Is Social Security Taxable?

Your Social Security benefits are taxable, but the taxation varies depending on if you receive other sources of income, your filing status and your overall total income. When filing taxes, you must factor in all income sources to determine the taxable amount. The key to limiting the taxes on your Social Security benefits is by lowering your overall taxable income.

- Written by Ebony J. Howard, CPA

Ebony J. Howard, CPA

Credentialed Tax Expert at Intuit

Ebony J. Howard is a certified public accountant and freelance consultant with a background in accounting, personal finance, and income tax planning and preparation. She specializes in analyzing financial information in the health care, banking and real estate sectors.

Read More- Edited By

Lamia Chowdhury

Lamia Chowdhury

Financial Editor

Lamia Chowdhury is a financial content editor for RetireGuide and has over three years of marketing experience in the finance industry. She has written copy for both digital and print pieces ranging from blogs, radio scripts and search ads to billboards, brochures, mailers and more.

Read More- Reviewed By

Brandon Renfro, Ph.D., CFP®, RICP®, EA

Brandon Renfro, Ph.D., CFP®, RICP®, EA

Retirement and Social Security Expert

Brandon Renfro is a Retirement and Social Security Expert and financial planner. He focuses on helping clients create a secure financial future in retirement and co-owns Belonging Wealth Management. He is also a former finance professor and writes for several publications.

Read More- Published: March 6, 2023

- Updated: December 20, 2024

- 8 min read time

- This page features 4 Cited Research Articles

- Edited By

- The Internal Revenue Service (IRS) sets the rules on how much of your Social Security benefits are taxable. There is a set base amount that your total “combined” income must exceed for your Social Security benefits to be taxable up to 85%.

- Currently, only 12 states levy a tax on some or all of their residents’ Social Security benefits.

- To limit taxes on your Social Security benefits, make withdrawals from your traditional retirement accounts before you start receiving the benefits.

Does Everyone Pay Taxes on Their Social Security Income?

While the majority of people may have to pay taxes on their Social Security income, it is not required of everyone. The taxability of Social Security income depends upon several factors such as an individual’s overall total income and their filing status. The more substantial the additional income that an individual receives might be, along with their Social Security benefits, the more likely they are required to pay taxes on their Social Security income.

As you work, Social Security taxes are taken out of your paycheck so you can get a monthly benefit in retirement. That Social Security benefits income, which can be received monthly or in lump-sum, replaces part of your income to help pay monthly expenses as you get older.

To supplement your income in addition to your benefits, you may also receive income from other sources such as wages, interest, self-employment and dividends. This total income combined is what determines if an individual has to pay taxes on their Social Security income. Everyone’s financial situation is different, so taxability varies.

However, most state governments don’t tax these benefits. Of the 50 states, currently, only 12 states levy a tax on some or all of their residents’ Social Security benefits.

- Colorado

- Connecticut

- Kansas

- Minnesota

- Missouri

- Montana

- Nebraska

- New Mexico

- Rhode Island

- Utah

- Vermont

- West Virginia

As of tax year 2022, Social Security income is not taxable for taxpayers in Colorado aged 65 and over. But, for Colorado residents aged 55 to 64, a portion of Social Security benefits above $20,000 is taxable.

Social Security benefits offer you a degree of tax efficiency in retirement because your entire benefit amount is never taxable. That makes Social Security planning even more valuable.

How Much of Your Social Security Is Taxable?

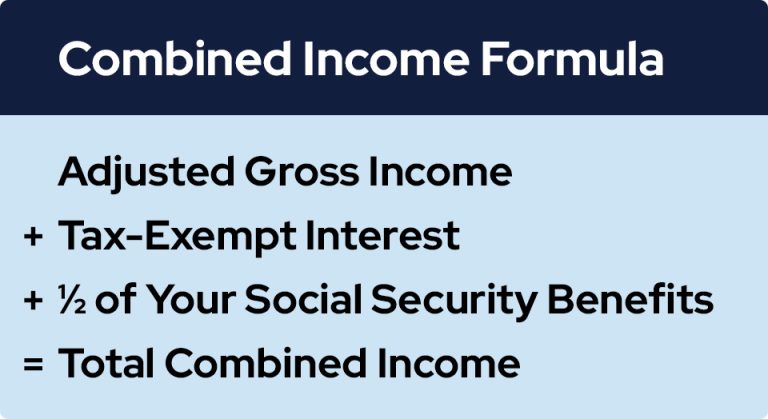

The Internal Revenue Service (IRS) sets the rules on how much of your Social Security benefits are taxable. There is a set base amount that your total combined income must meet.

To determine if your benefits are taxable, take the total of one-half of your benefits and add it to all your adjusted gross income, including tax-exempt interest.

This total is compared to the base amount for your filing status, which determines the percentage of your Social Security benefits that are taxable.

Individual Rates

According to the Social Security Administration, if you are single, the head of household or a qualifying surviving spouse, your Social Security benefits are generally not taxable if your total combined income is below a base amount of $25,000.

However, if your total combined income is between $25,000 to $34,000, then your Social Security benefits might be taxed up to 50%. If it is above $34,000, up to 85% of your Social Security benefits may be taxable.

Married Rates

If you are married and filing jointly, your Social Security benefits are generally not taxable if you and your spouse’s total combined income is below a base amount of $32,000.

However, if you and your spouse’s combined total income is between $32,000 to $44,000, then your Social Security benefits might be taxed up to 50%. If it is above $44,000, up to 85% of your Social Security benefits may be taxable.

How To Calculate the Taxes on Your Social Security Income

To calculate the taxes on your Social Security income, you must first figure out your adjusted gross income. Your adjusted gross income includes the total of your other income sources (wages, pensions, interest, ordinary dividends and capital gain distributions).

Next, you must take 50% of your Social Security benefits, plus tax-exempt interest, and add it to your adjusted gross income. Then subtract the base amount for your filing status according to the IRS income threshold rules from your total combined income.

For example, let’s say you file as an individual, have $25,000 in other income, $3,000 in tax-exempt interest, and received a total of $10,000 in Social Security benefits during the year. Your total combined income is $33,000 (other income plus tax-exempt interest plus half of your Social Security benefits).

Since this combined income falls between $25,000 to $35,000, up to 50% of your Social Security benefits would be taxable. The taxable amount is calculated as the difference between the combined income and the base amount multiplied by the percentage taxed ($33,000 – $25,000 = $8,000; $8,000 x 50% = $4,000).

IRS Publication 915 provides more information on figuring out the taxable portion of your Social Security benefits.

Are Other Types of Social Security Benefits Taxed?

Social Security benefits are not the only benefits subject to taxation, as there are different types subject to the same rules — such as disability, spousal and survivor benefits. When it pertains to you and your family, knowing which benefits are taxable can save you from surprises when it’s time to file your taxes.

Disability Benefits

Social Security disability benefits are paid to those who’ve worked and paid into the Social Security fund but are unable to work due to becoming sick or injured. These benefits are also taxable like regular Social Security benefits if your total combined income is above the threshold set by the IRS.

Supplemental Security Income (SSI) benefits, however, are paid to adults and children with a disability or blindness who have limited income and resources. These benefits are not taxable.

Spousal Benefits

Spousal benefits are Social Security benefits paid to the spouses of workers once the worker files for their benefits, which are based on the worker’s contributions to Social Security insurance. A spouse’s benefits are also subject to taxes the same as regular Social Security benefits — they are also factored into total combined income.

Survivor Benefits

Survivor benefits are paid to the surviving spouse, surviving divorced spouse, dependent parent or children. Generally, the benefits are taxable only to the extent that the beneficiaries’ total income exceeds the IRS threshold.

One thing to note is that if the children receive Social Security survivor benefit payments, this income does not count toward the parents’ total income. In most circumstances, a child will not have enough income sources for Social Security benefits to be taxed.

Including Social Security Income When Filing Taxes

At the beginning of each year, typically in January, you will receive a Social Security Benefit Statement (Form SSA-1099) from the Social Security Administration. This includes the total amount of benefits you received in the prior year.

When filing your income taxes, you will use this Benefit Statement to report the Social Security income you received to determine if your benefits are subject to taxes. The net amount of your Social Security benefits is in box 5 on Form SSA-1099, which you will report on line 6a of your Form 1040 (U.S. Individual Income Tax Return) or Form 1040-SR (U.S. Tax Return for Seniors).

How To Limit the Taxes on Your Social Security Benefits

To reduce the amount of your Social Security benefit that is subject to taxation, you need to reduce your combined income. Sometimes, this may mean shifting tax liability from one year to another. However, don’t just look at the tax effect on your Social Security benefits in a single year. Consider the impact on your total tax liability throughout retirement.

- Making withdrawals from your traditional retirement accounts before you start receiving Social Security benefits.

- Once you reach the age of 59 ½, you can start withdrawing from your retirement accounts penalty-free. This will be beneficial as it reduces your total taxable income when filing taxes.

- Purchasing a qualified longevity annuity contract (QLAC).

- This allows you to set aside up to 25% or $145,000 (whichever is lesser) of the money in your qualified retirement account (401(k)), 403(b), or an IRA) and convert it into an annuity. This deferred annuity reduces the amount in your retirement accounts which thereby minimizes the taxes on the required minimum distributions (RMD) you take. Just keep in mind that annuities are quite costly and in the long run, once the QLAC starts paying out income, this will contribute to higher taxes on your benefits.

- Converting some of your traditional retirement accounts to a Roth IRA.

- Since Roth IRAs are funded with after-tax dollars, you are not taxed upon withdrawal. The distributions received will not be included in calculating your total combined income used to calculate the amount of taxes owed on your Social Security benefits.

4 Cited Research Articles

- Internal Revenue Service. (2022, September 7). Social Security Income. Retrieved from https://www.irs.gov/faqs/social-security-income

- Internal Revenue Service. (2022, January 6). Publication 915 Social Security and Equivalent Railroad Retirement Benefits. Retrieved from https://www.irs.gov/pub/irs-pdf/p915.pdf

- Legislative Council Staff. (2021, May 12). Revised Fiscal Note HB 21-1311. Retrieved from https://leg.colorado.gov/sites/default/files/documents/2021A/bills/fn/2021a_hb1311_r1.pdf

- Social Security Administration. (n.d.). Income Taxes and Your Social Security Benefit. Retrieved from https://www.ssa.gov/benefits/retirement/planner/taxes.html

Your web browser is no longer supported by Microsoft. Update your browser for more security, speed and compatibility.

If you need help pricing and building your medicare plan, call us at 844-572-0696