States That Don’t Tax Retirement Income

Thirteen states currently don’t tax retirement income: Alaska, Florida, Illinois, Iowa, Mississippi, Nevada, New Hampshire, Pennsylvania, South Dakota, Tennessee, Texas, Washington and Wyoming. Living in one of these states during retirement can save you thousands of dollars of retirement income every year.

- Written by Barbara O’Neill, Ph.D., CFP®, AFC®, CRPC®

Barbara O’Neill, Ph.D., CFP®, AFC®, CRPC®

Certified Financial Planner™ professional, Accredited Financial Counselor™ and owner and CEO of Money Talk

Barbara O’Neill is a personal finance expert with 41 years of experience working at Rutgers University. She is a Certified Financial Planner™ professional and an Accredited Financial Counselor™. Currently, she is the owner and CEO of Money Talk, where she writes, speaks and reviews content related to personal finance. In 2020, she authored Flipping a Switch, published in 2020.

Read More- Edited By

Lamia Chowdhury

Lamia Chowdhury

Financial Editor

Lamia Chowdhury is a financial content editor for RetireGuide and has over three years of marketing experience in the finance industry. She has written copy for both digital and print pieces ranging from blogs, radio scripts and search ads to billboards, brochures, mailers and more.

Read More- Reviewed By Thomas Brock, CFA®, CPA

- Published: September 27, 2023

- Updated: January 2, 2025

- 7 min read time

- This page features 8 Cited Research Articles

- Edited By

- Comparing the cost of living, including income taxes, in different states is an important part of the retirement planning process.

- Income tax is not the only tax that affects retirees. There are also state sales, excise, property, estate and inheritance taxes to consider.

- Tax savings is only one factor to consider with a relocation. Other key factors are social support networks, weather and community services.

States That Don’t Tax Retirement Accounts and Plans

Eight states currently don’t tax any income, including retirement income.

- Alaska

- Florida

- Nevada

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

In addition, New Hampshire taxes only interest and dividends, but this will end in 2027, according to New Hampshire’s Department of Revenue Administration.

State taxes are a major consideration for retirement planning. Differences in state taxes on retirement income can result in big differences in spendable income. This is especially true for high earners.

For example, a person in Florida, where there is no income tax, will take home more money than a person who makes the same amount of money in California, which has the highest state income tax rate of 13.3%. The difference in taxes of these two states can be thousands, or even tens of thousands, of dollars.

Of course, income tax is not the only tax that affects retirees. There are also state sales, excise (e.g., gasoline and cigarette), property, estate and inheritance taxes to consider.

When it comes to retirement, settling in a tax-favored state can make the difference between living comfortably and exhausting your savings before you die. This is one of the reasons we’ve seen such a notable exodus from high income tax states, like California and New York, to no income tax states like Florida and Texas.

Pensions

Defined benefit pensions based on earnings and years of service can provide a significant chunk of retirement income. This is especially true for high-earning, long-tenured workers. Six-figure annual pension benefits are not unheard of. There are fifteen states that don’t tax pensions. The nine listed above, plus six more.

- Alabama

- Hawaii

- Illinois

- Iowa

- Mississippi

- Pennsylvania

Military Pensions

In addition to the nine states without income tax and the six that exempt pensions, 16 other states exempt military retirement pay.

- Arizona

- Arkansas

- Connecticut

- Kansas

- Louisiana

- Maine

- Massachusetts

- Michigan

- Minnesota

- Missouri

- Nebraska

- New Jersey

- New York

- North Carolina

- Ohio

- Wisconsin

Eleven more states with a state income tax only partially tax military retirement pay.

- Colorado

- Delaware

- Georgia

- Idaho

- Kentucky

- Maryland

- New Mexico

- Oklahoma

- Oregon

- South Carolina

- West Virginia

401(k) and Other Employer Retirement Savings Plans

Retirement plans that fall under this umbrella include 401(k) plans for employees of for-profit companies, 403(b) plans for teachers and non-profit sector employees, 457 plans for state and local government workers, and the thrift savings plan (TSP) for federal government workers and service members.

In addition to the nine states listed above that don’t tax any income, three states specifically do not tax these tax-deferred savings plans.

- Illinois

- Mississippi

- Pennsylvania

Individual Retirement Accounts (IRAs)

Traditional IRA deposits made with pre-tax dollars accumulate tax-deferred until withdrawal. Withdrawals are taxed as ordinary income and are mandatory at age 73 if you were born between 1951 to 1959, or 75 if you were born after 1959 when required minimum distributions (RMDs) begin.

Roth IRA contributions are made with after-tax dollars and withdrawals are tax free if an investor reaches age 59 1/2 and the account has been open for at least five years

The same three states that do not tax income from tax-deferred employer plans also do not tax income from IRAs and annuities, for a total of 12 tax-free states.

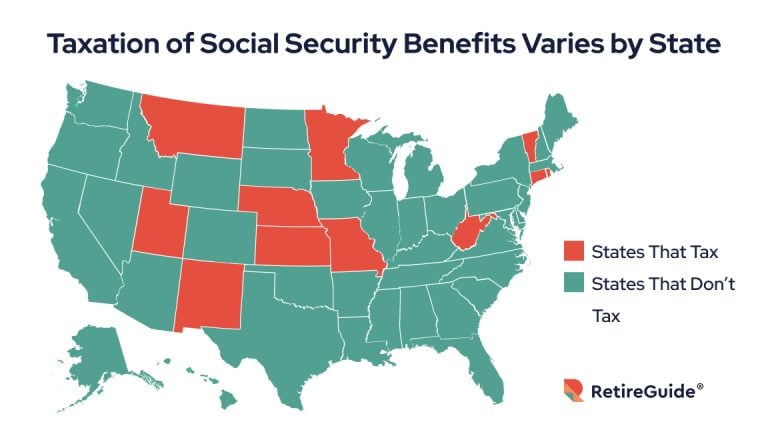

Social Security

Over three quarters of U.S. states do not tax Social Security benefits. Only 12 states currently do. Excluded benefit amounts vary from state to state and many only tax the benefits of more affluent taxpayers. Once a new law takes effect in Missouri in 2024, only 11 states will still tax benefits.

*Ad: Clicking will take you to our partner Annuity.org.

Pros and Cons of Retiring Somewhere That Doesn’t Tax Retirement Income

To paraphrase the band The Clash, “should you stay (put) or should you go?”

Tax savings is only one factor to consider with a relocation. Other key factors are social support networks, weather, community services and features in a new location. You will want to consider friends and family, doctors and hospitals, airports, parks and recreation, museums and theaters, and opportunities for work, education and volunteering.

The table below summarizes pros and cons of relocating to a state with no tax on retirement income. Note that not all moves have to be long distance. Georgia to Florida or New Jersey to Pennsylvania, for example, are not as drastic as a cross-country move.

- State income tax regulations that could save thousands of dollars of tax on pension, Social Security, RMDs and more.

- A “fresh start.” A chance to meet new people and a freedom from obligations tied to your current location, such as babysitting.

- An opportunity to downsize to a smaller home which would likely lower living expenses.

- Organized activities if you move to a 55+ community, and better weather in some states.

- The stress involved with selling an old home, buying a new home, downsizing and moving to a new state.

- Unfamiliarity with new community services, features and neighbors.

- The challenge of making new friends and building a new social support network.

- Distance from family members. Reduced ability to visit due to travel time and cost.

Can All Retirement Income Be Taxed?

The type of retirement income that’s taxed depends on the state. California, for example, taxes all retirement income, while Florida does not tax any.

Many high earners relocate for a more favorable tax climate. This has been called “The Great Wealth Migration.” The top five states for net negative outflows of wealth are California, New York, Illinois, New Jersey and Massachusetts. The states with the highest wealth inflows are Florida, Texas, Arizona, Colorado and North Carolina.

Things To Consider

While important, income taxes are only one factor to consider in a potential relocation.

- 1. Changing Tax Laws

- States, as well as the federal government, can always change income tax rules for retirement income to attract or retain residents.

- 2. Other Expenses

- These expenses include other taxes, gasoline, utilities, housing, and homeowners and auto insurance. For example, some states with no income tax are hurricane-prone, so property insurance is very expensive.

- 3. Out-of-State Income

- The tax structure of the state where you earn income is key. A nonresident tax return may be required to pay tax on income earned in another state.

- 4. Residency Requirements

- A person is generally considered a resident of a state for tax purposes if they spend half a year, 183 days, or more living there.

- 5. Types of Retirement Income

- If someone does not have a pension or tax-deferred account that requires RMDs, these tax rules are irrelevant.

How Can You Reduce Tax Obligations in Retirement?

A few ways to reduce tax obligations in retirement include delaying Social Security, opening a health savings account, utilizing long-term capital gains, donating to charity, utilizing a Roth IRA and investing efficiently.

- Delaying Social Security

- Postponing Social Security will generate a larger future income stream and keep income lower while taxable Roth conversions take place.

- Health Savings Account

- Workers with a high-deductible health plan can deposit money tax-free, which grows tax-free and comes out tax-free, if used for health care expenses. After age 65, you can use savings in an HSA for nonmedical purposes without penalty.

- Long-Term Capital Gains

- Holding taxable account securities for a year and a day or longer results in tax rates of 0%, 15% or 20% versus ordinary income tax rates up to 37%.

- Qualified Charitable Distributions (QCDs)

- Donating all or part of the balance in a traditional IRA to a qualified charity after age 70.5 to satisfy RMD requirements.

- Roth Conversions

- Transferring funds from a traditional IRA to a Roth IRA while in a lower tax bracket than what you expect in the future.

- Tax-Efficient Investing

- Selecting investments that lose less return to taxes. Examples include municipal bonds, U.S. savings bonds (no state/local taxes) and index mutual funds.

Even if you live in a state with no retirement income tax, these tips can still help reduce the impact of federal income taxes.

Editor Bianca Dagostino contributed to this article.

Connect With a Financial Advisor Instantly

Our free tool can help you find an advisor who serves your needs. Get matched with a financial advisor who fits your unique criteria. Once you’ve been matched, consult for free with no obligation.

8 Cited Research Articles

- Cagnassola, M.E. (2023, Aug. 16). Missouri Will No Longer Tax Social Security Benefits, but These 11 States Still Do. Retrieved from https://money.com/social-security-tax-states/.

- Kidder, B. (2023, Aug. 1). The Great Wealth Migration: The Flow of High-Income Earners Across States. Retrieved from https://myelisting.com/commercial-real-estate-news/1639/great-wealth-migration-flow-of-high-income-earners-across-states/

- Washington, K. (2023, July 31). Taxes in Retirement: How All 50 States Tax Retirees. Retrieved from https://www.kiplinger.com/retirement/602202/taxes-in-retirement-how-all-50-states-tax-retirees

- World Population Review. (2023, April). States That Don’t Tax Military Retirement. Retrieved from https://worldpopulationreview.com/state-rankings/military-retirement-tax-states

- Brandon, E. (2023, Feb. 6). 10 Ways To Reduce Taxes on Your Retirement Savings. Retrieved from https://money.usnews.com/money/retirement/slideshows/10-ways-to-reduce-taxes-on-your-retirement-savings

- New Hampshire Department of Revenue Administration. (2023). Frequently Asked Questions - Interest & Dividend Tax. Retrieved from https://www.revenue.nh.gov/faq/interest-dividend.htm

- Intuit Turbotax. (2022, Dec. 1). States With the Lowest Taxes and the Highest Taxes. Retrieved from https://turbotax.intuit.com/tax-tips/fun-facts/states-with-the-highest-and-lowest-taxes/L6HPAVqSF

- O’Neill, B. Flipping a Switch: Your Guide to Happiness and Financial Security in Later Life. Atlantic Publishing Group, Inc. 2020.

Calling this number connects you to one of our trusted partners.

If you're interested in help navigating your options, a representative will provide you with a free, no-obligation consultation.

Our partners are committed to excellent customer service. They can match you with a qualified professional for your unique objectives.

We/Our Partners do not offer every plan available in your area. Any information provided is limited to those plans offered in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

866-923-9782Your web browser is no longer supported by Microsoft. Update your browser for more security, speed and compatibility.

If you need help pricing and building your medicare plan, call us at 844-572-0696