Are CDs FDIC Insured?

Most certificates of deposit (CDs) are insured by the Federal Deposit Insurance Corporation (FDIC) up to $250,000. This means, if your bank goes out of business, then up to $250,000 of your deposits will be protected and reimbursed through a check or by moving your funds to another FDIC-insured bank.

- Written by Lindsey Crossmier

Lindsey Crossmier

Financial Writer

Lindsey Crossmier is an accomplished writer with experience working for The Florida Review and Bookstar PR. As a financial writer, she covers Medicare, life insurance and dental insurance topics for RetireGuide. Research-based data drives her work.

Read More- Edited By

Lamia Chowdhury

Lamia Chowdhury

Financial Editor

Lamia Chowdhury is a financial content editor for RetireGuide and has over three years of marketing experience in the finance industry. She has written copy for both digital and print pieces ranging from blogs, radio scripts and search ads to billboards, brochures, mailers and more.

Read More- Reviewed By

Brandon Renfro, Ph.D., CFP®, RICP®, EA

Brandon Renfro, Ph.D., CFP®, RICP®, EA

Retirement and Social Security Expert

Brandon Renfro is a Retirement and Social Security Expert and financial planner. He focuses on helping clients create a secure financial future in retirement and co-owns Belonging Wealth Management. He is also a former finance professor and writes for several publications.

Read More- Published: March 17, 2023

- Updated: May 3, 2023

- 5 min read time

- This page features 10 Cited Research Articles

- Edited By

What Is FDIC Insurance?

FDIC insurance protects your bank deposits if an FDIC-insured bank fails. This way, specific assets like CDs and savings accounts are covered, and you can feel secure about building your retirement plan.

FDIC insurance first became effective on Jan. 1, 1934, providing depositors with $2,500 in coverage. Now, most FDIC-insured deposit products are covered up to $250,000.

Keep in mind that FDIC insurance doesn’t cover every type of investment vehicle. For example, FDIC insurance doesn’t cover stock investments, mutual funds, crypto assets, life insurance policies and annuities.

If safety and low-risk investments are important to your retirement plan — consider looking into FDIC-insured CDs.

How Much Does the FDIC Insure CDs For?

The FDIC insures your CD up to $250,000 per depositor, per FDIC-insured bank. So, if you have all your banking accounts in one bank, all your funds combined would be covered up to $250,000.

But if you spread your funds across multiple banks, each bank has a coverage limit of $250,000. For example, if you have $500,000 in funds to invest, you could put $250,000 into two different banking institutions, so that 100% of your deposits would be FDIC insured.

How Does FDIC Insurance Work?

In the rare instance your bank closes, the FDIC will return your funds back to you up to the $250,000 limit. The FDIC will return your funds within a few days after the bank closes, either by opening a new account for you at another FDIC-insured bank or by issuing you a check. Below is a list of deposit products that are covered by FDIC insurance if a bank closes.

- Checking accounts

- Savings accounts

- Money market deposit accounts

- Certificates of deposit (CD)

- Prepaid cards

While the FDIC covers your funds if your bank closes, it does not protect them against losses due to fraud or theft. These cases are covered by other laws.

Even though there is a $250,000 limit for FDIC insurance, there are ways to get more coverage, such as purchasing CDs from different FDIC-insured banks. Below are a couple examples of how FDIC insurance works at one or multiple banks.

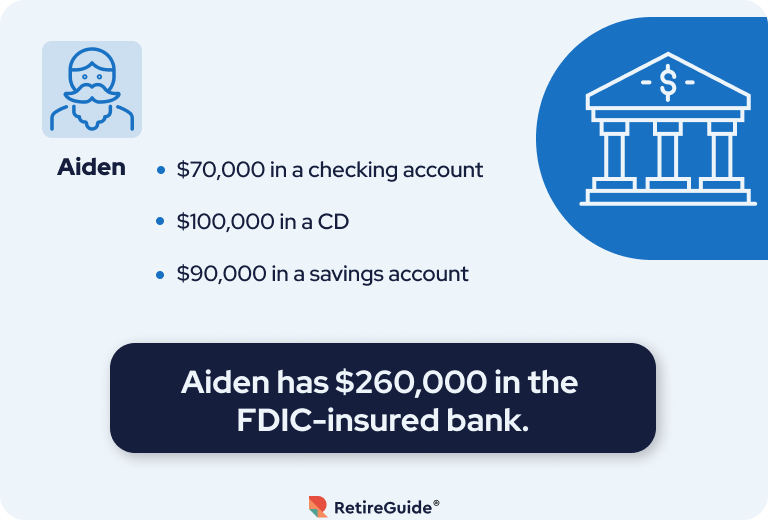

Example One

Aiden is looking to diversify his retirement investments and planning on keeping all her bank accounts at one FDIC-insured bank.

Altogether, Aiden has $260,000 in one bank. This leaves $10,000 uninsured since the FDIC-insured limit is $250,000.

Example Two

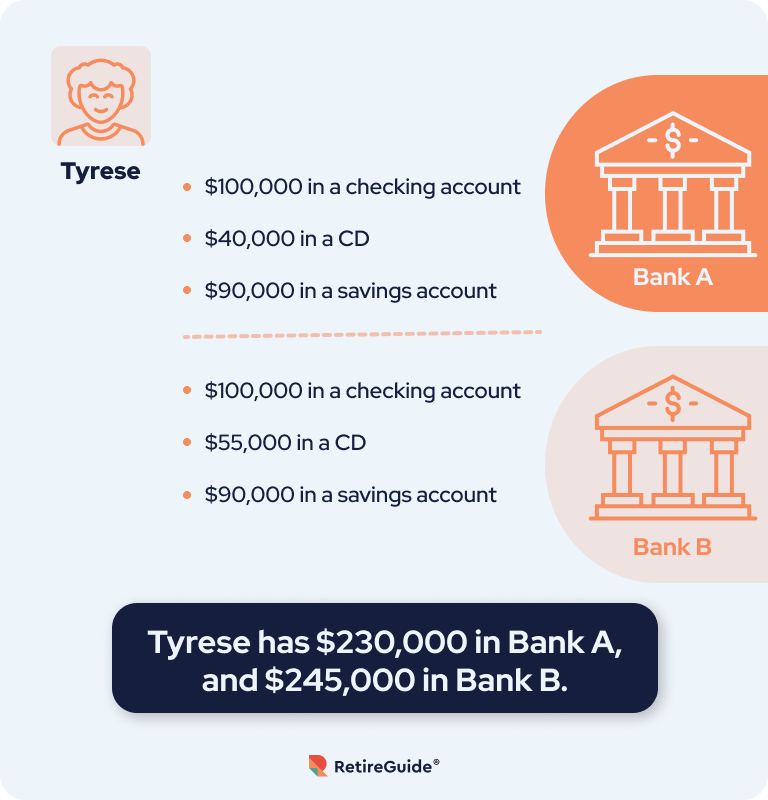

Tyrese has $475,000 he wants to deposit. In order to guarantee that all his money is insured, Tyrese holds his deposits in two separate FDIC-insured bank accounts.

Since Tyrese has under $250,000 in each bank, so 100% of his $475,000 is FDIC insured.

Are Brokered CDs FDIC Insured?

While brokerage CDs are typically FDIC insured, it is not guaranteed. You will need to confirm with the broker if the CD is FDIC insured or not. Since anyone can claim to be a deposit broker, you should also check the broker’s credentials and disciplinary history.

You can confirm your broker’s history using the Financial Industry Regulatory Authority database. Once you confirm the broker is trustworthy, ask them what bank they originally purchased the brokered CD from. Confirm that the specific bank is FDIC insured before purchasing the brokered CD.

How Do I Know If My Bank Is FDIC Insured?

The FDIC has a BankFind tool that can help you find out if your bank is FDIC insured. You can use the BankFind database to confirm whether a bank is FDIC insured this year, last year or as far back as 1934.

When using BankFind, you’ll need to input the bank’s name, status and address. However, all the fields are optional. You could verify if your bank is FDIC insured just by providing the bank’s name. The FDIC suggests providing minimal information to receive a wide range of results.

As of Feb. 17, 2023, there are 81,249 FDIC-insured branch offices with over $23 million in assets. Popular banks like Wells Fargo and the Bank of America are FDIC insured.

Are CDs From an Online Bank Safe?

CDs are known to be safe from an online bank — but this doesn’t mean you should trust every online bank out there. Barbara O’Neill, CFP®, CEO of Money Talk and author of Flipping a Switch, offered advice when asked if she considers CDs from an online bank safe.

“Assuming that the issuing bank is legitimate, and FDIC insured – yes, CDs from online banks are safe. However, I would caution that there are a lot of scams out there now. Do your homework and check the website before purchasing a CD, especially if you’ve never heard of the bank’s name before,” O’Neil told RetireGuide.

It also doesn’t hurt to research the bank’s credit ratings before purchasing a CD. A bank’s credit rating determines their financial soundness and dependability. Moody’s Investors Services, Fitch Ratings and S&P Global Ratings all provide trustworthy bank credit ratings.

“Assuming that the issuing bank is legitimate, and FDIC insured – yes, CDs from online banks are safe. However, I would caution that there are a lot of scams out there now. Do your homework and check the website before purchasing a CD, especially if you’ve never heard of the bank’s name before.”

FDIC Insurance FAQs

Connect With a Financial Advisor Instantly

Our free tool can help you find an advisor who serves your needs. Get matched with a financial advisor who fits your unique criteria. Once you’ve been matched, consult for free with no obligation.

10 Cited Research Articles

- Federal Deposit Insurance Corporation. (2023). BankFind Suite: Find Institutions by Name & Location. Retrieved from https://banks.data.fdic.gov/bankfind-suite/bankfind

- Wells Fargo. (2023). FDIC Insurance. Retrieved from https://www.wellsfargo.com/savings-cds/fdic/

- Stinson, R. (2022, October 5). The Advantages of Brokered CDs. Retrieved from https://www.kiplinger.com/personal-finance/banking/what-are-brokered-cds

- Federal Deposit Insurance Corporation. (2022, July 28). Fact Sheet: What the Public Needs To Know About FDIC Deposit Insurance and Crypto Companies. Retrieved from https://www.fdic.gov/news/fact-sheets/crypto-fact-sheet-7-28-22.html

- Federal Deposit Insurance Corporation. (2021, December 8). Deposit Insurance FAQs. Retrieved from https://www.fdic.gov/resources/deposit-insurance/faq/

- Federal Deposit Insurance Corporation. (2021, July 1). Are My Deposit Accounts Insured by the FDIC? Retrieved from https://www.fdic.gov/resources/deposit-insurance/financial-products-insured/

- National Credit Union Administration. (2020, March). Deposits Are Safe in Federally Insured Credit Unions. Retrieved from https://www.ncua.gov/newsroom/press-release/2020/deposits-are-safe-federally-insured-credit-unions

- Federal Deposit Insurance Corporation. (2016, August 4). When a Broker Offers a Bank CD: It Pays To Do Some Research. Retrieved from https://web.archive.org/web/20230331212715/https://www.fdic.gov/consumers/consumer/news/cnspr13/cdsfrombrokers.html

- Federal Deposit Insurance Corporation. (1998, September). A Brief History of Deposit Insurance in the United States. Retrieved from https://www.fdic.gov/bank/historical/brief/brhist.pdf

- Bank of America. (n.d.). Financial Center FAQs. Retrieved from https://www.bankofamerica.com/help/financial-center-faqs/

Your web browser is no longer supported by Microsoft. Update your browser for more security, speed and compatibility.

If you need help pricing and building your medicare plan, call us at 844-572-0696