How To Avoid 10 Common, Costly Retirement Mistakes

Some of the most common mistakes people make when planning for retirement can end up costing hundreds of thousands of dollars and even the lifestyle they expected. But there are simple steps you can take before and during retirement to avoid these costly errors.

- Written by Terry Turner

Terry Turner

Senior Financial Writer and Financial Wellness Facilitator

Terry Turner has more than 35 years of journalism experience, including covering benefits, spending and congressional action on federal programs such as Social Security and Medicare. He is a Certified Financial Wellness Facilitator through the National Wellness Institute and the Foundation for Financial Wellness and a member of the Association for Financial Counseling & Planning Education (AFCPE®).

Read More- Edited By

Lamia Chowdhury

Lamia Chowdhury

Financial Editor

Lamia Chowdhury is a financial content editor for RetireGuide and has over three years of marketing experience in the finance industry. She has written copy for both digital and print pieces ranging from blogs, radio scripts and search ads to billboards, brochures, mailers and more.

Read More- Reviewed By

Barbara O’Neill, Ph.D., CFP®, AFC®, CRPC®

Barbara O’Neill, Ph.D., CFP®, AFC®, CRPC®

Certified Financial Planner™ professional, Accredited Financial Counselor™ and owner and CEO of Money Talk

Barbara O’Neill is a personal finance expert with 41 years of experience working at Rutgers University. She is a Certified Financial Planner™ professional and an Accredited Financial Counselor™. Currently, she is the owner and CEO of Money Talk, where she writes, speaks and reviews content related to personal finance. In 2020, she authored Flipping a Switch, published in 2020.

Read More- Published: September 24, 2023

- Updated: December 23, 2024

- 19 min read time

- This page features 9 Cited Research Articles

Key Takeaways- Crafting a retirement plan that considers factors like retirement age, lifestyle, health and location is crucial to achieving a stable retirement.

- You can take a few simple steps to avoid the most common retirement planning mistakes.

- Achieving a fulfilling retirement isn't solely about finances; it's also about engaging in meaningful activities, nurturing relationships and planning for a purposeful post-work life.

Achieving a financially stable retirement requires deliberate effort. It is necessary to make wise financial choices from a young age, ideally starting in your 20s, and consistently follow through with your retirement plan.

“The two biggest mistakes are retiring from something instead of retiring to something; and then underestimating your actual cost of retirement,” Bruce Ward, a financial advisor with Cutter & Company in Ballwin, Missouri, told RetireGuide. “The happiest retirees fill their time with something that provides meaning to their lives. Find that something before retiring.”

This guide outlines 10 of the most common retirement planning mistakes and how to avoid each of them. Dodging these roadblocks can help you keep your finances on track and help you focus on retiring to something you want.

Start planning for retirement now to figure out what you need to save to maintain a comfortable lifestyle in later life. Don’t wait to start saving or you could make a “million dollar mistake” by forgoing savings in young adulthood and the resulting compound interest.Failing To Have a Retirement Plan

To secure your retirement and prevent financial struggles, it’s crucial to craft a plan that considers your likely lifespan. Include details like your intended retirement age, where you’ll live after retiring, your health and the lifestyle you aim for.

Not having a plan can leave you holding on to excess cash. This may look good on your bank account, but it can keep you from maximizing your retirement investments and savings, according to Moneyzine CEO Jonathan Merry.

“Hoarding your cash and your money in non-income generating platforms means you are missing out on passive income that would greatly benefit your retirement plans,” Merry told RetireGuide. “Retirees who avoid even the slightest risks are essentially missing out on the tremendous potential of compounding interest.”

How To Create a Retirement Plan

Having a clearly defined retirement plan will prevent this, and working with a licensed financial advisor or professional retirement planner can help you create a solid plan.

Steps To Create and Maintain a Retirement Plan- Calculate the funds you'll require for a comfortable retirement.

- Consider your spouse, partner and family when planning your retirement.

- Understand precisely how you want to spend your time in retirement.

- Design a personalized retirement plan that involves years left until retirement, chosen retirement locations, lifestyle preferences and overall health.

- Seek guidance from a financial expert to ensure your plan suits you.

- Routinely check to see if you are on track to meet your goals.

- Regularly update your plan to adapt to changing needs.

When To Apply for Social Security

Claiming Social Security benefits at the wrong time can mean either missing out on thousands of dollars in benefits or losing out on the maximum amount of money available.

“One common mistake is claiming Social Security benefits too early, resulting in reduced monthly payments over a lifetime,” Celeste Robertson, an estate planning attorney, told RetireGuide. “Analyze your individual circumstances, health and retirement goals to determine the optimal age for claiming benefits.”

If you start at 62, but your full retirement age is 66, your checks could be 25% less, affecting both you and your spouse. Yet, waiting brings rewards. At 66, you get the full amount; and waiting until 70 increases it by about a third.

Some people may fail to consider how Social Security’s spousal and survivor benefits may give them more income in retirement.

“If one spouse has a much higher income than the other, it could be beneficial for the lower-earning spouse to claim benefits early,” Evan Tunis, President of Florida Healthcare Insurance, told RetireGuide. “If one spouse passes away and the other is eligible for a survivor’s benefit, they should consider taking advantage of this opportunity.”

Your full retirement age depends on when you were born. But your health and desire to continue working can affect precisely when the time to apply for Social Security is right for you.

Avoid This Common Social Security Mistake

You can take a few simple steps to avoid this Social Security mistake.

What To Consider When Deciding When To Claim Social Security Benefits- Know your full retirement age.

- Starting at 62 means smaller checks, impacting you and your spouse.

- Waiting is rewarding; at 66, the full amount. At 70, about a third extra.

- Consider health, work and savings.

- If you’re unhealthy, consider claiming early to receive benefits while you can.

- If you’re single with inadequate savings, consider waiting.

- If you’re in poor health or have bills, consider if early benefits would help your unique situation.

Waiting To Save for Retirement

Delaying your retirement savings can have negative consequences. Many people delay retirement savings, thinking they have plenty of time or they prioritize other immediate financial needs.

“Time plays an important role in the growth of your investments. The earlier you start saving, the more time your money has to grow through the power of compounding interest,” Merry said. “As time passes, the compounding effect becomes less impactful, and you may need to contribute larger amounts to catch up on the retirement savings you’ve missed.”

Compound interest grows on the initial amount put into savings and the interest already earned. It speeds up how your investments grow. It gets stronger if the interest rate, compounding frequency or investment time changes.

For investments, compound interest is good for building wealth. Loans with compound interest, however, accumulate more debt. Your finances are affected by how compound interest is applied.

How To Avoid Waiting Too Long To Start Saving

The best way to avoid waiting too late to start saving for retirement is to start saving with your first paycheck. The second-best way is to start now. But since you can’t turn back time, there are some ways late starters can catch up on savings for the time they’ve missed.

Ways You Can Catch Up on Savings for Retirement- Choose your retirement location wisely.

- Opt for low-tax states to maximize your take-home retirement income.

- Convert to Roth IRA.

- Putting your savings into a Roth IRA can control future tax burdens, enhancing your retirement fund. Consult a tax advisor because this move has tax implications.

- Gradually raise savings.

- Increase retirement account contributions by at least 1% annually. This grows your savings without straining your budget.

- Make catch-up contributions.

- If you're 50 or older, capitalize on IRS rules allowing extra contributions to 401(k)s and IRAs, enhancing tax-advantaged savings. In 2025, 401(k)s, and similar plans allow a catch-up contribution of $7,500, and IRAs allow a catch-up contribution of an extra $1,000 over the contribution limits.

Not Making the Most of Employer Retirement Plans

If you don’t participate in your company’s retirement plans — such as a 401(k) or similar plan — you could cost yourself hundreds of thousands of dollars when you retire. And if your employer matches your contributions, failing to take full advantage could result in missed opportunities for extra money.

For example, if you contribute 6% and they match 3%, that’s like receiving free money.

Remember that there are limits on contributions but take advantage of catch-up contributions available for those 50 and older. Some companies may even match student loan repayments with retirement contributions.

In addition, workplace retirement plans can help you build good savings habits and better understand how to plan for retirement. These plans can also give you tax advantages now and in retirement. Plus, they allow you to take out a 401(k) loan if you ever need the money for an emergency or financial opportunity.

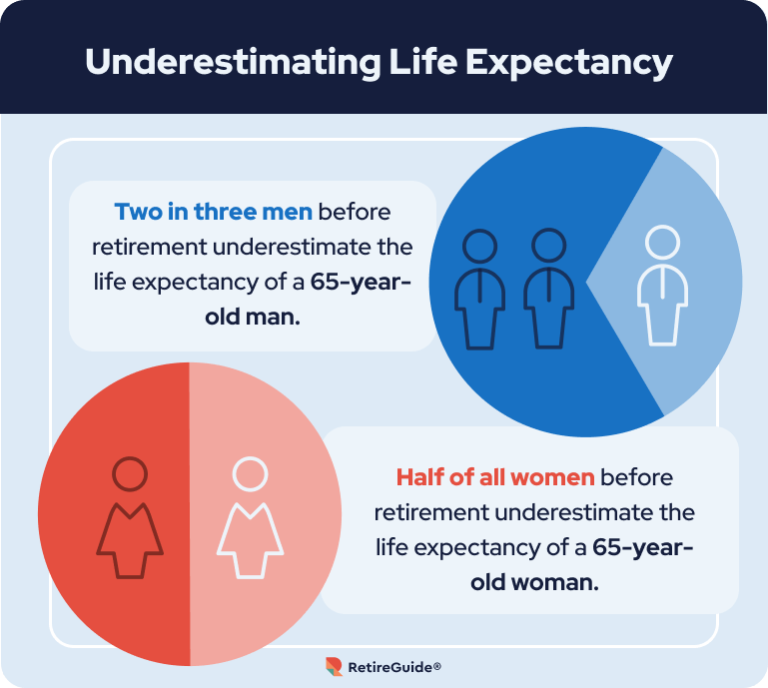

Underestimating Your Longevity

A common mistake in retirement planning is not guessing how long you’ll live after retiring. According to the Stanford Center on Longevity, if you live three years longer by 2050, your basic living expenses will cost 50% more.

“When we talk about retirement, longevity is a hard topic — we live longer, but our financial plans often operate on outdated life expectancies,” Daniel Morris, founder of My Caring Plan, a website for caregivers and older adults in the later stages of life, told RetireGuide.

Diversifying income sources and considering passive income streams is a good hedge, Morris said.

“Retirees should take into consideration the fact that they may live to be much older than they anticipate. This means that their retirement funds must last longer, and therefore, it is important for them to plan accordingly,” Tunis said.

How To Avoid Underestimating Longevity in Retirement Planning

There are no certainties as to how long you’ll live. But there are some ways to help you estimate your life expectancy. These include using life expectancy tables from the government, a life expectancy calculator or guessing based on family history.

Retiring at around 65 years old could mean spending 25 to 30 years in retirement. For this reason, advisors suggest saving enough to cover such a lengthy time in retirement.

“Plan on living to at least the age that your oldest grandparent lived,” Ward said.

He said there are also three issues woven around longevity that you need to consider. All require addressing early and planning for:

- Income sources you can't outlive.

- Loneliness after a spouse and your friends die.

- Finding a new place to live as you age.

“Planning for the trauma of aging before you need to make a decision allows you to think clearly and involve family and friends in the decision-making process,” Ward said. “Remember, surprises in old age are rarely fun.”

Ward suggests using an annuity to provide a lifetime guaranteed income source.

“Running out of enough money to live comfortably is a real danger of longevity,” Ward said. “I like using qualified money, that is, IRA and 401(k) money, to purchase the annuity.”

He points to two types of annuities that provide retirement income you cannot outlive: an income annuity and a variable annuity that has a guaranteed lifetime income rider.

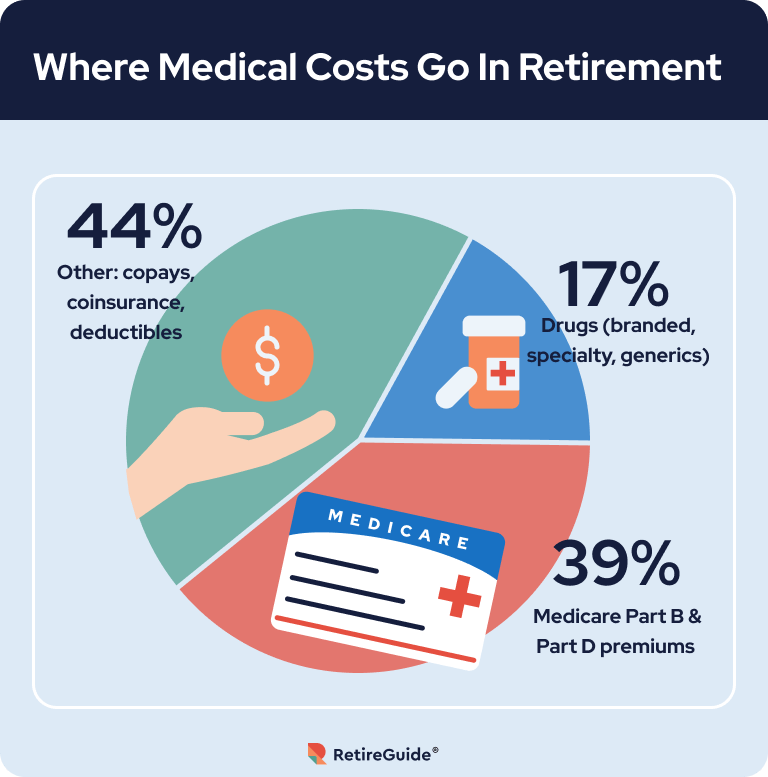

Underestimating Health Care Expenses

A single person aged 65 in 2023 may need about $157,000 saved to cover health care expenses during their retirement, according to the Fidelity Retiree Health Care Estimate. A 65-year-old couple will need $315,000.

“People frequently overlook factors such as rising health care costs and longer lifespans, resulting in insufficient savings,” Michael Hammelburger, the CEO and a CPA at The Bottom Line Group, a finance company in Baltimore, told RetireGuide.

Medicare does not cover all medical expenses. You still may have significant out-of-pocket costs associated with most plans. And Medicare does not cover any long-term care costs.

Around 70% of today’s 65-year-olds might need long-term care. And 20% could need it for over 5 years, according to research from the U.S. Department of Health and Human Services. Women tend to need it on average 18 months more than men.

The average monthly cost of a private room in a nursing home in the United States was $9,034 in 2021, according to a survey by Genworth. Semi-private room care was $7,908. Both were expected to top $10,000 a month by 2023.

Preparing for Health Care and Long-Term Care Costs in Retirement

While Medicare can offset many hospitalization, prescription and routine doctor’s visit costs, rising medical expenses in the United States require early planning for your medical care in retirement.

How To Prepare for Health Care Costs in Retirement- Plan for health care costs.

- Focus on premiums, out-of-pocket expenses and long-term care. Consider monthly premiums, prepare for out-of-pocket payments and consider long-term care like nursing homes. Understand that health insurance may not cover all needs, so save for unexpected expenses.

- Invest in a Health Savings Account (HSA).

- If you have a high-deductible health plan before retirement, consider an HSA. HSAs offer triple tax benefits — money goes in tax-free, grows tax-free and is spent tax-free for health care. And unlike FSAs and HRAs, you can use your HSA funds to pay for retirement health costs later.

- Understand Medicare.

- To understand Medicare for retirement, grasp its parts. Part A covers hospitals after 10 years of taxes. Part B broadens coverage, with costs based on income. Consider options like Medicare Advantage, which is private insurance that covers what Part A and B cover. Part D is also private insurance that helps cover prescription drugs. Study what each part covers had how much Medicare costs you.

- Understand coverage gaps.

- Aside from Medigap and Medicare Advantage, explore Medigap and other private insurance options. Though pricier, Medigap can cover gaps in Medicare coverage.

- Consider long-term care insurance or an annuity rider.

- Plan for expected and long-term care costs, considering long-term care insurance too. Some life insurance policies offer living benefits for long-term care. You may also be able to use a nonqualified annuity for long-term care.

Finally, know your health issues. Be aware of risks and take steps to minimize them. Sometimes, simply eating right and staying in shape now can pay off later.

“Health is wealth, they say, so investing in good health practices now can reduce future medical expenses,” Morris said.

Poor Investment Strategies

It’s essential to avoid poor investment strategies in retirement, adjust your investment strategies periodically before retirement and consider how inflation erodes your savings’ value over time.

“Individuals may need to reassess their risk tolerance and consider diversifying their investments during economic downturns,” Hammelburger said. “Adapting may entail postponing retirement or changing spending habits to account for lower returns.”

Investments must take into account inflation, which can make it harder to afford necessities in retirement, according to Merry.

“For example, a 3% inflation rate can reduce the purchasing power of retirement assets by about 42% over a 25-year period,” he said.

How To Avoid Investment Mistakes in Your Retirement Plan

Having and paying attention to your investment strategy can pay off by retirement. Keep an eye on your retirement goals while monitoring inflation and investment returns.

Four Steps To Avoid Investment Mistakes in Retirement Planning- For long-term gains, allocate most assets to stocks that offer strong returns over decades.

- As retirement nears, shift to more conservative options.

- Remember that not investing in stocks risks outliving your money unless lower returns suffice.

- Consider consulting a financial advisor or other investment professional to guide your strategy.

Poor Tax Planning

One common error in retirement tax planning is overlooking the tax consequences of different income sources, including Social Security benefits, retirement account withdrawals and investments, according to Hammelburger.

Failing to maximize withdrawals from accounts with tax benefits and taxable accounts can lead to unnecessary tax burdens. Additionally, neglecting strategies like Roth IRA conversions or keeping up with tax law changes can hinder effective tax management during retirement.

“Neglecting tax planning can lead to unnecessary tax burdens during retirement,” Robertson said. “Some retirees overlook tax-efficient withdrawal strategies from retirement accounts, potentially triggering higher tax rates.”

How To Avoid Tax Mistakes in Retirement Planning

The financial experts who spoke to RetireGuide suggested that if you anticipate higher taxes during retirement, it may be wise to opt for Roth accounts. This move will require you to pay taxes upfront, but you will benefit from tax-free withdrawals later. On the other hand, if you expect lower taxes in the future, it might be better to go for traditional IRAs or 401(k)s.

Taxes can be complicated. It is wise to seek tax advice from a professional before you hit retirement.

“To avoid these pitfalls and ensure a more financially secure retirement, it is critical to work with a financial advisor and stay proactive about tax-related updates,” Hammelburger said.

Three Strategies To Avoid Tax Mistakes in Retirement- Roth accounts for higher taxes

- Use a Roth 401(k) or Roth IRA if expecting higher retirement taxes. Pay taxes upfront, and enjoy tax-free withdrawals and earnings.

- Traditional for lower taxes

- Opt for a traditional IRA or 401(k) if you anticipate lower retirement taxes. Avoid high upfront taxes, and pay when withdrawing.

- Beware of 401(k) loans

- Loans from a regular 401(k) can lead to double taxation. Repay with after-tax money and face taxed withdrawals in retirement.

Continuing To Spend the Same Way As Before Retirement

Another mistake among new retirees is to continue spending as they did when working. This can cause you to burn your retirement savings much faster than expected.

The first few months of retirement may also hit you with unexpected sticker shock.

“The early retirement years can be expensive,” Ward said. “Extra costs include Medicare supplements, maybe more medicine and travel are the obvious new expenses.

He added that staying busy and entertained without a full-time or part-time job will cost more than expected.

Sticking with pre-retirement spending can hurt due to less income. Long retirement needs require a realistic view. Your savings may appear vast, but retirement could last decades. You will need careful financial management with your lower income in retirement.

Avoiding Spending Mistakes in Retirement

Creating a retirement budget is a crucial part of any retirement plan. It can be the key to determining how much money you’ll need in retirement.

“As an advisor, I know that telling someone to start a budget is like telling someone to start dieting,” Ward said. “However, a budget is critical in retirement because most people really don’t know where all their money is going — and so, budgeting isn’t necessarily spending less, it’s knowing how you are spending your money.”

Creating a realistic budget means you’ve taken the first step to avoid overspending.

Four Steps To Avoid Retirement Spending Mistakes- Create a retirement budget.

- Establish a new budget aligned with expected retirement income. Draw from Social Security and retirement accounts cautiously to sustain lifelong finances.

- Cut expenses.

- To allow for discretionary spending, trim costs in other areas. Reduce eating out, subscriptions and explore insurance savings. Refinancing may help.

- Plan your bucket list wisely.

- Prioritize and space out bucket list activities. Allocate funds for desired trips or adventures within budget limits.

- Wait to change your lifestyle.

- Refrain from significant purchases or lifestyle changes for three to six months after retiring. Avoid overspending during initial excitement.

Mistakes With Your Required Minimum Disbursements

An RMD, or required minimum distribution, is a mandated annual withdrawal from retirement accounts like IRAs and 401(k)s. It’s the minimum you must withdraw after a certain age to follow tax laws. After the SECURE 2.0 Act, you start at 73 (or 75 if you were born in 1960 or later). Exceptions apply if you’re still working or have Roth IRAs, which lack RMDs.

If you don’t take a required minimum distribution (RMD) from retirement accounts on time, you can face financial penalties. The IRS imposes a hefty penalty of 50% on the amount that you should have withdrawn but wasn’t. The SECURE ACT 2.0 dropped the excise rate to 25% — and possibly 10% — if you correct the RMD within two years.

This mistake can significantly reduce your retirement savings and disrupt your financial plans, making it crucial to adhere to RMD requirements to avoid these costly consequences.

Avoiding the Penalties for Failing To Take an RMD

People miss taking their required minimum distributions because they forgot or did the math incorrectly. Quickly correcting the error is the best way to fix this problem.

Avoiding RMD Penalties- Do the math.

- Calculate the missed RMD amount and withdraw it from your IRA or employer retirement plan promptly.

- Do the paperwork.

- Download and fill out IRS Form 5329, "Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts," either with your tax return or separately. You don't need to pay the penalty immediately if you request a waiver.

- Explain to the IRS what happened.

- Include a letter with form 5329 explaining the shortfall and the corrective measures you've taken. Explain the reasons for the mistake, such as illness, family death, address change issues or incorrect advice relied upon.

These steps won’t guarantee that you won’t be penalized, but they may go a long way in convincing the IRS to waive any penalty.

Conclusions

It’s important to acknowledge and plan for potential mistakes that may arise on your path to retirement. While avoiding financial setbacks is crucial, it’s just as essential to ensure that your retirement years are fulfilling and purposeful, as Morris suggests.

“Retirement isn’t just about money,” he said. “It’s about experiences, community, and legacy. Engage in activities that light up your spirit, nurture relationships, and, perhaps, give back to the community in ways that resonate with you.”

Featured Experts

-

Bruce Ward, CFP®, ChFC®, CLU®, RICP®Financial Advisor, Cutter & Company

Ballwin, MOBruce Ward is a certified financial planner in Ballwin, Missouri, at Cutter & Company, Inc. He has worked for various firms, including Metlife Securities and MassMutual Life Insurance Co. Ward is licensed as a securities agent and investment advisor representative, and is registered to assist investors in AZ, CA, CT, FL, IL, MO, NE and NY. -

Celeste RobertsonEstate Planning Attorney

Corpus Christi, TXThe Law Offices of Celeste Robertson in Corpus Christi and Rockport, Texas, provide legal services in family law, estate planning, probate and guardianship matters. Robertson graduated with honors from the University of Houston Law Center in 1994, after completing her bachelor’s degree in political science with honors. She is a member of the Texas Bar Foundation and actively participates in various civic and charitable organizations at the local, statewide and national levels. -

Daniel MorrisFounder, My Caring Plan

Daniel Morris is the founder of My Caring Plan, a website dedicated to helping caregivers and seniors navigate the later stages of life by providing financial, legal and health information.

Daniel Morris is the founder of My Caring Plan, a website dedicated to helping caregivers and seniors navigate the later stages of life by providing financial, legal and health information. -

Evan TunisPresident, Florida Healthcare Insurance

Parkland, FLEvan Tunis is an insurance professional with 15+ years of experience. Specializing in health insurance, he's known for his exceptional knowledge and personalized solutions. Evan was President of EST Insurance Solutions and a three-time President’s Council awardee for top 100 health insurance agents. The company was named one of the Top 50 Agencies by Humana, and in 2014, the company was named the Top Agency in the Southeast by Cigna. -

Jonathan MerryCEO, Moneyzine

Jonathan Merry is a UK-based entrepreneur and finance expert who has built financial service businesses from scratch. He has expertise in personal and business finance, investing, cryptocurrency and FX trading built from his over 20 years of experience in the finance industry.

Jonathan Merry is a UK-based entrepreneur and finance expert who has built financial service businesses from scratch. He has expertise in personal and business finance, investing, cryptocurrency and FX trading built from his over 20 years of experience in the finance industry. -

Michael Hammelburger, CPACEO, The Bottom Line

Baltimore, MDMichael Hammelburger is a CPA who has worked as a financial consultant since 2010. In 2019, Michael founded The Bottom Line Group, an expense reduction consulting firm helping companies reduce their expenses by thousands of dollars by focusing on areas not typically looked at by the leadership team.

AdvertisementConnect With a Financial Advisor Instantly

Our free tool can help you find an advisor who serves your needs. Get matched with a financial advisor who fits your unique criteria. Once you’ve been matched, consult for free with no obligation.

Last Modified: December 23, 2024Share This Page9 Cited Research Articles

- U.S. Internal Revenue Service. (2023, March 14). Retirement Plan and IRA Required Minimum Distributions FAQs. Retrieved from https://www.irs.gov/retirement-plans/retirement-plan-and-ira-required-minimum-distributions-faqs

- Morgan Stanley. (2023, February 7). 5 Mistakes To Avoid in Retirement. Retrieved from https://www.morganstanley.com/articles/retirement-planning-mistakes

- Taylor, M. (2023, January 2). Required Minimum Distribution Mistakes to Avoid. Retrieved from https://fortune.com/recommends/investing/required-minimum-distribution-mistakes-to-avoid/

- U.S. Social Security Administration. (2023, January). When to Start Receiving Retirement Benefits. Retrieved from https://www.ssa.gov/pubs/EN-05-10147.pdf

- Genworth. (2021). Cost of Care Survey. Retrieved from https://www.genworth.com/aging-and-you/finances/cost-of-care.html

- U.S. Department of Health and Human Services. (2020, February 18). How Much Care Will You Need? https://acl.gov/ltc/basic-needs/how-much-care-will-you-need

- Equifax. (n.d.). When Is the Best Time to File for Social Security Benefits? Retrieved from https://www.equifax.com/personal/education/life-stages/when-to-file-social-security-benefits/

- Fidelity. (n.d.). Boost Your Odds of a Successful Retirement. Retrieved from https://www.fidelity.com/learning-center/personal-finance/retirement/picture-yourself-retired

- Stanford Center on Longevity. (n.d.). Underestimating Years in Retirement. Retrieved from https://longevity.stanford.edu/underestimating-years-in-retirement/

- Edited By

Calling this number connects you to one of our trusted partners.

If you're interested in help navigating your options, a representative will provide you with a free, no-obligation consultation.

Our partners are committed to excellent customer service. They can match you with a qualified professional for your unique objectives.

We/Our Partners do not offer every plan available in your area. Any information provided is limited to those plans offered in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

844-897-8632Your web browser is no longer supported by Microsoft. Update your browser for more security, speed and compatibility.

If you need help pricing and building your medicare plan, call us at 844-572-0696