What Is Social Security?

Social Security was created as a way to promote the economic security for U.S. residents. It’s designed to pay retired workers age 65 or older a continuing income stream after retirement. The Social Security Administration currently serves over 63 million beneficiaries, including 47 million retirees, 10 million disabled workers and 6 million survivors of deceased workers.

- Written by Lindsey Crossmier

Lindsey Crossmier

Financial Writer

Lindsey Crossmier is an accomplished writer with experience working for The Florida Review and Bookstar PR. As a financial writer, she covers Medicare, life insurance and dental insurance topics for RetireGuide. Research-based data drives her work.

Read More- Edited By

Lamia Chowdhury

Lamia Chowdhury

Financial Editor

Lamia Chowdhury is a financial content editor for RetireGuide and has over three years of marketing experience in the finance industry. She has written copy for both digital and print pieces ranging from blogs, radio scripts and search ads to billboards, brochures, mailers and more.

Read More- Reviewed By

Marguerita M. Cheng, CFP®, CRPC®, CSRIC®, RICP®

Marguerita M. Cheng, CFP®, CRPC®, CSRIC®, RICP®

Marguerita M. Cheng, CFP®, CRPC®, CSRIC®, RICP®, is the founder and chief executive officer at Blue Ocean Global Wealth. She is a past spokesperson for the AARP Financial Freedom campaign and has extensive expertise in the fields of financial planning, personal finance, retirement and investing.

Read More- Published: April 27, 2020

- Updated: December 17, 2024

- 10 min read time

- This page features 14 Cited Research Articles

Key Takeaways- Social Security provides monthly benefits to qualifying retirees, disabled individuals and their loved ones.

- The average Social Security benefit will be around $1,827 per month in 2023, the maximum is $3,627 for someone at full retirement age.

- In 2023, the cost-of-living adjustment, or COLA, for benefits is 8.7%. Because of the COLA increase, Social Security scams will be on the rise in 2023.

- The amount of your benefit varies, depending on your work history and when you choose to retire.

- If you wait until you’re 70 to claim benefits, you’ll receive significantly higher benefits thanks to delayed retirement credits.

Social Security, also known as the Old-Age, Survivors and Disability Insurance (OASDI) program, provides monthly benefits to qualifying retirees and disabled individuals. In some cases, you can qualify for either spousal benefits or survivor benefits.

The Social Security program is funded through payroll taxes. In 2023, employers and employees pay 6.2% of wages up to the taxable maximum of $160,200. If you’re self-employed, you’ll pay 12.4% in taxes, according to the Social Security Administration.

Each year, there is also a cost-of-living adjustment (COLA), for Social Security benefits. The COLA in 2023 is the highest it has been for the last 40 years, raising benefits by 8.7%. From 2009 to 2020, the COLA never surpassed 3.6%, according to an article from the Social Security Administration.

Did You Know?Roughly 97% of adults between 60 and 89 years old currently receive or are soon due to receive Social Security benefits.How Does Social Security Work?

If you meet specific qualifications, Social Security will send you monthly benefits. The qualifications vary depending on whether you need retirement, disability or survivor benefits. In all cases, you do need a specific number of credits to qualify, and you earn the credits by working.

In 2023, you earn one credit for every $1,640 in covered earnings each year. You can earn a maximum of four credits per year. For example, by earning $6,560, you receive four credits, the maximum amount available in one year.

Qualification Rules for Different Benefit Types- Qualifying for Retirement Benefits

- You need to earn at least 40 credits and be at least 62 years old. If you wait until you reach your full retirement age, you'll receive a higher benefit amount.

- Qualifying for Disability Benefits

- You must take a recent work rest and duration work test. The number of credits you need depends on your age. The Social Security Administration has information on how many work credits you need for disability benefits. If you're over 31 years old, you'll need at least 20 work credits within the 10-year period after your disability began to qualify for benefits.

- Qualifying for Survivors Benefits

- The number of credits needed varies depending on the age of death. If the individual dies young, fewer credits are required. In some cases, benefits can be paid to the surviving spouse and children, even if there aren’t enough credits. If you pass away and you were already receiving Social Security benefits, the survivor's benefit will be based off that amount.

Source: Social Security Administration

For December 2022, the average Social Security benefit was $1,688 per month or $20,256 per year. According to the Social Security Administration, benefits will increase by over $140 on average in 2023. You can expect the average Social Security benefit to be around $1,827 per month in 2023.

3 Minute Quiz: Can You Retire Comfortably?Take our free quiz & match with a financial advisor in 3 easy steps. Tailored to your goals. Near you or online.Who Benefits from Social Security?

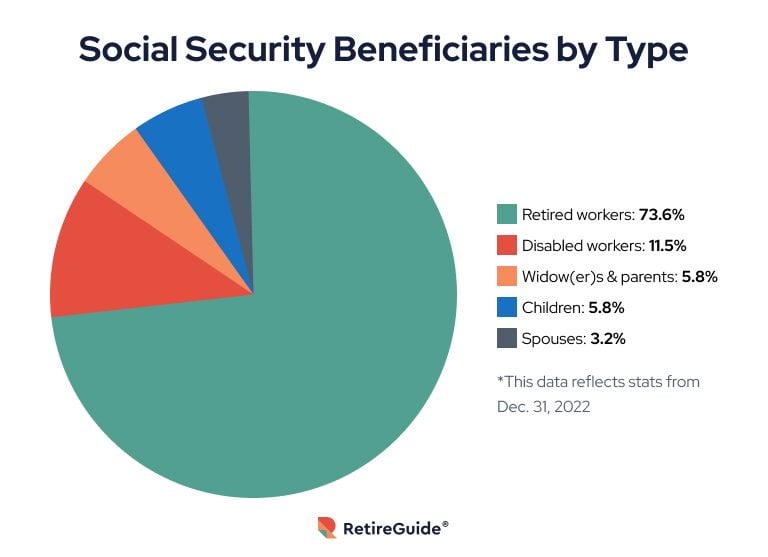

Retired workers, disabled individuals, spouses, children, widows and widowers can benefit from Social Security. As of December 2022, 73.6% of those receiving benefits from Social Security were retired workers, according to the Social Security Administration.

Expand

ExpandIn December 2022, retirees made the highest average benefit amount at $1,825 a month when compared to an aged widow/widower or disabled individual. The average monthly survivor’s Social Security benefit amount was $1,705 for an aged widow or widower. And the average monthly disability benefit was $1,483.

Are Social Security Benefits Taxed?

Social Security benefits have been taxable as income tax since 1983.

“Social Security benefits are generally subject to federal income tax; however, the extent to which they are taxed depends on the individual’s income level and filing status,” Andrew Lokenauth, founder of Fluent in Finance, told RetireGuide.

“For example, if you have other sources of income such as wages, interest or dividends, a portion of your Social Security benefits may be subject to federal income tax. But it’s worth noting that as of 2021, not all states tax Social Security benefits and not all recipients are required to pay taxes on them.”

Most Americans on Social Security must pay income taxes on their Social Security benefits. You may have to pay taxes on 50% to 85% of your Social Security income, depending on your income.

Spousal, survivor and disability benefits follow the same basic income tax rules as Social Security benefits. However, SSI benefits for people with low incomes and limited resources are not taxed.

Social Security benefits are generally subject to federal income tax, however, the extent to which they are taxed depends on the individual's income level and filing status.Contacting the Social Security Administration

About Social Security's Customer ServiceYou can contact the Social Security Administration online, in person or over the phone at 1-800-772-1213.

To find a Social Security office near you, use the Social Security Administration’s office locator tool.

Depending on which service you need, you may have other resources available for you. For example, if you need to replace a Social Security card or report a lost check, refer to the Social Security Administration’s list of online services.

The Social Security Administration’s list of online sources can help you:- Check a claim status or appeal

- Request a replacement Social Security card

- Print proof of benefits

- Find your full retirement age

- Correct or change your name

- Get assistance receiving information if you’re visually impaired or deaf

Never Miss Important News or UpdatesGet money-saving tips, hard-to-find info and tactics for a successful retirement in our free weekly newsletter.Preventing Social Security Fraud

The best way to prevent Social Security fraud is to remain vigilant and not share personal information with strangers who contact you. Scammers will pretend to be government officials in attempts to get your information.

The Social Security Administration will only contact you via text or email if you’ve opted to receive them. The only texts or emails sent will be regarding programs, services or a login verification to access your Social Security account. They will never ask for a return call to an unknown number or for personal information.

The Social Security Administration will never:- Threaten you with arrest or legal action if you don’t agree to pay them money immediately

- Suspend your Social Security number

- Promise a benefit increase in exchange for money

- Ask you to send gift cards, prepaid debit cards, wire transfers, Internet currency, cryptocurrency or cash through the mail

According to an article from Yahoo, there is a new scam related to the high 2023 COLA increase. Scammers are claiming that you must pay a fee or provide personal information to receive the 8.7% increase. This is not true. If someone calls asking you to pay a fee or requests private information for a COLA increase — it is a scam.

If you aren’t sure if a call or email from Social Security is legitimate, hang up and report it to the Office of the Inspector General.

What Is the Future of Social Security?

Social Security is expected to run out of cash reserves in 2033, according to the Old-Age and Survivors Insurance Trust Fund, which is the retirement benefits account managed by the Social Security Administration.

However, this doesn’t mean the program would be bankrupt and unable to pay out benefits. If Congress does nothing to reform the system by 2033, Social Security would still be able to pay 77% of promised benefits until 2090.

Social Security has run out of cash reserves before. Congress reformed the program in the 1980s by taxing benefits based on income levels and by gradually increasing the full retirement age from 65 to 67.

How Much Will You Receive?The Social Security Administration lets you check how much you’ve paid into the system every year you’ve worked. It also provides a retirement estimator to give you an approximate idea of how much you can expect to receive each month when you retire.Source: Social Security AdministrationThe Relationship Between Social Security and Medicare

Medicare and Social Security are both federal programs. Because they are both associated with retirement in the United States, people often think they are part of the same organization, but they are not. Different agencies run each program within the federal government.

Medicare provides coverage for inpatient and outpatient care, nursing care, prescription drugs and medical supplies to those 65 years or older. Social Security oversees paying qualified individuals’ retirement, disability, family and survivor benefits.

FAQs About Medicare and Social SecurityHow are Medicare and Social Security related?Both are federal programs that primarily provide insurance to retirees. Medicare is managed by the Centers for Medicare & Medicaid Services while the Social Security Administration administers Social Security.

You apply for Medicare through the Social Security Administration and money is taken out of your Social Security check to pay for your Medicare premiums.

Do you automatically get Medicare with Social Security?Not always. You can choose to claim Social Security benefits as early as age 62 or delay until you are 70. You are not eligible for Medicare until you turn 65. If you are already collecting Social Security benefits when you turn 65, you will be automatically enrolled in Medicare.

If you are not collecting benefits, you must enroll in Medicare within a window that begins three months before your birth month in which you turn 65 and lasts until three months after.

How are Medicare premiums paid if you’re already enrolled in Social Security?If you’re already enrolled in Social Security, your Medicare premiums are typically deducted from your monthly Social Security check. If you are enrolled in Medicare but not yet enrolled in Social Security, you will receive monthly or quarterly bills for your Medicare premiums.

How much is taken out of your Social Security check for Medicare?You must pay monthly premiums for Original Medicare. Most people don’t have to pay the Medicare Part A hospital insurance premium, and the Medicare Part B medical insurance premiums are based on your income.

Social Security looks at your tax returns from two years prior and bases your premium payments to Medicare on your income then. If your income is significantly lower now, you can file an appeal to let Social Security know that your income is less than it was.

Have you selected your 2024 Medicare plan?Maximize your Medicare savings by connecting with a licensed insurance agent. Annual Enrollment is open until December 7th.Frequently Asked Questions About Social Security

What is Social Security in simple terms?Social Security provides economic security by providing monthly benefits to qualifying retirees, disabled individuals and their family members.How long does Social Security last?The length of your Social Security benefits varies depending on what type of benefits you have. For retirement benefits, your payments last for life. Disability benefits last as long as your disability persists and keeps you from being able to work.When will I get my Social Security check?The Social Security check schedule varies depending on what day you were born on. If you were born on the 1st through the 10th, you’ll receive your check on the second Wednesday of every month. If you were born on the 11th through the 20th, you will get your check on the third Wednesday of every month. If you were born on the 21st through the 31st, you will get your check on the fourth Wednesday of every month.Can you live on Social Security alone?Whether you can live on Social Security alone depends on the cost of your monthly expenses and amount of debt. While it can be possible to live off your Social Security benefits alone, it’s probably best to increase your savings and consider other options, like an annuity, to improve your retirement security.AdvertisementConnect With a Financial Advisor Instantly

Our free tool can help you find an advisor who serves your needs. Get matched with a financial advisor who fits your unique criteria. Once you’ve been matched, consult for free with no obligation.

Last Modified: December 17, 2024Share This Page14 Cited Research Articles

- Cariaga, V. (2023, January 3). 3 Social Security Scams Tied Directly to Record 2023 COLA — How They Can Trick You. Retrieved from https://www.yahoo.com/now/3-social-security-scams-tied-122001920.html

- The Social Security Administration. (2023). Status of the Social Security and Medicare Programs. Retrieved from https://www.ssa.gov/oact/TRSUM/

- The Social Security Administration. (2023). Cost-of-Living Adjustment (COLA) Information for 2023. Retrieved from https://www.ssa.gov/cola/

- The Social Security Administration. (2023). Starting Your Retirement Benefits Early. Retrieved from https://www.ssa.gov/benefits/retirement/planner/agereduction.html

- The Social Security Administration. (2023). How is Social Security Financed? Retrieved from https://www.ssa.gov/news/press/factsheets/HowAreSocialSecurity.htm

- The Social Security Administration. (2023). Social Security Credits. Retrieved from https://www.ssa.gov/benefits/retirement/planner/credits.html

- The Social Security Administration. (2023). Benefits Paid by Type of Beneficiary. Retrieved from https://www.ssa.gov/OACT/ProgData/icp.html

- The Social Security Administration. (2023). Normal Retirement Age. Retrieved from https://www.ssa.gov/oact/progdata/nra.html

- The Social Security Administration. (2023). Protect Yourself from Social Security Scams. Retrieved from https://www.ssa.gov/scam/

- The Social Security Administration. (2023). Income Taxes and Your Social Security Benefit. Retrieved from https://www.ssa.gov/benefits/retirement/planner/taxes.html

- The Social Security Administration. (2023). Online Services. Retrieved from https://www.ssa.gov/onlineservices/

- Markowitz, A. (2022, December 5). Biggest Social Security Changes for 2023. Retrieved from https://www.aarp.org/retirement/social-security/info-2022/cola-increases-medicare-premium-drops.html

- Center on Budget and Policy Priorities. (2022, March 4). Policy Basics: Top Ten Facts about Social Security. Retrieved from https://www.cbpp.org/research/social-security/top-ten-facts-about-social-security

- The Social Security Administration. (n.d.). Cost-Of-Living Adjustments. Retrieved from https://www.ssa.gov/oact/cola/colaseries.html

- Edited By

Your web browser is no longer supported by Microsoft. Update your browser for more security, speed and compatibility.

If you need help pricing and building your medicare plan, call us at 844-572-0696