Your Grandchildren Earn Money

By opening a custodial Roth IRA, you’ll help your grandchild start saving for retirement as soon as they start earning money. Here are some ideas to help them begin their first job or entrepreneurial endeavors. Just make sure that if they plan to start a business, to get the proper clearance and/or permits from your city and county.

Help Out Around the Neighborhood

A great way for teens to start earning money is to perform yard work (raking leaves, shoveling snow or mowing lawns), babysitting, tutoring younger kids, or dog walking. If your grandchild is interested in earning money around the neighborhood, they can use these printable business cards to advertise their services to friends and neighbors.

If your grandchild is ready to start earning money, it’s also important that they learn to track their earnings and prioritize savings.

Teach Them to Track Savings

Saving in a Roth IRA can help kids achieve long-term goals. Encourage them to track their savings, set aside money with each paycheck and work responsibly toward their aspirations.

Help your grandchildren save throughout the year with this 52-week saving challenge sheet.

Time is your grandchild’s biggest advantage when it comes to their savings. With a Roth IRA for kids, you can give your grandchildren a head start on putting money toward their future.

Additionally, if you or your loved ones are looking for more peace of mind from a guaranteed stream of income in retirement, consider purchasing an annuity today.

Writer Lena Borrelli contributed to this article.

Connect With a Financial Advisor Instantly

Our free tool can help you find an advisor who serves your needs. Get matched with a financial advisor who fits your unique criteria. Once you’ve been matched, consult for free with no obligation.

6 Cited Research Articles

- Internal Revenue Service. (2021, November 5). Traditional and Roth IRAs. Retrieved from

- https://www.irs.gov/retirement-plans/traditional-and-roth-iras

- Internal Revenue Service. (2021, November 27). IRA Contribution Limits. Retrieved from https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-ira-contribution-limits

- Internal Revenue Service. (2022, February 18). Additional Tax on Early Distributions From Traditional and Roth IRAs. Retrieved from https://www.irs.gov/taxtopics/tc557

- Sean Peek. (2021, December 17). How to Help Your Kids Start a (Legal) Business. Retrieved from https://www.businessnewsdaily.com/10278-legal-business-tips-for-kids.html

- Bankrate. Roth IRA Calculator. Retrieved from https://www.bankrate.com/retirement/roth-ira-plan-calculator/

Calling this number connects you to one of our trusted partners.

If you're interested in help navigating your options, a representative will provide you with a free, no-obligation consultation.

Our partners are committed to excellent customer service. They can match you with a qualified professional for your unique objectives.

We/Our Partners do not offer every plan available in your area. Any information provided is limited to those plans offered in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

844-897-8632Your web browser is no longer supported by Microsoft. Update your browser for more security, speed and compatibility.

If you need help pricing and building your medicare plan, call us at 844-572-0696