Retirement Ages in the U.S.

When to retire is a personal decision, and you’ll need to factor in your preferences, financial situation, health and family’s needs. While retiring young is intriguing for many, waiting until your late 60s or early 70s has its benefits. For example, you may get larger Social Security checks and allow more time for your retirement savings to grow untouched.

- Written by Terry Turner

Terry Turner

Senior Financial Writer and Financial Wellness Facilitator

Terry Turner has more than 35 years of journalism experience, including covering benefits, spending and congressional action on federal programs such as Social Security and Medicare. He is a Certified Financial Wellness Facilitator through the National Wellness Institute and the Foundation for Financial Wellness and a member of the Association for Financial Counseling & Planning Education (AFCPE®).

Read More- Edited By

Lamia Chowdhury

Lamia Chowdhury

Financial Editor

Lamia Chowdhury is a financial content editor for RetireGuide and has over three years of marketing experience in the finance industry. She has written copy for both digital and print pieces ranging from blogs, radio scripts and search ads to billboards, brochures, mailers and more.

Read More- Reviewed By

Stephen Kates, CFP®

Stephen Kates, CFP®

Principal Financial Analyst for RetireGuide.com

Stephen Kates is a Certified Financial Planner™ professional and personal finance expert with over a decade of experience working with individuals and families who need help with their finances. With experience as a financial advisor for two of the largest financial firms in the country, Stephen has worked with hundreds of clients to build comprehensive financial plans to grow and protect their wealth.

Read More- Published: April 30, 2020

- Updated: March 24, 2025

- 9 min read time

- This page features 21 Cited Research Articles

Key Takeaways- Retiring before age 65 allows you to spend your time enjoying activities while you’re generally healthier, but it can come with financial and health insurance challenges.

- The COVID-19 pandemic led to increased early retirements, while some others are forced into early retirement due to factors like disabilities or caretaking responsibilities.

- Delaying your retirement until the traditional age or beyond can leave you in a financially more comfortable place but with less time to enjoy retirement.

- You can use the “Rule of 25” to figure out how much you should save for retirement. This involves multiplying your desired yearly retirement income by 25.

What’s the Full Retirement Age?

Full retirement age is the age at which you can start drawing the full amount of Social Security benefits. For people born in 1960 or later, it’s 67. For people born in 1954 through 1959, the full retirement age is 66 — but it increases by months after your birthday depending on which of those years you were born in.

You can file for Social Security as early as age 62 — called early retirement — but you’ll receive reduced Social Security benefits. You can also wait until after your full retirement age — called delayed retirement — and receive increasingly larger benefit payments the longer you wait up until age 70.

Full Retirement Ages Based on When You Were Born

Birth Year Full Retirement Age 1943 through 1954 66 years 1955 66 years, 2 months 1956 66 years, 4 months 1957 66 years, 6 months 1958 66 years, 8 months 1959 66 years, 10 months 1960 and later 67 years Social Security is only one part of your retirement planning. Other factors may help you decide on the right time for you to retire.

The average age Americans retire is 62, according to a 2023 Gallup Poll survey.

The dream for many workers is to retire young and live a life of leisure, enjoying the fruits of a career and working through a bucket list, or relaxing by the beach.

But financial and health considerations may make that dream unachievable for many Americans. And others prefer to keep working as long as possible because they enjoy the feeling of productivity and a sense of identity through their careers.

The decision is ultimately up to you, but there are important factors to consider about your physical and financial health when deciding what age to retire.

Is Your Retirement Plan on Track?Explore annuity solutions that align with your planning needs.

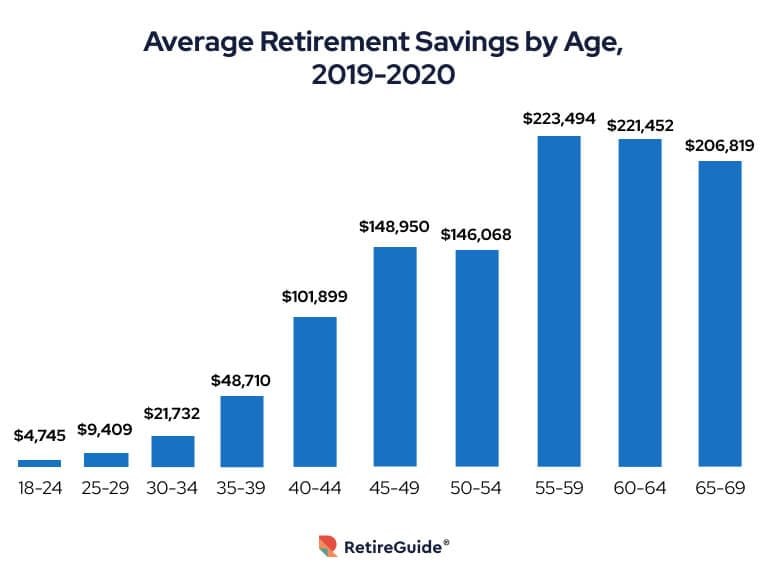

*Ad: Clicking will take you to our partner Annuity.org.Average Retirement Savings by Age

On average, Americans had $88,400 in retirement savings in 2024, according to Northwestern Mutual’s 2024 Planning and Progress Study.

Data in the Federal Reserve’s Survey of Consumer Finances can be broken down to give an estimate of retirement savings by age.

It’s difficult to pin down exact figures for how much Americans have saved for retirement. Savings depend on individual financial situations and retirement goals — among many other factors.

Financial professionals often refer to the “Rule of 25” or the “25x Rule” when talking about how much you should save for retirement.

Simply put, it means figuring out how much income you’ll need each year in retirement and multiplying it by 25. This should give you a grand total that will allow you to withdraw 4% of your savings each year — and it should last for 30 years.

Pros & Cons of Retiring at Different Ages

There are advantages and disadvantages to retiring at different ages. These often involve the amount of income you’ll have based on when you retire, but your health and life expectancy may also play a role.

Pros and Cons of Retirement Based on Different Ages

Before 65Pros- Enjoying retirement sooner

- Longer retirement

- Taking advantage of typically better health upon retirement

Cons- Working longer may result in better health and happiness

- Less time to save and potentially less money in retirement

- Lower Social Security benefits

- Unable to enroll in Medicare until you are 65

Full Retirement (age 66 - 70)Pros- Maximizes Social Security benefits

- Can enroll in Medicare at a cheaper rate than most private health insurance plans

- Retirement savings given more time to mature

- Allows you to take advantage of “catch-up contributions” to retirement plans, maximizing retirement accounts

Cons- Less time to enjoy retirement

Delayed Retirement (Over 70)Pros- Better quality of life if you enjoy your work

- You’ll have more money from both job income and retirement savings

- You draw the maximum amount possible in Social Security benefits

- Retiring later in life means you have a shorter time period to depend on your savings.

Cons- Social Security delayed retirement increases top out at 70

- Continuing to work can increase your income taxes as you take required minimum distributions (RMD) from retirement accounts

Lock In Today’s Best Fixed Annuity RatesStart with a free annuity consultation to learn how annuities can help fund your retirement.

*Ad: Clicking will take you to our partner Annuity.org.Early Retirement

There are obviously lots of reasons to want to retire early. At a minimum, once you can live off your savings, you no longer have to worry about losing your job.

For many, retirement means freedom. Your time becomes your own, and you can pursue what makes you happy. You can enjoy your leisure time before your health begins to decline.

The concept of retiring young has exploded in recent years from being able to retire in your 40s and 50s to some being financially able to retire as early as their 20s and 30s.

Very early retirement is becoming trendy to the point that it’s gotten an acronym — FIRE — for Financial Independence Retire Early.

The idea is to build up enough savings to be able to live comfortably without having to hold a job. There are several online communities built around the idea of reaching financial independence in as little as 10 years of work.

People in the FIRE movement work multiple jobs, find ways to earn money from their hobbies, invest aggressively and live frugally to get to the point where they feel they have enough money to attain financial freedom.

The earlier you retire, the more money you need to save. This is because your money will have less time to grow and will have to support you for a longer amount of time.

You won’t be able to collect Social Security to supplement your savings until you’re older. And when you’re old enough to collect Social Security, the amount will be reduced or perhaps even be eliminated by the fact that you spent fewer years in the workforce.

Social Security allocations are determined, in part, by averaging 35 years’ worth of earnings. For each year short of 35 that you worked, your earnings will be zero, which will significantly affect your average.

Did You Know?The normal retirement age (NRA) — also referred to as the full retirement age — for anyone born after 1959 is 67 years old. The NRA is the age at which people can receive full Social Security benefits after leaving the workforce.Source: Social Security AdministrationIn addition, people with children can’t save money and live as frugally as others. And for people who live in areas where the cost of living is higher, spending more is unavoidable.

For these reasons and others, most people will be unable to retire young.

COVID-19 Led to Increase in Early Retirements

Federal Reserve data suggested that the COVID-19 pandemic led to excessive early retirements between 2022 and 2022. The U.S. Census Bureau also reported that the pandemic modestly affected Americans’ early retirement decisions, especially for those in poorer health.

A strong stock market and rising housing prices may have allowed a lot of people to consider early retirement during the pandemic.

3 Minute Quiz: Can You Retire Comfortably?Take our free quiz & match with a financial advisor in 3 easy steps. Tailored to your goals. Near you or online.Delaying Retirement

Delaying retirement can improve a retiree’s financial outlook. There are several reasons for this.

Researchers at the National Bureau of Economic Research found that a 66-year-old who works just one year longer and delays taking Social Security by one year will see a 7.75% increase in retirement income adjusted for inflation. Social Security benefits account for 83% of that increase.

On the other end of the spectrum, several factors have left some people feeling like they have no choice but to keep working and delay retirement.

Factors That Delay Retirement- Decline in pensions

- Low retirement savings rates

- Incentives in Social Security

- Less physically demanding jobs

When Delaying Retirement Isn’t an Option

Delaying retirement is often not an option for many. According to research by the Urban Institute, even though life spans have increased since Social Security was first introduced, there is little evidence of improvement in the ability of people to work at older ages than in the past.

A little more than a third of nondisabled workers develop work limitations related to their health by age 65.

In addition to health limitations, finding and keeping a job is more difficult for many older Americans due to ageism in the workplace.

Older workers who lose their jobs face an uphill battle to find new ones.

Laid-Off Workers from 2008 to 2012Ages Remained Out of Work for at Least 12 Months 25 to 34 35% 35 to 49 39% 50 to 61 47% 62 and older 65% Source: Urban Institute, 2018Never Miss Important News or Updates with Our Weekly NewsletterGet money-saving tips, hard-to-find info and tactics for a successful retirement in our free weekly newsletter.Frequently Asked Questions About When to Retire

What is the full retirement age for Social Security?The full retirement age for Social Security depends on when you were born. People born in 1960 will reach full retirement age when they turn 67. People born in 1943 though 1954 reached full retirement age when they turned 66. For people born in 1955 through 1959, they reach full retirement age at some point between their 66th and 67th birthdays, depending on the year in which they were born.Does where you live affect your retirement age?No matter where you live in the United States, your full retirement age and benefits remain the same.How much money should you have when you retire?Financial professionals recommend that your retirement income should be 80% of the income you earned in your last full year before retirement. If your annual income was $100,000 in that last year, you’ll need $80,000 a year in retirement to live comfortably. You may also consider the “Rule of 25.” Figure out how much you’ll need each year to live comfortably in retirement and multiply that annual retirement income by 25 to determine how much you should have saved before you retire. You should be able to withdraw 4% of your savings each year for 30 years using this formula.Can I work after full retirement age?You can continue working after full retirement age and still receive full Social Security benefits. If you are younger than full retirement age, your benefits will be reduced. If you are at full retirement age or older, you can work and collect 100% of your Social Security benefits no matter how much you earn at your job.Writer Ashley Donohoe contributed to this article.

AdvertisementConnect With a Financial Advisor Instantly

Our free tool can help you find an advisor who serves your needs. Get matched with a financial advisor who fits your unique criteria. Once you’ve been matched, consult for free with no obligation.

Last Modified: March 24, 2025Share This Page21 Cited Research Articles

- Social Security Administration. (2025, January). How Work Affects Your Benefits. Retrieved from https://www.ssa.gov/pubs/EN-05-10069.pdf

- Centers for Disease Control and Prevention. (2024, October 25). Life Expectancy. Retrieved from https://www.cdc.gov/nchs/fastats/life-expectancy.htm

- Social Security Administration. (2024, September). Fast Facts & Figures About Social Security, 2024. Retrieved from https://www.ssa.gov/policy/docs/chartbooks/fast_facts/2024/fast_facts24.pdf

- Board of Governors of the Federal Reserve System. (2024, May 21). Survey of Household Economics and Decisionmaking. Retrieved from https://www.federalreserve.gov/consumerscommunities/shed.htm

- Social Security Administration. (2024, May). When to Start Receiving Retirement Benefits. Retrieved from https://www.ssa.gov/pubs/EN-05-10147.pdf

- Mather, M. and Scommegna, P. (2024, January 9). Fact Sheet: Aging in the United States. Retrieved from https://www.prb.org/resources/fact-sheet-aging-in-the-united-states/

- Northwestern Mutual. (2024). Planning and Progress Study 2024. Retrieved from https://news.northwesternmutual.com/planning-and-progress-study-2024

- Board of Governors of the Federal Reserve System. (2023, November 2). Survey of Consumer Finances, 1989 – 2022: Retirement Accounts by Age of Reference Person. Retrieved from https://www.federalreserve.gov/econres/scf/dataviz/scf/table/#series:Retirement_Accounts;demographic:agecl;population:all;units:median

- Brenan, M. (2023, May 25). Americans' Outlook for Their Retirement Has Worsened. Retrieved from https://news.gallup.com/poll/506330/americans-outlook-retirement-worsened.aspx

- Social Security Administration. (2023, January). Your Retirement Benefit: How It’s Figured. Retrieved from https://www.ssa.gov/pubs/EN-05-10070.pdf

- U.S. Census Bureau. (2022, September 19). Did COVID-19 Change Retirement Timing? Retrieved from https://www.census.gov/library/stories/2022/09/did-covid-19-change-retirement-timing.html

- Board of Governors of the Federal Reserve System. (2022, August 11). Monetary Policy Report – February 2022. Retrieved from https://www.federalreserve.gov/monetarypolicy/2022-02-mpr-part1.htm#xthelimitedrecoveryoflaborsupply-513ccedc

- Gregory, V. and Steinberg, J. (2021, October 4). Lavor Force Exits and COVID-19: Who Left, and Are They Coming Back? Retrieved from https://www.stlouisfed.org/on-the-economy/2021/october/labor-force-exits-covid19

- Social Security Administration. (2019, January). Thinking of Retiring? Retrieved from https://www.ssa.gov/osss/prd/pdf/en/55-plus-insert.pdf

- Zulkarnain, A. and Rutledge, M.S. (2018, October 3). How Does Delayed Retirement Affect Mortality and Health? Retrieved from https://crr.bc.edu/working-papers/how-does-delayed-retirement-affect-mortality-and-health/

- Johnson, R. W. (2018, November 16). Is It Time to Raise the Social Security Retirement Age? Retrieved from https://www.urban.org/research/publication/it-time-raise-social-security-retirement-age

- Johnson, R.W., and Smith, K. E. (2016, February 9.). How Retirement is Changing in America. Retrieved from https://www.urban.org/features/how-retirement-changing-america

- Social Security Administration. (n.d.). Normal Retirement Age. Retrieved from https://www.ssa.gov/OACT/ProgData/nra.html

- Social Security Administration. (n.d.). Starting Your Retirement Benefits Early. Retrieved from https://www.ssa.gov/benefits/retirement/planner/agereduction.html

- The American Institute of Stress. (n.d.). The Holmes-Rahe Stress Inventory. Retrieved from https://www.stress.org/wp-content/uploads/2024/02/Holmes-Rahe-Stress-inventory.pdf

- U.S. Census Bureau. (n.d.). Quick Facts United States. Retrieved from https://www.census.gov/quickfacts/fact/table/US/PST0452

- Edited By

Calling this number connects you to one of our trusted partners.

If you're interested in help navigating your options, a representative will provide you with a free, no-obligation consultation.

Our partners are committed to excellent customer service. They can match you with a qualified professional for your unique objectives.

We/Our Partners do not offer every plan available in your area. Any information provided is limited to those plans offered in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

844-897-8632Your web browser is no longer supported by Microsoft. Update your browser for more security, speed and compatibility.

If you need help pricing and building your medicare plan, call us at 844-572-0696