Tax-Sheltered Investments for High Net-Worth Individuals

Tax-sheltered investments are legal financial vehicles or strategies that reduce your tax liabilities. Each type can provide immediate tax relief, reduce your taxes during your retirement — or both. Learn about different tax-sheltered investment types, along with the pros, cons and general tips to maximize your tax savings.

- Written by Lindsey Crossmier

Lindsey Crossmier

Financial Writer

Lindsey Crossmier is an accomplished writer with experience working for The Florida Review and Bookstar PR. As a financial writer, she covers Medicare, life insurance and dental insurance topics for RetireGuide. Research-based data drives her work.

Read More- Edited By

Lamia Chowdhury

Lamia Chowdhury

Financial Editor

Lamia Chowdhury is a financial content editor for RetireGuide and has over three years of marketing experience in the finance industry. She has written copy for both digital and print pieces ranging from blogs, radio scripts and search ads to billboards, brochures, mailers and more.

Read More- Reviewed By

Ebony J. Howard, CPA

Ebony J. Howard, CPA

Credentialed Tax Expert at Intuit

Ebony J. Howard is a certified public accountant and freelance consultant with a background in accounting, personal finance, and income tax planning and preparation. She specializes in analyzing financial information in the health care, banking and real estate sectors.

Read More- Published: May 24, 2023

- Updated: July 10, 2023

- 6 min read time

- This page features 8 Cited Research Articles

Key Takeaways- Tax-sheltered investments provide legal ways to reduce your taxable income, unlike tax evasion.

- Common types of tax-sheltered investments are traditional, SEP and Roth IRAs, 401(k)s, 403(b)s, 457 plans, annuities and HSAs.

- Capping out your contributions to tax-sheltered accounts and taking advantage of available tax credits and deductions can help you maximize your tax benefits.

What are Tax-Sheltered Investments?

Tax-sheltered investments are defined as legal financial vehicles or strategies that reduce your tax liabilities, such as a 401(k). Tax-sheltered investments include tax deductions, tax credits and other investment types.

They can work in multiple different ways, either by delaying or eliminating a portion of your taxes altogether.

3 Ways Tax-Sheltered Investments Work- Pre Tax

- refers to benefits, like a health spending account (HSA), that is deducted from your payment before the taxes are calculated.

- Tax Deferred

- refers to your earnings, like those in a traditional individual retirement account (IRA), which are tax free until you make withdrawals.

- Tax Exempt

- refers to earnings that aren’t subject to taxes at withdrawal, like with a Roth IRA account.

Having multiple tax-sheltered investments can save you thousands of dollars a year.

For example, say you’re in the 24% tax bracket and you have a traditional IRA. If you contribute $6,000 to your IRA, you’ll pay $1,440 less in federal income taxes.

You could also consider making a charitable donation, which typically allows you to deduct up to 60% of your adjusted gross income from charitable donations.

Did You Know?There’s a fine line between legal forms of tax sheltering, and tax evasion – the latter of which can result in excessive fines and prison time.Source: Tax Policy CenterIf you have multiple tax-sheltered investments, your tax savings can quickly accumulate to round out a well-structured retirement plan.

Though high-net worth individuals may not be able to take advantage of Roth accounts unless contributing to an employer-sponsored Roth 401(k), there are ways around the Roth IRA income limit. Conversions allow those with higher income to make nondeductible contributions to a traditional IRA then later convert those funds to a Roth IRA.Types of Tax-Sheltered Investments

Common tax-sheltered investment types include traditional, SEP and Roth IRAs, 401(k)s, 403(b)s, 457 plans, annuities and HSAs.

You can also consider a 529 college savings plan, municipal bonds or making charitable donations to lower your taxes.

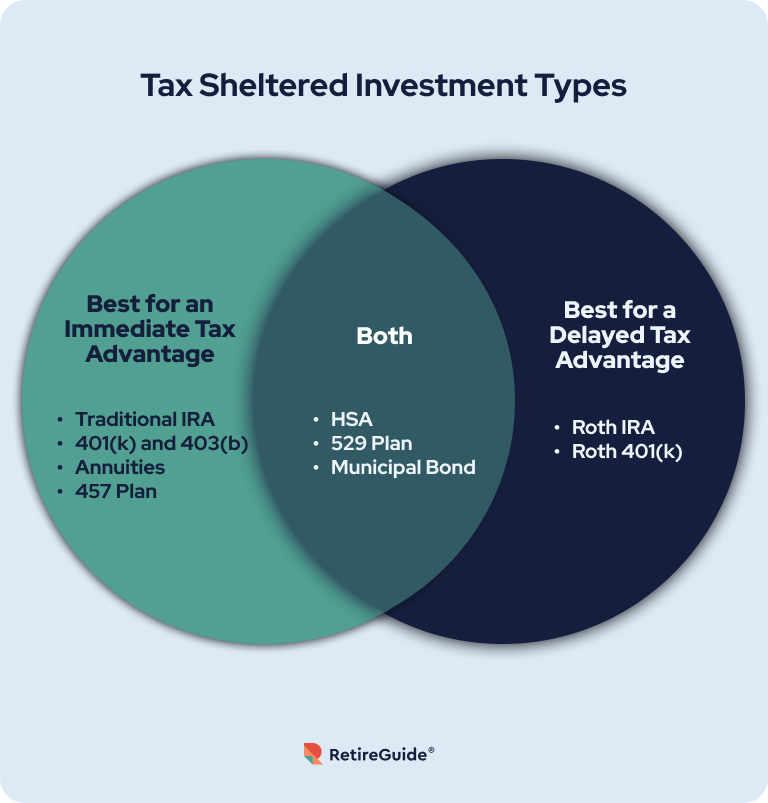

Each tax-sheltered investment offers different tax advantages. For example, if you’re looking for an immediate tax advantage, consider a traditional IRA instead of a Roth IRA. If you want immediate and delayed tax benefits, consider an HSA.

The diagram below lists the tax-sheltered investment types and separates each type based on their immediate and delayed tax advantages.

Expand

ExpandLearn about each tax-sheltered investment type’s specific tax advantage to determine which is best for you.

Tax Advantages of Each Tax-Sheltered Investment- Traditional IRA or SEP IRA

- 100% tax-deferred growth, with taxes only due on withdrawals.

- Roth IRA and Roth 401(k

- You pay taxes on the money deposited in your Roth IRA, but 100% of your withdrawals are tax-free.

- 401(k) and 403(b) Plans

- Lowers your taxable income so you owe less taxes now. Your contributions are 100% tax-free, but your withdrawals will be taxed as income.

- Annuities

- Annuities are tax-deferred investments, and you don’t owe income taxes until you start making withdrawals or receiving payments. How the withdrawals are taxed varies depending on if you purchased the annuity with pre-tax or post-tax funds.

- Health Savings Account (HSA)

- An HSA offers a triple tax advantage – your deposits are tax-deductible, growth is tax-deferred, and spending is tax-free as long as it’s spent on eligible medical expenses.

- Tax-Exempt Municipal Bond

- 100% tax exempt on federal income and state and local income in specific cases.

- 529 Plans

- Contributions don’t reduce your taxable income, but they are tax deferred. Withdrawals used for eligible education expenses are also tax-free.

- 457 Plans

- Your contributions reduce your taxable income and are 100% tax-free, but your withdrawals will be taxed as income.

Is Your Retirement Plan on Track?Explore annuity solutions that align with your planning needs.

*Ad: Clicking will take you to our partner Annuity.org.Benefits and Risks of Tax-Sheltered Investments for Retirement Planning

While there are specific benefits and risks for each type of tax-sheltered investment type, there are several general pros and cons to consider. Dana Ronald, enrolled agent for the IRS and president of Tax Crisis Institute told RetireGuide, “The pros of tax-sheltered investments for retirement planning include reducing taxable income, growing pre-tax funds and taking money out tax-free upon retirement. The cons include potential penalties or fees associated with early withdrawals from certain accounts (such as 401Ks or IRAs).”

Benefits and RisksWhat is capital preservation?Benefits- Tax savings with compounded interest options

- Reduces your taxable income

- Tax deferred in most cases

- Lowered tax rates in retirement

- Diversified investment portfolio

Risks- Potential early withdrawal penalties

- Limited investment options

- Required minimum withdrawals (RMDs) with some investments

- Lower returns compared to other investment options, like stocks

AdvertisementTips for Maximizing Tax Savings with Tax-Sheltered Investments

Utilizing the five tips below should provide you with a steady strategy to maximize your tax savings.

5 Tips To Maximize Your Tax Savings- Maximize contributions to tax-sheltered accounts

- Take advantage of all tax credits and deductions available

- Consider Roth conversions

- Optimize asset location

- Review and adjust investment strategy regularly

Ronald offered RetireGuide his endorsement and more context on the first two tips listed above.

“Contribute the maximum amount to your retirement accounts (such as 401K plans, IRAs and SEP IRAs). This will reduce your taxable income and help you save on taxes.”

“Take advantage of all tax credits and deductions available to you. This can help reduce your taxable income and maximize your savings,” Ronald told RetireGuide.

Lock In Today’s Best Fixed Annuity RatesStart with a free annuity consultation to learn how annuities can help fund your retirement.

*Ad: Clicking will take you to our partner Annuity.org.The Best Tax Shelters for High Net-Worth Individuals

“For high-net-worth individuals, the best tax shelters are 401Ks, IRAs, SEP IRAs, HSAs and 529 plans,” Ronald told RetireGuide.

“Each account offers different advantages and disadvantages that should be carefully considered when determining the best approach for each individual.”

Scheduling a consultation with a financial advisor can help you best determine which tax-sheltered accounts can help you reduce your tax bill.

When speaking to a financial advisor, make sure to evaluate your investment goals and risk tolerance for each tax-sheltered investment type.

Frequently Asked Questions About Tax-Sheltered Investments

How much can I contribute to my tax-sheltered accounts each year?The contribution limits vary depending on what tax-sheltered account type you have. For example, the annual contribution limit for a 401(k) is $22,500 in 2023 (or $30,000 if you’re over 50). For IRAs, you can contribute only $6,500 annually (or $7,500 if you’re over 50) to this type of tax-sheltered account.Are there any penalties for withdrawing money from tax-sheltered accounts before retirement age?For most tax-sheltered accounts, like a 401(k) or IRA, you face a 10% penalty if you take any distributions before age 59 ½. However, there are several exceptions. A tax-exempt municipal bond doesn’t have an early distribution penalty at all and an HSA has a hefty 20% penalty if you access funds for ineligible expenses before you turn 65.Can I use tax-sheltered investments for short-term financial goals or are they strictly for retirement planning?Tax-sheltered investments can be used for short-term financial goals and long-term retirement goals. For example, you could open a traditional and Roth IRA to get an immediate tax break from the traditional IRA while still reaping the benefits of tax-free distributions later from the Roth IRA.Editor Malori Malone contributed to this article.

AdvertisementConnect With a Financial Advisor Instantly

Our free tool can help you find an advisor who serves your needs. Get matched with a financial advisor who fits your unique criteria. Once you’ve been matched, consult for free with no obligation.

Last Modified: July 10, 2023Share This PageAdvertisement8 Cited Research Articles

- Heaslip, E. (2023, March 14). How Do Charitable Donations Impact Your Taxes? Retrieved from https://www.uschamber.com/co/grow/marketing/charitable-donations-tax-implications

- Brandon, E. (2023, January 10). How to Make a Last-Minute IRA Contribution. Retrieved from https://money.usnews.com/money/retirement/iras/articles/how-to-make-a-last-minute-ira-contribution

- HSA Central. (2023). HAS Tax Advantages. Retrieved from https://www.hsacentral.net/consumers/tax-benefits-health-savings-account/

- FINRA. (2022, October 26). What Does It Mean to Be Pre-Tax or Tax-Advantaged? Retrieved from https://www.finra.org/investors/insights/tax-advantaged

- Internal Revenue Service. (2022, October 21). 401(k) Limit Increases to $22,500 for 2023, IRA Limit Rises to $6,500. Retrieved from https://www.irs.gov/newsroom/401k-limit-increases-to-22500-for-2023-ira-limit-rises-to-6500

- Internal Revenue Service. (2022, September 19). Retirement Topics - Exceptions to Tax on Early Distributions. Retrieved from https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-tax-on-early-distributions

- Benefit Resource. (2022, August 4). How To Avoid Penalties on an HSA Withdrawal. Retrieved from https://www.benefitresource.com/blog/how-to-avoid-penalties-on-an-hsa-withdrawal/

- Tax Policy Center. (2014). What is a Tax Shelter? Retrieved from https://www.taxpolicycenter.org/briefing-book/what-tax-shelter

- Edited By

Calling this number connects you to one of our trusted partners.

If you're interested in help navigating your options, a representative will provide you with a free, no-obligation consultation.

Our partners are committed to excellent customer service. They can match you with a qualified professional for your unique objectives.

We/Our Partners do not offer every plan available in your area. Any information provided is limited to those plans offered in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

844-359-1705Your web browser is no longer supported by Microsoft. Update your browser for more security, speed and compatibility.

If you need help pricing and building your medicare plan, call us at 844-572-0696