How Do Survivor Benefits Work?

Survivor benefits grant monthly Social Security payments to the family of a deceased worker meeting specific criteria. Beneficiaries, including spouses, children and parents, get a specific amount based on the worker's prior contributions. This is what to know about the specific qualifications and average 2025 benefit amounts, as well as how to apply for survivor benefits.

- Written by Lindsey Crossmier

Lindsey Crossmier

Financial Writer

Lindsey Crossmier is an accomplished writer with experience working for The Florida Review and Bookstar PR. As a financial writer, she covers Medicare, life insurance and dental insurance topics for RetireGuide. Research-based data drives her work.

Read More- Edited By

Lamia Chowdhury

Lamia Chowdhury

Financial Editor

Lamia Chowdhury is a financial content editor for RetireGuide and has over three years of marketing experience in the finance industry. She has written copy for both digital and print pieces ranging from blogs, radio scripts and search ads to billboards, brochures, mailers and more.

Read More- Reviewed By

Brandon Renfro, Ph.D., CFP®, RICP®, EA

Brandon Renfro, Ph.D., CFP®, RICP®, EA

Retirement and Social Security Expert

Brandon Renfro is a Retirement and Social Security Expert and financial planner. He focuses on helping clients create a secure financial future in retirement and co-owns Belonging Wealth Management. He is also a former finance professor and writes for several publications.

Read More- Published: March 6, 2023

- Updated: May 1, 2025

- 9 min read time

- This page features 6 Cited Research Articles

Key Takeaways- Surviving spouses, unmarried children and parents of a deceased individual can qualify for survivor benefits.

- The deceased must have worked for a certain period of time to qualify their family members for survivor benefits.

- You can only apply for survivor benefits in-person or on the phone, not online.

- The higher the deceased's income was, the higher the benefit will be.

Basics About Survivor Benefits

If you pass away, your family members can be eligible for monthly benefits through survivor benefits. Whoever passed away must have worked long enough and paid taxes into Social Security.

Social Security, also known as Old-Age Survivors and Disability Insurance (OASDI), provides survivor benefits to qualifying family members who have lost a loved one who they were financially dependent on. Beneficiaries of survivor benefits are typically spouses and children, though there are other qualifying exceptions.

As of January 2025, 8.4% of Social Security beneficiaries were spouses, children, widow(er)s and parents receiving survivor benefits. While survivor benefits are not as common as retirement benefits, which took up 79.5% of Social Security beneficiaries, they are still a crucial element of providing economic stability to those suffering a financial loss.

A deceased worker’s child received an average survivor benefit amount of $1,135.54 a month as of January 2025. A non-disabled widow received an average $1,835.82, while disabled widows received an average $951.26 in benefits.

2025 benefit amounts reflect 2.5% cost-of-living adjustment (COLA) for a maximum amount of earnings of $176,100 subject to the Social Security tax.

Who Qualifies?

Surviving spouses, unmarried children and parents can qualify for survivor benefits. Even if the surviving spouse has divorced the deceased, they can still potentially qualify.

Family Members Who Qualify for Benefits- Surviving spouses over 60 years old (or 50 if they are disabled)

- Surviving divorced spouses, with specific eligibility rules

- Children of the deceased younger than 18 (or 19 if they are enrolled in school)

- Children 18 or older who developed a disability before they turned 22

- A stepchild, grandchild, step grandchild or adopted child, in specific instances

- Parents who are 62 or older and dependent on the deceased for at least 50% of their support

In the past, same-sex couples were denied survivor benefits. As of June 26, 2015, the U.S. Supreme Court ruled that same-sex couples have a constitutional right to marry in all states. Since the ruling, same-sex couples can qualify for survivor benefits.

If you were denied benefits prior to June 26, 2015, you can ask the Social Security Administration to reopen your application to start receiving survivor benefits.

3 Minute Quiz: Can You Retire Comfortably?Take our free quiz & match with a financial advisor in 3 easy steps. Tailored to your goals. Near you or online.How Much Can You Qualify For?

How much you qualify for can vary depending on who is claiming the benefit, the deceased’s work history, if you are still working while receiving benefits and the family maximum benefit limit.

Together, these factors determine how much you qualify for in survivor benefits.

Factors to consider:- Who is claiming the benefit?

- When comparing average monthly survivor benefit amounts, widow(er)s received the highest benefit amount at $1,835.32 a month. A disabled widow(er) received the lowest average amount at $951.26 a month. A child of the deceased averaged at $1,135.54 a month. A parent of the deceased made the second highest average benefit amount at $1,684.81 a month. This is based on data from January 2025.

- The deceased’s work history

- If the deceased made a high income, the survivor benefit will reflect this. If the deceased had a low income, the benefit will be smaller.

- If you’re still working while receiving benefits

- If you are still working while getting survivor benefits and younger than your full retirement age, your benefits may be reduced. Once you reach your full retirement age, your benefits will no longer be reduced, no matter how much you work.

- Family maximum benefit limit

- There is a family maximum benefit, which is the maximum monthly benefit that can be paid out based on the deceased’s earnings. Generally, it is between 150% to 180% of the basic benefit rate. If your payable benefits exceed this limit, your benefits will be reduced.

If you are the surviving spouse or child, you can also receive a special lump-sum payment of $255. You can ask the Social Security Administration if you qualify for the lump-sum payment when you apply for survivor benefits.

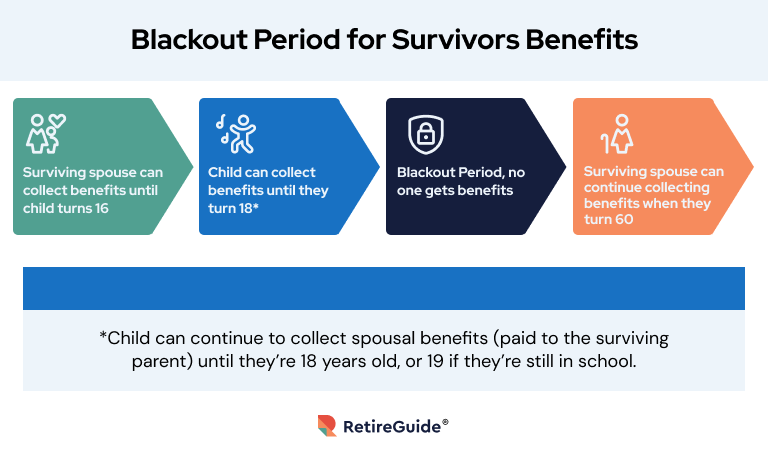

Blackout Periods

A blackout period is the time when there are no payable survivor benefits. The blackout period is based on age and the family members involved.

With the surviving spouse, they become eligible for survivor benefits once they turn 60. If disabled, they can qualify for benefits at 50. Any time before the eligibility age is considered the blackout period when no survivor benefits are paid.

Things can get more complicated if benefits are being paid to a surviving spouse with a child. If a child is involved, benefits will be paid to the surviving spouse until the child turns 16.

Payments can continue until the child turns 18 (or 19 if still in school), and the benefits are technically paid to the child, not the surviving parent. That being said, it might be a good idea for the benefits to be handled by the adult, not the child.

Below is an image which breaks down each period, including the blackout period, if you are receiving benefits as the surviving spouse with a child.

Expand

ExpandBenefits for Spouses

If you married or divorced the deceased, you can qualify for spousal survivor benefits. When you can start receiving survivor benefits as a spouse depends on your age, if you are disabled and if you have a child.

Generally, you can start receiving spouse benefits when you turn 60 years old. However, if you are disabled, you can start getting benefits when you turn 50. If you have a child with the deceased and you have not remarried, you can start receiving survivor benefits at any age.

Your average amounts also vary, depending on what type of spouse you are.

Average 2023 Benefit Amounts by Type of SpouseType of Spouse Average monthly benefit amount* Aged widow(er) $1,835.82 Young widow with child in care $1,302.44 Disabled Widow(er) $951.26 Source: Social Security AdministrationMaximizing Spousal Benefits

The best way to maximize your spousal benefits is to wait until you are your full retirement age (FRA). If you get your survivor benefits early, before you reach your FRA, you could only receive 71% of the deceased’s benefit amount. If you wait until you reach your FRA, you receive 100% of the intended benefit.

When you were born makes your FRA vary. For example, if you were born after 1960, you will reach your FRA when you turn 67.

The Social Security Administration has a chart to help you determine your full retirement age.

Never Miss Important News or UpdatesGet money-saving tips, hard-to-find info and tactics for a successful retirement in our free weekly newsletter.Benefits for Children and Others

Children and parents of the deceased qualify for dependent survivor benefits.

Children must be unmarried and under 18 years old (or 19 if still in school) to receive survivor benefits. If the child developed a disability before they turned 22, they can qualify at any age. In certain instances, stepchildren, grandchildren, step-grandchildren or adopted children can also qualify for survivor benefits.

If your parents are over 62 years old and they depend on you for at least 50% of their financial support, they can also qualify for survivor benefits.

Average Benefit Amounts by Beneficiary TypeType of Beneficiary Average monthly benefit amount* Child of deceased worker $1,135.34 Parent of deceased worker $1,684.81 Source: Social Security AdministrationHow Are Social Security Survivor Benefits Calculated?

Survivor benefits are calculated by the earnings of the individual who passed away. Similar to retirement benefits, the deceased must have enough credits to qualify. Credits are received by working. In 2025, you earn one credit for each $1,810 earned, and you can earn four credits in one year.

Typically, the deceased will need 40 credits for you to qualify for survivor benefits. However, fewer credits may be needed to qualify if they passed away at a younger age. For example, some can get benefits if the deceased worked for at least 1.5 years of work, earning about six credits, in the last 3 years before their death.

The type of family member receiving the benefit, as well as their age, can also adjust the survivor benefit amount.

How Much of the Survivor Benefit You Could ReceiveType of family member Family member’s age You could receive __% of the deceased benefit’s amount Surviving spouse Full retirement age or older 100% Surviving spouse Age 60 to their full retirement age 71.5% to 99% Disabled surviving spouse Age 50 to 59 71.5% Surviving spouse caring for a child under 16 years old Any age 75% Disabled child of deceased Under 18, or under 19 if they’re still in school 75% Child of deceased Under 18, or under 19 if they’re still in school 75% Parent of the deceased 62 or older 82.5% Parents of the deceased 62 or older 75% to each parent Source: Social Security Administration*Rules for surviving spouse also apply if you are divorced.

3 Minute Quiz: Can You Retire Comfortably?Take our free quiz & match with a financial advisor in 3 easy steps. Tailored to your goals. Near you or online.Applying for Survivors Benefits

You can apply for survivor benefits in person at a local Social Security office near you or call to apply at 1-800-772-1213. If you are deaf or hard of hearing, dial 1-800-325-0778 instead. The Social Security Administration recommends reporting the death as soon as possible.

Unfortunately, there is no way to apply for survivor benefits online. Instead, you will need to mail all necessary documents needed to apply.

The documents required vary, depending on your relationship to the deceased. If you are the surviving spouse, refer to the checklist below to ensure you have all required documents.

Documents Needed for Applying for Survivors Benefits as a Widow(er)- Proof of the worker's death

- Birth certificate

- Proof of U.S. citizenship or lawful alien status

- U.S. military discharge paper(s) if you had military service before 1968

- For disability benefits, the two forms (SSA-3368 and SSA-827) that describe your medical condition and authorize disclosure of information to them

- W-2 forms(s) and/or self-employment tax returns for last year

- Final divorce decree, if applying as a surviving divorced spouse

- Marriage certificate

If applying on behalf of a child who lost a parent or guardian, refer to the checklist below.

Documents Needed for Applying for Survivor Benefits for a Child- The child's birth certificate or adoption papers

- Proof of the worker’s marriage to the child’s natural or adoptive parent if the child is the worker’s stepchild

- Proof of the child’s U.S. citizenship or lawful alien status

- W-2 form(s) and/or self-employment tax returns if the child had earnings last year

- If the worker is deceased, proof of the worker’s death

Be sure to include your Social Security number with your mailed documents. This way, they can ensure the documents can be matched with the correct application so you can start receiving your benefits that much sooner.

Writer Lena Borrelli contributed to this article.

AdvertisementConnect With a Financial Advisor Instantly

Our free tool can help you find an advisor who serves your needs. Get matched with a financial advisor who fits your unique criteria. Once you’ve been matched, consult for free with no obligation.

Last Modified: May 1, 2025Share This Page6 Cited Research Articles

- Social Security Administration. (2025, March). Who can get Survivor benefits. Retrieved from https://www.ssa.gov/survivor/eligibility.

- Social Security Administration. (2025, March). Annual Statistical Supplement, 2020 - Social Security (Old-Age, Survivors, and Disability Insurance) Program Description and Legislative History. Retrieved from https://www.ssa.gov/policy/docs/statcomps/supplement/2020/oasdi.html.

- Social Security Administration. (2025, February). Monthly Statistical Snapshot, January 2025. Retrieved from https://www.ssa.gov/policy/docs/quickfacts/stat_snapshot/.

- Social Security Administration. (2024, October). Social Security Announces 2.5 Percent Benefit Increase for 2025. Retrieved from https://www.ssa.gov/news/press/releases/2024/#2024-10-10.

- Social Security Administration. (2025, March). Survivor benefits. Retrieved from https://www.ssa.gov/survivor#h7.

- Social Security Administration. (2025, March). Receiving Benefits While Working. Retrieved from https://www.ssa.gov/benefits/retirement/planner/whileworking.html.

- Edited By

Your web browser is no longer supported by Microsoft. Update your browser for more security, speed and compatibility.

If you need help pricing and building your medicare plan, call us at 844-572-0696